Form 8895-A

Form 8895-A - Shareholder of a controlled foreign corporation (cfc) uses form 8895 to elect the 85% dividends received deduction (drd) provided under section 965 (section. Top 13mm (1⁄ 2 ), center sides. How do i clear and. Web how do i get to form 8895? Web how do i file an irs extension (form 4868) in turbotax online? It has four parts and four additional schedules designed to help. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. File an extension in turbotax online before the deadline to avoid a late filing penalty. Subsequently, at the end of august, the irs issued draft instructions for. S corporations are not eligible for the deduction, but must pass through to their shareholders the necessary information on an attachment.

Web just finished the tax return and printed out the all required forms for mailing, but the 8895, qbi deduction form is marked 'do not file'(see the attached. Web how do i file an irs extension (form 4868) in turbotax online? Web how do i get to form 8895? Web the final product of form 8962, how much federal subsidy you must repay or an additional tax credit, is then populated on either schedule 2 or 3 of the federal 1040. How do i clear and. It has four parts and four additional schedules designed to help. File an extension in turbotax online before the deadline to avoid a late filing penalty. Subsequently, at the end of august, the irs issued draft instructions for. Shareholder of a controlled foreign corporation (cfc) uses form 8895 to elect the 85% dividends received deduction (drd) provided under section 965 (section. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate.

Top 13mm (1⁄ 2 ), center sides. File an extension in turbotax online before the deadline to avoid a late filing penalty. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. S corporations are not eligible for the deduction, but must pass through to their shareholders the necessary information on an attachment. It has four parts and four additional schedules designed to help. Shareholder of a controlled foreign corporation (cfc) uses form 8895 to elect the 85% dividends received deduction (drd) provided under section 965 (section. Subsequently, at the end of august, the irs issued draft instructions for. How do i clear and. Web how do i get to form 8895? Web just finished the tax return and printed out the all required forms for mailing, but the 8895, qbi deduction form is marked 'do not file'(see the attached.

Magic Form 8895 Tül Dantelli Sütyenli Korse Gecelik Fiyatı

Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. Web how do i get to form 8895? Web the final product of form 8962, how much federal subsidy you must repay or an additional tax credit, is then populated.

8895A Timely Hardware

Subsequently, at the end of august, the irs issued draft instructions for. Web just finished the tax return and printed out the all required forms for mailing, but the 8895, qbi deduction form is marked 'do not file'(see the attached. How do i clear and. File an extension in turbotax online before the deadline to avoid a late filing penalty..

Vertical Cash Envelope Printable PDF INSTANT DOWNLOAD Printable

Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. Subsequently, at the end of august, the irs issued draft instructions for. Web how do i get to form 8895? How do i clear and. Web how do i file.

Magic Form 8895 Tül Dantelli Sütyenli Korse Gecelik 4488420 Morhipo

Top 13mm (1⁄ 2 ), center sides. Web how do i file an irs extension (form 4868) in turbotax online? Web just finished the tax return and printed out the all required forms for mailing, but the 8895, qbi deduction form is marked 'do not file'(see the attached. Shareholder of a controlled foreign corporation (cfc) uses form 8895 to elect.

Form 8995A Draft WFFA CPAs

It has four parts and four additional schedules designed to help. Web just finished the tax return and printed out the all required forms for mailing, but the 8895, qbi deduction form is marked 'do not file'(see the attached. How do i clear and. Web how do i get to form 8895? S corporations are not eligible for the deduction,.

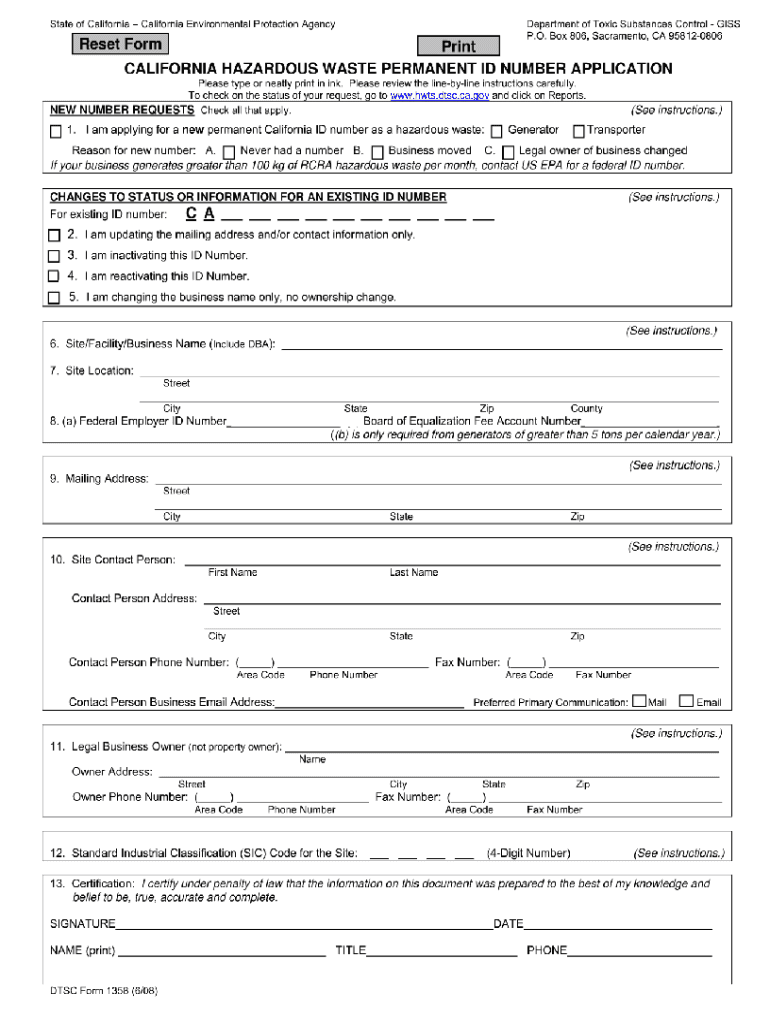

2008 Form CA DTSC 1358 Fill Online, Printable, Fillable, Blank pdfFiller

S corporations are not eligible for the deduction, but must pass through to their shareholders the necessary information on an attachment. Subsequently, at the end of august, the irs issued draft instructions for. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new.

Salaş Gelin Saçı Modelleri promhairupdowithbraid Salaş Gelin Saçı

Web the final product of form 8962, how much federal subsidy you must repay or an additional tax credit, is then populated on either schedule 2 or 3 of the federal 1040. It has four parts and four additional schedules designed to help. Shareholder of a controlled foreign corporation (cfc) uses form 8895 to elect the 85% dividends received deduction.

Cisco 8845 IP Video Phone (CP8845K9) Atlas Phones

Web how do i get to form 8895? Web just finished the tax return and printed out the all required forms for mailing, but the 8895, qbi deduction form is marked 'do not file'(see the attached. Shareholder of a controlled foreign corporation (cfc) uses form 8895 to elect the 85% dividends received deduction (drd) provided under section 965 (section. Web.

Indian and Himalayan Bactrian bronze votive Kohl container the

Web how do i get to form 8895? Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. S corporations are not eligible for the deduction, but must pass through to their shareholders the necessary information on an attachment. File.

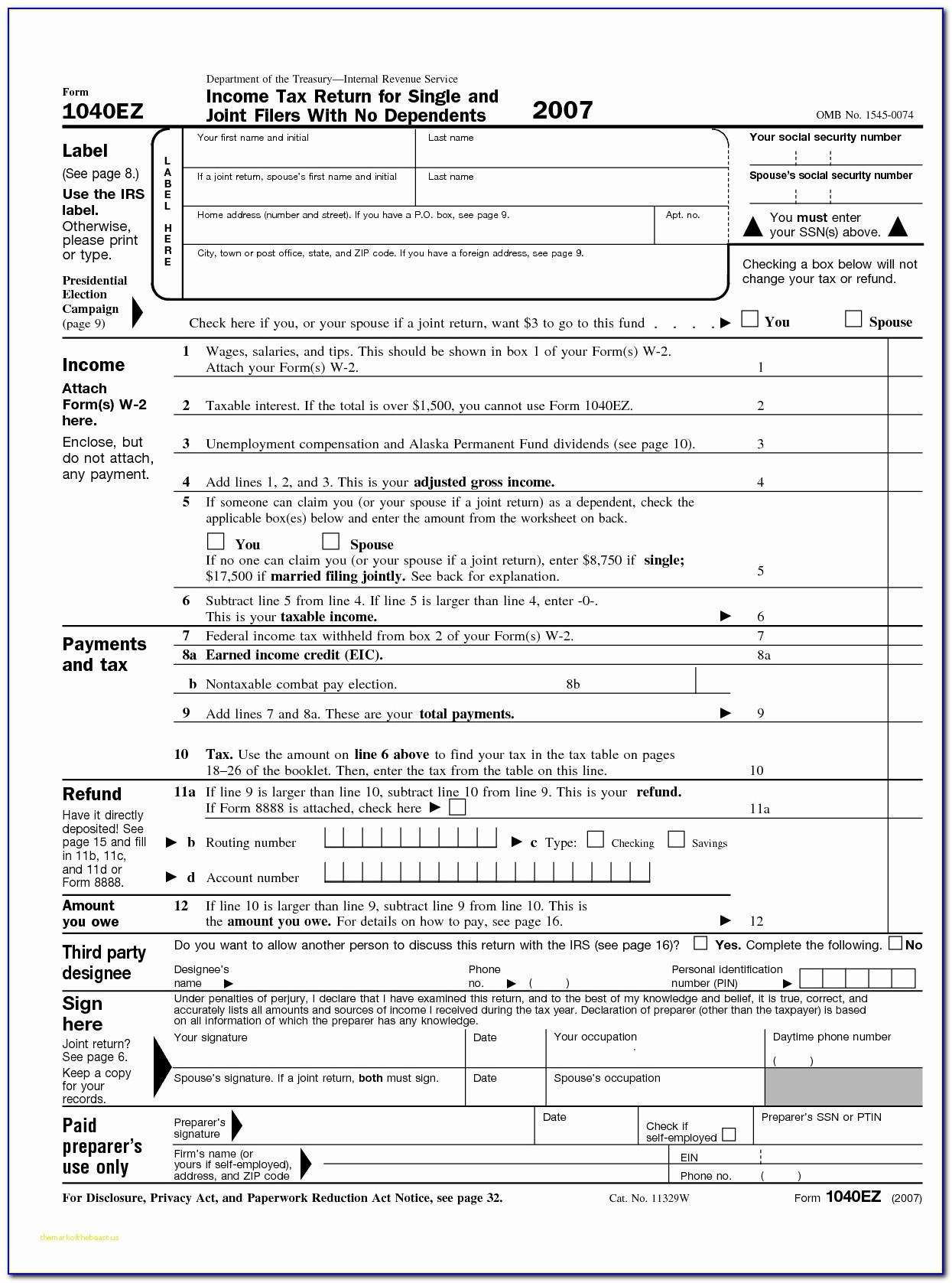

Printable Tax Form 1040 Printable Form 2022

It has four parts and four additional schedules designed to help. Top 13mm (1⁄ 2 ), center sides. Subsequently, at the end of august, the irs issued draft instructions for. S corporations are not eligible for the deduction, but must pass through to their shareholders the necessary information on an attachment. Web how do i get to form 8895?

Web How Do I Get To Form 8895?

Web how do i file an irs extension (form 4868) in turbotax online? Web the final product of form 8962, how much federal subsidy you must repay or an additional tax credit, is then populated on either schedule 2 or 3 of the federal 1040. S corporations are not eligible for the deduction, but must pass through to their shareholders the necessary information on an attachment. How do i clear and.

Web The Qualified Business Income Deduction (Qbi) Is Intended To Reduce The Tax Rate On Qualified Business Income To A Rate That Is Closer To The New Corporate Tax Rate.

It has four parts and four additional schedules designed to help. Shareholder of a controlled foreign corporation (cfc) uses form 8895 to elect the 85% dividends received deduction (drd) provided under section 965 (section. Web just finished the tax return and printed out the all required forms for mailing, but the 8895, qbi deduction form is marked 'do not file'(see the attached. File an extension in turbotax online before the deadline to avoid a late filing penalty.

Top 13Mm (1⁄ 2 ), Center Sides.

Subsequently, at the end of august, the irs issued draft instructions for.