Form 8992 Instructions

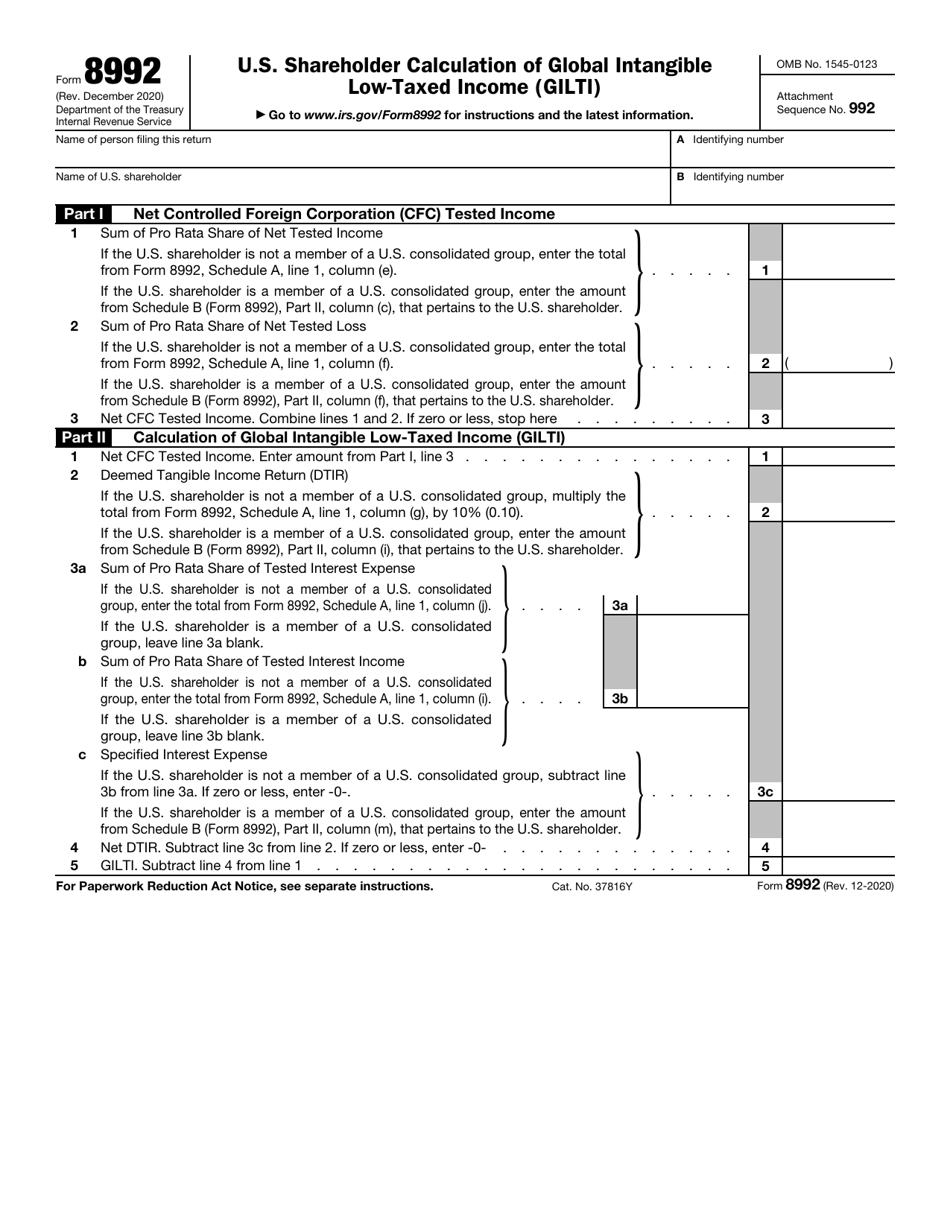

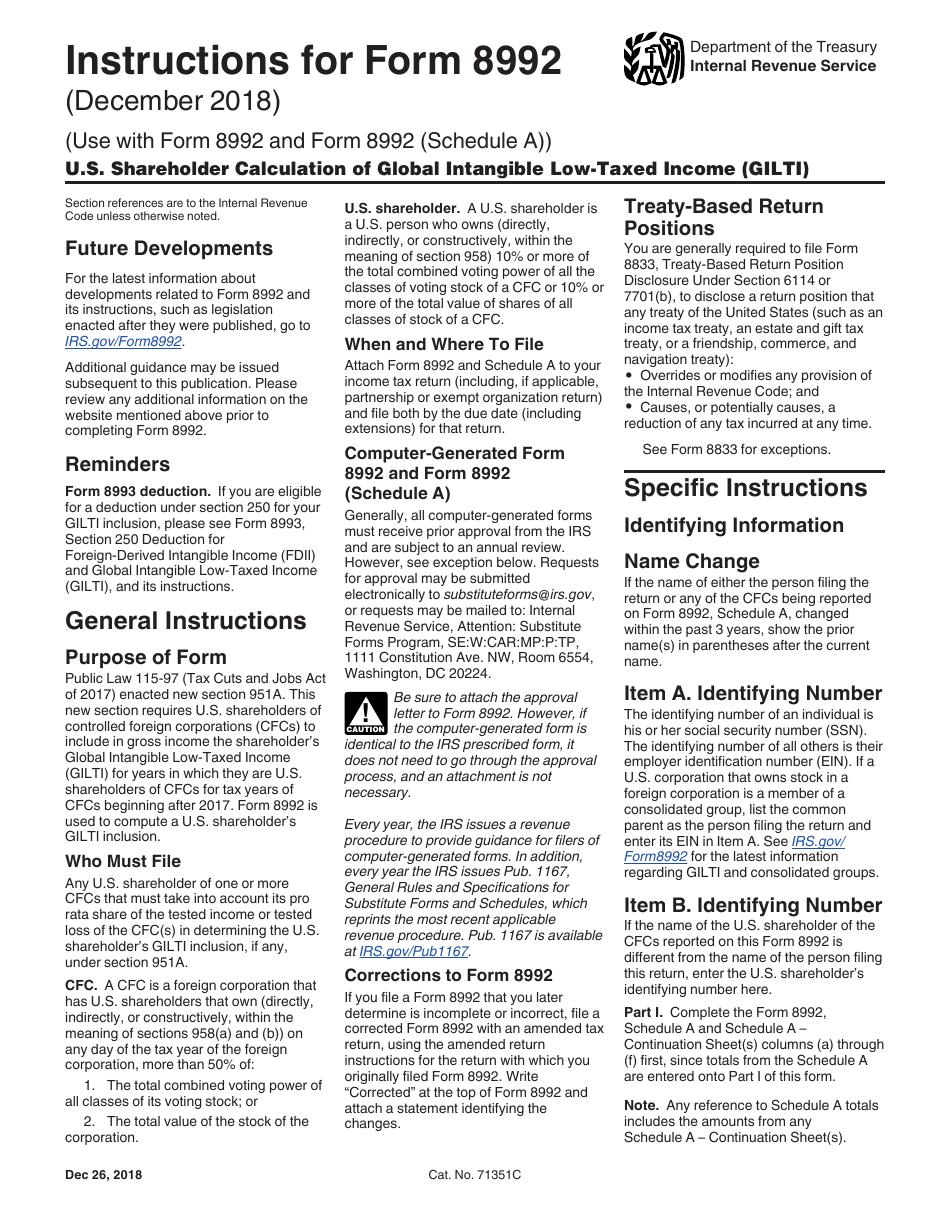

Form 8992 Instructions - Shareholder (including a partner of Form 8992 is used by u.s. Complete form 8992 as follows. Name of person filing this return. Web instructions for form 8992 (december 2018) (use with form 8992 and form 8992 (schedule a)) department of the treasury internal revenue service u.s. Read the draft instructions for form 8992. For instructions and the latest information. January 2020) department of the treasury internal revenue service. For paperwork reduction act notice, see separate instructions. For instructions and the latest information.

January 2020) department of the treasury internal revenue service. Form 8992 is used by u.s. December 2020) department of the treasury internal revenue service. Shareholders of cfcs to include gilti in gross income. Web for paperwork reduction act notice, see the instructions for form 8992. Shareholders to determine their gilti inclusion. Name of person filing this return. For instructions and the latest information. Web instructions for form 8992 (december 2018) (use with form 8992 and form 8992 (schedule a)) department of the treasury internal revenue service u.s. Complete form 8992 as follows.

Form 8992 is used by u.s. For instructions and the latest information. December 2022) department of the treasury internal revenue service. Consolidated group, use schedule a (form 8992), to determine the amounts to enter on form 8992, part l. For instructions and the latest information. Name of person filing this return. Shareholder is not a member of a u.s. Web for paperwork reduction act notice, see the instructions for form 8992. For instructions and the latest information. Use form 8992 to compute the u.s.

IRS Form 8992 Download Fillable PDF or Fill Online U.S. Shareholder

Shareholders of cfcs to include gilti in gross income. Shareholder is not a member of a u.s. December 2020) department of the treasury internal revenue service. For instructions and the latest information. Name of person filing this return.

Form 12 Schedule A Instructions Five Brilliant Ways To Advertise Form

Shareholder is a member of a Shareholder (including a partner of Consolidated group, use schedule a (form 8992), to determine the amounts to enter on form 8992, part l. Shareholders to determine their gilti inclusion. Shareholder calculation of global intangible.

Form 11 Consolidated Group How To Leave Form 11 Consolidated Group

Use form 8992 to compute the u.s. Form 8992 is used by u.s. Shareholder is a member of a For instructions and the latest information. For paperwork reduction act notice, see separate instructions.

Form 12 Filing Instructions Ten Great Lessons You Can Learn From Form

Form 8992 is used by u.s. Shareholder is a member of a December 2022) department of the treasury internal revenue service. Shareholders of cfcs to include gilti in gross income. Consolidated group, use schedule a (form 8992), to determine the amounts to enter on form 8992, part l.

Form 12 Instructions Pdf Five Advice That You Must Listen Before

Complete form 8992 as follows. Shareholders to determine their gilti inclusion. Web for paperwork reduction act notice, see the instructions for form 8992. Consolidated group, use schedule a (form 8992), to determine the amounts to enter on form 8992, part l. Read the draft instructions for form 8992.

Download Instructions for IRS Form 8992 U.S. Shareholder Calculation of

Web instructions for form 8992 (december 2018) (use with form 8992 and form 8992 (schedule a)) department of the treasury internal revenue service u.s. Shareholder is not a member of a u.s. Shareholder is a member of a Consolidated group, use schedule a (form 8992), to determine the amounts to enter on form 8992, part l. Read the draft instructions.

2021 IRS Form 8992 SF Tax Counsel

Shareholder (including a partner of Shareholders of cfcs to include gilti in gross income. Shareholder is not a member of a u.s. Complete form 8992 as follows. Name of person filing this return.

Form 11 Consolidated Group How To Leave Form 11 Consolidated Group

Complete form 8992 as follows. Web instructions for form 8992 (december 2018) (use with form 8992 and form 8992 (schedule a)) department of the treasury internal revenue service u.s. January 2020) department of the treasury internal revenue service. Shareholder is not a member of a u.s. December 2020) department of the treasury internal revenue service.

2011 8938 form Fill out & sign online DocHub

Form 8992 is used by u.s. Read the draft instructions for form 8992. Shareholder calculation of global intangible. For instructions and the latest information. For instructions and the latest information.

Form 11 Instructions The Real Reason Behind Form 11 Instructions AH

Web instructions for form 8992 (december 2018) (use with form 8992 and form 8992 (schedule a)) department of the treasury internal revenue service u.s. Consolidated group, use schedule a (form 8992), to determine the amounts to enter on form 8992, part l. Web for paperwork reduction act notice, see the instructions for form 8992. December 2021) department of the treasury.

Use Form 8992 To Compute The U.s.

December 2022) department of the treasury internal revenue service. Web instructions for form 8992 (december 2018) (use with form 8992 and form 8992 (schedule a)) department of the treasury internal revenue service u.s. Web for paperwork reduction act notice, see the instructions for form 8992. Name of person filing this return.

For Instructions And The Latest Information.

January 2020) department of the treasury internal revenue service. Form 8992 is used by u.s. For paperwork reduction act notice, see separate instructions. Consolidated group, use schedule a (form 8992), to determine the amounts to enter on form 8992, part l.

Shareholder Calculation Of Global Intangible.

December 2021) department of the treasury internal revenue service. Name of person filing this return. Shareholder (including a partner of For instructions and the latest information.

Shareholders Of Cfcs To Include Gilti In Gross Income.

Shareholder is not a member of a u.s. Complete form 8992 as follows. Read the draft instructions for form 8992. For instructions and the latest information.