Form 5695 Instruction

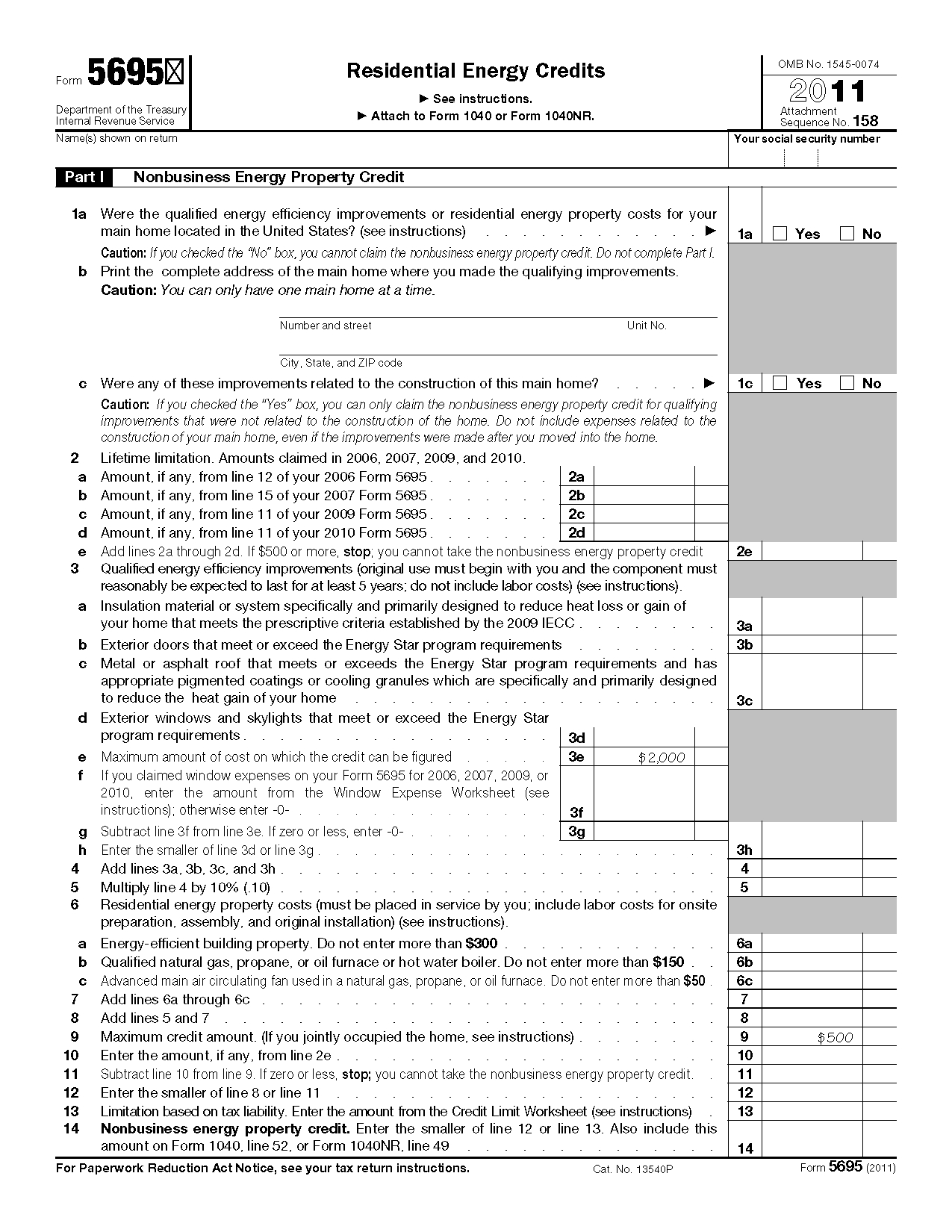

Form 5695 Instruction - Web on line 25 of the form with the combined amount on line 24, cross out the preprinted $500 and enter $1,000. The residential energy credits are: Web what is form 5695? Web form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water heating, small. Purpose of form use form 5695 to figure and take your residential energy credits. Line 30 has the instructions you need to include the credit. Web instructions for form 5695 residential energy credits section references are to the internal revenue code unless otherwise noted. • the residential energy efficient property credit, and • the. Web the form 5695 instructions include a worksheet on page 6 to help you make the necessary calculations. Web purpose of form use form 5695 to figure and take your residential energy credits.

Press f6to bring up open forms. Web instructions for form 5695 residential energy credits section references are to the internal revenue code unless otherwise noted. Web purpose of form use form 5695 to figure and take your residential energy credits. Web the form 5695 instructions include a worksheet on page 6 to help you make the necessary calculations. Purpose of form use form 5695 to figure and take your residential energy credits. Web purpose of form use form 5695 to figure and take your residential energy credits. Line 30 has the instructions you need to include the credit. Web form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water heating, small wind turbines,. Web purpose of form use form 5695 to figure and take your residential energy credits. The residential energy credits are:

• the residential clean energy credit, and • the energy. Web instructions for form 5695 residential energy credit section references are to the internal revenue code unless otherwise noted. Web the form 5695 instructions include a worksheet on page 6 to help you make the necessary calculations. Purpose of form use form 5695 to figure and take your residential energy credits. • the residential energy efficient property credit, and • the. The residential energy credits are: Web form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water heating, small wind turbines,. Web on line 25 of the form with the combined amount on line 24, cross out the preprinted $500 and enter $1,000. Type 5695to highlight the form 5695 and click okto open the form. The residential energy credits are:

Instructions for filling out IRS Form 5695 Everlight Solar

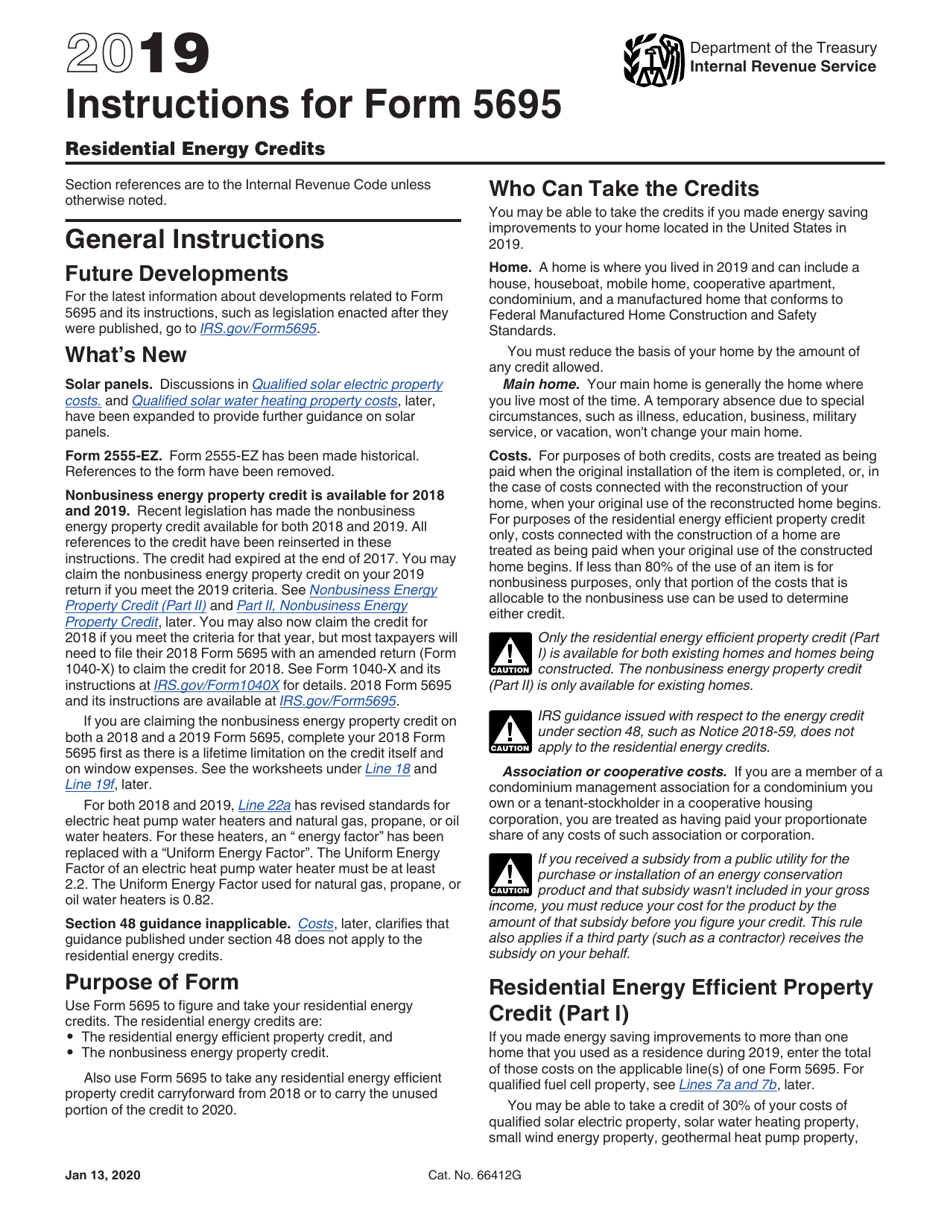

Web purpose of form use form 5695 to figure and take your residential energy credits. General instructions future developments for. • the residential energy efficient property credit, and • the. Department of the treasury internal revenue service. Web what is form 5695?

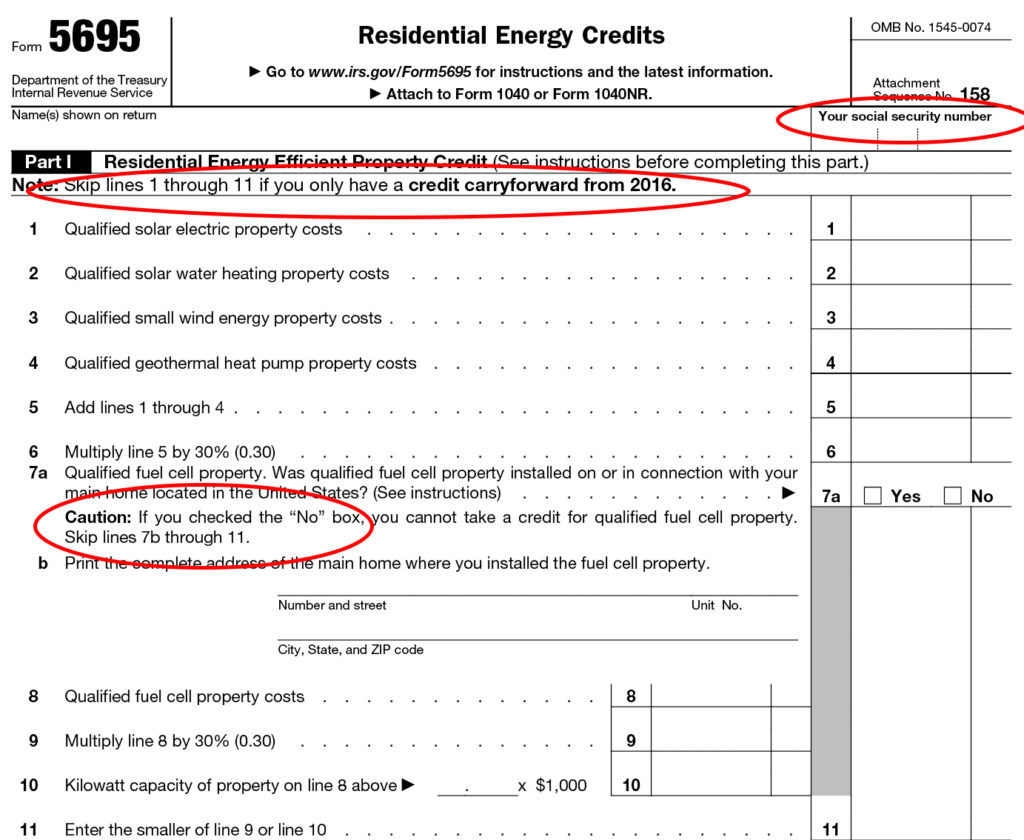

2016 Form 5695 Fill Online, Printable, Fillable, Blank pdfFiller

Purpose of form use form 5695 to figure and take your residential energy credits. • the residential energy efficient property credit, and • the. Web purpose of form use form 5695 to figure and take your residential energy credits. For instructions and the latest. Web purpose of form use form 5695 to figure and take your residential energy credits.

Form 5695 YouTube

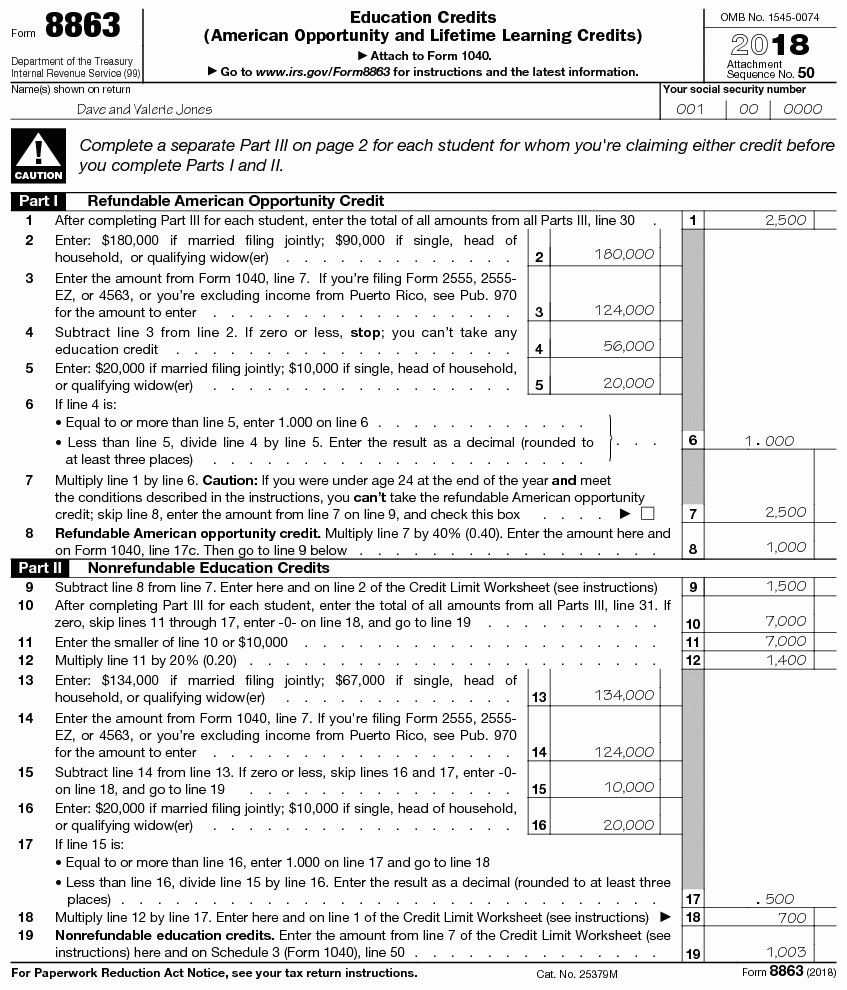

Purpose of form use form 5695 to figure and take your residential energy credits. Web form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water heating, small wind turbines,. • the residential clean energy credit, and • the energy. Web the instructions to form 5695, residential energy credits, indicate.

Steps To Complete Form 5695 Lovetoknow —

Web generating the 5695 in proseries: • the residential clean energy credit, and • the energy. Web form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water heating, small. Web the instructions to form 5695, residential energy credits, indicate that if a taxpayer and spouse own and live apart.

How to Claim the Solar Investment Tax Credit YSG Solar YSG Solar

Type 5695to highlight the form 5695 and click okto open the form. Web purpose of form use form 5695 to figure and take your residential energy credits. Web the rce credit replaces the reep credit beginning with the 2022 tax year and runs through 2032 at its full amount with reduced amounts in 2033 and 2034. Web purpose of form.

Download Instructions for IRS Form 5695 Residential Energy Credits PDF

Department of the treasury internal revenue service. Web on line 25 of the form with the combined amount on line 24, cross out the preprinted $500 and enter $1,000. • the residential energy efficient property credit, and • the. For instructions and the latest. Web generating the 5695 in proseries:

Form Instructions Is Available For How To File 5695 2018 —

Web instructions for form 5695 residential energy credits section references are to the internal revenue code unless otherwise noted. Web the rce credit replaces the reep credit beginning with the 2022 tax year and runs through 2032 at its full amount with reduced amounts in 2033 and 2034. • the residential energy efficient property credit, and • the. Web per.

Residential Energy Efficient Property Credit Limit Worksheet

• the residential clean energy credit, and • the energy. Line 30 has the instructions you need to include the credit. Web instructions for form 5695 residential energy credit section references are to the internal revenue code unless otherwise noted. For instructions and the latest. Web purpose of form use form 5695 to figure and take your residential energy credits.

Form 5695 Residential Energy Credits —

The residential energy credits are: Web the form 5695 instructions include a worksheet on page 6 to help you make the necessary calculations. Web on line 25 of the form with the combined amount on line 24, cross out the preprinted $500 and enter $1,000. The residential energy credits are: Web instructions for form 5695 residential energy credits section references.

Completed Form 5695 Residential Energy Credit Capital City Solar

Web instructions for form 5695 residential energy credit section references are to the internal revenue code unless otherwise noted. • the residential clean energy credit, and • the energy. Web form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water heating, small. The residential energy credits are: Web the.

Web Instructions For Form 5695 Residential Energy Credits Section References Are To The Internal Revenue Code Unless Otherwise Noted.

• the residential energy efficient property credit, and • the. Press f6to bring up open forms. Web form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water heating, small. General instructions future developments for.

Web The Rce Credit Replaces The Reep Credit Beginning With The 2022 Tax Year And Runs Through 2032 At Its Full Amount With Reduced Amounts In 2033 And 2034.

Web purpose of form use form 5695 to figure and take your residential energy credits. Web generating the 5695 in proseries: Web on line 25 of the form with the combined amount on line 24, cross out the preprinted $500 and enter $1,000. For instructions and the latest.

The Residential Energy Credits Are:

Type 5695to highlight the form 5695 and click okto open the form. Purpose of form use form 5695 to figure and take your residential energy credits. On the dotted line to the left of line 25, enter more. Web purpose of form use form 5695 to figure and take your residential energy credits.

Web Purpose Of Form Use Form 5695 To Figure And Take Your Residential Energy Credits.

Web what is form 5695? Web the instructions to form 5695, residential energy credits, indicate that if a taxpayer and spouse own and live apart in separate homes, the credit limits will apply to each spouse. Department of the treasury internal revenue service. Web instructions for form 5695 residential energy credit section references are to the internal revenue code unless otherwise noted.