Form 8888 Total Refund

Form 8888 Total Refund - Form 8888 allows a taxpayer to split one refund in up to three accounts or savings bonds. Ad access irs tax forms. You want us to directly deposit your refund (or part of it) to either two or three accounts at a bank or other financial institution (such as a mutual fund, brokerage. This option is available for tax returns filed either on paper or electronically. Web here's an update on my own situation: Web taxpayers can choose to: Web although you may owe your tax return preparer a fee for preparing your return, don’t have any part of your refund deposited into the preparer’s account to pay the fee. Applied to next year's estimated tax: Tax on income less state refund per. Web completing the form 8888 total refund per computer with signnow will give greater confidence that the output template will be legally binding and safeguarded.

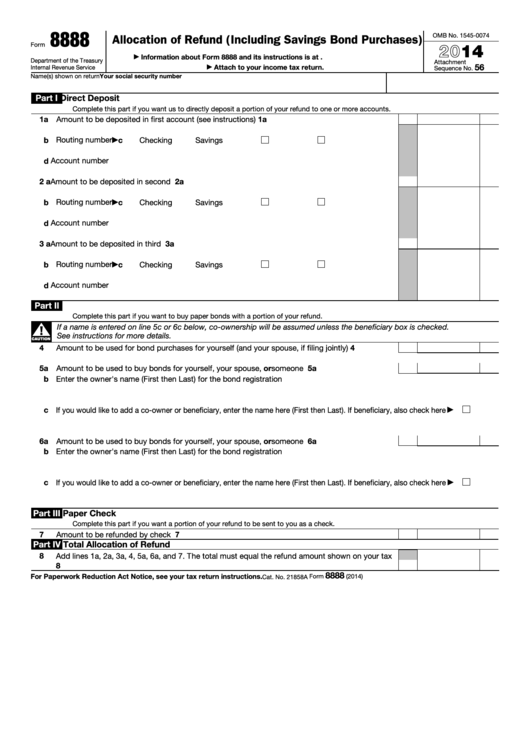

Web form 8888, allocation of refund (including savings bond purchases) is automatically generated by turbotax when you choose to receive your refund all or in. This option is available for tax returns filed either on paper or electronically. Web taxpayers can choose to: Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. The total must equal the refund amount shown on your tax. Applied to next year's estimated tax: Web completing the form 8888 total refund per computer with signnow will give greater confidence that the output template will be legally binding and safeguarded. Web use form 8888 if:

Web what does form 8888 total refund per computer 0.00 mean? Web refund or amount owed amount you owe: Web part iv total allocation of refund 8 add lines 1a, 2a, 3a, 4, 5a, 6a, and 7. • apply any portion of their overpayment to the following tax year • receive all or part of their refund using direct deposit • receive all or part of their. A refund on an amended return can’t be directly deposited to an account or used to buy savings bonds. Web here's an update on my own situation: Tax on income less state refund per. Complete, edit or print tax forms instantly. Web use form 8888 if: The tax advocate advised me that the irs declined my form 8888, which it flagged as possible identity theft due to (1) my.

Form 8888 Allocation of Refund (Including Savings Bond Purchases

Web if you’re looking for an easy way to get your tax refund deposited right into your normal bank account, then form 8888 is for you. 8 for paperwork reduction act notice, see your tax return instructions. For paperwork reduction act notice, see. You want us to directly deposit your refund (or part of it) to either two or three.

Form 8888 Allocation of Refund Including Savings Bond Purchases Stock

Web here's an update on my own situation: Web if you’re looking for an easy way to get your tax refund deposited right into your normal bank account, then form 8888 is for you. Get ready for tax season deadlines by completing any required tax forms today. Web completing the form 8888 total refund per computer with signnow will give.

Fillable Form 8888 Allocation Of Refund (Including Saving'S Bond

Web what does form 8888 total refund per computer 0.00 mean? Web although you may owe your tax return preparer a fee for preparing your return, don’t have any part of your refund deposited into the preparer’s account to pay the fee. Web taxpayers can choose to: The total must equal the refund amount shown on your tax. Get ready.

Form 8888 Allocation of Refund (Including Savings Bond Purchases

Web part iv total allocation of refund 8 add lines 1a, 2a, 3a, 4, 5a, 6a, and 7. Web form 8888, allocation of refund (including savings bond purchases) is automatically generated by turbotax when you choose to receive your refund all or in. Complete, edit or print tax forms instantly. Form 8888 allows a taxpayer to split one refund in.

Form 8888 Allocation of Refund (Including Savings Bond Purchases

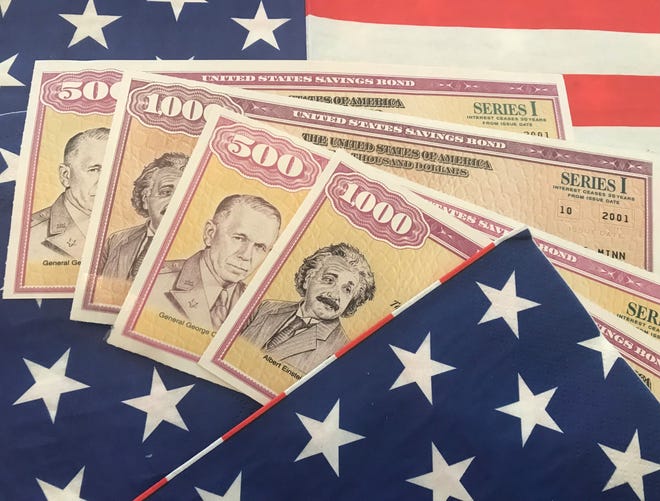

According to treasury direct, i should be able to get a $5000 refund for both people in a. Form 8888 allows a taxpayer to split one refund in up to three accounts or savings bonds. Web refund or amount owed amount you owe: Web completing the form 8888 total refund per computer with signnow will give greater confidence that the.

Save Your Tax Refund for Emergencies and Unplanned Expenses

Web completing the form 8888 total refund per computer with signnow will give greater confidence that the output template will be legally binding and safeguarded. • apply any portion of their overpayment to the following tax year • receive all or part of their refund using direct deposit • receive all or part of their. Web taxpayers can choose to:.

I Bond rates to be announced in November Why you should buy now

Web what does form 8888 total refund per computer 0.00 mean? You want us to directly deposit your refund (or part of it) to one or more accounts at a bank or other financial institution (such as a mutual fund, brokerage firm, or. Get ready for tax season deadlines by completing any required tax forms today. Web form 8888 allows.

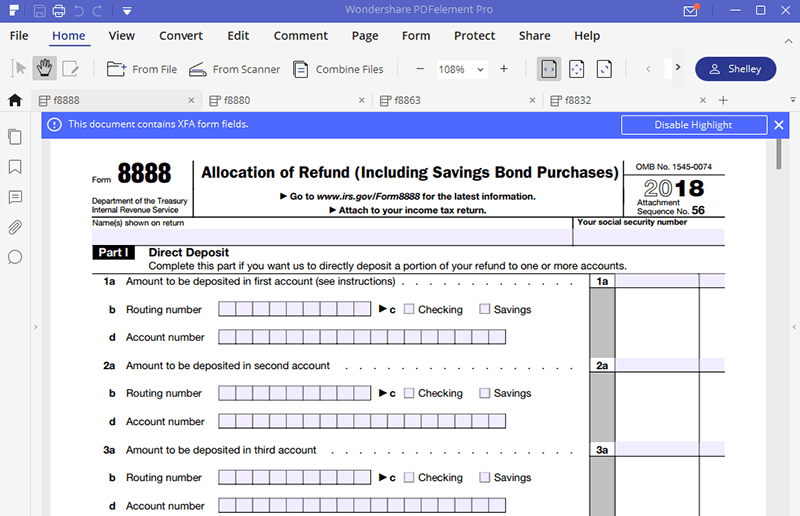

Irs Form 8888 Fill out and Edit Online PDF Template

Web if you’re looking for an easy way to get your tax refund deposited right into your normal bank account, then form 8888 is for you. 8 for paperwork reduction act notice, see your tax return instructions. Web we last updated the allocation of refund (including savings bond purchases) in december 2022, so this is the latest version of form.

Fill Free fillable Allocation of Refund (Including Savings Bond

Web although you may owe your tax return preparer a fee for preparing your return, don’t have any part of your refund deposited into the preparer’s account to pay the fee. You want us to directly deposit your refund (or part of it) to one or more accounts at a bank or other financial institution (such as a mutual fund,.

IRS Form 8888 Use the Best Form Filler to Complete it

Ad access irs tax forms. Web part iv total allocation of refund 8 add lines 1a, 2a, 3a, 4, 5a, 6a, and 7. The tax advocate advised me that the irs declined my form 8888, which it flagged as possible identity theft due to (1) my. Web form 8888 allows taxpayers to directly deposit their tax refund in up to.

Web Taxpayers Can Choose To:

You want us to directly deposit your refund (or part of it) to either two or three accounts at a bank or other financial institution (such as a mutual fund, brokerage. Complete, edit or print tax forms instantly. Form 8888 allows a taxpayer to split one refund in up to three accounts or savings bonds. Web use form 8888 if:

Web Refund Or Amount Owed Amount You Owe:

Tax on income less state refund per. For paperwork reduction act notice, see. Web form 8888, allocation of refund (including savings bond purchases) is automatically generated by turbotax when you choose to receive your refund all or in. Web use form 8888 if:

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web we last updated the allocation of refund (including savings bond purchases) in december 2022, so this is the latest version of form 8888, fully updated for tax year. The tax advocate advised me that the irs declined my form 8888, which it flagged as possible identity theft due to (1) my. Complete, edit or print tax forms instantly. You want us to directly deposit your refund (or part of it) to one or more accounts at a bank or other financial institution (such as a mutual fund, brokerage firm, or.

This Option Is Available For Tax Returns Filed Either On Paper Or Electronically.

• apply any portion of their overpayment to the following tax year • receive all or part of their refund using direct deposit • receive all or part of their. The document was designed to. Applied to next year's estimated tax: Web here's an update on my own situation: