Form 8915-F 2021

Form 8915-F 2021 - Web department of the treasury internal revenue service go to www.irs.gov/form8915f for instructions and the latest information. A qualified annuity plan the distribution must be to an eligible individual. The timing of your distributions and repayments will determine whether you need to file an amended return to claim them. • major disaster declarations at Repayments of current and prior year qualified disaster distributions. The withdrawal must come from an eligible retirement plan. Qualified disaster recovery distributions are qualified disaster distributions. This could be any of the following: It also allows you to spread the taxable portion of the distribution over three years, if needed and report prior year distribution amounts which are to be taxed in 2021.

Qualified disaster recovery distributions are qualified disaster distributions. The withdrawal must come from an eligible retirement plan. The timing of your distributions and repayments will determine whether you need to file an amended return to claim them. A qualified annuity plan the distribution must be to an eligible individual. Repayments of current and prior year qualified disaster distributions. It also allows you to spread the taxable portion of the distribution over three years, if needed and report prior year distribution amounts which are to be taxed in 2021. This could be any of the following: Web department of the treasury internal revenue service go to www.irs.gov/form8915f for instructions and the latest information. • major disaster declarations at

Qualified disaster recovery distributions are qualified disaster distributions. Repayments of current and prior year qualified disaster distributions. • major disaster declarations at The withdrawal must come from an eligible retirement plan. The timing of your distributions and repayments will determine whether you need to file an amended return to claim them. A qualified annuity plan the distribution must be to an eligible individual. This could be any of the following: Web department of the treasury internal revenue service go to www.irs.gov/form8915f for instructions and the latest information. It also allows you to spread the taxable portion of the distribution over three years, if needed and report prior year distribution amounts which are to be taxed in 2021.

8915e tax form instructions Somer Langley

The withdrawal must come from an eligible retirement plan. Qualified disaster recovery distributions are qualified disaster distributions. This could be any of the following: Web department of the treasury internal revenue service go to www.irs.gov/form8915f for instructions and the latest information. A qualified annuity plan the distribution must be to an eligible individual.

Insurance concerns in the wake of the coronavirus WZTV

It also allows you to spread the taxable portion of the distribution over three years, if needed and report prior year distribution amounts which are to be taxed in 2021. This could be any of the following: A qualified annuity plan the distribution must be to an eligible individual. The withdrawal must come from an eligible retirement plan. Qualified disaster.

Publication 4492A (7/2008), Information for Taxpayers Affected by the

This could be any of the following: The timing of your distributions and repayments will determine whether you need to file an amended return to claim them. Repayments of current and prior year qualified disaster distributions. A qualified annuity plan the distribution must be to an eligible individual. Qualified disaster recovery distributions are qualified disaster distributions.

form 8915 e instructions turbotax Renita Wimberly

This could be any of the following: Web department of the treasury internal revenue service go to www.irs.gov/form8915f for instructions and the latest information. A qualified annuity plan the distribution must be to an eligible individual. The withdrawal must come from an eligible retirement plan. Repayments of current and prior year qualified disaster distributions.

Form Appendix B Pdf Fill Out and Sign Printable PDF Template signNow

It also allows you to spread the taxable portion of the distribution over three years, if needed and report prior year distribution amounts which are to be taxed in 2021. Qualified disaster recovery distributions are qualified disaster distributions. This could be any of the following: The withdrawal must come from an eligible retirement plan. Web department of the treasury internal.

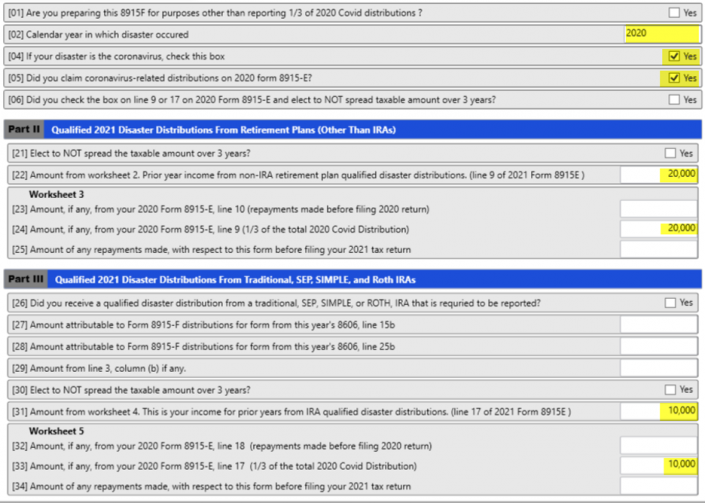

Basic 8915F Instructions for 2021 Taxware Systems

This could be any of the following: A qualified annuity plan the distribution must be to an eligible individual. Qualified disaster recovery distributions are qualified disaster distributions. The withdrawal must come from an eligible retirement plan. • major disaster declarations at

'Forever' form 8915F issued by IRS for retirement distributions Newsday

Qualified disaster recovery distributions are qualified disaster distributions. Repayments of current and prior year qualified disaster distributions. A qualified annuity plan the distribution must be to an eligible individual. The timing of your distributions and repayments will determine whether you need to file an amended return to claim them. It also allows you to spread the taxable portion of the.

2020 ezAccounting Business Software Offers New 941 Form For Coronavirus

The withdrawal must come from an eligible retirement plan. It also allows you to spread the taxable portion of the distribution over three years, if needed and report prior year distribution amounts which are to be taxed in 2021. This could be any of the following: Repayments of current and prior year qualified disaster distributions. Web department of the treasury.

IRS Form 8916 Download Fillable PDF or Fill Online Reconciliation of

Repayments of current and prior year qualified disaster distributions. A qualified annuity plan the distribution must be to an eligible individual. This could be any of the following: Qualified disaster recovery distributions are qualified disaster distributions. It also allows you to spread the taxable portion of the distribution over three years, if needed and report prior year distribution amounts which.

Form 8915 Qualified Hurricane Retirement Plan Distributions and

The withdrawal must come from an eligible retirement plan. The timing of your distributions and repayments will determine whether you need to file an amended return to claim them. It also allows you to spread the taxable portion of the distribution over three years, if needed and report prior year distribution amounts which are to be taxed in 2021. •.

Web Department Of The Treasury Internal Revenue Service Go To Www.irs.gov/Form8915F For Instructions And The Latest Information.

This could be any of the following: Repayments of current and prior year qualified disaster distributions. • major disaster declarations at Qualified disaster recovery distributions are qualified disaster distributions.

The Withdrawal Must Come From An Eligible Retirement Plan.

It also allows you to spread the taxable portion of the distribution over three years, if needed and report prior year distribution amounts which are to be taxed in 2021. A qualified annuity plan the distribution must be to an eligible individual. The timing of your distributions and repayments will determine whether you need to file an amended return to claim them.