Form 8865 Instructions 2021

Form 8865 Instructions 2021 - Department of the treasury internal revenue service. Web similarly, a u.s. Learn more about irs form 8865 with the expat tax preparation experts at h&r block. Persons with respect to certain foreign partnerships. Web information about form 8865, return of u.s. Persons with respect to certain foreign partnerships. International irs tax form 8865 refers to a return of u.s. For instructions and the latest information. When a us person has a qualifying interest in a foreign. Attach to your tax return.

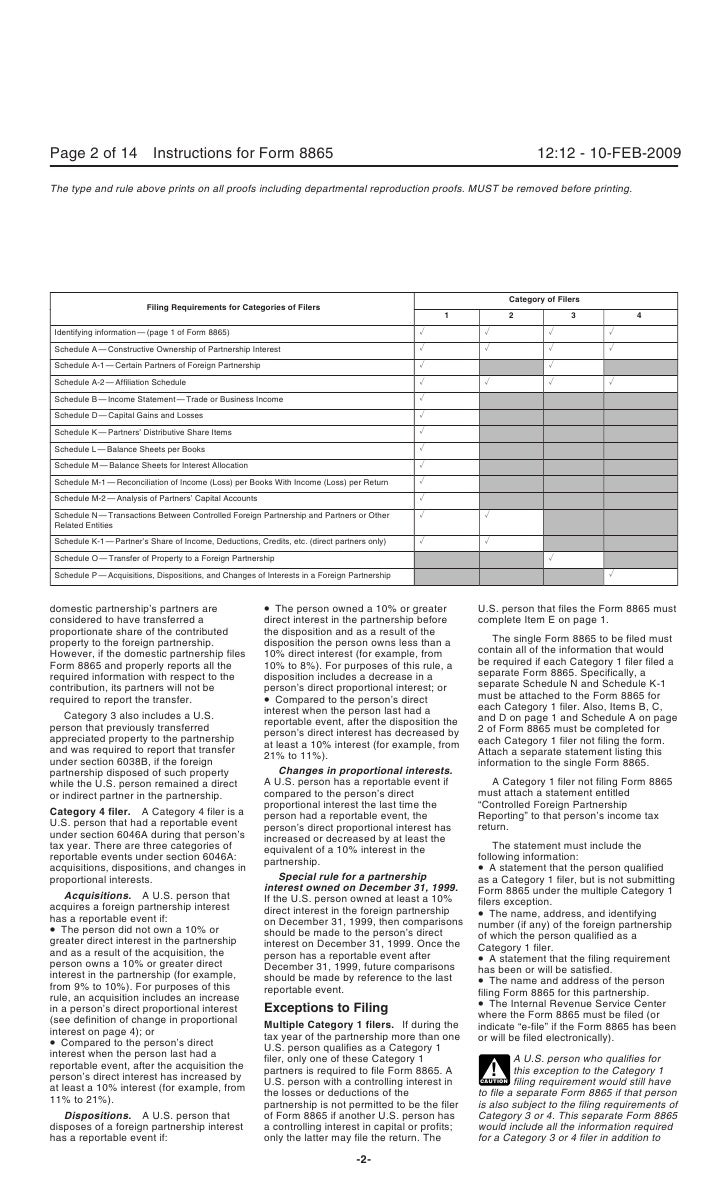

Person filing form 8865 with respect to a foreign partnership that has made an mtm election described in treas. You can view or download the instructions for form 1065 at irs.gov/scheduled(form1065). See the instructions for form 8865. October 2021) department of the treasury internal revenue service. Web (form 8865) 2022 partner’s share of income, deductions, credits, etc.— international department of the treasury internal revenue service omb no. Department of the treasury internal revenue service. Web similarly, a u.s. Web for specific instructions for form 8865, schedule b, use the instructions for form 1065, lines 1a through 21 (income and deductions). Attach to your tax return. Web form 8865 :

Persons with respect to certain foreign partnerships, including recent updates, related forms, and instructions on how to file. Do you have ownership in a foreign partnership? For instructions and the latest information. Information furnished for the foreign partnership’s tax year. Web form 8865 : International irs tax form 8865 refers to a return of u.s. Web information about form 8865, return of u.s. Web for specific instructions for form 8865, schedule b, use the instructions for form 1065, lines 1a through 21 (income and deductions). When a us person has a qualifying interest in a foreign. Department of the treasury internal revenue service.

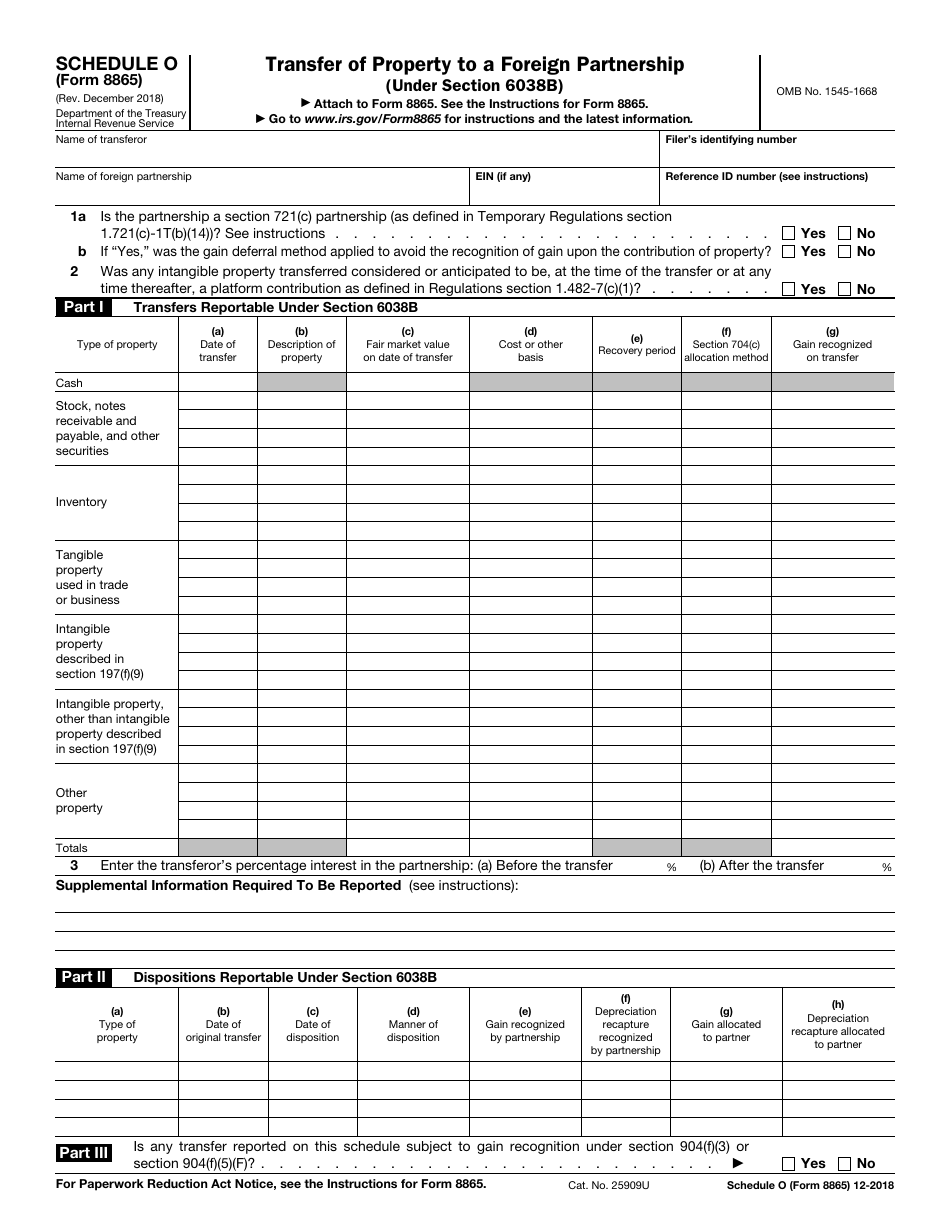

IRS Form 8865 Schedule O Download Fillable PDF or Fill Online Transfer

Web for specific instructions for form 8865, schedule b, use the instructions for form 1065, lines 1a through 21 (income and deductions). Form 8865 is used to report the information required under section 6038 (reporting with respect to controlled foreign partnerships), section 6038b (reporting of transfers to. Web similarly, a u.s. For calendar year 2022, or tax year beginning /.

2021 Form IRS 8865 Schedule K1 Fill Online, Printable, Fillable

For instructions and the latest information. Web (form 8865) 2022 partner’s share of income, deductions, credits, etc.— international department of the treasury internal revenue service omb no. International irs tax form 8865 refers to a return of u.s. See the instructions for form 8865. Transfer of property to a foreign partnership (under section 6038b).

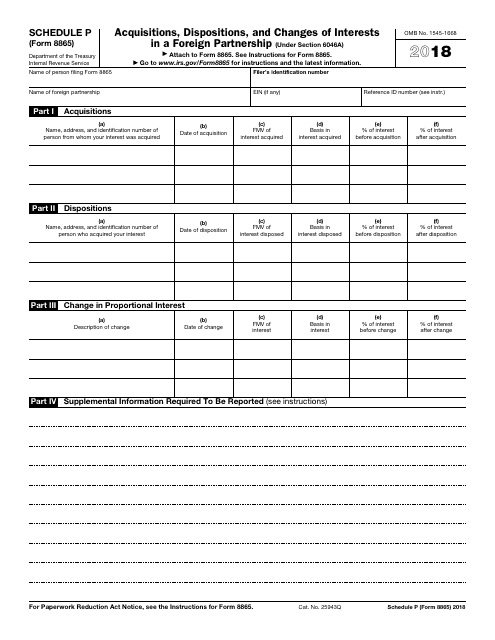

Form 8865 (Schedule P) Acquisitions, Dispositions, and Changes of

Web 4 min read october 25, 2022 resource center forms tax form 8865 at a glance if you are involved in a foreign partnership, you may need to file form 8865. Form 8865 is used to report the information required under section 6038 (reporting with respect to controlled foreign partnerships), section 6038b (reporting of transfers to. Web information about form.

Inst 8865Instructions for Form 8865, Return of U.S. Persons With Res…

October 2021) department of the treasury internal revenue service. Transfer of property to a foreign partnership (under section 6038b). Web information about form 8865, return of u.s. For calendar year 2022, or tax year beginning / / 2022 , ending / see separate instructions. Web 4 min read october 25, 2022 resource center forms tax form 8865 at a glance.

2021 Form IRS Instructions 8865 Fill Online, Printable, Fillable, Blank

Persons with respect to certain foreign partnerships. For instructions and the latest information. International irs tax form 8865 refers to a return of u.s. Web similarly, a u.s. Do you have ownership in a foreign partnership?

Inst 8865Instructions for Form 8865, Return of U.S. Persons With Res…

Web form 8865 : For instructions and the latest information. Department of the treasury internal revenue service. For instructions and the latest information. Transfer of property to a foreign partnership (under section 6038b).

IRS Form 8865 Schedule P Download Fillable PDF or Fill Online

Learn more about irs form 8865 with the expat tax preparation experts at h&r block. Persons with respect to certain foreign partnerships. Web information about form 8865, return of u.s. Department of the treasury internal revenue service. International irs tax form 8865 refers to a return of u.s.

Form 8865 Tax Returns for Foreign Partnerships

For calendar year 2022, or tax year beginning / / 2022 , ending / see separate instructions. For instructions and the latest information. Persons with respect to certain foreign partnerships. Web information about form 8865, return of u.s. Persons with respect to certain foreign partnerships.

Form 8865 Return of U.S. Persons With Respect to Certain Foreign

Web information about form 8865, return of u.s. Form 8865 is used to report the information required under section 6038 (reporting with respect to controlled foreign partnerships), section 6038b (reporting of transfers to. For instructions and the latest information. October 2021) department of the treasury internal revenue service. See the instructions for form 8865.

Form 8865 Return of U.S. Persons With Respect to Certain Foreign

Department of the treasury internal revenue service. Information furnished for the foreign partnership’s tax year. For instructions and the latest information. Web 4 min read october 25, 2022 resource center forms tax form 8865 at a glance if you are involved in a foreign partnership, you may need to file form 8865. Web information about form 8865, return of u.s.

Web Similarly, A U.s.

Attach to your tax return. Department of the treasury internal revenue service. Persons with respect to certain foreign partnerships, including recent updates, related forms, and instructions on how to file. Web for specific instructions for form 8865, schedule b, use the instructions for form 1065, lines 1a through 21 (income and deductions).

Persons With Respect To Certain Foreign Partnerships.

Information furnished for the foreign partnership’s tax year. When a us person has a qualifying interest in a foreign. Web (form 8865) 2022 partner’s share of income, deductions, credits, etc.— international department of the treasury internal revenue service omb no. Web 4 min read october 25, 2022 resource center forms tax form 8865 at a glance if you are involved in a foreign partnership, you may need to file form 8865.

Web Form 8865 :

Form 8865 is used to report the information required under section 6038 (reporting with respect to controlled foreign partnerships), section 6038b (reporting of transfers to. Person filing form 8865 with respect to a foreign partnership that has made an mtm election described in treas. October 2021) department of the treasury internal revenue service. Web information about form 8865, return of u.s.

You Can View Or Download The Instructions For Form 1065 At Irs.gov/Scheduled(Form1065).

International irs tax form 8865 refers to a return of u.s. For calendar year 2022, or tax year beginning / / 2022 , ending / see separate instructions. Persons with respect to certain foreign partnerships. For instructions and the latest information.