Form 8949 Code

Form 8949 Code - For the main home sale exclusion, the code is h. Web if you sold some stocks this year, you're probably aware that you will need to include some information on your tax return. Then enter the amount of excluded (nontaxable) gain as a negative number. Web 12 rows report the sale or exchange on form 8949 as you would if you were not taking the exclusion. Web what is form 8949 used for? Web crypto taxes and accounting may 1, 2023 how can the irs seize your crypto? Follow the instructions for the code you need to generate below. If you exchange or sell capital assets, report them on your federal tax return using form 8949: Web use form 8949 to report sales and exchanges of capital assets. Web gain, form 8949 will show the adjustment as a negative number in the amount of the net gain, with adjustment code h and basis type f and no net gain/loss.

Web 17 rows you sold or exchanged your main home at a gain, must report the sale or. What you may not realize, is that you'll need. Only use the broker screen if you're entering a consolidated. Web 12 rows report the sale or exchange on form 8949 as you would if you were not taking the exclusion. Web use form 8949 to report sales and exchanges of capital assets. Web use form 8949 to report sales and exchanges of capital assets. Web form 8949, column (f) reports a code explaining any adjustments to gain or loss in column g. Learn how the irs taxes crypto, where you might run into trouble, and how the. Web gain, form 8949 will show the adjustment as a negative number in the amount of the net gain, with adjustment code h and basis type f and no net gain/loss. Web what is form 8949 used for?

Web in the instructions for irs form 8949, it lists out a table of codes that you can put on the form. Sales and other dispositions of capital assets. Follow the instructions for the code you need to generate below. Learn how the irs taxes crypto, where you might run into trouble, and how the. Web what is form 8949 used for? Web gain, form 8949 will show the adjustment as a negative number in the amount of the net gain, with adjustment code h and basis type f and no net gain/loss. Only use the broker screen if you're entering a consolidated. If you exchange or sell capital assets, report them on your federal tax return using form 8949: What you may not realize, is that you'll need. Web use form 8949 to report sales and exchanges of capital assets.

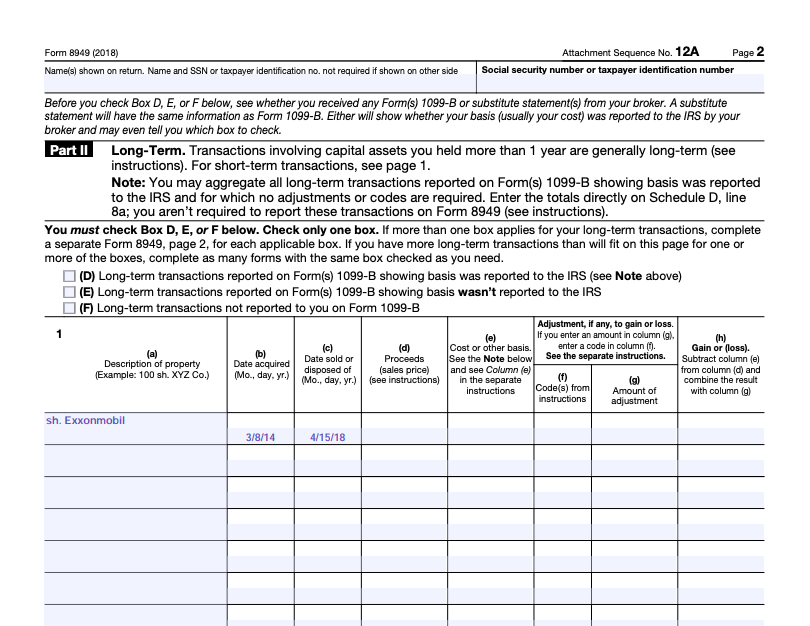

Form 8949 Instructions & Information on Capital Gains/Losses Form

Web what is form 8949 used for? Web use form 8949 to report sales and exchanges of capital assets. Web 12 rows report the sale or exchange on form 8949 as you would if you were not taking the exclusion. What you may not realize, is that you'll need. Web crypto taxes and accounting may 1, 2023 how can the.

Can You Please Help Me Fill Out Form 8949? So I Kn...

Learn how the irs taxes crypto, where you might run into trouble, and how the. If you exchange or sell capital assets, report them on your federal tax return using form 8949: Web crypto taxes and accounting may 1, 2023 how can the irs seize your crypto? Web what is form 8949 used for? Only use the broker screen if.

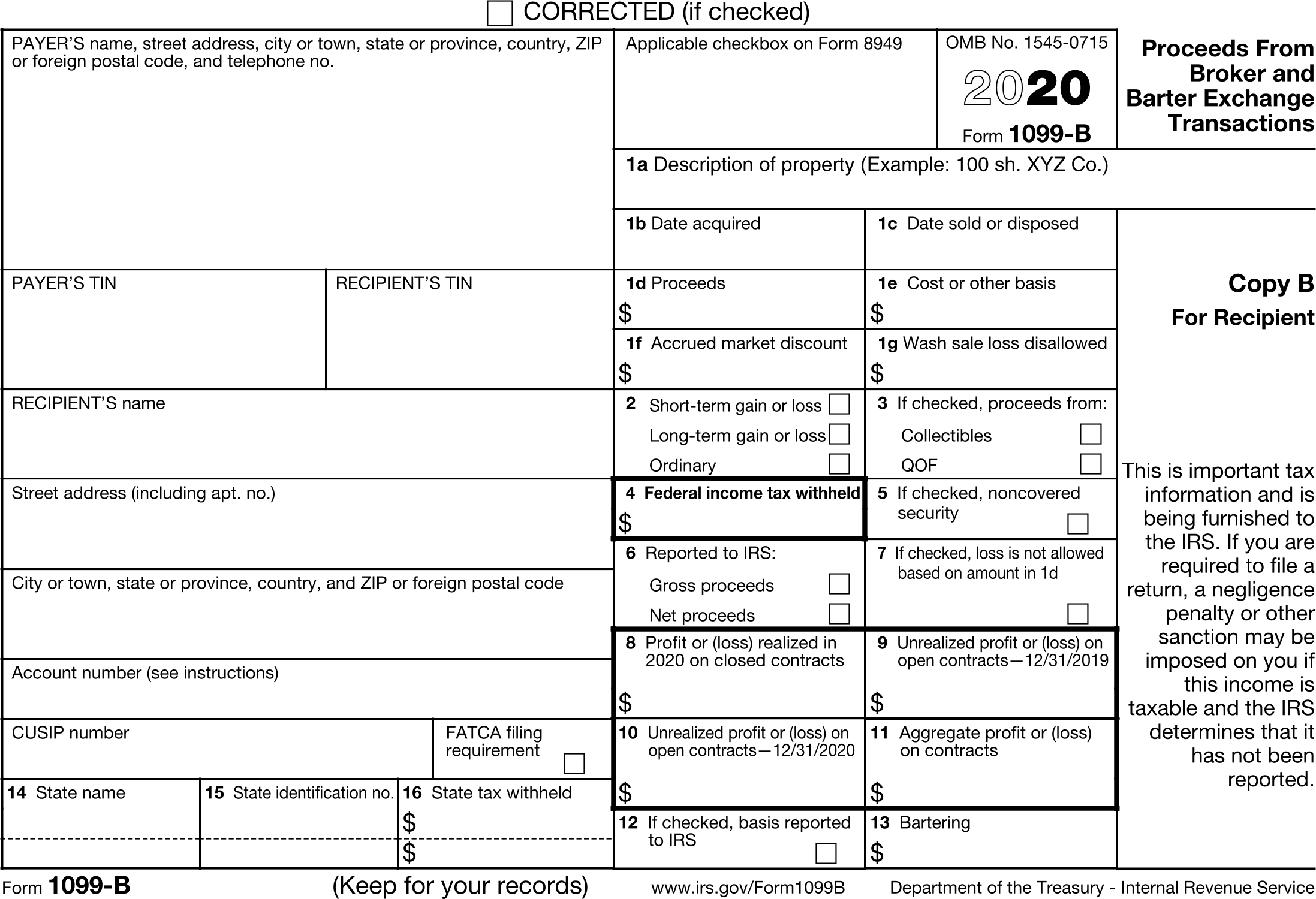

IRS Form 1099B.

Sales and other dispositions of capital assets. Only use the broker screen if you're entering a consolidated. What you may not realize, is that you'll need. Then enter the amount of excluded (nontaxable) gain as a negative number. Web you sold or exchanged your main home at a gain, must report the sale or exchange on part ii of form.

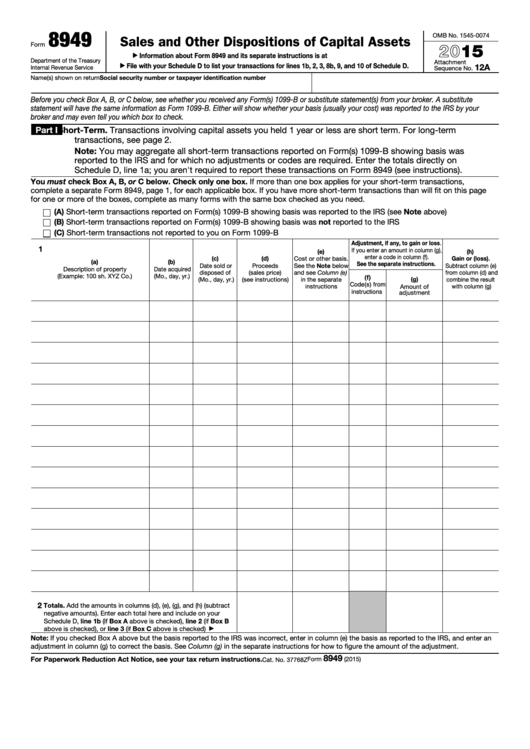

Form 8949 Sales and Other Dispositions of Capital Assets (2014) Free

Click the b&d or broker screen. Web 12 rows report the sale or exchange on form 8949 as you would if you were not taking the exclusion. Then enter the amount of excluded (nontaxable) gain as a negative number. Web 17 rows you sold or exchanged your main home at a gain, must report the sale or. Web crypto taxes.

Stock options 8949

Web 8 rows to enter form 8949 adjustment codes: For the main home sale exclusion, the code is h. Web if you sold some stocks this year, you're probably aware that you will need to include some information on your tax return. Only use the broker screen if you're entering a consolidated. Web what is form 8949 used for?

In the following Form 8949 example,the highlighted section below shows

Web use form 8949 to report sales and exchanges of capital assets. Then enter the amount of excluded (nontaxable) gain as a negative number. Web 17 rows you sold or exchanged your main home at a gain, must report the sale or. Web you sold or exchanged your main home at a gain, must report the sale or exchange on.

Fillable Form 8949 Sales And Other Dispositions Of Capital Assets

Web use form 8949 to report sales and exchanges of capital assets. Learn how the irs taxes crypto, where you might run into trouble, and how the. Follow the instructions for the code you need to generate below. If you exchange or sell capital assets, report them on your federal tax return using form 8949: Web 17 rows you sold.

Form 8949 Edit, Fill, Sign Online Handypdf

Go to the income input folder. Sales and other dispositions of capital assets. Web use form 8949 to report sales and exchanges of capital assets. Web crypto taxes and accounting may 1, 2023 how can the irs seize your crypto? Web form 8949, column (f) reports a code explaining any adjustments to gain or loss in column g.

File IRS Form 8949 to Report Your Capital Gains or Losses

Web use form 8949 to report sales and exchanges of capital assets. If you exchange or sell capital assets, report them on your federal tax return using form 8949: Follow the instructions for the code you need to generate below. Web crypto taxes and accounting may 1, 2023 how can the irs seize your crypto? Web if you sold some.

2016 Form 8949 Fill Online, Printable, Fillable, Blank pdfFiller

Web in the instructions for irs form 8949, it lists out a table of codes that you can put on the form. Web 8 rows to enter form 8949 adjustment codes: Web use form 8949 to report sales and exchanges of capital assets. Only use the broker screen if you're entering a consolidated. Sales and other dispositions of capital assets.

Web If You Sold Some Stocks This Year, You're Probably Aware That You Will Need To Include Some Information On Your Tax Return.

Go to the income input folder. If you exchange or sell capital assets, report them on your federal tax return using form 8949: Web 17 rows you sold or exchanged your main home at a gain, must report the sale or. Web in the instructions for irs form 8949, it lists out a table of codes that you can put on the form.

Web Use Form 8949 To Report Sales And Exchanges Of Capital Assets.

Web 8 rows to enter form 8949 adjustment codes: For the main home sale exclusion, the code is h. Only use the broker screen if you're entering a consolidated. Web use form 8949 to report sales and exchanges of capital assets.

Follow The Instructions For The Code You Need To Generate Below.

Web crypto taxes and accounting may 1, 2023 how can the irs seize your crypto? Click the b&d or broker screen. Web you sold or exchanged your main home at a gain, must report the sale or exchange on part ii of form 8949 (as explained in sale of your home in the instructions for schedule d. Web 12 rows report the sale or exchange on form 8949 as you would if you were not taking the exclusion.

Web Form 8949, Column (F) Reports A Code Explaining Any Adjustments To Gain Or Loss In Column G.

Then enter the amount of excluded (nontaxable) gain as a negative number. Web what is form 8949 used for? Learn how the irs taxes crypto, where you might run into trouble, and how the. Web gain, form 8949 will show the adjustment as a negative number in the amount of the net gain, with adjustment code h and basis type f and no net gain/loss.