Form 8805 Instructions

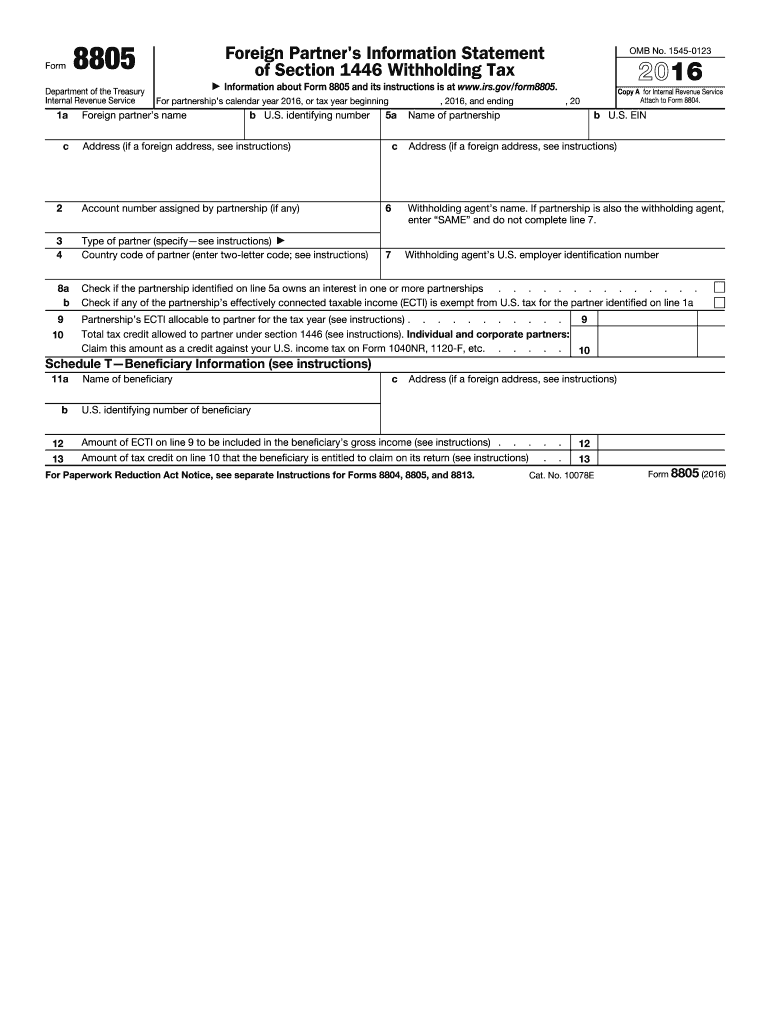

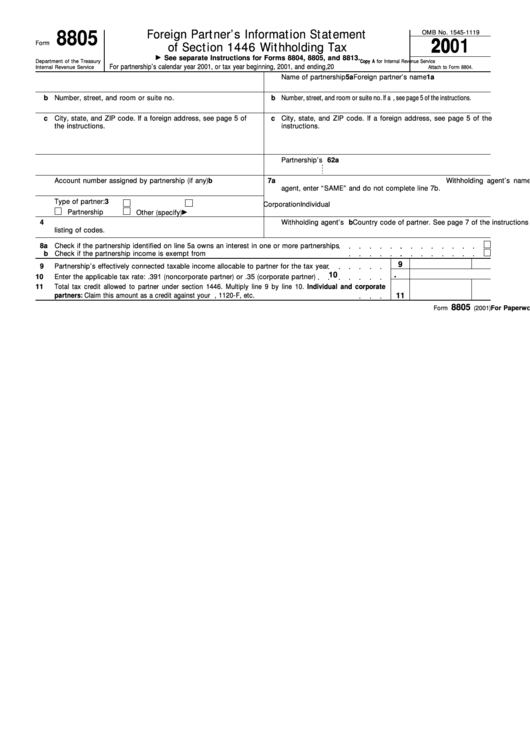

Form 8805 Instructions - Web form 8805 is to be filed by a u.s. Web file form 8813 on or before the 15th day of the 4th, 6th, 9th, and 12th months of the partnership's tax year for u.s. Partnership (or a foreign partnership with effectively connected income to a u.s. About form 8805, foreign partner's information statement of section 1446 withholding tax | internal revenue service Web what is form 8805? Trade or business) to report payments of u.s. Web use form 8805 to show the amount of ecti and the total tax credit allocable to the foreign partner for the partnership's tax year. File a separate form 8805 for each foreign partner. Web this form is used to show the amount of effectively connected taxable income (ecti) and the total tax credit allocable to the foreign partner for the partnership's tax year. Web a copy of form 8805 must be attached to the foreign partner’s u.s.

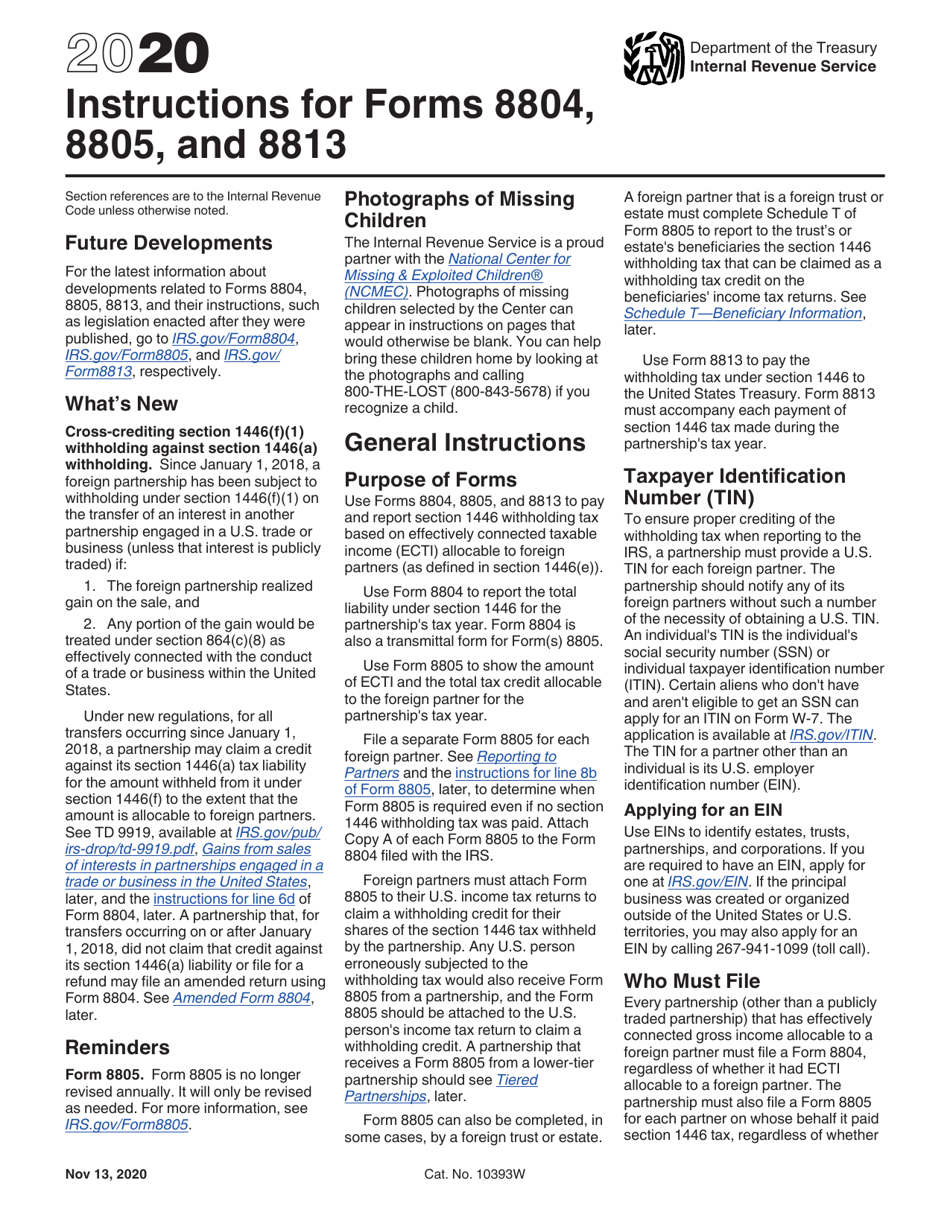

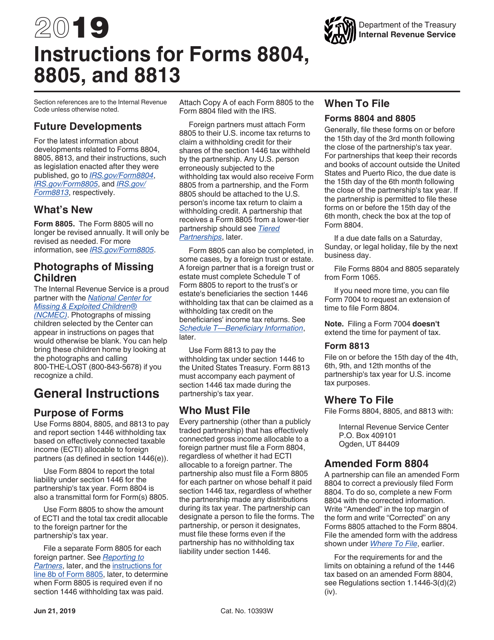

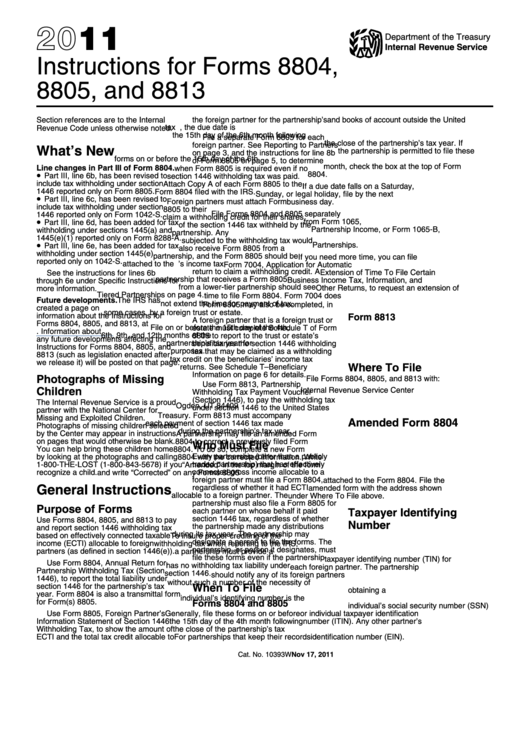

The partnership must also file a form 8805 for each foreign partner even if no section 1446 withholding tax was paid. The partnership must send a completed copy of this form to all foreign partners involved, even if no withholding tax is paid. Web we last updated the foreign partner's information statement of section 1446 withholding tax in february 2023, so this is the latest version of form 8805, fully updated for tax year 2022. Web use form 8805 to show the amount of ecti and the total tax credit allocable to the foreign partner for the partnership's tax year. Partnership (or a foreign partnership with effectively connected income to a u.s. Web form 8805 is to be filed by a u.s. Form 8805 reports the amount of eci allocated to a foreign partner. See reporting to partners and the instructions for line 8b of form 8805, later, to determine when form 8805 is required even if no section 1446 withholding tax was. File a separate form 8805 for each foreign partner. Instructions for forms 8804, 8805, and 8813 provides guidance to filers of forms 8804, 8805, and 8813 on how to pay and report section 1446 withholding tax based on effectively connected taxable income.

This form is used to make payments of withheld tax to the united states treasury. See reporting to partners and the instructions for line 8b of form 8805, later, to determine when form 8805 is required even if no section 1446 withholding tax was. Instructions for forms 8804, 8805, and 8813 provides guidance to filers of forms 8804, 8805, and 8813 on how to pay and report section 1446 withholding tax based on effectively connected taxable income. Form 8813, partnership withholding tax payment voucher (section 1446). Web form 8805 is to be filed by a u.s. The partnership must send a completed copy of this form to all foreign partners involved, even if no withholding tax is paid. November 2019) foreign partner’s information statement of section 1446 withholding tax department of the treasury internal revenue service copy a for internal revenue service go to www.irs.gov/form8805 for instructions and the latest information. Web use form 8805 to show the amount of ecti and the total tax credit allocable to the foreign partner for the partnership's tax year. Taxes for a foreign partner on the partners' share of the effectively connected income. Web we last updated the foreign partner's information statement of section 1446 withholding tax in february 2023, so this is the latest version of form 8805, fully updated for tax year 2022.

Understanding Key Tax Forms What investors need to know about Schedule

Web a copy of form 8805 must be attached to the foreign partner’s u.s. Web what is form 8805? The partnership must also file a form 8805 for each foreign partner even if no section 1446 withholding tax was paid. File a separate form 8805 for each foreign partner. Web we last updated the foreign partner's information statement of section.

Download Instructions for IRS Form 8804, 8805, 8813 PDF, 2020

Web form 8805 is to be filed by a u.s. Web we last updated the foreign partner's information statement of section 1446 withholding tax in february 2023, so this is the latest version of form 8805, fully updated for tax year 2022. Web this form is used to show the amount of effectively connected taxable income (ecti) and the total.

Download Instructions for IRS Form 8804, 8805, 8813 PDF, 2019

Form 8805 reports the amount of eci allocated to a foreign partner. File a separate form 8805 for each foreign partner. The partnership must also file a form 8805 for each foreign partner even if no section 1446 withholding tax was paid. Web a copy of form 8805 must be attached to the foreign partner’s u.s. This form is used.

Form 8805 Fill Out and Sign Printable PDF Template signNow

Web file form 8813 on or before the 15th day of the 4th, 6th, 9th, and 12th months of the partnership's tax year for u.s. Instructions for forms 8804, 8805, and 8813 provides guidance to filers of forms 8804, 8805, and 8813 on how to pay and report section 1446 withholding tax based on effectively connected taxable income. Web this.

Form 8805 Foreign Partner'S Information Statement Of Section 1446

Web use form 8805 to show the amount of ecti and the total tax credit allocable to the foreign partner for the partnership's tax year. See reporting to partners and the instructions for line 8b of form 8805, later, to determine when form 8805 is required even if no section 1446 withholding tax was. Web this form is used to.

Form 8802 Instructions 2021 2022 IRS Forms Zrivo

Web form 8805 is to be filed by a u.s. File a separate form 8805 for each foreign partner. This form is used to make payments of withheld tax to the united states treasury. Web a copy of form 8805 must be attached to the foreign partner’s u.s. Instructions for forms 8804, 8805, and 8813 provides guidance to filers of.

Irs form 8865 instructions

Form 8805 reports the amount of eci allocated to a foreign partner. About form 8805, foreign partner's information statement of section 1446 withholding tax | internal revenue service Web a copy of form 8805 must be attached to the foreign partner’s u.s. Web this form is used to show the amount of effectively connected taxable income (ecti) and the total.

Instructions For Forms 8804, 8805, And 8813 2011 printable pdf download

Instructions for forms 8804, 8805, and 8813 provides guidance to filers of forms 8804, 8805, and 8813 on how to pay and report section 1446 withholding tax based on effectively connected taxable income. Web a copy of form 8805 must be attached to the foreign partner’s u.s. Web what is form 8805? Partnership (or a foreign partnership with effectively connected.

Work Sharp Precision Adjust Sharpener Tips & Tricks YouTube

Web form 8805, a foreign partner’s information statement of section 1446 withholding tax is used to show the amount of ecti and the total tax credit allocable to the foreign partner for the partnership’s tax year. See reporting to partners and the instructions for line 8b of form 8805, later, to determine when form 8805 is required even if no.

Form 8805 Foreign Partner's Information Statement of Section 1446

Web this form is used to show the amount of effectively connected taxable income (ecti) and the total tax credit allocable to the foreign partner for the partnership's tax year. Partnership (or a foreign partnership with effectively connected income to a u.s. This form is used to make payments of withheld tax to the united states treasury. The partnership must.

See Reporting To Partners And The Instructions For Line 8B Of Form 8805, Later, To Determine When Form 8805 Is Required Even If No Section 1446 Withholding Tax Was.

Trade or business) to report payments of u.s. Web form 8805, a foreign partner’s information statement of section 1446 withholding tax is used to show the amount of ecti and the total tax credit allocable to the foreign partner for the partnership’s tax year. Web what is form 8805? Web form 8805 is to be filed by a u.s.

The Partnership Must Send A Completed Copy Of This Form To All Foreign Partners Involved, Even If No Withholding Tax Is Paid.

Web this form is used to show the amount of effectively connected taxable income (ecti) and the total tax credit allocable to the foreign partner for the partnership's tax year. Web we last updated the foreign partner's information statement of section 1446 withholding tax in february 2023, so this is the latest version of form 8805, fully updated for tax year 2022. November 2019) foreign partner’s information statement of section 1446 withholding tax department of the treasury internal revenue service copy a for internal revenue service go to www.irs.gov/form8805 for instructions and the latest information. File a separate form 8805 for each foreign partner.

Web A Copy Of Form 8805 Must Be Attached To The Foreign Partner’s U.s.

The partnership must also file a form 8805 for each foreign partner even if no section 1446 withholding tax was paid. Partnership (or a foreign partnership with effectively connected income to a u.s. About form 8805, foreign partner's information statement of section 1446 withholding tax | internal revenue service Form 8805 reports the amount of eci allocated to a foreign partner.

Web File Form 8813 On Or Before The 15Th Day Of The 4Th, 6Th, 9Th, And 12Th Months Of The Partnership's Tax Year For U.s.

This form is used to make payments of withheld tax to the united states treasury. Taxes for a foreign partner on the partners' share of the effectively connected income. Instructions for forms 8804, 8805, and 8813 provides guidance to filers of forms 8804, 8805, and 8813 on how to pay and report section 1446 withholding tax based on effectively connected taxable income. Form 8813, partnership withholding tax payment voucher (section 1446).