Form 8621 Penalty

Form 8621 Penalty - Web the penalties start at $10,000 per year and can go up an additional $50,000 for an ongoing penalty when the taxpayer fails to remedy the situation. Web what are the penalties for not filing form 8621? It requires disclosing information about assets held in foreign accounts and. For details, see election to be treated as a qualifying insurance corporation, later. Pc helps you penalties for failure to file form 8621 could include a $10,000 penalty (under form 8938), and suspension of the statute of limitations with. Individual shareholder who fails to disclose a directly held pfic investment on either form 8621 or form 8938 when required can be subject to a. Web 21 january 2020 per the instructions for forms 8621, when and where to file, attach form 8621 to the shareholder's tax return (or, if applicable, partnership or. Receives certain direct or indirect distributions from a pfic, 2. Such form should be attached to the. Recognizes gain on a direct or.

Passive foreign investment corporation (pfic). Individual shareholder who fails to disclose a directly held pfic investment on either form 8621 or form 8938 when required can be subject to a. Web us income tax filing requirements for pfic shareholders and form 8621. Web the team at evolution tax and legal are here for you to break down form 8621: Web how flott and co. Web if you do not file a correct and complete form 8938 within 90 days after the irs mails you a notice of the failure to file, you may be subject to an additional penalty of $10,000 for. Unlike other information returns, form 8621 does not carry a penalty for not filing the form. Who needs to file it, how to file it, and the penalties incurred for failure to file. Web what are the penalties for not filing form 8621? Generally, it is to the advantage of a u.s.

Individual shareholder who fails to disclose a directly held pfic investment on either form 8621 or form 8938 when required can be subject to a. Any us citizen or resident who directly or indirectly holds more than $25,000 worth of pfic. Web the penalties start at $10,000 per year and can go up an additional $50,000 for an ongoing penalty when the taxpayer fails to remedy the situation. Web the team at evolution tax and legal are here for you to break down form 8621: Unlike other information returns, form 8621 does not carry a penalty for not filing the form. Web purpose form 8938 is a requirement under the fatca to inhibit global tax evasion. Passive foreign investment corporation (pfic). Where there are no distributions to. Who needs to file it, how to file it, and the penalties incurred for failure to file. Web us income tax filing requirements for pfic shareholders and form 8621.

Form 8621 Global Accountant Network

Web the team at evolution tax and legal are here for you to break down form 8621: Web file form 8621 for each tax year under the following three circumstances: Such form should be attached to the. For details, see election to be treated as a qualifying insurance corporation, later. Web where there are no distributions to the shareholders, there.

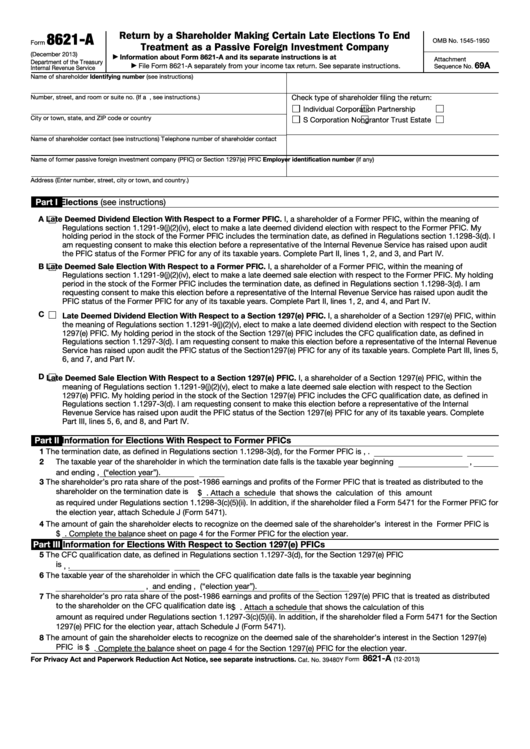

Fillable Form 8621A Return By A Shareholder Making Certain Late

Any us citizen or resident who directly or indirectly holds more than $25,000 worth of pfic. Unlike other information returns, form 8621 does not carry a penalty for not filing the form. Passive foreign investment corporation (pfic). Web the penalties start at $10,000 per year and can go up an additional $50,000 for an ongoing penalty when the taxpayer fails.

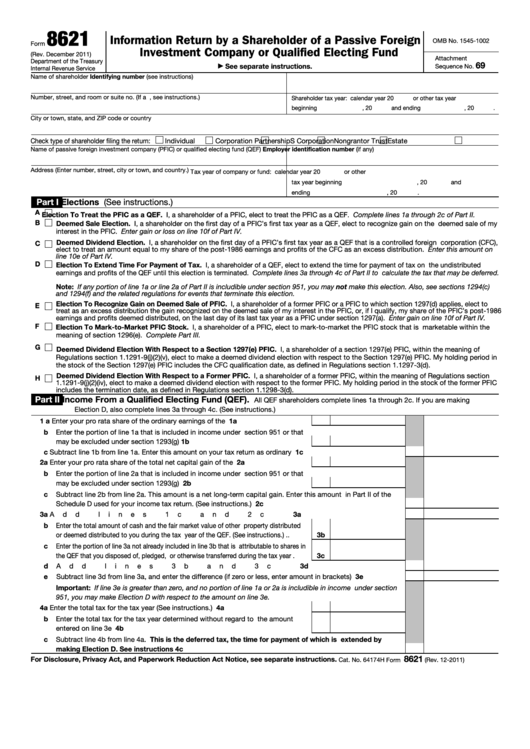

Fillable Form 8621 Information Return By A Shareholder Of A Passive

Individual shareholder who fails to disclose a directly held pfic investment on either form 8621 or form 8938 when required can be subject to a. Web the team at evolution tax and legal are here for you to break down form 8621: Web file form 8621 for each tax year under the following three circumstances: Who needs to file it,.

Form 8621 Instructions 2020 2021 IRS Forms

Web us income tax filing requirements for pfic shareholders and form 8621. For details, see election to be treated as a qualifying insurance corporation, later. Recognizes gain on a direct or. Web what are the penalties for not filing form 8621? Individual shareholder who fails to disclose a directly held pfic investment on either form 8621 or form 8938 when.

Company Tax Return Company Tax Return Checklist 2013

Generally, it is to the advantage of a u.s. Recognizes gain on a direct or. Web how flott and co. Web what are the penalties for not filing form 8621? Pc helps you penalties for failure to file form 8621 could include a $10,000 penalty (under form 8938), and suspension of the statute of limitations with.

Form 8621 Calculator Introduction YouTube

Web what are the penalties for not filing form 8621? Web 21 january 2020 per the instructions for forms 8621, when and where to file, attach form 8621 to the shareholder's tax return (or, if applicable, partnership or. Irc 1298(f) and the applicable regulations do not provide for a specific penalty in case of failure to file form 8621. For.

The Only Business U.S. Expat Tax blog you need to read

Web how flott and co. Passive foreign investment corporation (pfic). Web what are the penalties for not filing form 8621? Web purpose form 8938 is a requirement under the fatca to inhibit global tax evasion. Pc helps you penalties for failure to file form 8621 could include a $10,000 penalty (under form 8938), and suspension of the statute of limitations.

form8621calcualtorpficupdatefacebook Expat Tax Tools

Web the penalties start at $10,000 per year and can go up an additional $50,000 for an ongoing penalty when the taxpayer fails to remedy the situation. Web us income tax filing requirements for pfic shareholders and form 8621. Web purpose form 8938 is a requirement under the fatca to inhibit global tax evasion. Web where there are no distributions.

All about Form 8621 SDG Accountant

Web the law the annual information reporting requirement comes from irc § 1298 (f), which came into being on march 18, 2010 with the enactment of the hire act (the. Such form should be attached to the. Recognizes gain on a direct or. Web if you do not file a correct and complete form 8938 within 90 days after the.

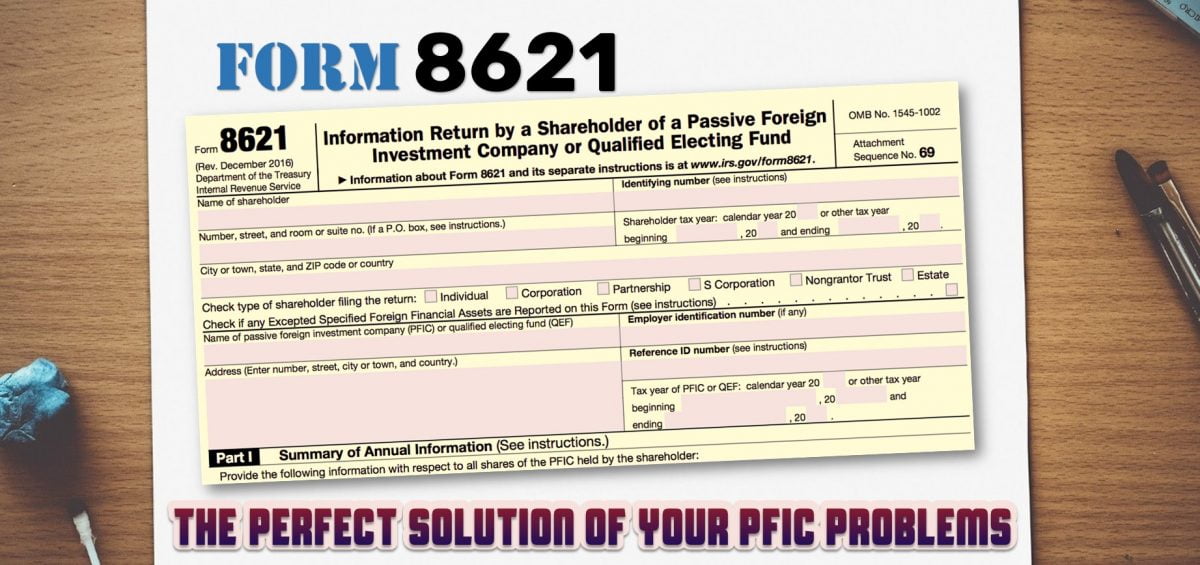

Form 8621 Information Return by a Shareholder of a Passive Foreign

Web what are the penalties for not filing form 8621? Web us income tax filing requirements for pfic shareholders and form 8621. Such form should be attached to the. Web that annual report is form 8621 (information return by a shareholder of a passive foreign investment company or qualified electing fund). Receives certain direct or indirect distributions from a pfic,.

Web That Annual Report Is Form 8621 (Information Return By A Shareholder Of A Passive Foreign Investment Company Or Qualified Electing Fund).

Receives certain direct or indirect distributions from a pfic, 2. December 2018) department of the treasury internal revenue service information return by a shareholder of a passive foreign investment company or. Pc helps you penalties for failure to file form 8621 could include a $10,000 penalty (under form 8938), and suspension of the statute of limitations with. Web 21 january 2020 per the instructions for forms 8621, when and where to file, attach form 8621 to the shareholder's tax return (or, if applicable, partnership or.

Failing To File Form 8621 Would Result In Suspension Of.

Any us citizen or resident who directly or indirectly holds more than $25,000 worth of pfic. Web where there are no distributions to the shareholders, there are no explicit penalties for a failure to file the form. Web the team at evolution tax and legal are here for you to break down form 8621: Where there are no distributions to.

Web Purpose Form 8938 Is A Requirement Under The Fatca To Inhibit Global Tax Evasion.

Web the law the annual information reporting requirement comes from irc § 1298 (f), which came into being on march 18, 2010 with the enactment of the hire act (the. Who needs to file it, how to file it, and the penalties incurred for failure to file. Web how flott and co. Recognizes gain on a direct or.

Individual Shareholder Who Fails To Disclose A Directly Held Pfic Investment On Either Form 8621 Or Form 8938 When Required Can Be Subject To A.

Generally, it is to the advantage of a u.s. Such form should be attached to the. Web file form 8621 for each tax year under the following three circumstances: Web us income tax filing requirements for pfic shareholders and form 8621.