Form 8849 Schedule 6

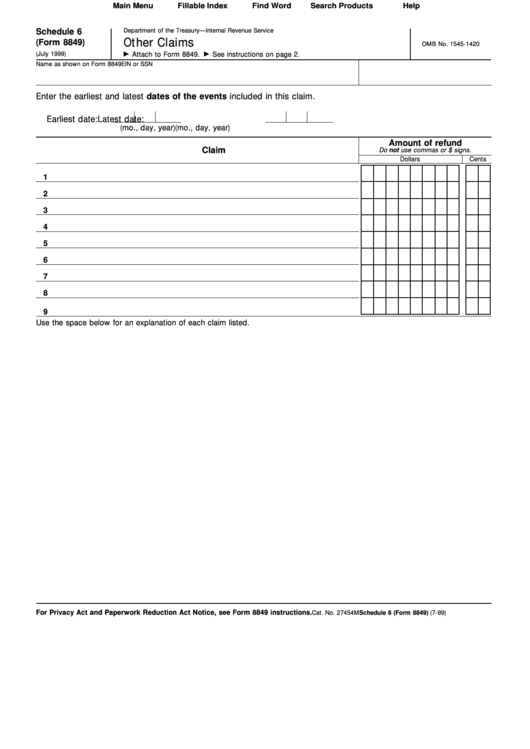

Form 8849 Schedule 6 - The irs form 8849 (schedule 6) helps you claim tax refund for vehicles that were sold, destroyed, or stolen. Use this form to claim a refund of excise taxes on certain fuel related sales. Web schedule 6 (form 8849) and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form8849. Web form 8849 (schedule 8) registered credit card issuers 1006 07/17/2012 inst 8849 (schedule 6) instructions for schedule 6 (form 8849), other claims 0715 08/03/2015 form 8849 (schedule 6) other claims 0813 09/19/2014 form 8849 (schedule 5) section 4081(e) claims 0106 To claim refunds on nontaxable use of fuels. For amending sales by registered ultimate vendors. Attach schedule 6 to form 8849. Web what are the different schedules of form 8849? The vehicle identification number (vin). You can also use schedule 6 to claim credit for low mileage vehicles.

Information about schedule 6 (form 8849) and its instructions, is at. Web schedule 6 (form 8849) (rev. Web what is schedule 6 (form 8849)? The vehicle identification number (vin). Other claims including the credit claim of form 2290. The irs form 8849 (schedule 6) helps you claim tax refund for vehicles that were sold, destroyed, or stolen. Web • for schedules 1 and 6, send form 8849 to: Offering electronic filing of form 8849 satisfies the congressional mandate to provide filers an electronic option for filing form 8849 with schedules 2, 3, or 8. You can also use schedule 6 to claim credit for low mileage vehicles. Use this form to claim a refund of excise taxes on certain fuel related sales.

To claim refunds on nontaxable use of fuels. See form 2290, crn 365, later. Web information about form 8849, claim for refund of excise taxes, including recent updates, related forms and instructions on how to file. Web schedule 6 (form 8849) and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form8849. The irs form 8849 (schedule 6) helps you claim tax refund for vehicles that were sold, destroyed, or stolen. Web what is schedule 6 (form 8849)? Schedules 1, 5, and 6 are also available. The vehicle identification number (vin). What's new for dispositions of vehicles on or after july 1, 2015, treasury decision 9698 changed the information to be submitted for credit or refund claims for vehicles sold. Web form 8849 (schedule 8) registered credit card issuers 1006 07/17/2012 inst 8849 (schedule 6) instructions for schedule 6 (form 8849), other claims 0715 08/03/2015 form 8849 (schedule 6) other claims 0813 09/19/2014 form 8849 (schedule 5) section 4081(e) claims 0106

Form 8849 (Schedule 6) Other Claims of Taxes IRS Form (2014) Free

Attach schedule 6 to form 8849. Offering electronic filing of form 8849 satisfies the congressional mandate to provide filers an electronic option for filing form 8849 with schedules 2, 3, or 8. Web what is schedule 6 (form 8849)? Do not use schedule 6 to make adjustments to liability reported on forms 720 filed for prior quarters. Other claims including.

IRS Form 8849 Form 8849 Schedule 6 Claim for Refund

Offering electronic filing of form 8849 satisfies the congressional mandate to provide filers an electronic option for filing form 8849 with schedules 2, 3, or 8. The vehicle identification number (vin). Web what are the different schedules of form 8849? Web schedule 6 (form 8849) and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form8849. See.

Form 8849 Claim for Refund of Excise Taxes (2014) Free Download

Information about schedule 6 (form 8849) and its instructions, is at. August 2013) department of the treasury internal revenue service. Other claims including the credit claim of form 2290. Attach schedule 6 to form 8849. Use this form to claim a refund of excise taxes on certain fuel related sales.

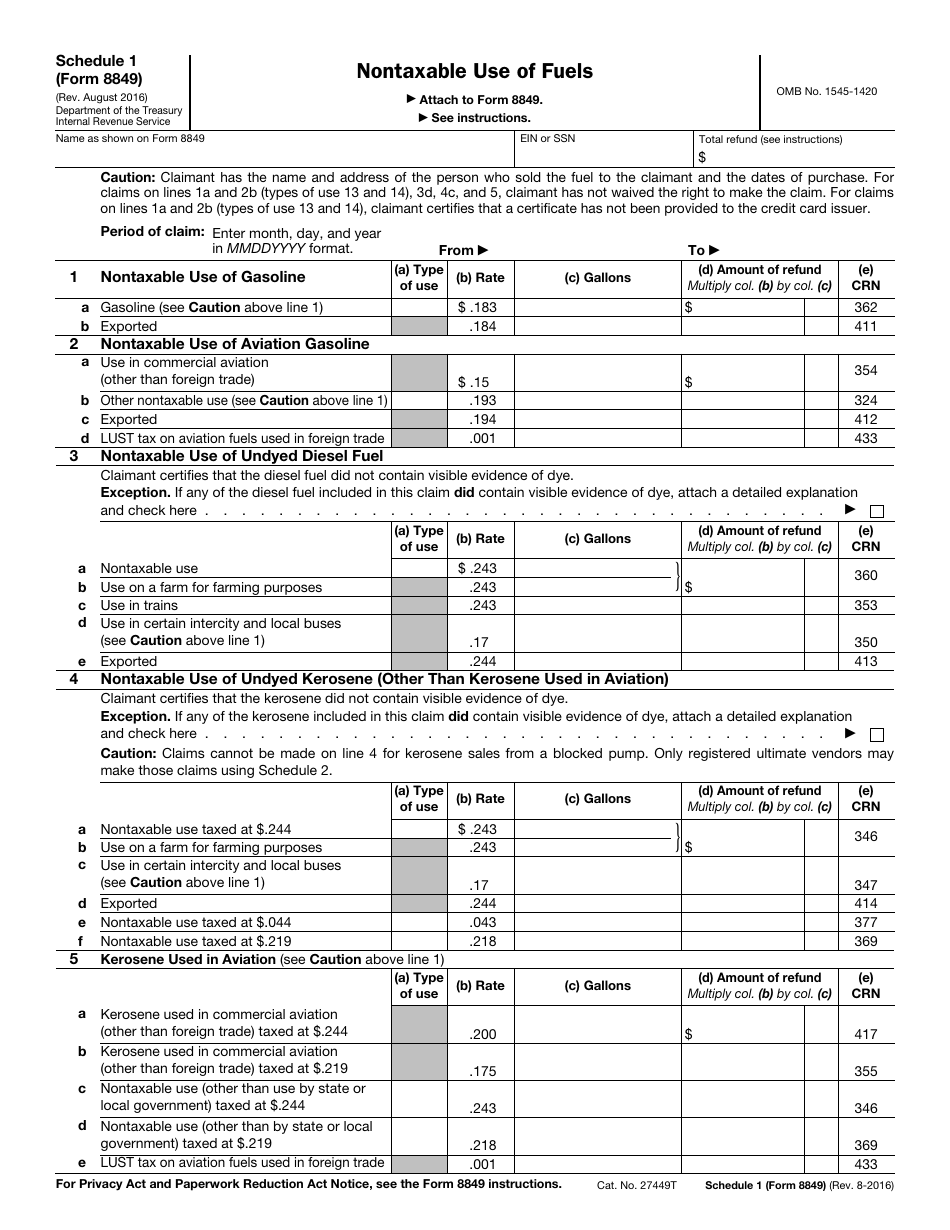

IRS Form 8849 Schedule 1 Download Fillable PDF or Fill Online

The vehicle identification number (vin). For claiming alternative fuel credits. The taxable gross weight category. Web form 8849 (schedule 8) registered credit card issuers 1006 07/17/2012 inst 8849 (schedule 6) instructions for schedule 6 (form 8849), other claims 0715 08/03/2015 form 8849 (schedule 6) other claims 0813 09/19/2014 form 8849 (schedule 5) section 4081(e) claims 0106 Schedules 1, 5, and.

Form 8849 (Schedule 1) Nontaxable Use of Fuels (2012) Free Download

Web schedule 6 (form 8849) and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form8849. Web to make a claim for a vehicle that was sold, destroyed, or stolen, the following information must be attached to schedule 6. The taxable gross weight category. Offering electronic filing of form 8849 satisfies the congressional mandate to provide filers.

Form 8849 (Schedule 1) Nontaxable Use of Fuels (2012) Free Download

Web • for schedules 1 and 6, send form 8849 to: Schedules 1, 5, and 6 are also available. Information about schedule 6 (form 8849) and its instructions, is at. Web to make a claim for a vehicle that was sold, destroyed, or stolen, the following information must be attached to schedule 6. If you attach additional sheets, write your.

Fillable Schedule 6 (Form 8849) Other Claims printable pdf download

Schedules 1, 5, and 6 are also available. Other claims including the credit claim of form 2290. For amending sales by registered ultimate vendors. Web schedule 6 (form 8849) (rev. Use this form to claim a refund of excise taxes on certain fuel related sales.

Form 2848 Example

Web what are the different schedules of form 8849? To claim refunds on nontaxable use of fuels. Do not use schedule 6 to make adjustments to liability reported on forms 720 filed for prior quarters. Other claims including the credit claim of form 2290. Web to make a claim for a vehicle that was sold, destroyed, or stolen, the following.

Fill Free fillable F8849s6 Schedule 6 (Form 8849) (Rev. August 2013

Mail it to the irs at the address under where to file in the form 8849 instructions. Schedules 1, 5, and 6 are also available. Web schedule 6 (form 8849) and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form8849. Private delivery services designated by the irs cannot deliver items to p.o. Web what are the.

The IRS Form 8849 Schedule 6 Claim for Refund Fill Online, Printable

If you attach additional sheets, write your name and taxpayer identification number on each sheet. Web what is schedule 6 (form 8849)? Web • for schedules 1 and 6, send form 8849 to: Web why is irs offering electronic filing of form 8849, claim for refund of excise taxes? Web form 8849 (schedule 8) registered credit card issuers 1006 07/17/2012.

Do Not Use Schedule 6 To Make Adjustments To Liability Reported On Forms 720 Filed For Prior Quarters.

For claiming alternative fuel credits. Information about schedule 6 (form 8849) and its instructions, is at. Mail it to the irs at the address under where to file in the form 8849 instructions. The vehicle identification number (vin).

Private Delivery Services Designated By The Irs Cannot Deliver Items To P.o.

Other claims including the credit claim of form 2290. Schedules 1, 5, and 6 are also available. If you attach additional sheets, write your name and taxpayer identification number on each sheet. Web information about form 8849, claim for refund of excise taxes, including recent updates, related forms and instructions on how to file.

Web What Is Schedule 6 (Form 8849)?

Offering electronic filing of form 8849 satisfies the congressional mandate to provide filers an electronic option for filing form 8849 with schedules 2, 3, or 8. Web to make a claim for a vehicle that was sold, destroyed, or stolen, the following information must be attached to schedule 6. To claim refunds on nontaxable use of fuels. You can also use schedule 6 to claim credit for low mileage vehicles.

Web Form 8849 (Schedule 8) Registered Credit Card Issuers 1006 07/17/2012 Inst 8849 (Schedule 6) Instructions For Schedule 6 (Form 8849), Other Claims 0715 08/03/2015 Form 8849 (Schedule 6) Other Claims 0813 09/19/2014 Form 8849 (Schedule 5) Section 4081(E) Claims 0106

What's new for dispositions of vehicles on or after july 1, 2015, treasury decision 9698 changed the information to be submitted for credit or refund claims for vehicles sold. Web what are the different schedules of form 8849? The taxable gross weight category. August 2013) department of the treasury internal revenue service.