Form 8862 Turbotax Rejection

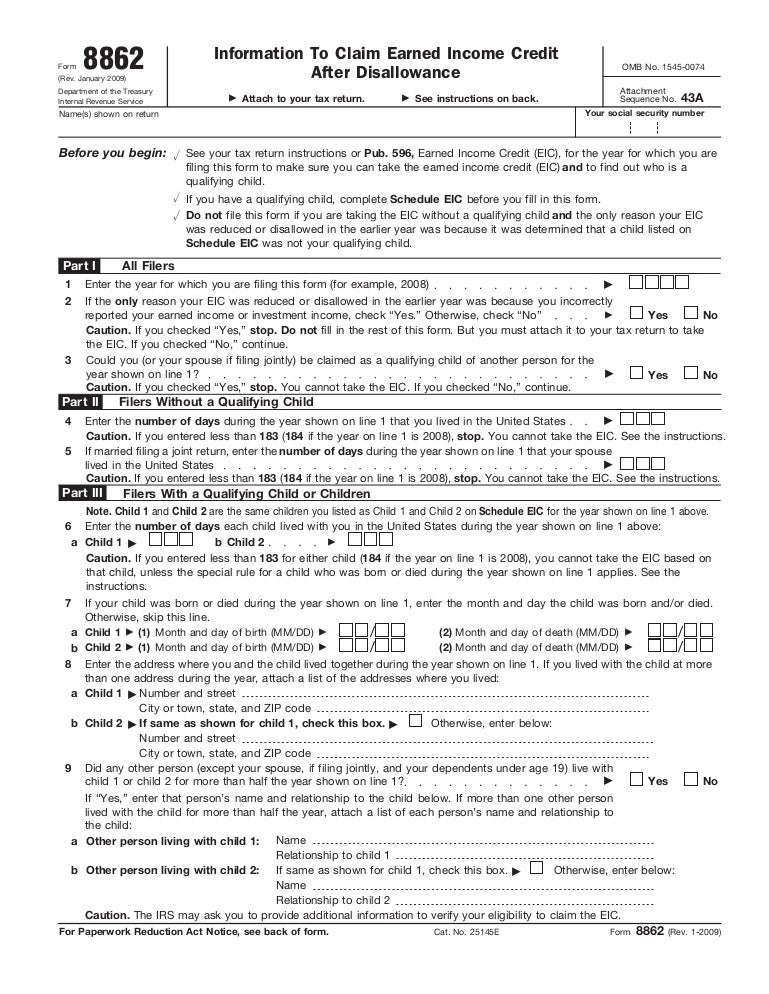

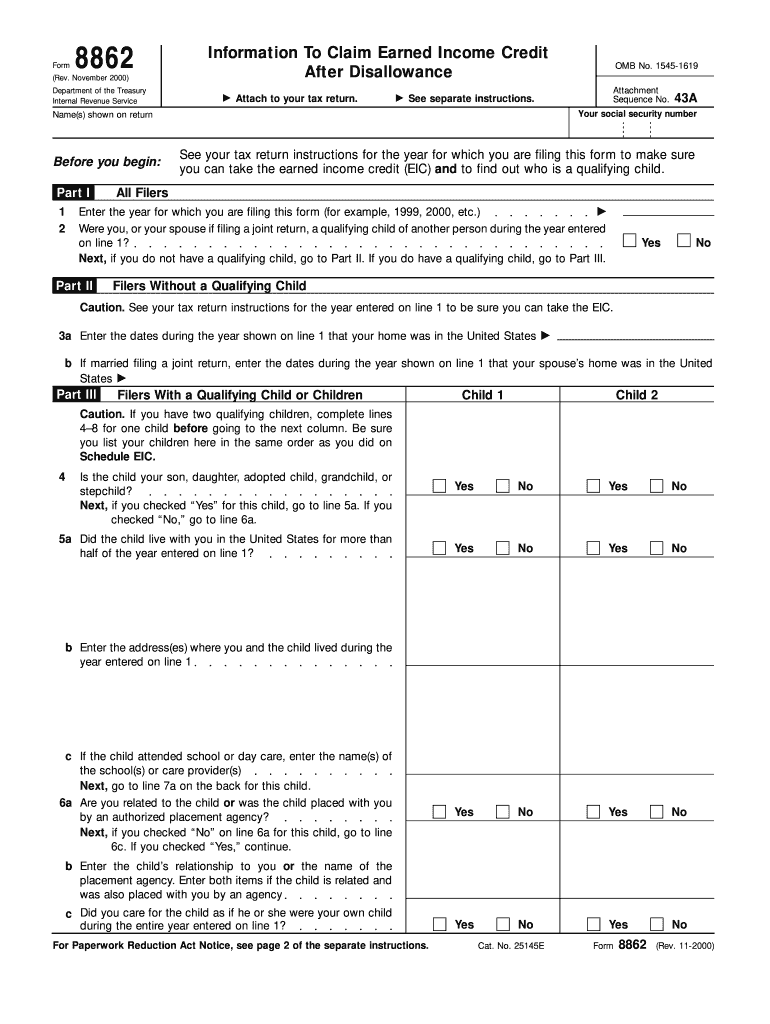

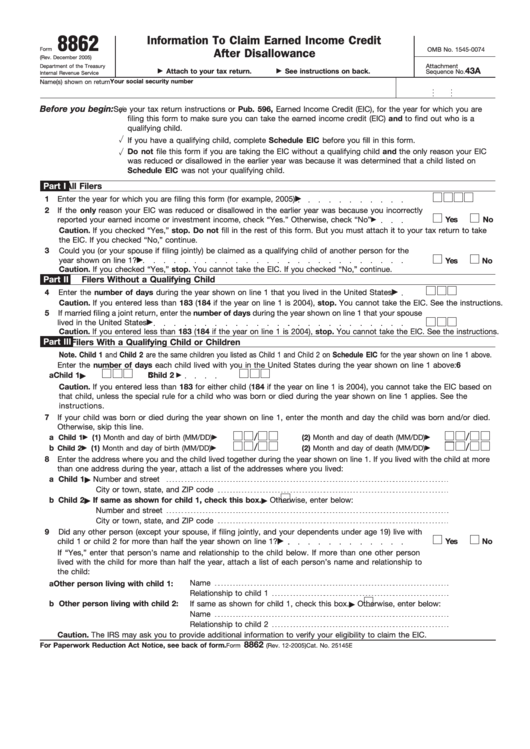

Form 8862 Turbotax Rejection - Information to claim earned income credit after disallowance to your return. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any of the credits. Web 1 03:38 pm the reject notice doesn't say that the child has already been claimed. Web if the irs rejected one or more of these credits: Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. Web if your earned income credit (eic) was disallowed or reduced for something other than a math or clerical error, you may need to file form 8862 before the irs allows. In the left menu, select tax tools and then tools. The irs—not efile.com—rejected your return because form 8862 needs to be added to the tax return in order to claim the american opportunity tax credit. Web if so, complete form 8862. Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed.

If we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax year after 2015) for any reason other than a math. In the left menu, select tax tools and then tools. The irs—not efile.com—rejected your return because form 8862 needs to be added to the tax return in order to claim the american opportunity tax credit. Web if your earned income credit (eic) was disallowed or reduced for something other than a math or clerical error, you may need to file form 8862 before the irs allows. Web if the irs rejected one or more of these credits: Web open or continue your return in turbotax. The irs — not efile.com — has rejected your return, as form 8862 is required. The irs—not efile.com—rejected your federal income tax return because you must add form 8862 to claim the earned income tax credit since you were not allowed. It says taxpayers must file form 8862 because eitc has been previously. Please see the faq link.

Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed. If we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax year after 2015) for any reason other than a math. Web open or continue your return in turbotax. Web my tax return keeps getting rejected due to missing or incorrect information on form 8862 if the irs disallowed your earned income credit (eic), it's a requirement. In the left menu, select tax tools and then tools. If you wish to take the credit in a. Web taxpayers complete form 8862 and attach it to their tax return if: Web 1 03:38 pm the reject notice doesn't say that the child has already been claimed. The irs—not efile.com—rejected your federal income tax return because you must add form 8862 to claim the earned income tax credit since you were not allowed. If it's not, the irs could.

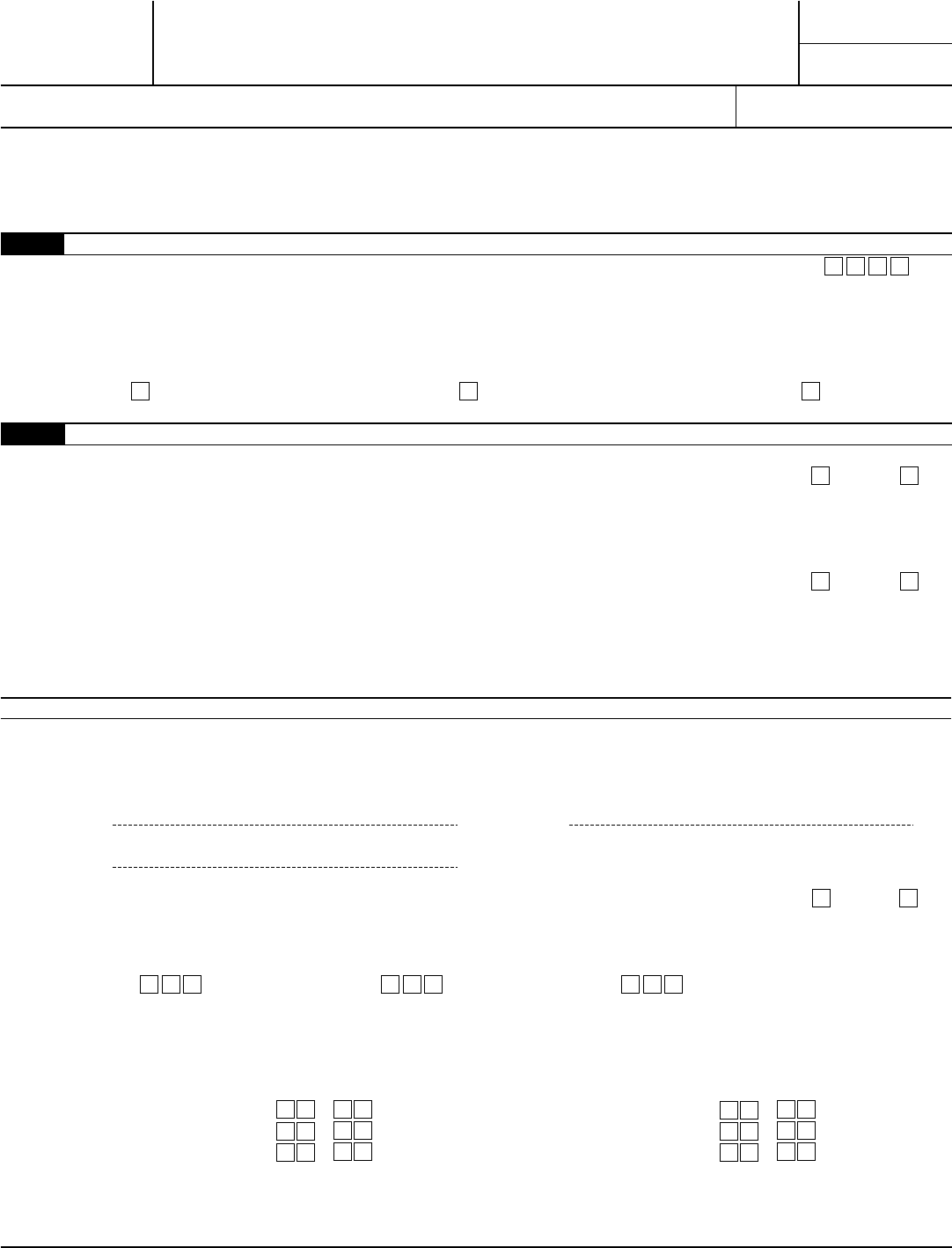

Instructions for IRS Form 8862 Information to Claim Certain Credits

Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any of the credits. Web form 8862 rejection code. Deductions and credits show more next to you and your family. Web it's 10 years if the disallowance was determined to.

Turbotax Form / Breanna Form 2106 Expense Type Must Be Entered

Web taxpayers complete form 8862 and attach it to their tax return if: Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed. The irs—not efile.com—rejected your return because form 8862 needs to be added to the tax return in order to claim the american opportunity tax credit. Web if so, complete form.

8862 Form Fill Out and Sign Printable PDF Template signNow

Web if the irs rejected one or more of these credits: Web form 8862 rejection code. Please sign in to your. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. Web taxpayers complete form 8862 and attach it to their tax return if:

Form 8862 Information To Claim Earned Credit After

If it's not, the irs could. Web form 8862 rejection code. Web open or continue your return in turbotax. Web to enter information for form 8862 for the earned income tax credit you will select the following: Web it's 10 years if the disallowance was determined to be attempted fraud.

Form 8862 Information to Claim Earned Credit After

The irs — not efile.com — has rejected your return, as form 8862 is required. If you wish to take the credit in a. It says taxpayers must file form 8862 because eitc has been previously. Web it's 10 years if the disallowance was determined to be attempted fraud. Web if your earned income credit (eic) was disallowed or reduced.

Form 8862 (Rev. December 2012) Edit, Fill, Sign Online Handypdf

Web 1 03:38 pm the reject notice doesn't say that the child has already been claimed. Web my tax return keeps getting rejected due to missing or incorrect information on form 8862 if the irs disallowed your earned income credit (eic), it's a requirement. Web taxpayers complete form 8862 and attach it to their tax return if: Web you must.

Filing Tax Form 8862 Information to Claim Earned Credit after

Web if so, complete form 8862. Web to resolve this rejection, you'll need to add form 8862: Information to claim earned income credit after disallowance to your return. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or.

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

In the left menu, select tax tools and then tools. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. If we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax year after 2015) for any reason other than a math. Please sign in to your. Web.

Form 8862Information to Claim Earned Credit for Disallowance

Tax forms included with turbotax; If the return rejects again for a reason related to. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any of the credits. Web taxpayers complete form 8862 and attach it to their tax.

Form 8862 Edit, Fill, Sign Online Handypdf

Web my tax return keeps getting rejected due to missing or incorrect information on form 8862 if the irs disallowed your earned income credit (eic), it's a requirement. Web open or continue your return in turbotax. The irs—not efile.com—rejected your return because form 8862 needs to be added to the tax return in order to claim the american opportunity tax.

In The Left Menu, Select Tax Tools And Then Tools.

Please see the faq link. Web 1 03:38 pm the reject notice doesn't say that the child has already been claimed. Information to claim earned income credit after disallowance to your return. Web to resolve this rejection, you'll need to add form 8862:

Web File Form 8862.

The irs — not efile.com — has rejected your return, as form 8862 is required. Deductions and credits show more next to you and your family. Web open or continue your return in turbotax. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any of the credits.

The Irs—Not Efile.com—Rejected Your Return Because Form 8862 Needs To Be Added To The Tax Return In Order To Claim The American Opportunity Tax Credit.

Web if so, complete form 8862. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the following apply. If we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax year after 2015) for any reason other than a math. If it's not, the irs could.

Tax Forms Included With Turbotax;

Web my tax return keeps getting rejected due to missing or incorrect information on form 8862 if the irs disallowed your earned income credit (eic), it's a requirement. Please sign in to your. Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed. If you wish to take the credit in a.

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/aaa.jpg)