Form 8615 Instructions 2022

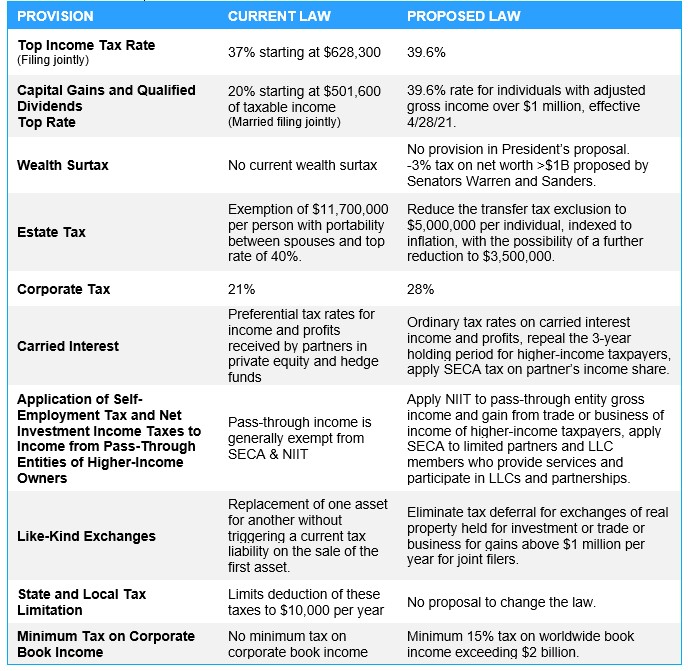

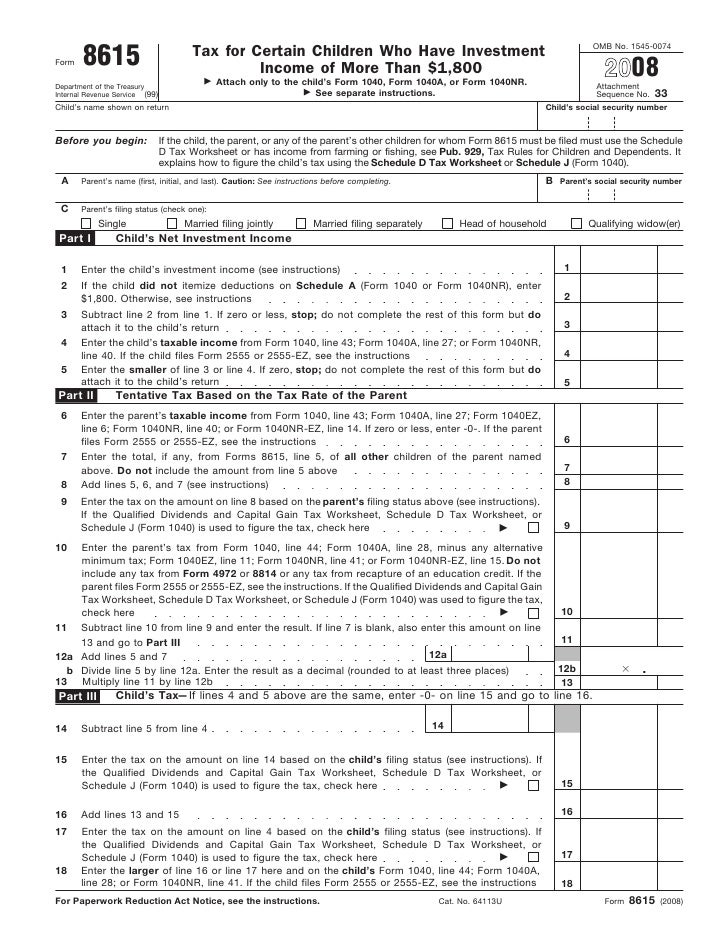

Form 8615 Instructions 2022 - You are required to file a tax return. Find the document template you need from our collection of legal form samples. Try it for free now! Web form 8615 must be filed with the child’s tax return if all of the following apply: Subtract line 6 of this worksheet from line 1 (but don’t enter less than zero or more than the amount on form 8615, line 5). Here what's considered earned income? Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Web 11/29/2022 inst 8615: Register and subscribe now to work on your irs form 8615 & more fillable forms. Web single married filing jointlymarried filing separately head of householdqualifying widow(er) part i child’s net unearned income 1 enter the child’s unearned income.

Subtract line 6 of this worksheet from line 1 (but don’t enter less than zero or more than the amount on form 8615, line 5). Web form 8615 must be filed with the child’s tax return if all of the following apply: Web 11/29/2022 inst 8615: Find the document template you need from our collection of legal form samples. For example, if the child's parents were married to each other and filed a. Here what's considered earned income? Attach only to the child’s form 1040 or. You had more than $2,300 of unearned income. Do not file draft forms. Department of the treasury internal revenue service.

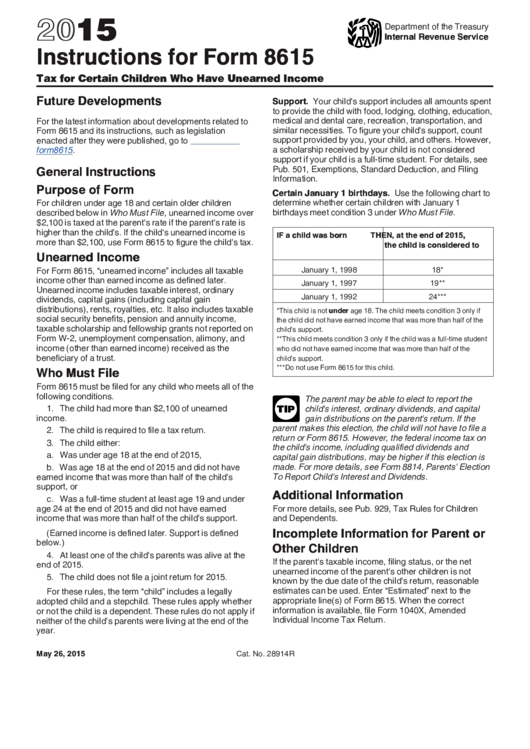

For children under age 18 and certain older children described below in who must file, unearned income over $2,000 is taxed at the parent's rate if the parent's. You had more than $2,300 of unearned income. Attach only to the child’s form 1040 or. Subtract line 6 of this worksheet from line 1 (but don’t enter less than zero or more than the amount on form 8615, line 5). Find the document template you need from our collection of legal form samples. Purpose of form for children under age 18 and certain older children described below in who must file, unearned income over $2,300 is. Web per irs instructions for form 8615: Web qualified dividends on form 8615, line 5. Under age 18, age 18 and did not have earned income that. Ad upload, modify or create forms.

Instructions for IRS Form 8615 Tax For Certain Children Who Have

Web general instructions purpose of form for children under age 18 and certain older children described below in who must file, unearned income over $2,200 is taxed at the parent's. Register and subscribe now to work on your irs form 8615 & more fillable forms. Web per irs instructions for form 8615: Subtract line 6 of this worksheet from line.

Form 568 instructions 2012

Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Purpose of form for children under age 18 and certain older children described below in who must file, unearned income over $2,300 is. Department of the treasury internal revenue service. Instructions for form 8615 form. The child.

Form 8615 Tax for Certain Children Who Have Unearned (2015

Web form 8615 must be filed for any child who meets all of the following conditions: Under age 18, age 18 and did not have earned income that. The child had more than $2,300 of unearned income. Web 11/29/2022 inst 8615: Here what's considered earned income?

Publication 929 Tax Rules for Children and Dependents; Tax Rules for

Register and subscribe now to work on your irs form 8615 & more fillable forms. For example, if the child's parents were married to each other and filed a. Under age 18, age 18 and did not have earned income that. Subtract line 6 of this worksheet from line 1 (but don’t enter less than zero or more than the.

Form 8615 Office Depot

Web per irs instructions for form 8615: The child is required to file a tax return. Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Web form 8615 must be filed with the child’s tax return if all of the following apply: You had more than.

Solved Form 8615 election for children to be taxed at par... Intuit

Instructions for form 8615 form. Try it for free now! Web qualified dividends on form 8615, line 5. Do not file draft forms. The child is required to file a tax return.

net investment tax 2021 form Do Good Podcast Fonction

Under age 18, age 18 and did not have earned income that. For example, if the child's parents were married to each other and filed a. Attach only to the child’s form 1040 or. Do not file draft forms. Instructions for form 8615, tax for certain children who have unearned income 2022 11/17/2022 form 15307:

Form 8615 Instructions (2015) printable pdf download

Web 11/29/2022 inst 8615: Purpose of form for children under age 18 and certain older children described below in who must file, unearned income over $2,300 is. Web form 8615 must be filed for any child who meets all of the following conditions. Web form 8615 must be filed with the child’s tax return if all of the following apply:.

Solved Form 8615 election for children to be taxed at par... Intuit

Web per irs instructions for form 8615: For example, if the child's parents were married to each other and filed a. Web form 8615 must be filed with the child’s tax return if all of the following apply: You had more than $2,300 of unearned income. Under age 18, age 18 and did not have earned income that.

Form 8615Tax for Children Under Age 14 With Investment of Mor…

Under age 18, age 18 and did not have earned income that. For children under age 18 and certain older children described below in who must file, unearned income over $2,000 is taxed at the parent's rate if the parent's. Instructions for form 8615, tax for certain children who have unearned income 2022 11/17/2022 form 15307: Web form 8615 is.

Web Form 8615 Must Be Filed For Any Child Who Meets All Of The Following Conditions.

Register and subscribe now to work on your irs form 8615 & more fillable forms. Subtract line 6 of this worksheet from line 1 (but don’t enter less than zero or more than the amount on form 8615, line 5). For children under age 18 and certain older children described below in who must file, unearned income over $2,000 is taxed at the parent's rate if the parent's. Attach only to the child’s form 1040 or.

Web Qualified Dividends On Form 8615, Line 5.

Here what's considered earned income? Web form 8615 must be filed with the child’s tax return if all of the following apply: Web complete irs 8615 in just a couple of clicks following the guidelines below: Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information.

The Child Had More Than $2,300 Of Unearned Income.

Web general instructions purpose of form for children under age 18 and certain older children described below in who must file, unearned income over $2,200 is taxed at the parent's. Web form 8615 is required to be used when a taxpayer’s child had unearned income over $2,300 and is: Web 11/29/2022 inst 8615: Below are answers to frequently asked questions about using form 8615 and 8814 in proseries basic and proseries.

Instructions For Form 8615, Tax For Certain Children Who Have Unearned Income 2022 11/17/2022 Form 15307:

Web solved•by intuit•15•updated july 12, 2022. Web form 8615 must be filed for any child who meets all of the following conditions: Try it for free now! Web single married filing jointlymarried filing separately head of householdqualifying widow(er) part i child’s net unearned income 1 enter the child’s unearned income.