Form 8910 Qualifying Vehicles

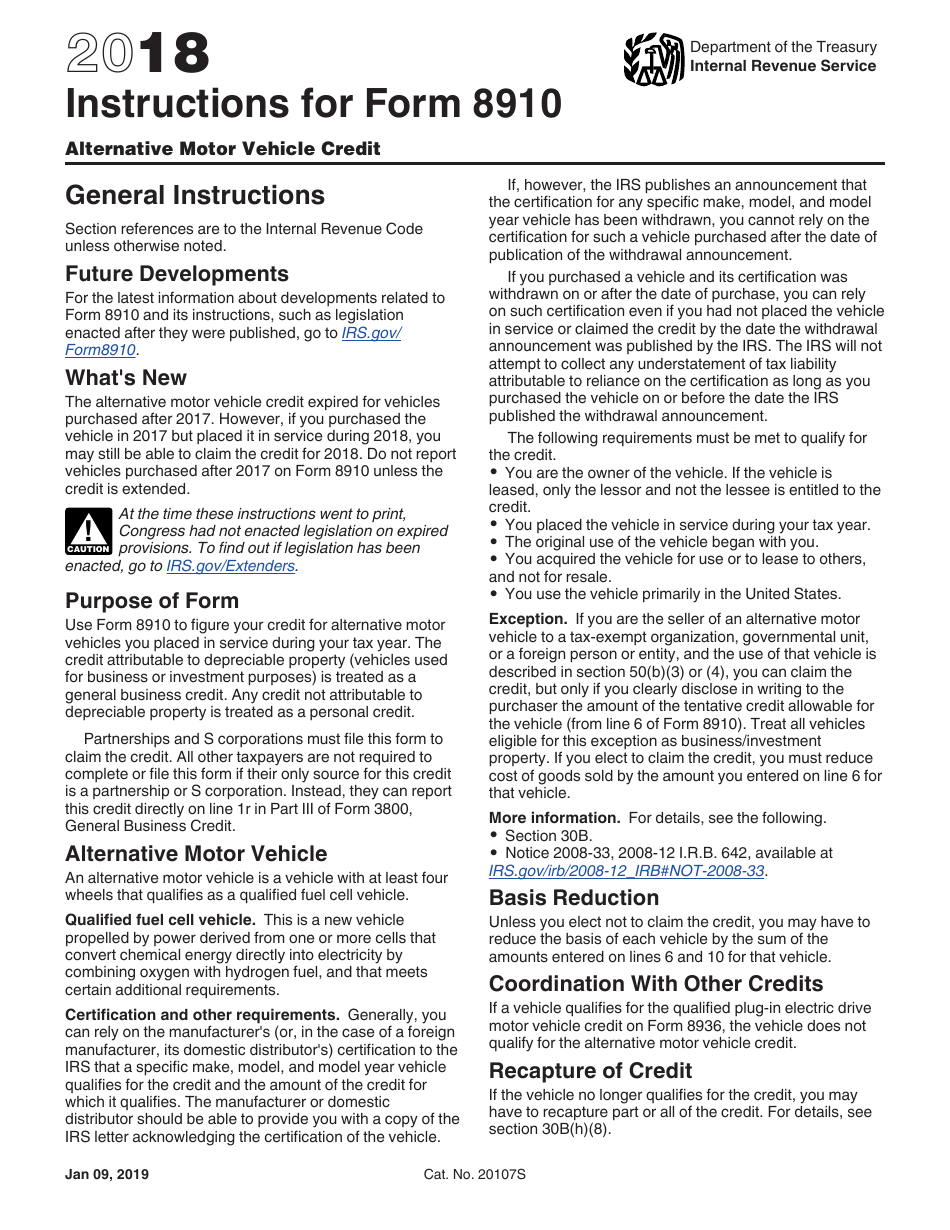

Form 8910 Qualifying Vehicles - The inflation reduction act of 2022 overhauled the ev tax credit, worth up to $7,500. The credit attributable to depreciable property (vehicles. Part i tentative credit next: Complete the first page of section a. The credit attributable to depreciable property (vehicles used for. It added income limits, price caps and. The alternative motor vehicle credit expired for vehicles purchased after 2021. If the vehicle is leased, only the lessor and not the lessee is entitled to the. Web what vehicles qualify for the alternative motor vehicle credit (form 8910)? Alternative motor vehicle an alternative motor vehicle is a vehicle with at.

Web credits to enter information for vehicle credits. Web in general, to qualify for the ev tax credit, the ev vehicle: The credit attributable to depreciable property (vehicles used for. This is a new vehicle propelled by power derived from one or more cells that convert chemical energy directly into electricity by combining oxygen with. Web to apply for disabled veteran license plates, you must submit: It offers a tax credit for qualified hybrid, fuel. Entering a vehicle credit for. This is a new vehicle that draws propulsion energy from onboard sources of stored energy that are both an internal combustion or heat engine using. If you qualify based on your age (referenced on page 1: Part i tentative credit next:

If you qualify based on your age (referenced on page 1: The taxpayer certainty and disaster tax relief act of 2020 extended the alternative motor vehicle. This is a new vehicle that draws propulsion energy from onboard sources of stored energy that are both an internal combustion or heat engine using. You are the owner of the vehicle. Web use form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year. The vehicle is transporting hazardous materials and is required to be placarded. Web what vehicles qualify for the alternative motor vehicle credit (form 8910)? It offers a tax credit for qualified hybrid, fuel. Complete the first page of section a. Web what are the qualifications for the alternative motor vehicle credit (form 8910)?

Financial Concept Meaning Form 8910 Alternative Motor Vehicle Credit

Have an external charging source have a gross vehicle weight rating of less than 14,000 pounds be made. Proof of age and a photo must be included to qualify and obtain a photo. The following articles are the top questions referring to vehicle credits faqs (8846). The alternative motor vehicle credit was enacted by the energy policy act of 2005..

Form 8910 Edit, Fill, Sign Online Handypdf

The credit attributable to depreciable property (vehicles used for. Entering a vehicle credit for. It added income limits, price caps and. This is a new vehicle propelled by power derived from one or more cells that convert chemical energy directly into electricity by combining oxygen with. Web to apply for disabled veteran license plates, you must submit:

Form 8910 Alternative Motor Vehicle Credit (2014) Free Download

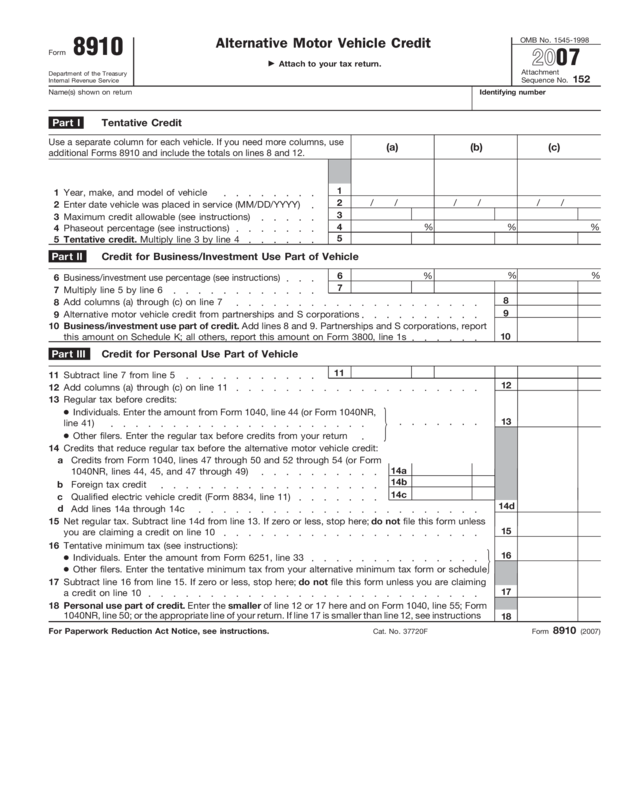

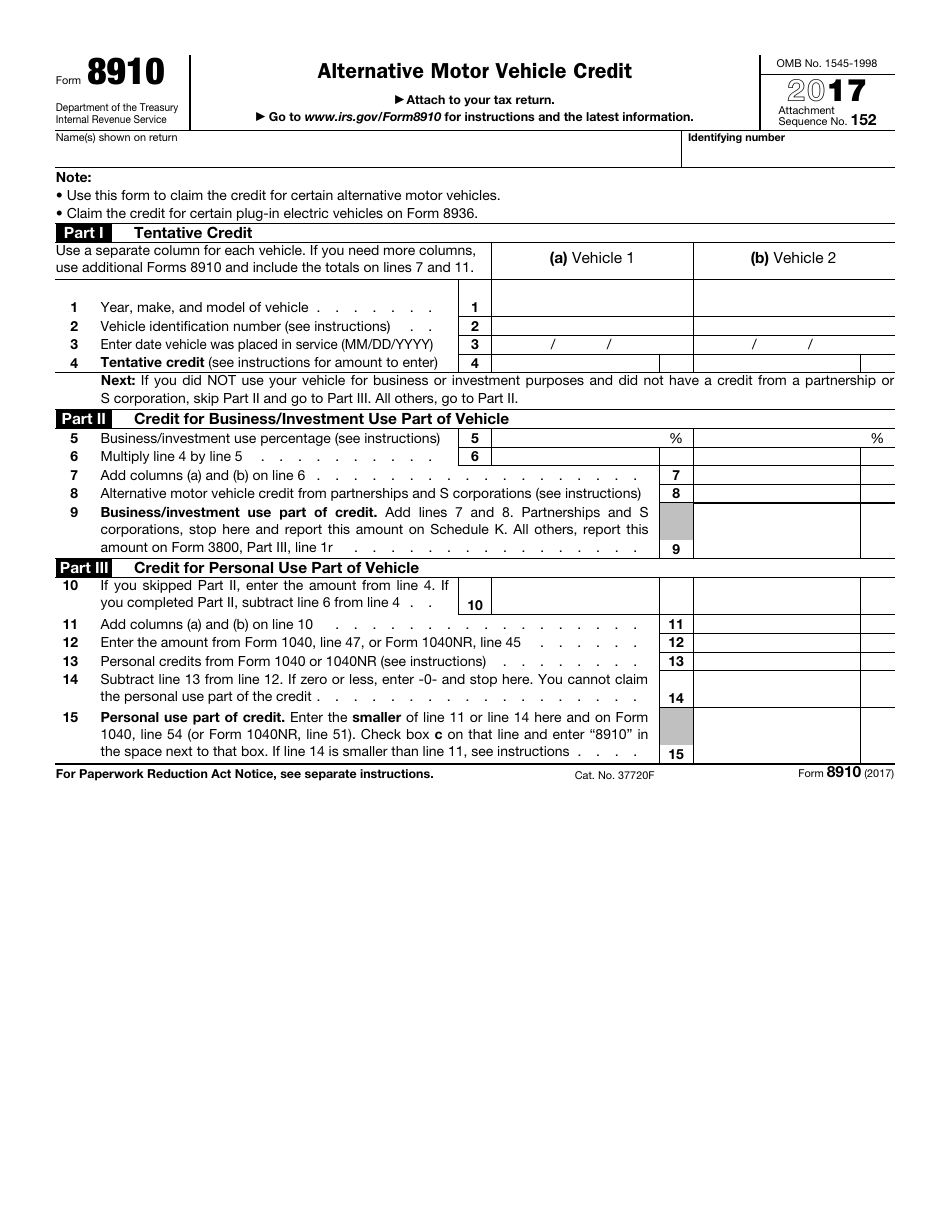

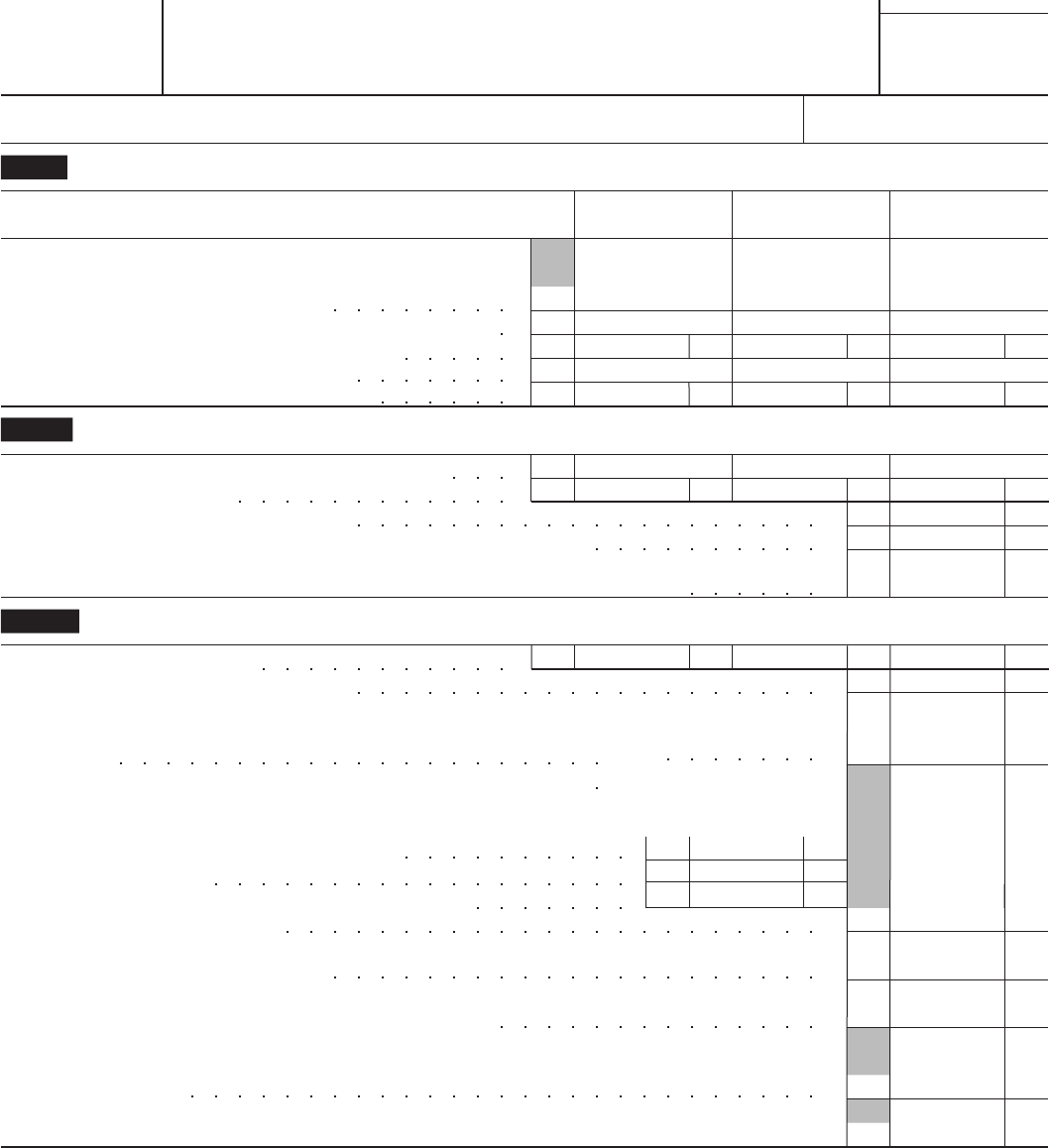

Web • use this form to claim the credit for certain alternative motor vehicles. Web general instructions purpose of form use form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year. Complete the first page of section a. It added income limits, price caps and. Part i tentative credit next:

Fill Free fillable Form 8910 Alternative Motor Vehicle Credit 2019

Web the vehicle is designed to transport 16 or more passengers, including the driver; The credit attributable to depreciable property (vehicles. Entering a vehicle credit for. You are the owner of the vehicle. Alternative motor vehicle an alternative motor vehicle is a vehicle with at.

IRS Form 8910 Download Fillable PDF or Fill Online Alternative Motor

Web what are the qualifications for the alternative motor vehicle credit (form 8910)? The alternative motor vehicle credit expired for vehicles purchased after 2021. Web use form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year. Alternative motor vehicle an alternative motor vehicle is a vehicle with at. Web qualified fuel cell.

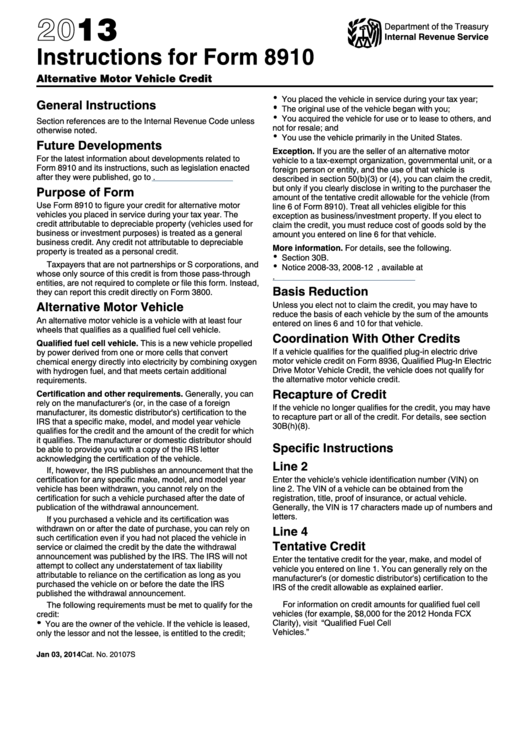

Download Instructions for IRS Form 8910 Alternative Motor Vehicle

Web what are the qualifications for the alternative motor vehicle credit (form 8910)? This is a new vehicle propelled by power derived from one or more cells that convert chemical energy directly into electricity by combining oxygen with. Web to apply for disabled veteran license plates, you must submit: Web general instructions purpose of form use form 8910 to figure.

Instructions for Form 8910, Alternative Motor Vehicle Credit

Proof of age and a photo must be included to qualify and obtain a photo. Alternative motor vehicle an alternative motor vehicle is a vehicle with at. Part i tentative credit next: Web what are the qualifications for the alternative motor vehicle credit (form 8910)? This is a new vehicle propelled by power derived from one or more cells that.

Form 8910 Alternative Motor Vehicle Credit (2014) Free Download

Be sure to read the form. Have an external charging source have a gross vehicle weight rating of less than 14,000 pounds be made. Alternative motor vehicle an alternative motor vehicle is a vehicle with at. Web the 2023 chevrolet bolt. Web the vehicle is designed to transport 16 or more passengers, including the driver;

Form 8910 Edit, Fill, Sign Online Handypdf

It added income limits, price caps and. The alternative motor vehicle credit expired for vehicles purchased after 2021. The alternative motor vehicle credit was enacted by the energy policy act of 2005. You are the owner of the vehicle. Web use this form to claim the credit for certain alternative motor vehicles.

Instructions For Form 8910 Alternative Motor Vehicle Credit 2013

The credit attributable to depreciable property (vehicles. Web use form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year. Part i tentative credit next: Proof of age and a photo must be included to qualify and obtain a photo. Web the 2023 chevrolet bolt.

Web Qualified Fuel Cell Vehicle.

The alternative motor vehicle credit was enacted by the energy policy act of 2005. This is a new vehicle that draws propulsion energy from onboard sources of stored energy that are both an internal combustion or heat engine using. You are the owner of the vehicle. Web use form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year.

The Vehicle Is Transporting Hazardous Materials And Is Required To Be Placarded.

If the vehicle is leased, only the lessor and not the lessee is entitled to the. Web what vehicles qualify for the alternative motor vehicle credit (form 8910)? Web use this form to claim the credit for certain alternative motor vehicles. Entering a vehicle credit for.

The Credit Attributable To Depreciable Property (Vehicles.

Web to apply for disabled veteran license plates, you must submit: Web the following requirements must be met to qualify for the credit. Web general instructions purpose of form use form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year. The alternative motor vehicle credit expired for vehicles purchased after 2021.

Be Sure To Read The Form.

Part i tentative credit next: If you qualify based on your age (referenced on page 1: Web in general, to qualify for the ev tax credit, the ev vehicle: The taxpayer certainty and disaster tax relief act of 2020 extended the alternative motor vehicle.