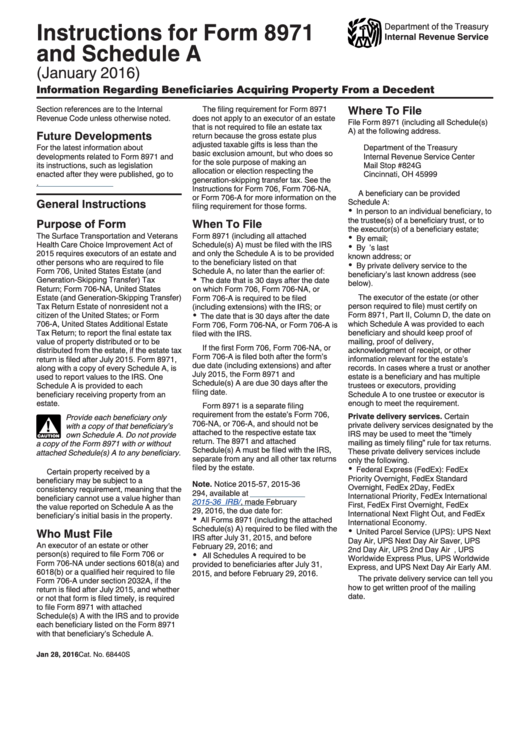

Form 8971 Instructions

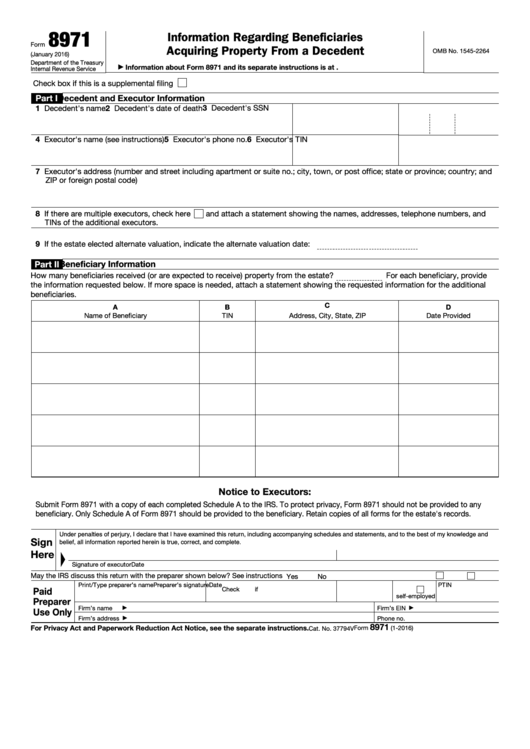

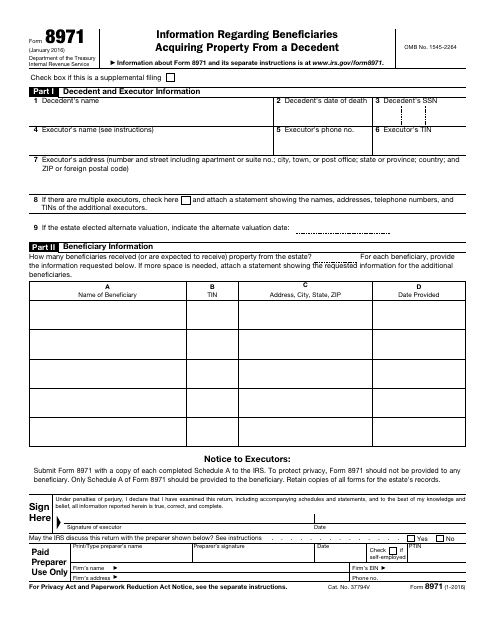

Form 8971 Instructions - Web the form 8971 and schedule(s) a are due 30 days after the filing date. It is not clear that form 8971 is required under these circumstances. And zip or foreign postal code) The initial reports under the new statutory requirement are due four weeks from that release date, by february 29, 2016. About form 8971, information regarding beneficiaries acquiring property from a decedent | internal revenue service Check box if this is a supplemental filing 7 executor's address (number and street including apartment or suite no.; Web the irs released form 8971 and instructions to form 8971 on january 29, 2016. Each schedule a should include every item of property that could potentially pass to the recipient. One schedule a is provided to each beneficiary receiving property from an estate. Web form 8971 is required for any estate that files a 706 after july, 2015, regardless of the decedent’s date of death.

City, town, or post office; Web irs form 8971 is the tax form that the executor of an estate must use to report the final estate tax value of property of that estate. Web the irs released form 8971 and instructions to form 8971 on january 29, 2016. Do you have to file form 8971 for an estate that files its original 706 prior to july, 2015, but files a supplemental 706 after july, 2015? About form 8971, information regarding beneficiaries acquiring property from a decedent | internal revenue service Web the form 8971 and schedule(s) a are due 30 days after the filing date. Check box if this is a supplemental filing 7 executor's address (number and street including apartment or suite no.; It is not clear that form 8971 is required under these circumstances. Form 8971 and attached schedule(s) a must be filed with the irs, separate from. Web form 8971 and all schedules a must be signed by the executor and filed with the irs.

The initial reports under the new statutory requirement are due four weeks from that release date, by february 29, 2016. Each schedule a should include every item of property that could potentially pass to the recipient. About form 8971, information regarding beneficiaries acquiring property from a decedent | internal revenue service Web the form 8971 and schedule(s) a are due 30 days after the filing date. Form 8971 and attached schedule(s) a must be filed with the irs, separate from. Web irs form 8971 is the tax form that the executor of an estate must use to report the final estate tax value of property of that estate. City, town, or post office; One schedule a is provided to each beneficiary receiving property from an estate. Web this form, along with a copy of every schedule a, is used to report values to the irs. Web department of the treasury internal revenue service information about form 8971 and its separate instructions is at www.irs.gov/form8971.

Instructions For Form 8971 And Schedule A 2016 printable pdf download

This information return reports the values from the decedent’s gross estate to both the irs and to each beneficiary receiving property from the estate. And zip or foreign postal code) Each schedule a should include every item of property that could potentially pass to the recipient. It is not clear that form 8971 is required under these circumstances. Web this.

IRS Form 8971 Instructions Reporting a Decedent's Property

Web department of the treasury internal revenue service information about form 8971 and its separate instructions is at www.irs.gov/form8971. Web form 8971 and all schedules a must be signed by the executor and filed with the irs. It is not clear that form 8971 is required under these circumstances. About form 8971, information regarding beneficiaries acquiring property from a decedent.

IRS Form 8971 Instructions Reporting a Decedent's Property

One schedule a is provided to each beneficiary receiving property from an estate. Do you have to file form 8971 for an estate that files its original 706 prior to july, 2015, but files a supplemental 706 after july, 2015? Web irs form 8971 is the tax form that the executor of an estate must use to report the final.

IRS Form 8978 Instructions Reporting Partner's Additional Taxes

The initial reports under the new statutory requirement are due four weeks from that release date, by february 29, 2016. Web instructions include rate schedules. Web the form 8971 and schedule(s) a are due 30 days after the filing date. Form 8971 and attached schedule(s) a must be filed with the irs, separate from. City, town, or post office;

Fillable Form 8971 Information Regarding Beneficiaries Acquiring

One schedule a is provided to each beneficiary receiving property from an estate. Web form 8971 is required for any estate that files a 706 after july, 2015, regardless of the decedent’s date of death. And zip or foreign postal code) Check box if this is a supplemental filing 7 executor's address (number and street including apartment or suite no.;.

IRS Form 8978 Instructions Reporting Partner's Additional Taxes

Web the form 8971 and schedule(s) a are due 30 days after the filing date. The executor must complete a schedule a for each beneficiary who can receive property from the estate. Web the irs released form 8971 and instructions to form 8971 on january 29, 2016. Each schedule a should include every item of property that could potentially pass.

IRS Form 1310 Instructions Tax Refund on A Decedent's Behalf

Web this form, along with a copy of every schedule a, is used to report values to the irs. Web irs form 8971 is the tax form that the executor of an estate must use to report the final estate tax value of property of that estate. Each schedule a should include every item of property that could potentially pass.

Fill Free fillable Form 8971 Acquiring Property From a Decedent 2016

Form 8971 and attached schedule(s) a must be filed with the irs, separate from. Web irs form 8971 is the tax form that the executor of an estate must use to report the final estate tax value of property of that estate. Do you have to file form 8971 for an estate that files its original 706 prior to july,.

IRS Form 8971 Download Fillable PDF or Fill Online Information

Form 8971 and attached schedule(s) a must be filed with the irs, separate from any and all other tax returns filed by the estate. About form 8971, information regarding beneficiaries acquiring property from a decedent | internal revenue service City, town, or post office; Web irs form 8971 is the tax form that the executor of an estate must use.

IRS Form 8971 Instructions Reporting a Decedent's Property

Web department of the treasury internal revenue service information about form 8971 and its separate instructions is at www.irs.gov/form8971. Form 8971 and attached schedule(s) a must be filed with the irs, separate from. The executor must complete a schedule a for each beneficiary who can receive property from the estate. And zip or foreign postal code) Form 8971 and attached.

Form 8971 And Attached Schedule(S) A Must Be Filed With The Irs, Separate From.

Web the form 8971 and schedule(s) a are due 30 days after the filing date. City, town, or post office; It is not clear that form 8971 is required under these circumstances. This information return reports the values from the decedent’s gross estate to both the irs and to each beneficiary receiving property from the estate.

About Form 8971, Information Regarding Beneficiaries Acquiring Property From A Decedent | Internal Revenue Service

Form 8971 and attached schedule(s) a must be filed with the irs, separate from any and all other tax returns filed by the estate. Web irs form 8971 is the tax form that the executor of an estate must use to report the final estate tax value of property of that estate. The form includes a schedule a that will be sent to each beneficiary receiving property included on the estate tax return. Web department of the treasury internal revenue service information about form 8971 and its separate instructions is at www.irs.gov/form8971.

And Zip Or Foreign Postal Code)

Web instructions include rate schedules. Do you have to file form 8971 for an estate that files its original 706 prior to july, 2015, but files a supplemental 706 after july, 2015? Web the irs released form 8971 and instructions to form 8971 on january 29, 2016. The initial reports under the new statutory requirement are due four weeks from that release date, by february 29, 2016.

Each Schedule A Should Include Every Item Of Property That Could Potentially Pass To The Recipient.

Web form 8971 and all schedules a must be signed by the executor and filed with the irs. The executor must complete a schedule a for each beneficiary who can receive property from the estate. Web form 8971 is required for any estate that files a 706 after july, 2015, regardless of the decedent’s date of death. Web this form, along with a copy of every schedule a, is used to report values to the irs.