Form 6765 2022

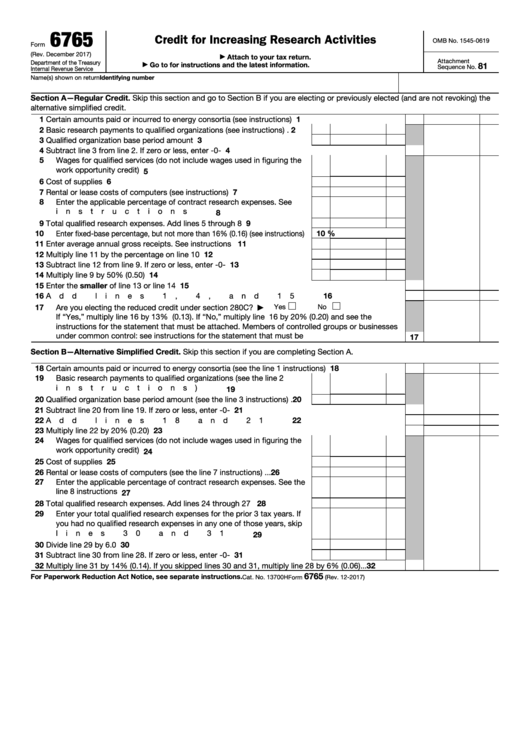

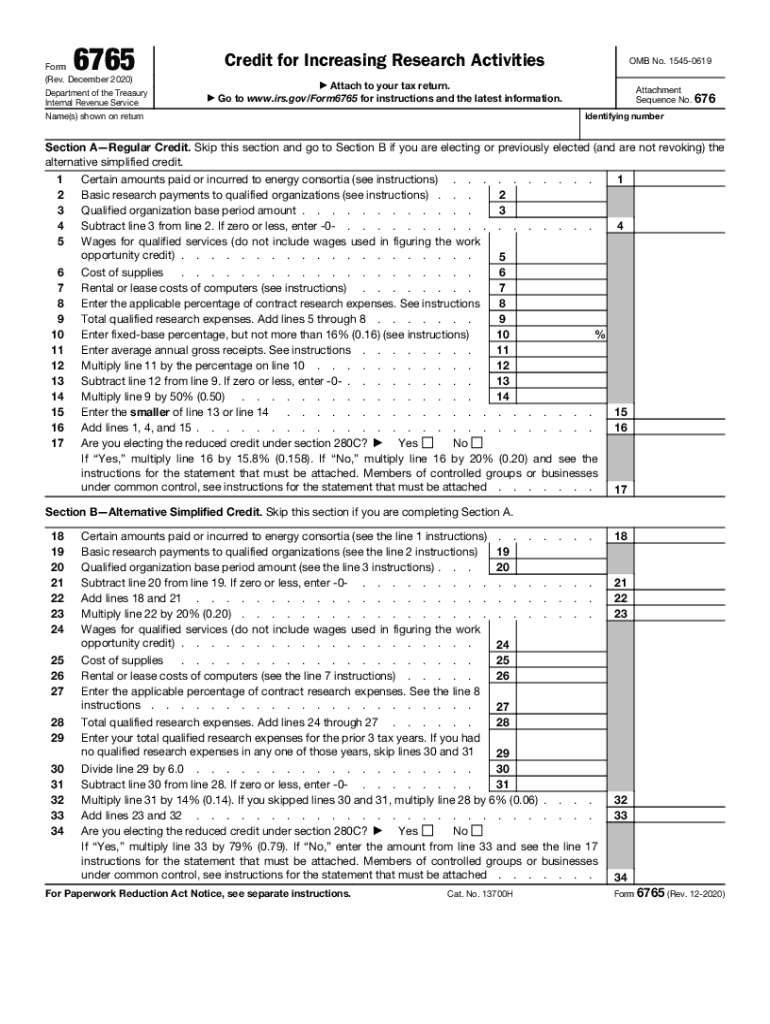

Form 6765 2022 - Web we last updated the credit for increasing research activities in february 2023, so this is the latest version of form 6765, fully updated for tax year 2022. On january 12, 2023, the internal revenue service (irs) released new draft instructions to the federal form 6765, the credit for increasing research activities. It also allows you to communicate how you would like to. Web to document their qualified r&d expenses, businesses must complete the four basic sections of form 6765: Do not file draft forms and do not rely on information in draft instructions or publications. Draft versions of tax forms, instructions, and publications. Web what is form 6765, and why would i need it? The draft instructions contain updates regarding: Section b applies to the alternative simplified credit (asc). Calculate and claim the r&d tax credit elect to take a reduced credit (see below for more information on this election) elect and calculate the payroll tax credit (see below).

Web information about form 6765, credit for increasing research activities, including recent updates, related forms and instructions on how to file. Web what is form 6765, and why would i need it? Web update on irs changes to form 6765. The draft instructions contain updates regarding: You can print other federal tax forms here. Basic research payments to qualified organizations (see instructions). On january 12, 2023, the internal revenue service (irs) released new draft instructions to the federal form 6765, the credit for increasing research activities. View more information about using irs forms, instructions, publications and other item files. Section b applies to the alternative simplified credit (asc). The form includes four sections:

Basic research payments to qualified organizations (see instructions). On january 12, 2023, the internal revenue service (irs) released new draft instructions to the federal form 6765, the credit for increasing research activities. Calculate and claim the r&d tax credit elect to take a reduced credit (see below for more information on this election) elect and calculate the payroll tax credit (see below). The irs will provide a grace period (until january 10, 2022) before requiring the inclusion of this information with timely filed section 41 research credit claims for refund. Web taxpayers use form 6765 to: The draft instructions contain updates regarding: Web what is form 6765, and why would i need it? To calculate the regular credit amount Web information about form 6765, credit for increasing research activities, including recent updates, related forms and instructions on how to file. Web use form 6765 to figure and claim the credit for increasing research activities, to elect the reduced credit under section 280c, and to elect to claim a certain amount of the credit as a payroll tax credit against the employer portion of social security taxes.

Fill Free fillable Form 6765 Credit for Increasing Research

You can print other federal tax forms here. Do not file draft forms and do not rely on information in draft instructions or publications. Web use form 6765 to figure and claim the credit for increasing research activities, to elect the reduced credit under section 280c, and to elect to claim a certain amount of the credit as a payroll.

Fillable Form 6765 Credit For Increasing Research Activities 2016

The irs will provide a grace period (until january 10, 2022) before requiring the inclusion of this information with timely filed section 41 research credit claims for refund. Calculate and claim the r&d tax credit elect to take a reduced credit (see below for more information on this election) elect and calculate the payroll tax credit (see below). It also.

Form 6765 Credit for Increasing Research Activities Stock Image Image

Web taxpayers use form 6765 to: The irs will provide a grace period (until january 10, 2022) before requiring the inclusion of this information with timely filed section 41 research credit claims for refund. Web 6765 section a—regular credit. View more information about using irs forms, instructions, publications and other item files. On january 12, 2023, the internal revenue service.

IRS 6765 2020 Fill out Tax Template Online US Legal Forms

Web this may be done using form 6765, credit for increasing research activities pdf. The draft instructions contain updates regarding: To calculate the regular credit amount Form 6765 is used to calculate and claim the r&d tax credits you are entitled to for increasing research and experimentation activities. Web information about form 6765, credit for increasing research activities, including recent.

Form 6765 Tax Credit Advice

Web to document their qualified r&d expenses, businesses must complete the four basic sections of form 6765: On january 12, 2023, the internal revenue service (irs) released new draft instructions to the federal form 6765, the credit for increasing research activities. Draft versions of tax forms, instructions, and publications. Basic research payments to qualified organizations (see instructions). The irs will.

Form 6765 Instructions Gusto

Web 6765 section a—regular credit. The irs will provide a grace period (until january 10, 2022) before requiring the inclusion of this information with timely filed section 41 research credit claims for refund. Section a is used to claim the regular credit and has eight lines of required information (lines 1,2,3,7,8,10,11 and17). Calculate and claim the r&d tax credit elect.

Free Q&A and Articles Tax Credit Advice

Web use form 6765 to figure and claim the credit for increasing research activities, to elect the reduced credit under section 280c, and to elect to claim a certain amount of the credit as a payroll tax credit against the employer portion of social security taxes. Certain amounts paid or incurred to energy consortia (see instructions). The irs will provide.

IRS Form 6765 Instructions How to Fill it Out in 2022

The irs will provide a grace period (until january 10, 2022) before requiring the inclusion of this information with timely filed section 41 research credit claims for refund. Web use form 6765 to figure and claim the credit for increasing research activities, to elect the reduced credit under section 280c, and to elect to claim a certain amount of the.

Form 6765 How to Get R&D Tax Credits (Research & Development)

Web we last updated the credit for increasing research activities in february 2023, so this is the latest version of form 6765, fully updated for tax year 2022. Draft versions of tax forms, instructions, and publications. It also allows you to communicate how you would like to. Web information about form 6765, credit for increasing research activities, including recent updates,.

Form 6765 ≡ Fill Out Printable PDF Forms Online

The draft instructions contain updates regarding: Use form 6765 to figure and claim the credit for increasing research activities or to elect the reduced credit under section 280c. Web this may be done using form 6765, credit for increasing research activities pdf. Web what is form 6765, and why would i need it? It also allows you to communicate how.

Web What Is Form 6765, And Why Would I Need It?

Use form 6765 to figure and claim the credit for increasing research activities or to elect the reduced credit under section 280c. Web we last updated the credit for increasing research activities in february 2023, so this is the latest version of form 6765, fully updated for tax year 2022. Draft versions of tax forms, instructions, and publications. Form 6765 is used to calculate and claim the r&d tax credits you are entitled to for increasing research and experimentation activities.

The Irs Will Provide A Grace Period (Until January 10, 2022) Before Requiring The Inclusion Of This Information With Timely Filed Section 41 Research Credit Claims For Refund.

You can print other federal tax forms here. Certain amounts paid or incurred to energy consortia (see instructions). Web use form 6765 to figure and claim the credit for increasing research activities, to elect the reduced credit under section 280c, and to elect to claim a certain amount of the credit as a payroll tax credit against the employer portion of social security taxes. Skip this section and go to section b if you are electing or previously elected (and are not revoking) the alternative simplified credit.

It Also Allows You To Communicate How You Would Like To.

To calculate the regular credit amount Basic research payments to qualified organizations (see instructions). Section b applies to the alternative simplified credit (asc). On january 12, 2023, the internal revenue service (irs) released new draft instructions to the federal form 6765, the credit for increasing research activities.

Web This May Be Done Using Form 6765, Credit For Increasing Research Activities Pdf.

The draft instructions contain updates regarding: Web update on irs changes to form 6765. Web 6765 section a—regular credit. Do not file draft forms and do not rely on information in draft instructions or publications.