Form 8995 Vs Form 8995-A

Form 8995 Vs Form 8995-A - Web here are the steps to convert a decimal to a fraction, more specifically how to get.995 as a simplified fraction: 55a name(s) shown on return your taxpayer identification number part i trade, business, or aggregation information complete schedules a, b,. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). You have qbi, qualified reit dividends, or qualified ptp income or loss; Web according to the 2019 instructions for form 8995: That have qbi use form 8995 to figure the qbi deduction if…. Form 8995 is the simplified form and is used if all of the following are true: Web documentation last modified: The individual has qualified business.

Form 8995 is the simplified form and is used if all of the following are true: Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web according to the 2019 instructions for form 8995: Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). 55a name(s) shown on return your taxpayer identification number part i trade, business, or aggregation information complete schedules a, b,. That have qbi use form 8995 to figure the qbi deduction if…. The individual has qualified business. Web documentation last modified: Include the following schedules (their specific instructions are. Rewrite 0.995 as a fraction dividing it by 1.

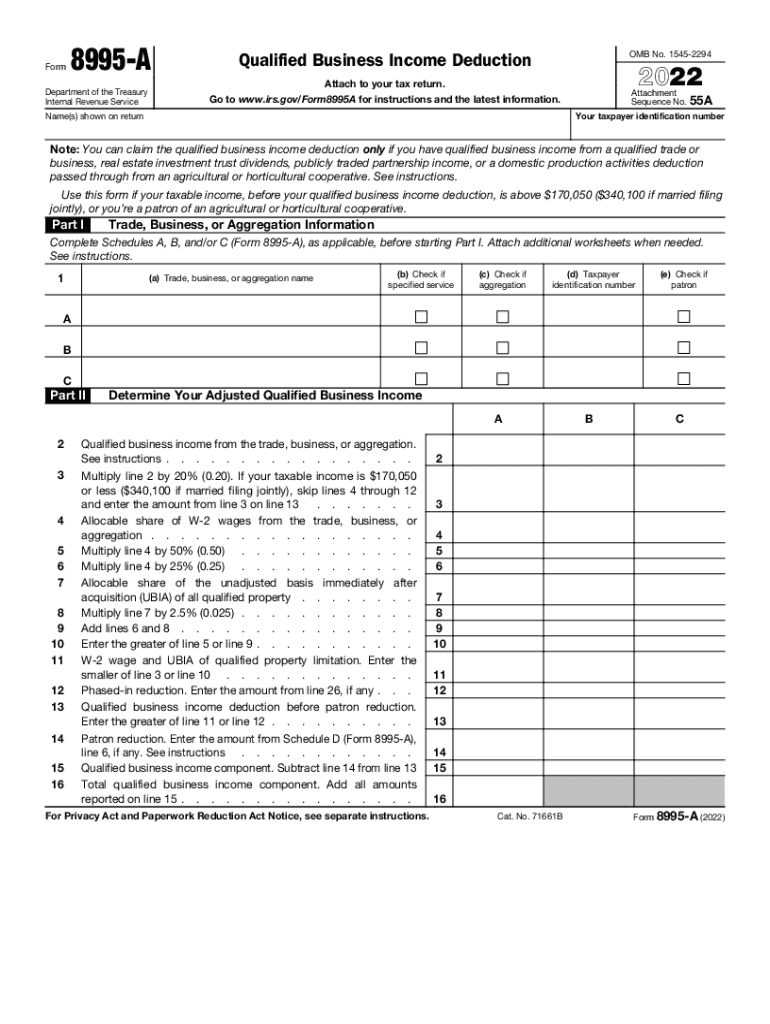

The individual has qualified business. That have qbi use form 8995 to figure the qbi deduction if…. And your 2019 taxable income. You have qbi, qualified reit dividends, or qualified ptp income or loss; Web 2019 attachment sequence no. 55a name(s) shown on return your taxpayer identification number part i trade, business, or aggregation information complete schedules a, b,. Form 8995 is the simplified form and is used if all of the following are true: [y]ou aren’t a patron in a specified. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web according to the 2019 instructions for form 8995:

QBI gets 'formified'

Web 2019 attachment sequence no. And your 2019 taxable income. Web here are the steps to convert a decimal to a fraction, more specifically how to get.995 as a simplified fraction: Rewrite 0.995 as a fraction dividing it by 1. Web according to the 2019 instructions for form 8995:

Staying on Top of Changes to the 20 QBI Deduction (199A) One Year

55a name(s) shown on return your taxpayer identification number part i trade, business, or aggregation information complete schedules a, b,. That have qbi use form 8995 to figure the qbi deduction if…. And your 2019 taxable income. Rewrite 0.995 as a fraction dividing it by 1. Web form 8995 is a newly created tax form used to calculate the qualified.

IRS Form 8995 Download Fillable PDF or Fill Online Qualified Business

Rewrite 0.995 as a fraction dividing it by 1. And your 2019 taxable income. Web documentation last modified: That have qbi use form 8995 to figure the qbi deduction if…. Web 2019 attachment sequence no.

IRS Form 8995A Your Guide to the QBI Deduction

Include the following schedules (their specific instructions are. The individual has qualified business. 55a name(s) shown on return your taxpayer identification number part i trade, business, or aggregation information complete schedules a, b,. Web here are the steps to convert a decimal to a fraction, more specifically how to get.995 as a simplified fraction: That have qbi use form 8995.

8995 Form Updates Patch Notes fo 8995 Form Product Blog

You have qbi, qualified reit dividends, or qualified ptp income or loss; Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web documentation last modified: Form 8995 is the simplified form and is used if all of the following are true: Web 2019 attachment sequence no.

What is Form 8995A? TurboTax Tax Tips & Videos

Web according to the 2019 instructions for form 8995: Rewrite 0.995 as a fraction dividing it by 1. Web here are the steps to convert a decimal to a fraction, more specifically how to get.995 as a simplified fraction: The individual has qualified business. Form 8995 and form 8995a.

8995 Form Updates Patch Notes fo 8995 Form Product Blog

Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web 2019 attachment sequence no. Web documentation last modified: Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). You have qbi, qualified reit dividends, or qualified ptp income or loss;

Form 8995 Basics & Beyond

That have qbi use form 8995 to figure the qbi deduction if…. [y]ou aren’t a patron in a specified. Form 8995 is the simplified form and is used if all of the following are true: Web according to the 2019 instructions for form 8995: You have qbi, qualified reit dividends, or qualified ptp income or loss;

Fill Free fillable Form 2020 8995A Qualified Business

Web 2019 attachment sequence no. Web documentation last modified: You have qbi, qualified reit dividends, or qualified ptp income or loss; And your 2019 taxable income. Rewrite 0.995 as a fraction dividing it by 1.

8995 A Qualified Business Deduction Form Fill Out and Sign Printable

Include the following schedules (their specific instructions are. 55a name(s) shown on return your taxpayer identification number part i trade, business, or aggregation information complete schedules a, b,. The individual has qualified business. Web 2019 attachment sequence no. Rewrite 0.995 as a fraction dividing it by 1.

Web Here Are The Steps To Convert A Decimal To A Fraction, More Specifically How To Get.995 As A Simplified Fraction:

Form 8995 and form 8995a. Form 8995 is the simplified form and is used if all of the following are true: Web documentation last modified: Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid).

[Y]Ou Aren’t A Patron In A Specified.

And your 2019 taxable income. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web 2019 attachment sequence no. Include the following schedules (their specific instructions are.

Web According To The 2019 Instructions For Form 8995:

That have qbi use form 8995 to figure the qbi deduction if…. You have qbi, qualified reit dividends, or qualified ptp income or loss; The individual has qualified business. Rewrite 0.995 as a fraction dividing it by 1.