Form 8915 E 2021

Form 8915 E 2021 - This post is for discussion. Web updated january 13, 2023. At the time these instructions went to print, only the 2020. If you are under age 59 1/2, the distribution. This will also include any coronavirus relate. Web for 2021 only, anyone who qualified for unemployment benefits will be treated as if their income is 133% of the fpl for the purposes of the ptc, meaning they will. Qualified 2019 disaster retirement plan distributions and repayments. It appears you don't have a pdf plugin for this browser. Will that deferred amount automatically carry over to our client's 2021. Web taxpayers deferred taxation of distributions from 401k accounts in 2020 if covid related.

From within your taxact return (online or desktop), click federal (on smaller devices, click in the top left corner of your. It appears you don't have a pdf plugin for this browser. This post is for discussion. Web updated january 13, 2023. Will that deferred amount automatically carry over to our client's 2021. In prior tax years, form 8915. At the time these instructions went to print, only the 2020. If you have already filed. Web taxpayers deferred taxation of distributions from 401k accounts in 2020 if covid related. This is exceedingly disappointing to have a release date of 3/31/2022 when the update came from the irs.

At the time these instructions went to print, only the 2020. From within your taxact return (online or desktop), click federal (on smaller devices, click in the top left corner of your. This post is for discussion. In prior tax years, form 8915. Web taxpayers deferred taxation of distributions from 401k accounts in 2020 if covid related. Web updated january 13, 2023. Will that deferred amount automatically carry over to our client's 2021. Any distributions you took within the 2021 tax year will be taxable on your federal return. This is exceedingly disappointing to have a release date of 3/31/2022 when the update came from the irs. If you are under age 59 1/2, the distribution.

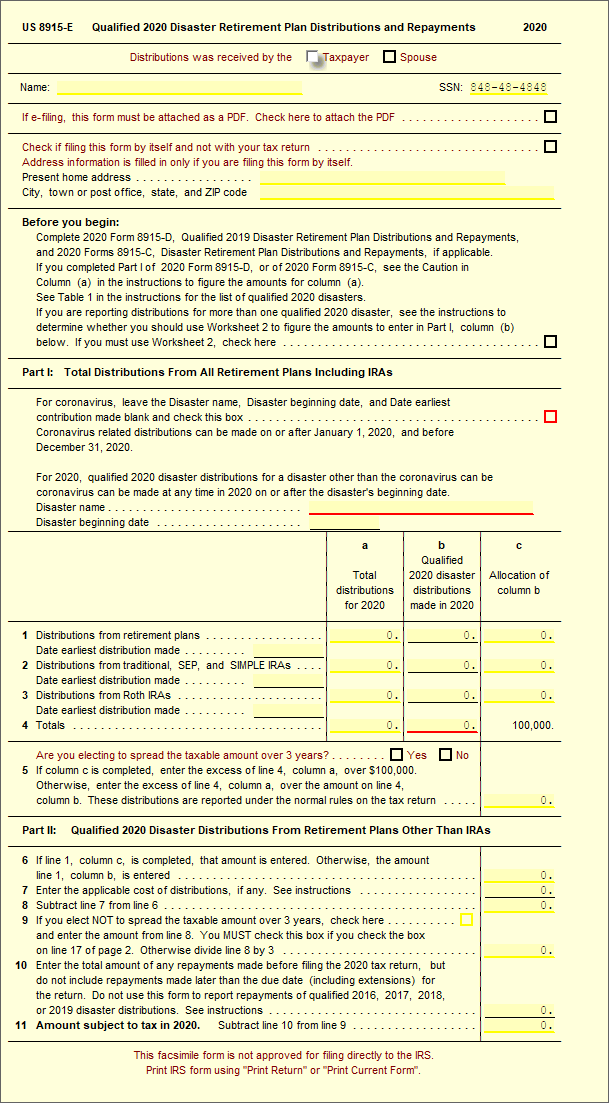

8915E Qualified 2020 Disaster Retirement Plan Distributions and

Thank you for your patience. At the time these instructions went to print, only the 2020. If you are under age 59 1/2, the distribution. Web updated january 13, 2023. Will that deferred amount automatically carry over to our client's 2021.

8915e tax form release date Chaffin

At the time these instructions went to print, only the 2020. Department of the treasury internal revenue service. If you are under age 59 1/2, the distribution. It appears you don't have a pdf plugin for this browser. Qualified 2019 disaster retirement plan distributions and repayments.

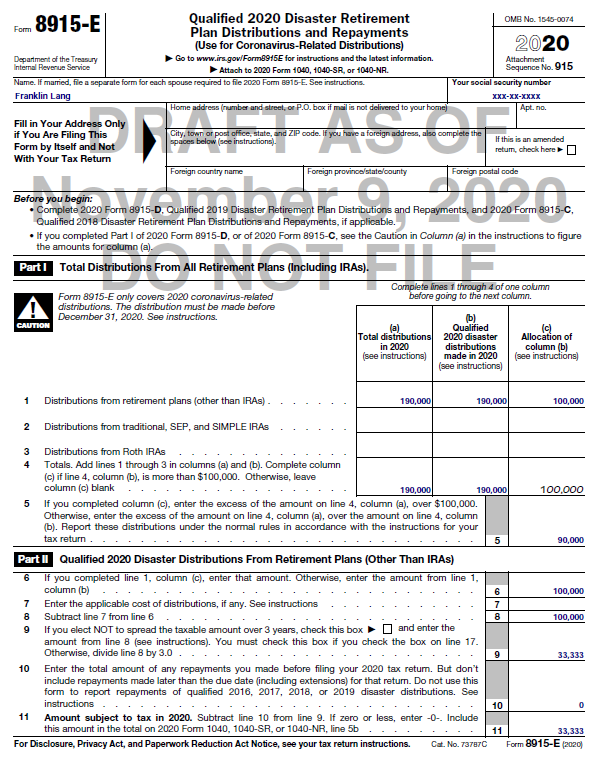

8915e tax form instructions Somer Langley

If you have already filed. Web taxpayers deferred taxation of distributions from 401k accounts in 2020 if covid related. Will that deferred amount automatically carry over to our client's 2021. Web updated january 13, 2023. Qualified 2019 disaster retirement plan distributions and repayments.

Form 8915e TurboTax Updates On QDRP Online & Instructions To File It

This will also include any coronavirus relate. Web for 2021 only, anyone who qualified for unemployment benefits will be treated as if their income is 133% of the fpl for the purposes of the ptc, meaning they will. Thank you for your patience. At the time these instructions went to print, only the 2020. From within your taxact return (online.

Kandy Snell

From within your taxact return (online or desktop), click federal (on smaller devices, click in the top left corner of your. Qualified 2019 disaster retirement plan distributions and repayments. Thank you for your patience. This is exceedingly disappointing to have a release date of 3/31/2022 when the update came from the irs. This post is for discussion.

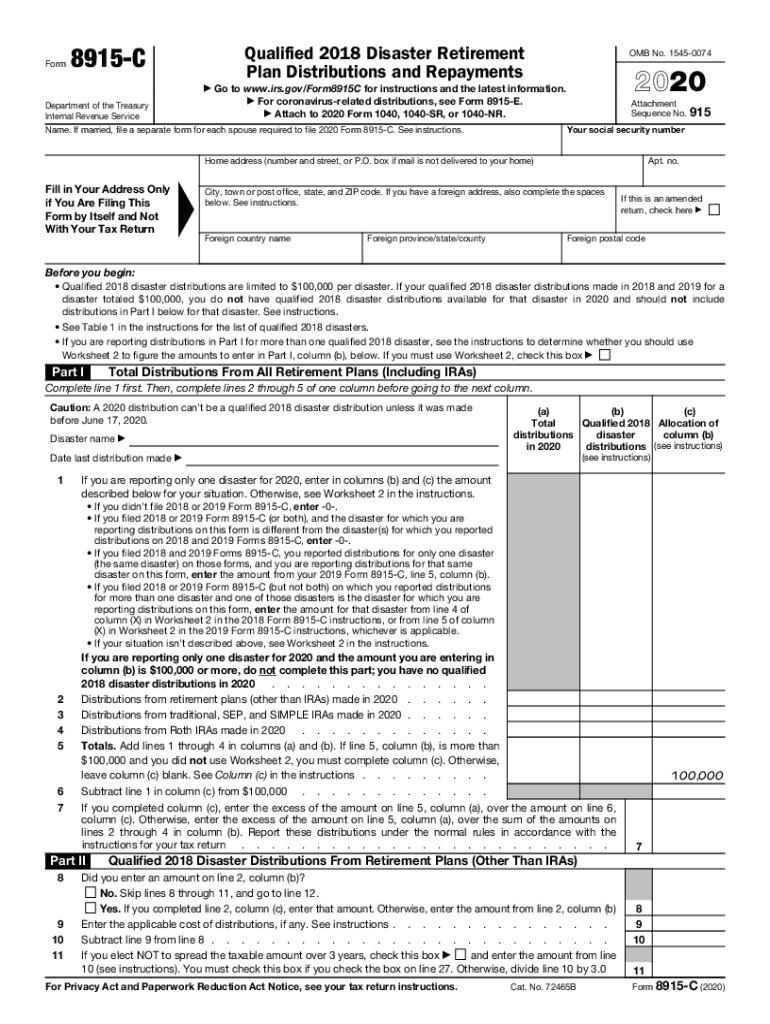

2020 Form IRS 8915C Fill Online, Printable, Fillable, Blank pdfFiller

At the time these instructions went to print, only the 2020. From within your taxact return (online or desktop), click federal (on smaller devices, click in the top left corner of your. Web updated january 13, 2023. In prior tax years, form 8915. Will that deferred amount automatically carry over to our client's 2021.

Publication 4492A (7/2008), Information for Taxpayers Affected by the

Department of the treasury internal revenue service. Thank you for your patience. Will that deferred amount automatically carry over to our client's 2021. This post is for discussion. Any distributions you took within the 2021 tax year will be taxable on your federal return.

National Association of Tax Professionals Blog

Web updated january 13, 2023. Will that deferred amount automatically carry over to our client's 2021. Web for 2021 only, anyone who qualified for unemployment benefits will be treated as if their income is 133% of the fpl for the purposes of the ptc, meaning they will. If you are under age 59 1/2, the distribution. This is exceedingly disappointing.

Fill Free fillable Form 8915E Plan Distributions and Repayments

Any distributions you took within the 2021 tax year will be taxable on your federal return. Web for 2021 only, anyone who qualified for unemployment benefits will be treated as if their income is 133% of the fpl for the purposes of the ptc, meaning they will. This will also include any coronavirus relate. This is exceedingly disappointing to have.

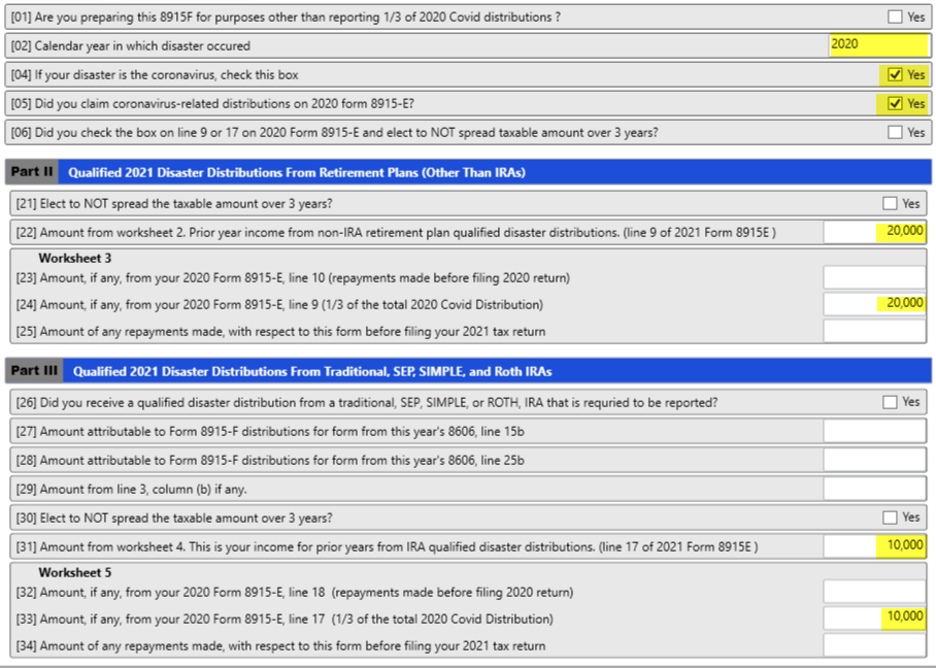

Basic 8915F Instructions for 2021 Taxware Systems

At the time these instructions went to print, only the 2020. Web taxpayers deferred taxation of distributions from 401k accounts in 2020 if covid related. If you have already filed. Will that deferred amount automatically carry over to our client's 2021. Any distributions you took within the 2021 tax year will be taxable on your federal return.

Web Updated January 13, 2023.

This post is for discussion. In prior tax years, form 8915. This will also include any coronavirus relate. Will that deferred amount automatically carry over to our client's 2021.

This Is Exceedingly Disappointing To Have A Release Date Of 3/31/2022 When The Update Came From The Irs.

From within your taxact return (online or desktop), click federal (on smaller devices, click in the top left corner of your. Qualified 2019 disaster retirement plan distributions and repayments. If you are under age 59 1/2, the distribution. Any distributions you took within the 2021 tax year will be taxable on your federal return.

Web For 2021 Only, Anyone Who Qualified For Unemployment Benefits Will Be Treated As If Their Income Is 133% Of The Fpl For The Purposes Of The Ptc, Meaning They Will.

It appears you don't have a pdf plugin for this browser. Thank you for your patience. If you have already filed. Web taxpayers deferred taxation of distributions from 401k accounts in 2020 if covid related.

Department Of The Treasury Internal Revenue Service.

At the time these instructions went to print, only the 2020.