Form 8804 Instructions 2021

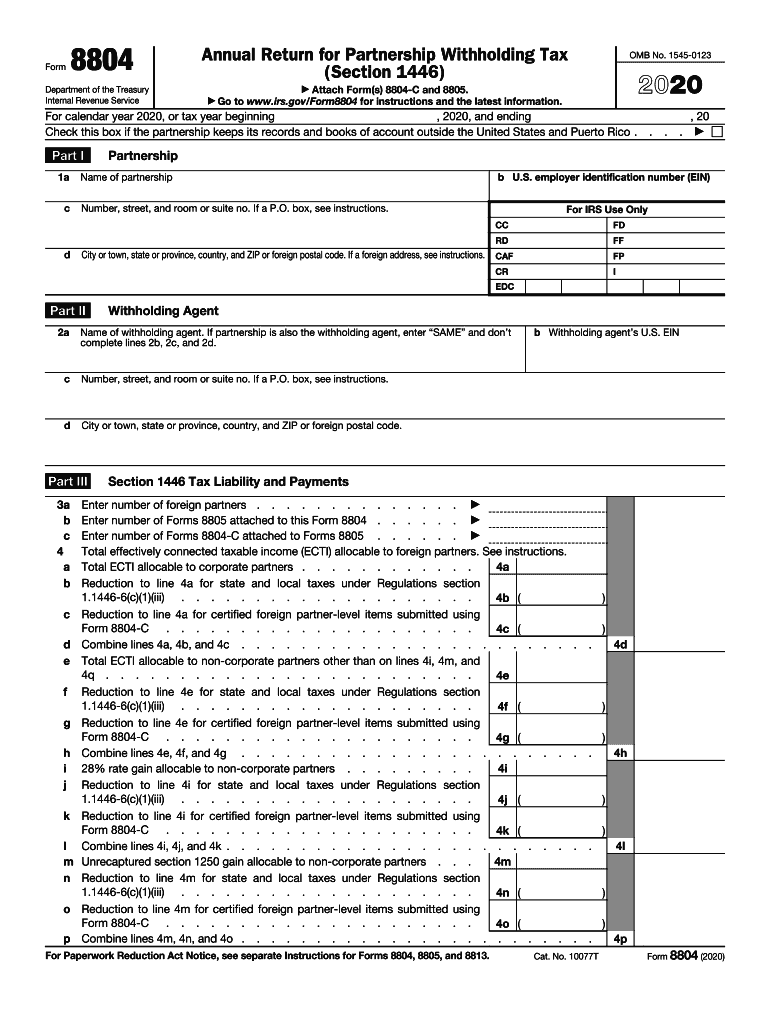

Form 8804 Instructions 2021 - Use form 8805 to show. Web information about form 8804, annual return for partnership withholding tax (section 1446), including recent updates, related forms, and instructions on how to file. Form 8804 is also a transmittal form for form(s) 8805. Easily fill out pdf blank, edit, and. Both the form and instructions. File form 8804 by the 15th day of the 3rd month (4th month for. Use form 8805 to show the. Section 1445(a) or 1445(e) tax withheld from or paid by. New instructions for form 2848, draft 2021 form 1099. Form 8804 is also a transmittal form for form(s) 8805.

Form 8804 is also a transmittal form for form(s) 8805. This article will help you generate and file forms 8804, annual return for partnership. Use form 8805 to show the. Web a form 8805 for each foreign partner must be attached to form 8804, whether or not any withholding tax was paid. Web form 8804, annual return for partnership withholding tax (section 1446) specifically is used to report the total liability under section 1446 for the partnership’s tax. Penalty for underpayment of estimated section 1446 tax by partnerships online with us legal forms. File form 8804 by the 15th day of the 3rd month (4th month for. Both the form and instructions. Use form 8805 to show. Web information about form 8804, annual return for partnership withholding tax (section 1446), including recent updates, related forms, and instructions on how to file.

Use form 8805 to show the. Form 8804 is also a transmittal form for form(s) 8805. Web form 8804, annual return for partnership withholding tax (section 1446) specifically is used to report the total liability under section 1446 for the partnership’s tax. This article will help you generate and file forms 8804, annual return for partnership. Section 1445(a) or 1445(e) tax withheld from or paid by. Web use form 8804 to report the total liability under section 1446 for the partnership's tax year. Use form 8805 to show. Web complete 2021 schedule a (form 8804). File form 8804 by the 15th day of the 3rd month (4th month for. Web generating forms 8804 and 8805 for a partnership return in lacerte.

Form 8804C Certificate of PartnerLevel Items to Reduce Section 1446

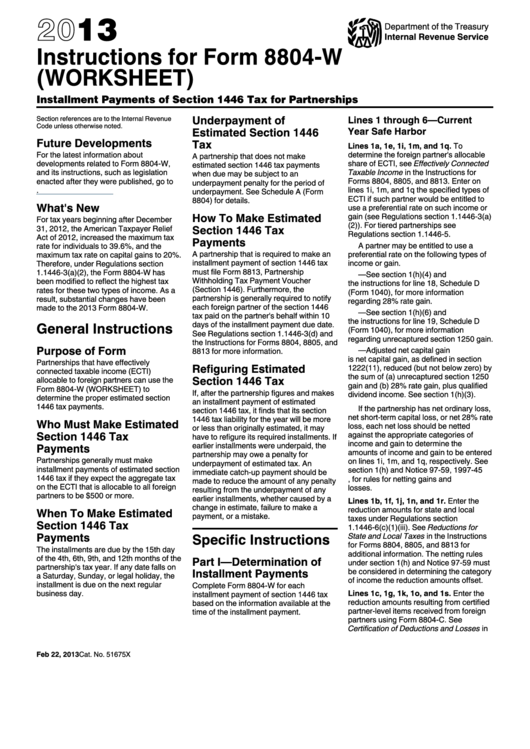

Web back to all comply would like to call your attention to a few updates that the irs published last week! Form 8804 and these instructions have been converted from an annual revision to continuous use. Penalty for underpayment of estimated section 1446 tax by partnerships online with us legal forms. New instructions for form 2848, draft 2021 form 1099..

Form 8804 PDF Internal Revenue Service Fill Out and Sign Printable

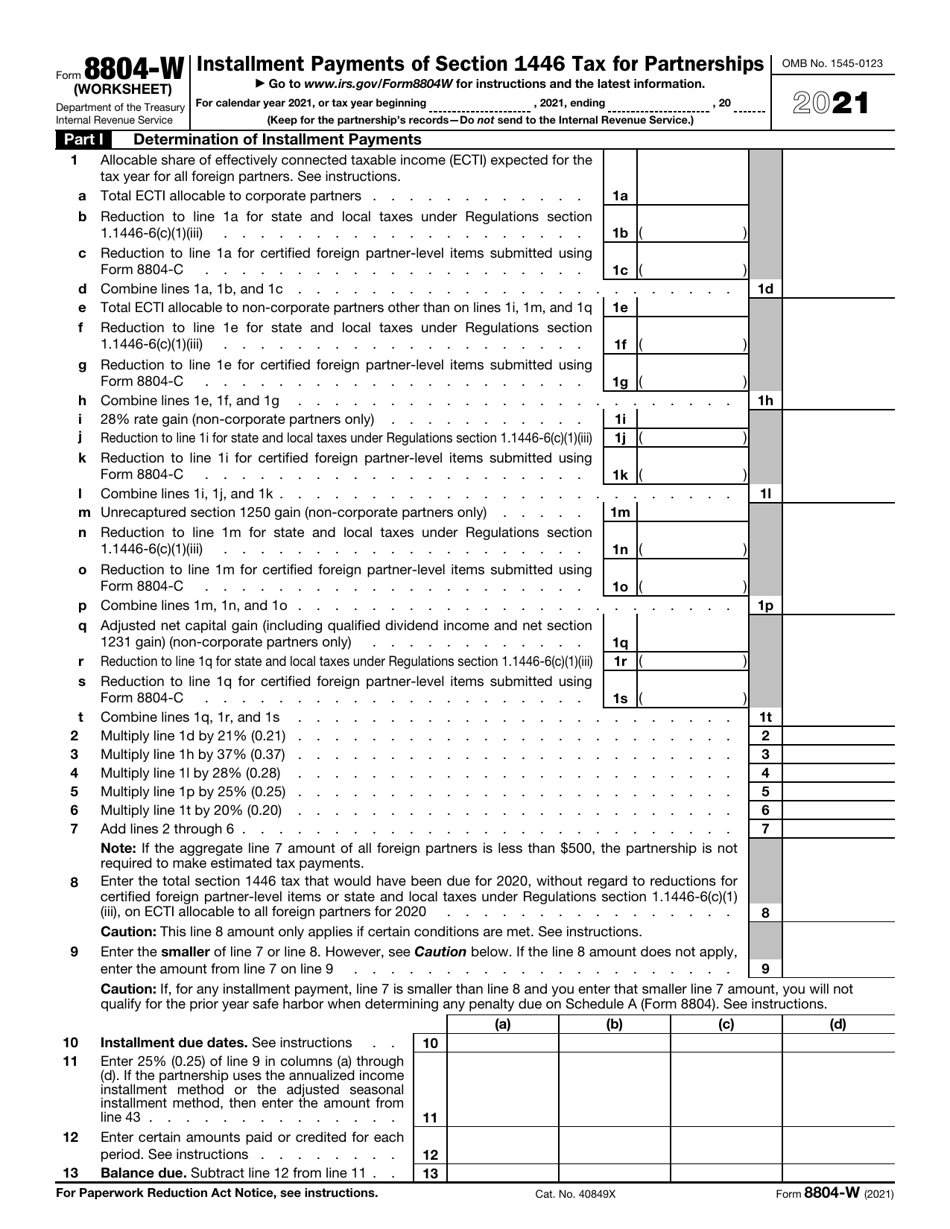

Web generating forms 8804 and 8805 for a partnership return in lacerte. Web instructions for forms 8804, 8805 and 8813 2021 12/28/2021 inst 8804 (schedule a) instructions for schedule a (form 8804), penalty for underpayment of estimated. New instructions for form 2848, draft 2021 form 1099. Web use form 8804 to report the total liability under section 1446 for the.

Form 8804 Schedule A Instructions Fill online, Printable, Fillable Blank

Form 8804 is also a transmittal form for form(s) 8805. Web use form 8804 to report the total liability under section 1446 for the partnership's tax year. Web back to all comply would like to call your attention to a few updates that the irs published last week! Web use form 8804 to report the total liability under section 1446.

Instructions For Form 8804W (Worksheet) Installment Payments Of

Both the form and instructions. Web information about form 8804, annual return for partnership withholding tax (section 1446), including recent updates, related forms, and instructions on how to file. Web instructions for forms 8804, 8805 and 8813 2021 12/28/2021 inst 8804 (schedule a) instructions for schedule a (form 8804), penalty for underpayment of estimated. Easily fill out pdf blank, edit,.

Form 8804 Annual Return for Partnership Withholding Tax

Use form 8805 to show the. Web generating forms 8804 and 8805 for a partnership return in lacerte. Section 1445(a) or 1445(e) tax withheld from or paid by. Use form 8805 to show. Form 8804 is also a transmittal form for form(s) 8805.

Form 8804 Annual Return for Partnership Withholding Tax (Section 1446

Web back to all comply would like to call your attention to a few updates that the irs published last week! Web form 8804, annual return for partnership withholding tax (section 1446) specifically is used to report the total liability under section 1446 for the partnership’s tax. File form 8804 by the 15th day of the 3rd month (4th month.

IRS Form 8804W Download Fillable PDF or Fill Online Installment

File form 8804 by the 15th day of the 3rd month (4th month for. Use form 8805 to show the. Web see the instructions for form 8804, lines 6b and 6c, in the instructions for forms 8804, 8805, and 8813. Use form 8805 to show. Web form 8804, annual return for partnership withholding tax (section 1446) specifically is used to.

Fill Free fillable Installment Payments of Section 1446 Tax for

Web information about form 8804, annual return for partnership withholding tax (section 1446), including recent updates, related forms, and instructions on how to file. Web instructions for forms 8804, 8805 and 8813 2021 12/28/2021 inst 8804 (schedule a) instructions for schedule a (form 8804), penalty for underpayment of estimated. Form 8804 is also a transmittal form for form(s) 8805. Web.

Form 8804 Annual Return for Partnership Withholding Tax (Section 1446

Use form 8805 to show the. Section 1445(a) or 1445(e) tax withheld from or paid by. Use form 8805 to show. Web use form 8804 to report the total liability under section 1446 for the partnership's tax year. Form 8804 is also a transmittal form for form(s) 8805.

Form 8802 Instructions 2021 2022 IRS Forms Zrivo

Web form 8804, annual return for partnership withholding tax (section 1446) specifically is used to report the total liability under section 1446 for the partnership’s tax. Web information about form 8804, annual return for partnership withholding tax (section 1446), including recent updates, related forms, and instructions on how to file. Both the form and instructions. Use form 8805 to show.

Use Form 8805 To Show.

Section 1445(a) or 1445(e) tax withheld from or paid by. Penalty for underpayment of estimated section 1446 tax by partnerships online with us legal forms. Web use form 8804 to report the total liability under section 1446 for the partnership's tax year. This article will help you generate and file forms 8804, annual return for partnership.

Both The Form And Instructions.

Form 8804 is also a transmittal form for form(s) 8805. Web form 8804, annual return for partnership withholding tax (section 1446) specifically is used to report the total liability under section 1446 for the partnership’s tax. New instructions for form 2848, draft 2021 form 1099. Web complete 2021 schedule a (form 8804).

Web Use Form 8804 To Report The Total Liability Under Section 1446 For The Partnership's Tax Year.

Form 8804 is also a transmittal form for form(s) 8805. Use form 8805 to show the. Web generating forms 8804 and 8805 for a partnership return in lacerte. Web instructions for forms 8804, 8805 and 8813 2021 12/28/2021 inst 8804 (schedule a) instructions for schedule a (form 8804), penalty for underpayment of estimated.

Web A Form 8805 For Each Foreign Partner Must Be Attached To Form 8804, Whether Or Not Any Withholding Tax Was Paid.

Easily fill out pdf blank, edit, and. Web information about form 8804, annual return for partnership withholding tax (section 1446), including recent updates, related forms, and instructions on how to file. Form 8804 and these instructions have been converted from an annual revision to continuous use. File form 8804 by the 15th day of the 3rd month (4th month for.