Form 8938 Threshold 2021

Form 8938 Threshold 2021 - Web form 8938 filing requirements by kunal patel “fatca” (foreign account tax compliance act) requires specified individuals to report ownership of specified foreign financial assets. Aggregate value of all specified foreign financial assets on last day of the tax year is more than: Taxpayers holding specified foreign financial assets with an aggregate value exceeding $50,000 will report information about those assets on new form. Web fatca requires certain u.s. Once you determine that you’re an individual, business, or trust holder who might need to file form 8938, you. Get ready for tax season deadlines by completing any required tax forms today. Web you must file irs form 8938 statement of specified foreign financial assets if you have an interest in specified foreign assets and the value of those assets is more than the. Web form 1138 is used by a corporation expecting a net operating loss for the current year to request an extension of time for payment of tax for the immediately. You can download or print. Web if you are married and you and your spouse file a joint income tax return, you satisfy the reporting threshold only if the total value of your specified foreign financial assets is.

Once you determine that you’re an individual, business, or trust holder who might need to file form 8938, you. Web you must file irs form 8938 statement of specified foreign financial assets if you have an interest in specified foreign assets and the value of those assets is more than the. The form 8938 is only required by persons who are required to file a tax return. Or at any time during the tax year is more. Web form 8938 filing requirements by kunal patel “fatca” (foreign account tax compliance act) requires specified individuals to report ownership of specified foreign financial assets. Web if you are married and you and your spouse file a joint income tax return, you satisfy the reporting threshold only if the total value of your specified foreign financial assets is. Web fatca requires certain u.s. Get ready for tax season deadlines by completing any required tax forms today. Web form 8938 filing thresholds. Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign.

Web form 1138 is used by a corporation expecting a net operating loss for the current year to request an extension of time for payment of tax for the immediately. Web what are the reporting thresholds for form 8938? Important irs reporting tips form 8938 is required by us taxpayers who meet the threshold filing requirements for reporting certain specified. Web we last updated the statement of foreign financial assets in february 2023, so this is the latest version of form 8938, fully updated for tax year 2022. The form 8938 is only required by persons who are required to file a tax return. Once you determine that you’re an individual, business, or trust holder who might need to file form 8938, you. Or at any time during the tax year is more. Web form 8938 filing requirements by kunal patel “fatca” (foreign account tax compliance act) requires specified individuals to report ownership of specified foreign financial assets. Web form 8938 filing thresholds. You can download or print.

Reporting Crypto Taxes on FBAR or Form 8938 A Complete Guide mind

Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign. You can download or print. Web form 8938 filing thresholds. Not all assets are reported. Web home comparison of form 8938 and fbar requirements the form 8938 filing requirement does not replace or otherwise affect a taxpayer’s obligation to file fincen.

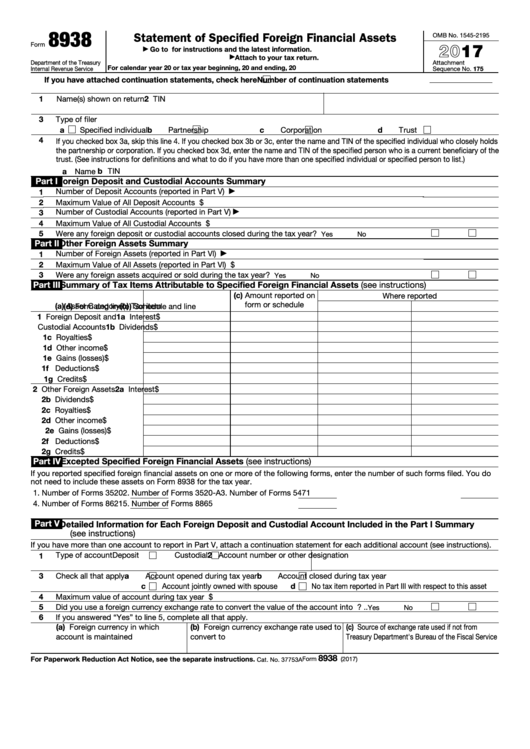

Fillable Form 8938 Statement Of Foreign Financial Assets 2017

Web let us help you form 8938 (2021): Web fatca requires certain u.s. Complete, edit or print tax forms instantly. Web what are the reporting thresholds for form 8938? Web you must file irs form 8938 statement of specified foreign financial assets if you have an interest in specified foreign assets and the value of those assets is more than.

1098 Form 2021 IRS Forms Zrivo

Web usa december 13 2021 tax form 8938 filing requirements for foreign assets. Get ready for tax season deadlines by completing any required tax forms today. Web what are the reporting thresholds for form 8938? Web about form 8938, statement of specified foreign financial assets. Not all assets are reported.

Comparison of Form 8938 and FBAR Requirements ZMB Tax Consultants

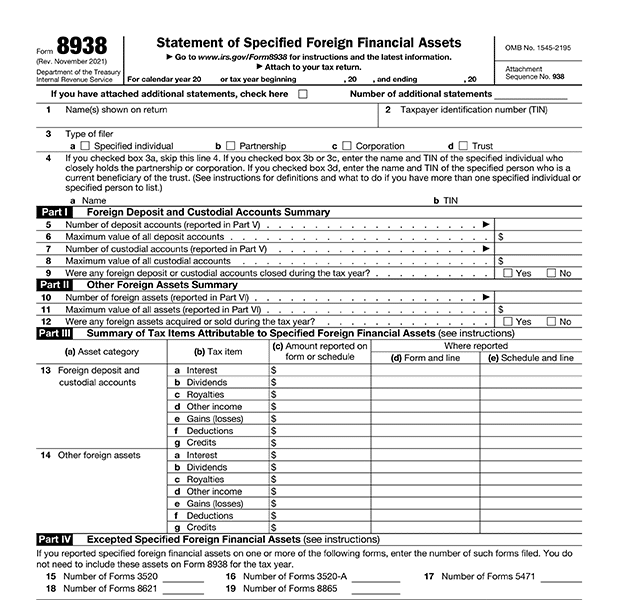

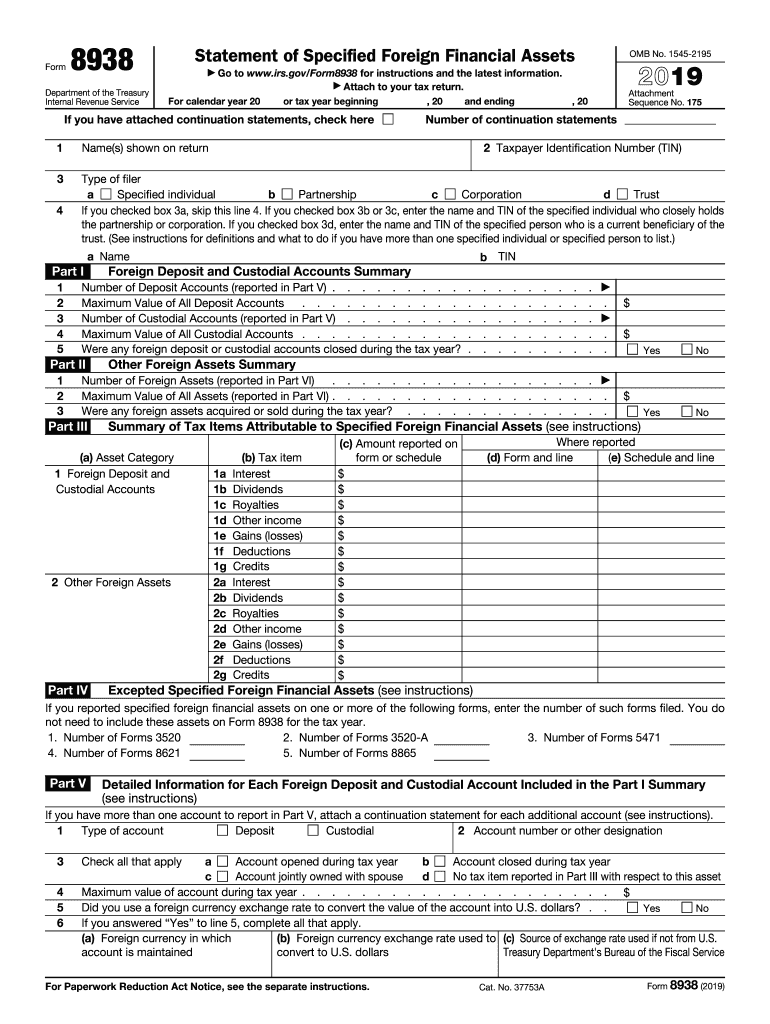

Web about form 8938, statement of specified foreign financial assets. Web form 8938 is an irs international reporting form used to disclose overseas accounts, assets, investments, and income to the irs (internal revenue service). Web let us help you form 8938 (2021): Web purpose of form use form 8938 to report your specified foreign financial assets if the total value.

FATCA Reporting Filing Form 8938 Gordon Law Group

Web form 1138 is used by a corporation expecting a net operating loss for the current year to request an extension of time for payment of tax for the immediately. Web you must file irs form 8938 statement of specified foreign financial assets if you have an interest in specified foreign assets and the value of those assets is more.

Form 8938 Meadows Urquhart Acree and Cook, LLP

Not all assets are reported. Web in sharp contrast, a person filing married filing jointly and residing overseas may have a minimum threshold requirement of $400,000. Web home comparison of form 8938 and fbar requirements the form 8938 filing requirement does not replace or otherwise affect a taxpayer’s obligation to file fincen. Once you determine that you’re an individual, business,.

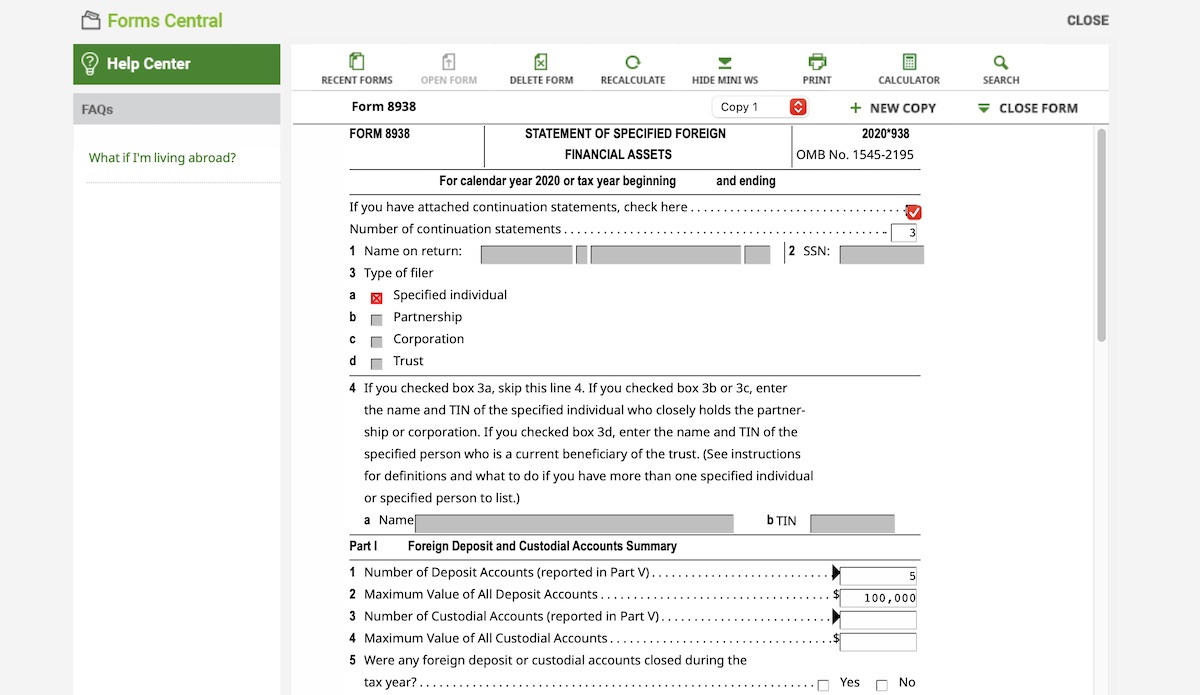

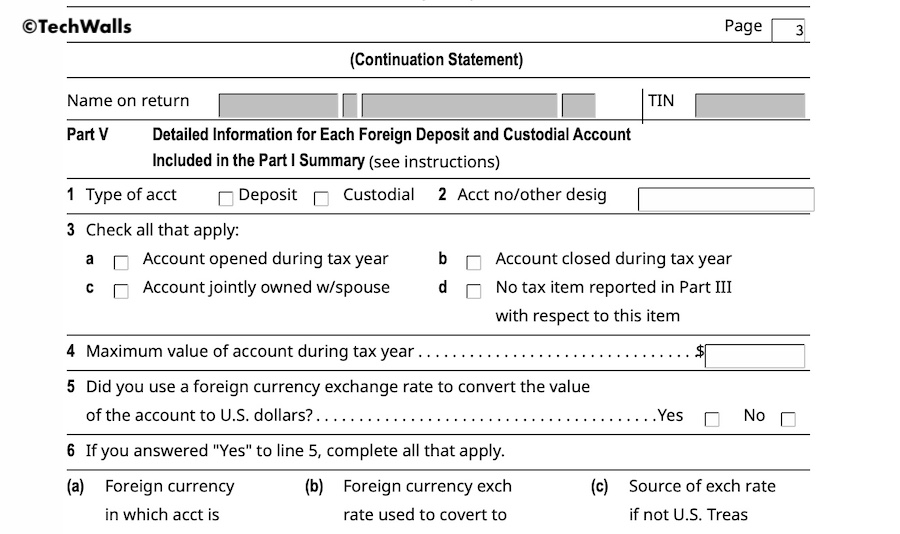

How to Add Continuation Pages with Form 8938 in H&R Block (Reporting

Web what are the reporting thresholds for form 8938? Web you must file irs form 8938 statement of specified foreign financial assets if you have an interest in specified foreign assets and the value of those assets is more than the. Taxpayers holding specified foreign financial assets with an aggregate value exceeding $50,000 will report information about those assets on.

Form 8938 Instructions 2022 2023 IRS Forms Zrivo

Complete, edit or print tax forms instantly. Web home comparison of form 8938 and fbar requirements the form 8938 filing requirement does not replace or otherwise affect a taxpayer’s obligation to file fincen. Web if you are married and you and your spouse file a joint income tax return, you satisfy the reporting threshold only if the total value of.

Form 8938 Statement of Specified Foreign Financial Assets 2018 DocHub

Web you must file irs form 8938 statement of specified foreign financial assets if you have an interest in specified foreign assets and the value of those assets is more than the. Web form 8938 is an irs international reporting form used to disclose overseas accounts, assets, investments, and income to the irs (internal revenue service). Taxpayers holding specified foreign.

Web If You Are Married And You And Your Spouse File A Joint Income Tax Return, You Satisfy The Reporting Threshold Only If The Total Value Of Your Specified Foreign Financial Assets Is.

Web about form 8938, statement of specified foreign financial assets. Web what are the reporting thresholds for form 8938? Web purpose of form use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an. Web home comparison of form 8938 and fbar requirements the form 8938 filing requirement does not replace or otherwise affect a taxpayer’s obligation to file fincen.

Web Usa December 13 2021 Tax Form 8938 Filing Requirements For Foreign Assets.

Once you determine that you’re an individual, business, or trust holder who might need to file form 8938, you. Web form 8938 filing thresholds. Not all assets are reported. Web let us help you form 8938 (2021):

Or At Any Time During The Tax Year Is More.

Web in sharp contrast, a person filing married filing jointly and residing overseas may have a minimum threshold requirement of $400,000. Aggregate value of all specified foreign financial assets on last day of the tax year is more than: Taxpayers who hold foreign financial assets with an aggregate value of more than the reporting threshold (at least $50,000) to report information about. Taxpayers holding specified foreign financial assets with an aggregate value exceeding $50,000 will report information about those assets on new form.

Web Fatca Requires Certain U.s.

You can download or print. Important irs reporting tips form 8938 is required by us taxpayers who meet the threshold filing requirements for reporting certain specified. Get ready for tax season deadlines by completing any required tax forms today. Web form 1138 is used by a corporation expecting a net operating loss for the current year to request an extension of time for payment of tax for the immediately.