Form 8888 Allocation Of Refund

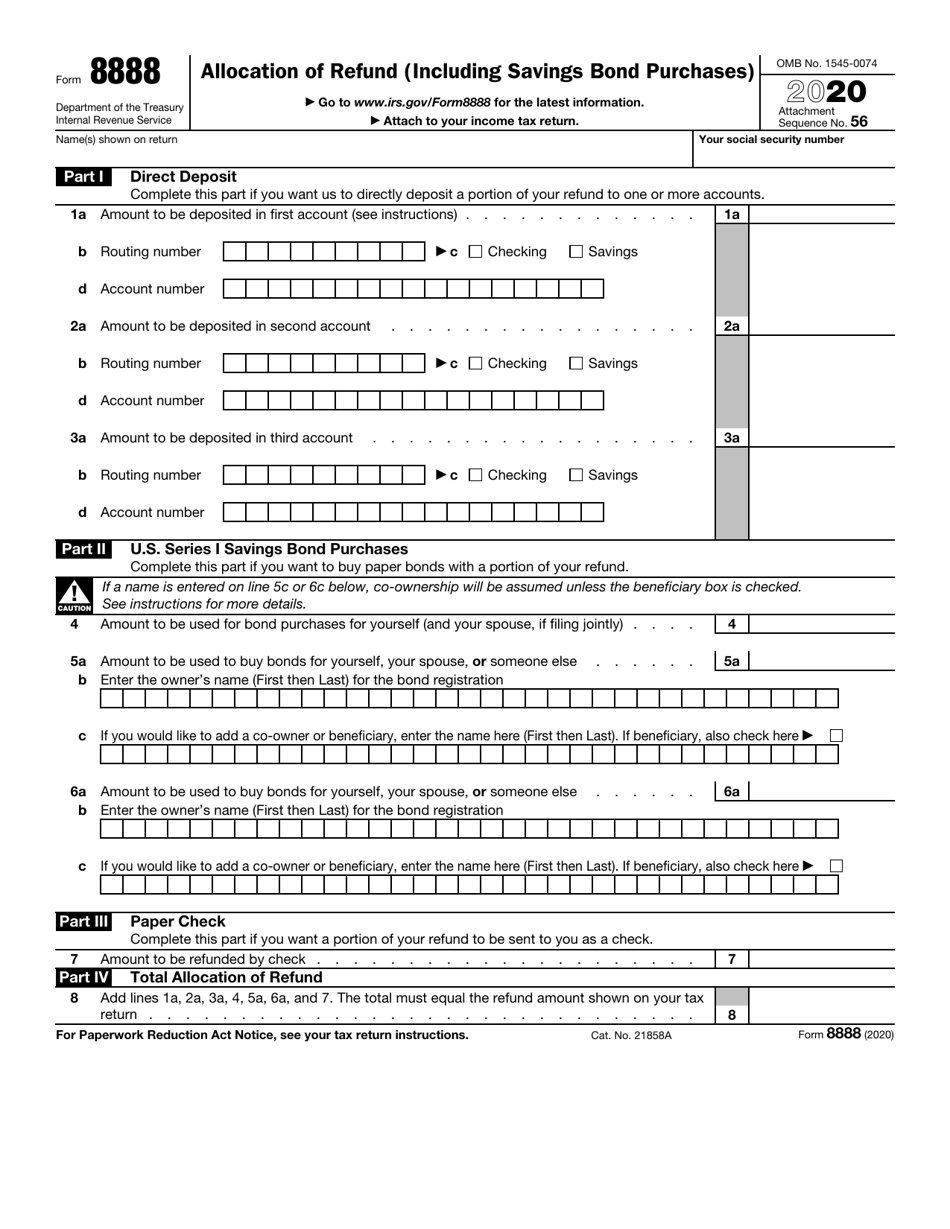

Form 8888 Allocation Of Refund - Web irs form 8888 allocation of refund (including savings bond purchases) is used by taxpayers who want their refunds to be deposited into more than one account or used to. Irs form 8888 lets to. Complete, edit or print tax forms instantly. Web allocation of refund (including savings bond purchases) complete this part if you want to buy paper bonds with a portion of your refund. Complete, edit or print tax forms instantly. If a name is entered on line 5c or 6c. Learn how to use irs form 8888 to. 2020 allocation of refund (including savings (irs). Web total allocation of refund. Web if you file a paper tax return, complete and attach form 8888, allocation of refund (including savings bond purchases) to your federal income tax return to tell irs how.

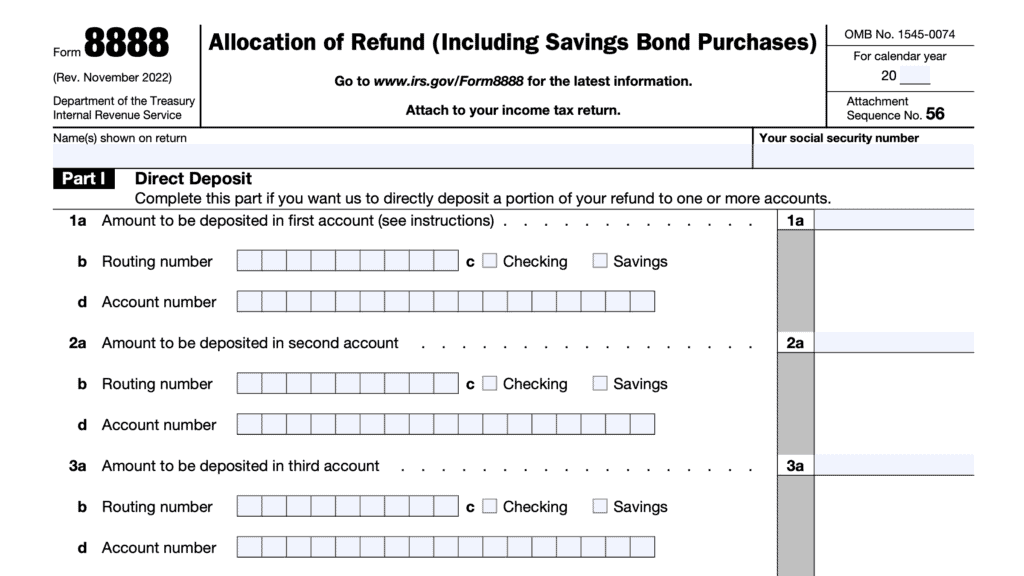

You want us to directly deposit your refund (or part of it) to one or more accounts at a bank or other financial institution (such as a mutual fund, brokerage firm, or. You can generally get information. Get ready for tax season deadlines by completing any required tax forms today. The total must equal the refund amount shown on your tax. Complete, edit or print tax forms instantly. Learning how to fill it outgoing and further. Web allocation of refund (including savings bond purchases) complete this part if you want to buy paper bonds with a portion of your refund. If a name is entered on line 5c or 6c. Web if you file a paper return, use form 8888, allocation of refund (including bond purchases) pdf. Web form 8888 department of the treasury internal revenue service allocation of refund (including savings bond purchases) go to www.irs.gov/form8888 for the latest.

Web form 8888 cannot be used if the taxpayer is using a bank product to facilitate their refund. You can generally get information. 2020 allocation of refund (including savings (irs). Complete, edit or print tax forms instantly. All forms are printable and downloadable. Edit your irs form 8888 allocation of refund where to send it online type text, add images, blackout confidential details, add comments, highlights and more. Web did you know that you can allocate your tax refund to multiple accounts, purchase savings bonds, or receive a paper check? Learn how to use irs form 8888 to. Web total allocation of refund. Irs form 8888 lets to.

Fill Free fillable Form 8888 2019 Allocation of Refund PDF form

If you file a joint return and complete form. If a name is entered on line 5c or 6c. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Learning how to fill it outgoing and further.

Savings Bond Text Concept Closeup. American Dollars Cash Money,3D

Web allocation of refund (including savings bond purchases) complete this part if you want to buy paper bonds with a portion of your refund. You want us to directly deposit your refund (or part of it) to one or more accounts at a bank or other financial institution (such as a mutual fund, brokerage firm, or. Get ready for tax.

Form 8888 Allocation of Refund (Including Savings Bond Purchases

The instructions explain what you need to do. Web form 8888 department of the treasury internal revenue service allocation of refund (including savings bond purchases) go to www.irs.gov/form8888 for the latest. Web irs form 8888 allocation of refund (including savings bond purchases) is used by taxpayers who want their refunds to be deposited into more than one account or used.

Form 8888 Allocation of Refund (Including Savings Bond Purchases

Web if you file a paper return, use form 8888, allocation of refund (including bond purchases) pdf. Web you can’t have your refund deposited into more than one account or buy paper series i savings bonds if you file form 8379, injured spouse allocation. Web allocation of refund (including savings bond purchases) complete this part if you want to buy.

Fill Free fillable Form 8888 2020 Allocation of Refund (Including

Complete, edit or print tax forms instantly. Add lines 1a, 2a, 3a, 4, 5a, 6a, and 7. 2020 allocation of refund (including savings (irs). Web did you know that you can allocate your tax refund to multiple accounts, purchase savings bonds, or receive a paper check? Web use form 8888 if:

Fill Free fillable Form 8888 2020 Allocation of Refund (Including

Learning how to fill it outgoing and further. Irs form 8888 lets to. Web form 8888 department of the treasury internal revenue service allocation of refund (including savings bond purchases) go to www.irs.gov/form8888 for the latest. Learn how to use irs form 8888 to. Web did you know that you can allocate your tax refund to multiple accounts, purchase savings.

Form 8888 Allocation of Refund Incl. Savings Bond Purchases

You can generally get information. All forms are printable and downloadable. Complete, edit or print tax forms instantly. Web you can’t have your refund deposited into more than one account or buy paper series i savings bonds if you file form 8379, injured spouse allocation. The total must equal the refund amount shown on your tax.

Form 8888 Allocation of Refund Including Savings Bond Purchases Stock

Irs form 8888 lets to. Web allocation of refund (including savings bond purchases) complete this part if you want to buy paper bonds with a portion of your refund. 2020 allocation of refund (including savings (irs). Web we last updated the allocation of refund (including savings bond purchases) in december 2022, so this is the latest version of form 8888,.

IRS Form 1310 Instructions Tax Refund on A Decedent's Behalf

Web we last updated the allocation of refund (including savings bond purchases) in december 2022, so this is the latest version of form 8888, fully updated for tax year. Web total allocation of refund. Web if you file a paper tax return, complete and attach form 8888, allocation of refund (including savings bond purchases) to your federal income tax return.

IRS Form 8888 Download Fillable PDF or Fill Online Allocation of Refund

Web we last updated the allocation of refund (including savings bond purchases) in december 2022, so this is the latest version of form 8888, fully updated for tax year. Web total allocation of refund. Web if you file a paper return, use form 8888, allocation of refund (including bond purchases) pdf. Web aattach to your income tax return. Web once.

Web We Last Updated The Allocation Of Refund (Including Savings Bond Purchases) In December 2022, So This Is The Latest Version Of Form 8888, Fully Updated For Tax Year.

Web allocation of refund (including savings bond purchases) complete this part if you want to buy paper bonds with a portion of your refund. Irs form 8888 lets to. Web you can’t have your refund deposited into more than one account or buy paper series i savings bonds if you file form 8379, injured spouse allocation. Web form 8888 cannot be used if the taxpayer is using a bank product to facilitate their refund.

Complete, Edit Or Print Tax Forms Instantly.

Web form 8888 department of the treasury internal revenue service allocation of refund (including savings bond purchases) go to www.irs.gov/form8888 for the latest. The instructions explain what you need to do. Web use form 8888 if: Complete, edit or print tax forms instantly.

Web Total Allocation Of Refund.

Web irs form 8888 lets you allocate your federative pay refund to couple or three severed your. You want us to directly deposit your refund (or part of it) to one or more accounts at a bank or other financial institution (such as a mutual fund, brokerage firm, or. The total must equal the refund amount shown on your tax. Get ready for tax season deadlines by completing any required tax forms today.

Web If You File A Paper Tax Return, Complete And Attach Form 8888, Allocation Of Refund (Including Savings Bond Purchases) To Your Federal Income Tax Return To Tell Irs How.

Web aattach to your income tax return. Complete, edit or print tax forms instantly. Web if you file a paper return, use form 8888, allocation of refund (including bond purchases) pdf. Edit your irs form 8888 allocation of refund where to send it online type text, add images, blackout confidential details, add comments, highlights and more.