Form 8582 Cr

Form 8582 Cr - Written comments should be received on or before. Web form 8582, passive activity loss limitations is used to calculate the amount of any passive activity loss that a taxpayer can take in a given year. However, for purposes of the donor’s. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed. Worksheet 1—for form 8582, lines 1a,. You can download or print. Noncorporate taxpayers use form 8582 to: Web special allowance for rental real estate activities in the instructions.) 1 a activities with net income (enter the amount from part iv, column (a)). Web form 8282 is used by donee organizations to report information to irs about dispositions of certain charitable deduction property made within three years after the. 1a b activities with net loss (enter.

Figure the amount of any passive activity loss (pal) for. Figure the amount of any passive activity credit (pac). Noncorporate taxpayers use form 8582 to: However, credits from (2)(a) and (2)(b) without taking into these activities may be subject to who must file. What is the form used for? For more information on passive. Web form 8283 contains more than one item, this exception applies only to those items that are clearly identified as having a value of $500 or less. Keep a copy for your records. 8582 (2018) form 8582 (2018) page. The worksheets must be filed with your tax return.

Web about form 8582, passive activity loss limitations. Web special allowance for rental real estate activities in the instructions.) 1 a activities with net income (enter the amount from part iv, column (a)). The worksheets must be filed with your tax return. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. Figure the amount of any passive activity credit (pac). Keep a copy for your records. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed. A passive activity loss occurs when total losses (including. However, credits from (2)(a) and (2)(b) without taking into these activities may be subject to who must file. Web form 8282 is used by donee organizations to report information to irs about dispositions of certain charitable deduction property made within three years after the.

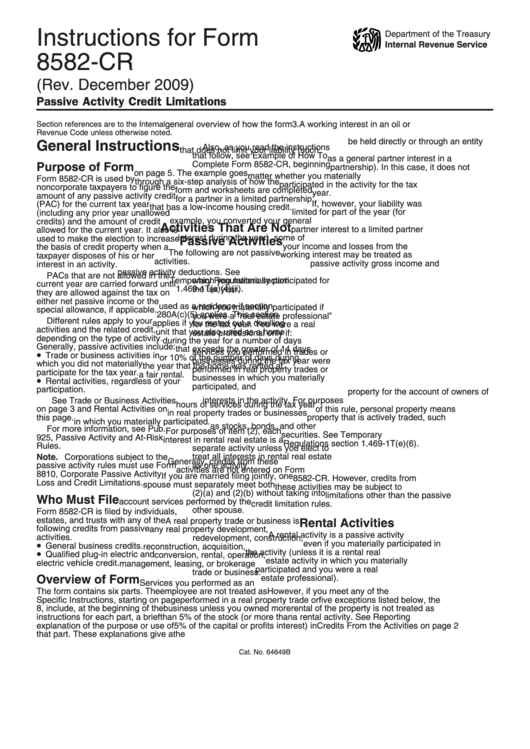

Instructions for Form 8582CR (01/2012) Internal Revenue Service

Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. Noncorporate taxpayers use form 8582 to: For more information on passive. You can download or print. A passive activity loss occurs when total losses (including.

Instructions for Form 8582CR, Passive Activity Credit Limitations

Worksheet 1—for form 8582, lines 1a,. 8582 (2018) form 8582 (2018) page. 1a b activities with net loss (enter. A passive activity loss occurs when total losses (including. Web form 8582, passive activity loss limitations is used to calculate the amount of any passive activity loss that a taxpayer can take in a given year.

Instructions For Form 8582Cr (Rev. December 2009) printable pdf download

What is the form used for? Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed. For more information on passive. Figure the amount of any passive activity credit (pac). Web form 8582 is used by noncorporate taxpayers.

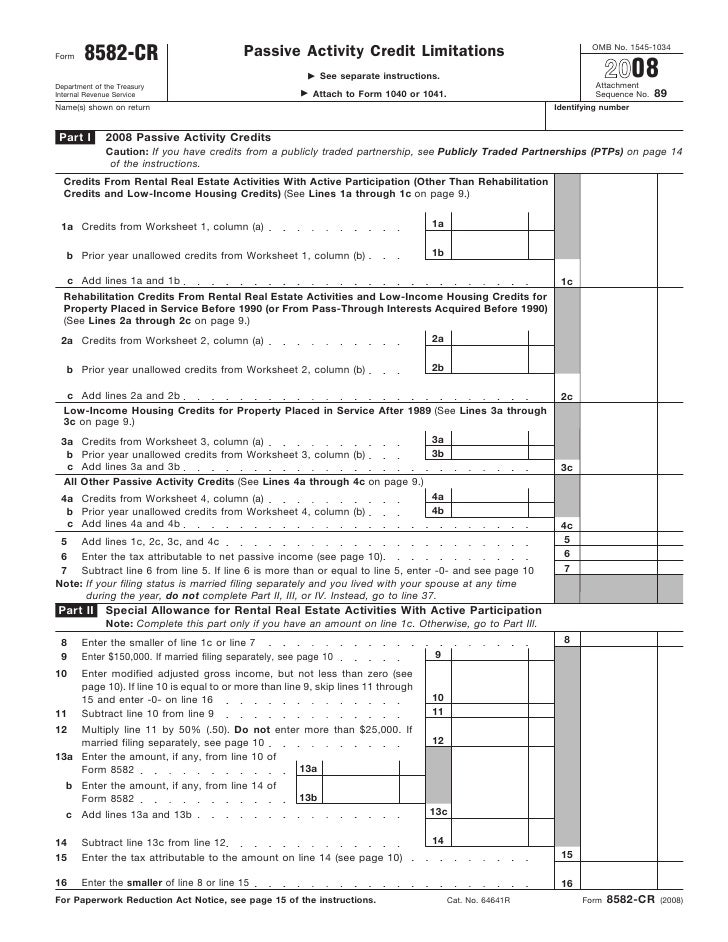

Form 8582CR Passive Activity Credit Limitations

Noncorporate taxpayers use form 8582 to: Web loss and credit limitations. Keep a copy for your records. Web about form 8582, passive activity loss limitations. What is the form used for?

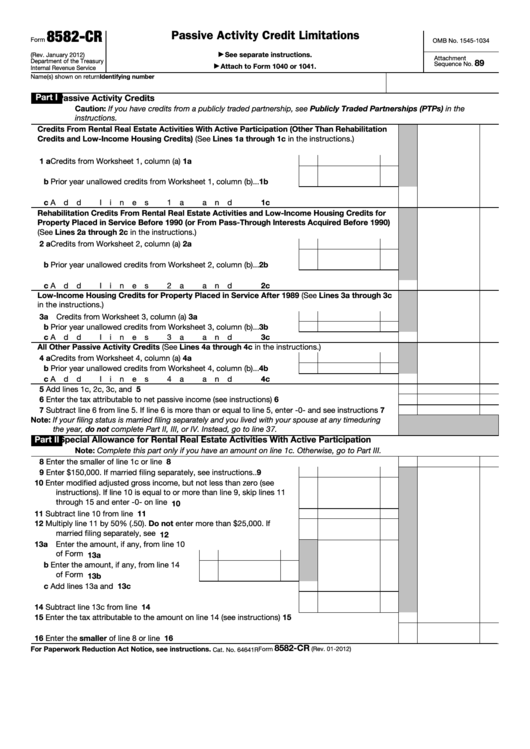

Fillable Form 8582Cr Passive Activity Credit Limitations printable

Figure the amount of any passive activity credit (pac). Web special allowance for rental real estate activities in the instructions.) 1 a activities with net income (enter the amount from part iv, column (a)). 8582 (2018) form 8582 (2018) page. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the.

Form 8582 Passive Activity Loss Limitations (2014) Free Download

Web form 8282 is used by donee organizations to report information to irs about dispositions of certain charitable deduction property made within three years after the. Keep a copy for your records. A passive activity loss occurs when total losses (including. However, for purposes of the donor’s. Web form 8283 contains more than one item, this exception applies only to.

Form 8582CR Passive Activity Credit Limitations (2012) Free Download

Written comments should be received on or before. Noncorporate taxpayers use form 8582 to: You can download or print. Figure the amount of any passive activity credit (pac). 8582 (2018) form 8582 (2018) page.

Instructions for Form 8582CR (12/2019) Internal Revenue Service

Web about form 8582, passive activity loss limitations. Written comments should be received on or before. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed. Noncorporate taxpayers use form 8582 to: You can download or print.

Instructions for Form 8582CR, Passive Activity Credit Limitations

Web form 8282 is used by donee organizations to report information to irs about dispositions of certain charitable deduction property made within three years after the. Figure the amount of any passive activity credit (pac). A passive activity loss occurs when total losses (including. Web special allowance for rental real estate activities in the instructions.) 1 a activities with net.

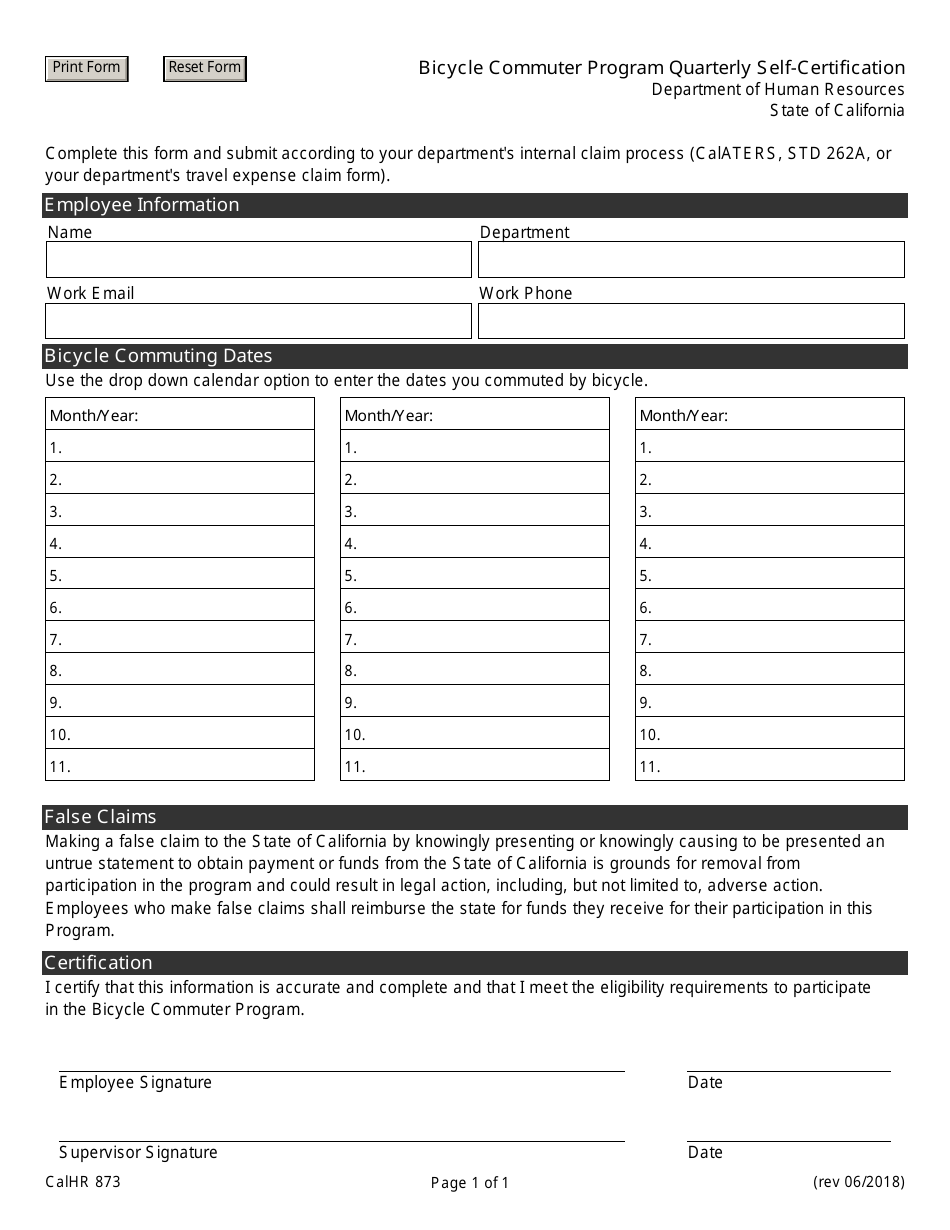

Form CALHR873 Download Fillable PDF or Fill Online Bicycle Commuter

Figure the amount of any passive activity loss (pal) for. Web about form 8582, passive activity loss limitations. However, credits from (2)(a) and (2)(b) without taking into these activities may be subject to who must file. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. Web loss.

Figure The Amount Of Any Passive Activity Loss (Pal) For.

You can download or print. For more information on passive. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. Noncorporate taxpayers use form 8582 to:

1A B Activities With Net Loss (Enter.

Worksheet 1—for form 8582, lines 1a,. Web loss and credit limitations. Web special allowance for rental real estate activities in the instructions.) 1 a activities with net income (enter the amount from part iv, column (a)). The worksheets must be filed with your tax return.

Written Comments Should Be Received On Or Before.

Web form 8582, passive activity loss limitations is used to calculate the amount of any passive activity loss that a taxpayer can take in a given year. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed. However, credits from (2)(a) and (2)(b) without taking into these activities may be subject to who must file. Web form 8282 is used by donee organizations to report information to irs about dispositions of certain charitable deduction property made within three years after the.

What Is The Form Used For?

However, for purposes of the donor’s. Figure the amount of any passive activity credit (pac). Web form 8283 contains more than one item, this exception applies only to those items that are clearly identified as having a value of $500 or less. 8582 (2018) form 8582 (2018) page.