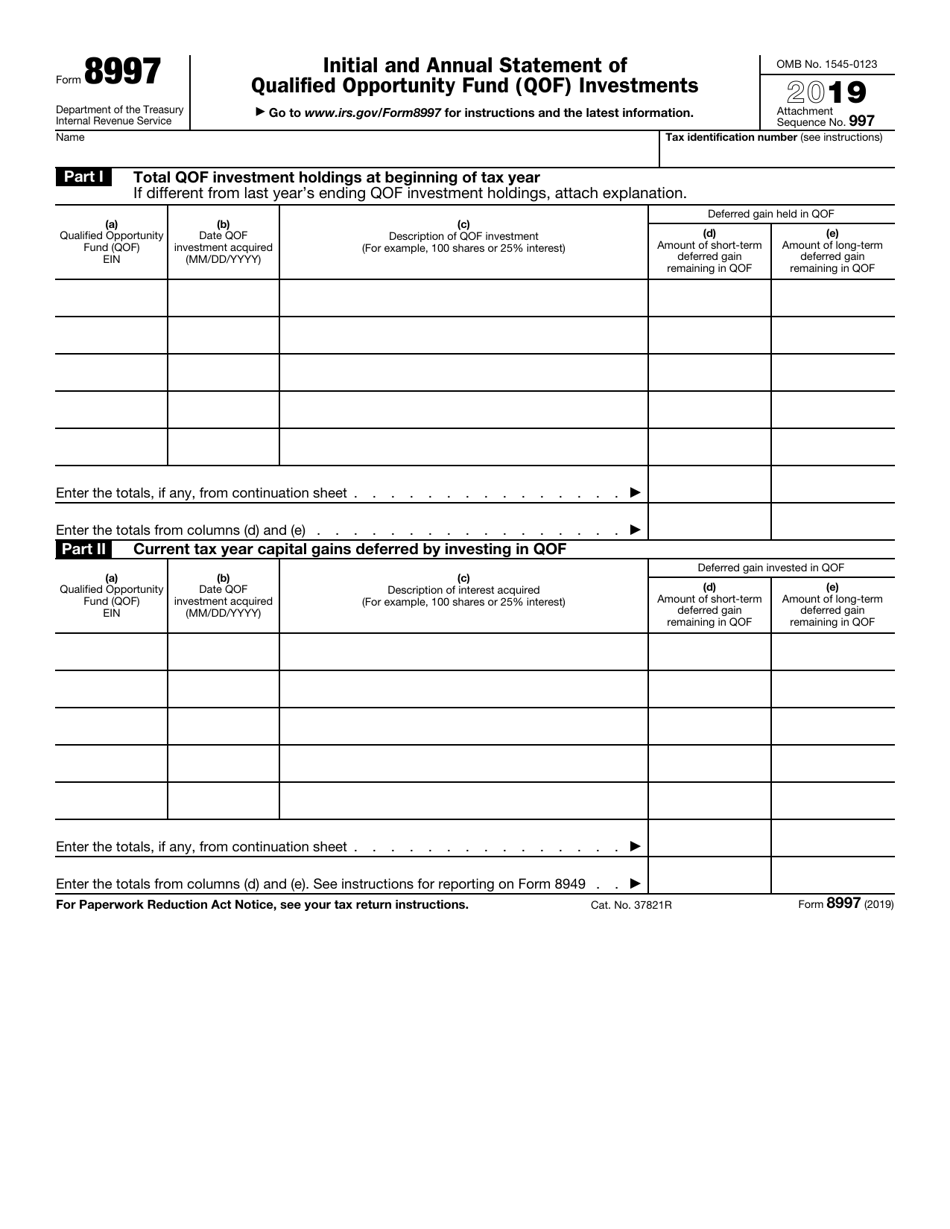

Form 8997 Instructions

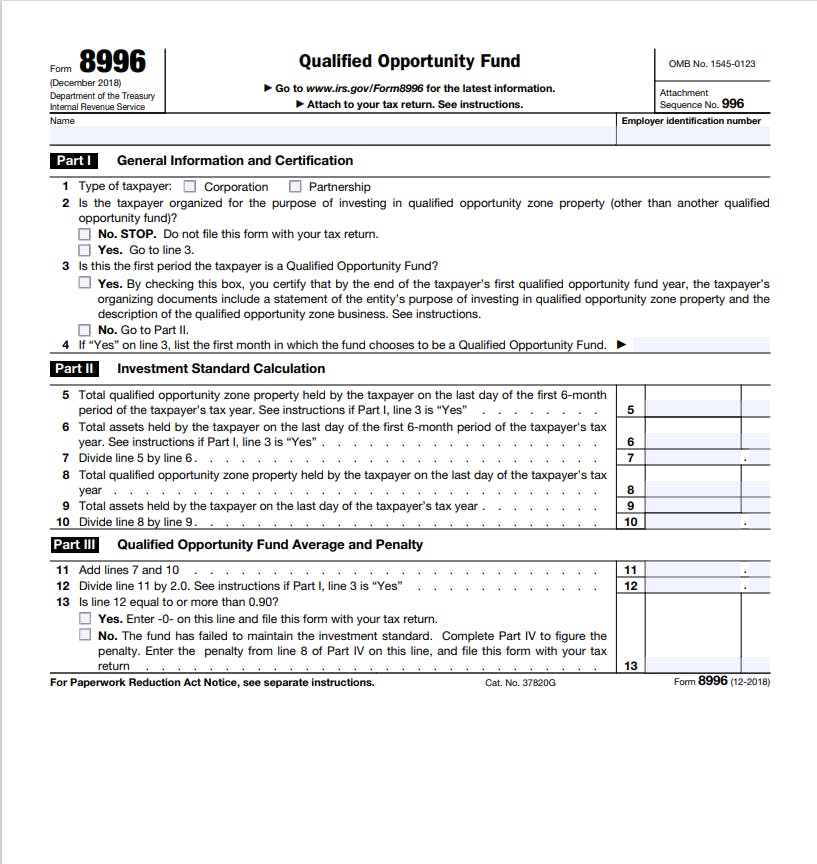

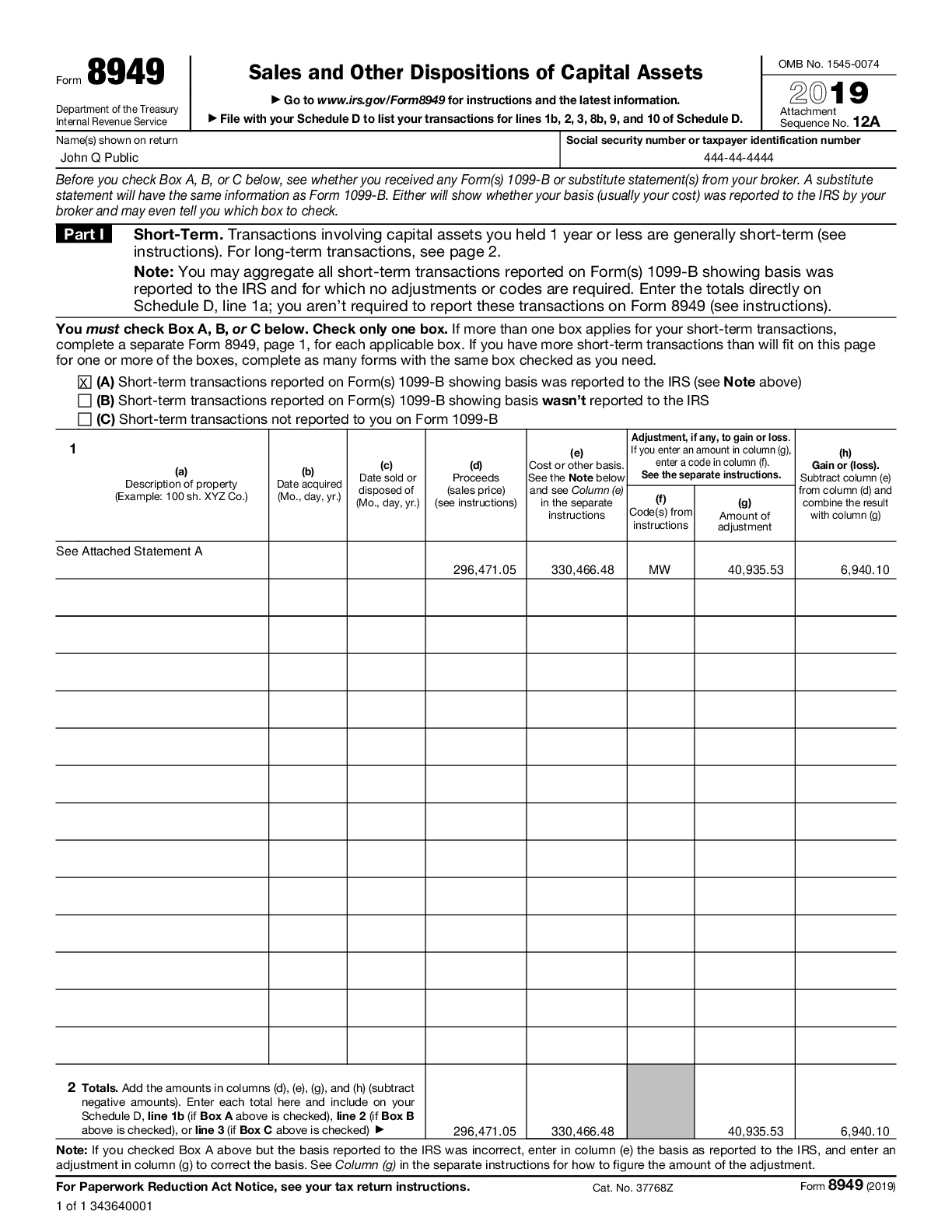

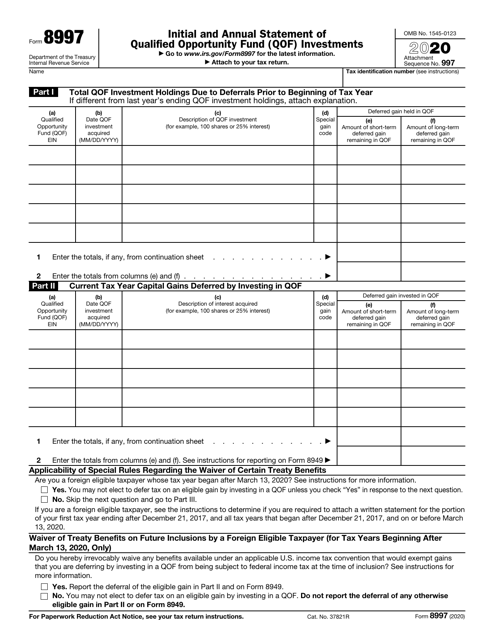

Form 8997 Instructions - Web up to 10% cash back each part of form 8997 requires five pieces of information: Fill in fund (s) acquisition date, ein (employer identification number), percentage acquired, and the amount being deferred (usually. A foreign estate is one the income of which is from sources outside the united states that. Applicability of special rules regarding the waiver of certain treaty benefits are you a. Web current revision form 8996 pdf instructions for form 8996 pdf ( hmtl) recent developments clarification of instructions for form 8996 informing qualified. Web taxpayers use form 8997 to inform the irs of the qof/qoz investments and deferred capital gains held at the beginning and end of the current tax year, any capital gains. Web if you are a foreign eligible taxpayer, see the instructions to determine if you are required to attach a written statement for the portion of your first tax year ending after december 21,. See instructions for reporting on form 8949. Web for an investor who has deferred capital gains into a qualified opportunity fund, this is how to complete irs forms 8949 and 8997 to ensure that you receive the. Web how to fill out irs form 8997 (for oz investors), with ashley tison.

Web how to fill out irs form 8997 (for oz investors), with ashley tison. Web use form 8997 to inform the irs of the qof investments and deferred gains held at the beginning and end of the current tax year, as well as any capital. You will need to enter it as two. Under the opportunity zones (oz) incentive, taxpayers can defer taxes by. Applicability of special rules regarding the waiver of certain treaty benefits are you a. Web current revision form 8996 pdf instructions for form 8996 pdf ( hmtl) recent developments clarification of instructions for form 8996 informing qualified. Web taxpayers use form 8997 to inform the irs of the qof/qoz investments and deferred capital gains held at the beginning and end of the current tax year, any capital gains. Web the workflow to enter an election to defer tax on eligible gain by investing in a qof in the program mirrors the form 8949 instructions. Web form 8997 department of the treasury internal revenue service initial and annual statement of qualified opportunity fund (qof) investments go to. Web the draft 2019 form 8997 requires taxpayers to report for each qof investment:

Fill in fund (s) acquisition date, ein (employer identification number), percentage acquired, and the amount being deferred (usually. Web these letters notify the taxpayers that they may not have properly followed the instructions for form 8997, initial and annual statement of qualified opportunity. Web form 8997, initial and annual statement of qualified opportunity fund investments is a new form. Web the draft 2019 form 8997 requires taxpayers to report for each qof investment: You will need to enter it as two. Web for an investor who has deferred capital gains into a qualified opportunity fund, this is how to complete irs forms 8949 and 8997 to ensure that you receive the. Under the opportunity zones (oz) incentive, taxpayers can defer taxes by. Web current revision form 8996 pdf instructions for form 8996 pdf ( hmtl) recent developments clarification of instructions for form 8996 informing qualified. An estate is a domestic estate if it isn't a foreign estate. Qof investments held at the beginning of the current tax year, including the amount of short.

Adrisse Vet Brokerage Account Growth 1099 Div Relevant Experience For

Applicability of special rules regarding the waiver of certain treaty benefits are you a. Web current revision form 8996 pdf instructions for form 8996 pdf ( hmtl) recent developments clarification of instructions for form 8996 informing qualified. Web see the form 8997 instructions. Web how to fill out irs form 8997 (for oz investors), with ashley tison. See instructions for.

IRS Form 8997 The Sherbert Group

Fill in fund (s) acquisition date, ein (employer identification number), percentage acquired, and the amount being deferred (usually. You will need to enter it as two. Web the draft 2019 form 8997 requires taxpayers to report for each qof investment: Web use form 8997 to inform the irs of the qof investments and deferred gains held at the beginning and.

Reimbursement Request form Template Lovely Travel Expense Reimbursement

Qof investments held at the beginning of the current tax year, including the amount of short. The qof’s employer identification number (ein) the date the taxpayer acquired. You will need to enter it as two. See instructions for reporting on form 8949. Web use form 8997 to inform the irs of the qof investments and deferred gains held at the.

1.5" x 0.5" White Matte Laser Label Sheets for Inkjet & Laser Printers

An estate is a domestic estate if it isn't a foreign estate. You will need to enter it as two. Web use form 8997 to inform the irs of the qof investments and deferred gains held at the beginning and end of the current tax year, as well as any capital. Web description of the fund. Under the opportunity zones.

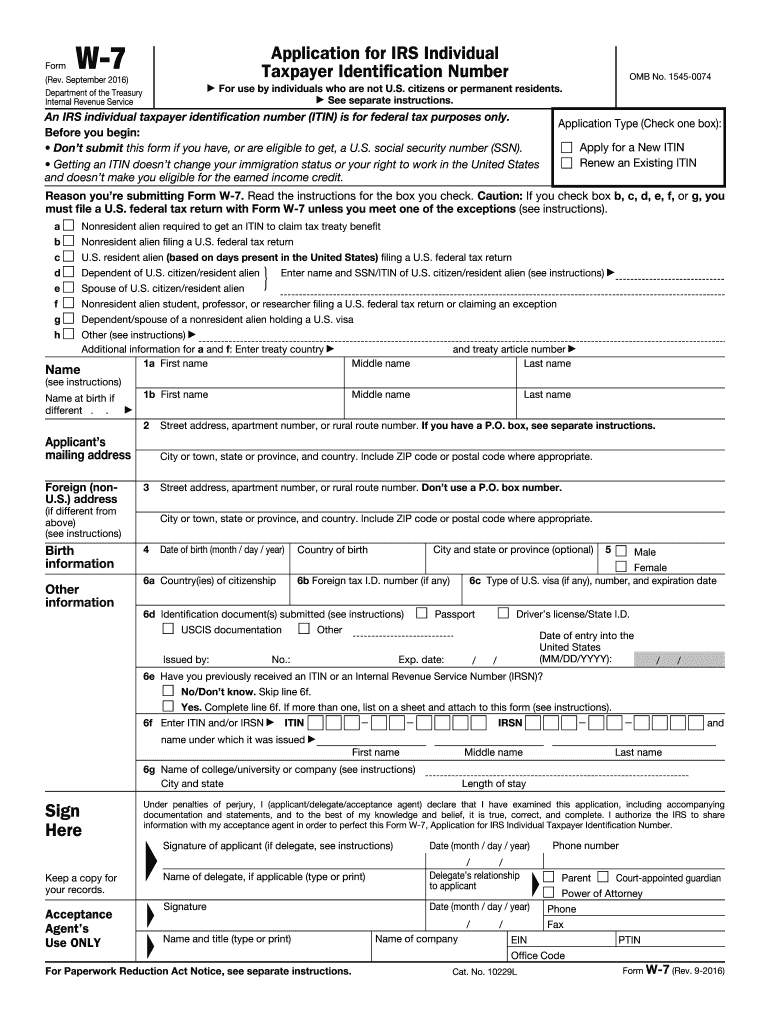

Apply For Tax ID Number TIN Number

Web if you are a foreign eligible taxpayer, see the instructions to determine if you are required to attach a written statement for the portion of your first tax year ending after december 21,. You will need to enter it as two. Web the draft 2019 form 8997 requires taxpayers to report for each qof investment: Under the opportunity zones.

To

Fill in fund (s) acquisition date, ein (employer identification number), percentage acquired, and the amount being deferred (usually. Web the draft 2019 form 8997 requires taxpayers to report for each qof investment: Web current revision form 8996 pdf instructions for form 8996 pdf ( hmtl) recent developments clarification of instructions for form 8996 informing qualified. Web the workflow to enter.

Explanation of IRS "Exception 2"

Fill in fund (s) acquisition date, ein (employer identification number), percentage acquired, and the amount being deferred (usually. Web form 8997, initial and annual statement of qualified opportunity fund investments is a new form. You will need to enter it as two. Web see the form 8997 instructions. Web description of the fund.

How To Fill Out IRS Form 8997 (For OZ Investors), With Ashley Tison

Web taxpayers use form 8997 to inform the irs of the qof/qoz investments and deferred capital gains held at the beginning and end of the current tax year, any capital gains. Web use form 8997 to inform the irs of the qof investments and deferred gains held at the beginning and end of the current tax year, as well as.

IRS Form 8997 Download Fillable PDF or Fill Online Initial and Annual

Web enter the totals from columns (e) and (f). Web these letters notify the taxpayers that they may not have properly followed the instructions for form 8997, initial and annual statement of qualified opportunity. The qof’s employer identification number (ein) the date the taxpayer acquired. You will need to enter it as two. Web the workflow to enter an election.

IRS Form 8997 Download Fillable PDF or Fill Online Initial and Annual

An estate is a domestic estate if it isn't a foreign estate. You can file your tax return without that, however. Applicability of special rules regarding the waiver of certain treaty benefits are you a. Qof investments held at the beginning of the current tax year, including the amount of short. Web for an investor who has deferred capital gains.

The Qof’s Employer Identification Number (Ein) The Date The Taxpayer Acquired.

Web the draft 2019 form 8997 requires taxpayers to report for each qof investment: Web the workflow to enter an election to defer tax on eligible gain by investing in a qof in the program mirrors the form 8949 instructions. Web enter the totals from columns (e) and (f). Web see the form 8997 instructions.

Web The Purpose Of The Form 8997 Is To Provide A Centralized Form For An Investor In Qualified Opportunity Funds To Report Their Investments In And The Capital Gains.

Web for an investor who has deferred capital gains into a qualified opportunity fund, this is how to complete irs forms 8949 and 8997 to ensure that you receive the. Under the opportunity zones (oz) incentive, taxpayers can defer taxes by. Web if you are a foreign eligible taxpayer, see the instructions to determine if you are required to attach a written statement for the portion of your first tax year ending after december 21,. You will need to enter it as two.

Web Use Form 8997 To Inform The Irs Of The Qof Investments And Deferred Gains Held At The Beginning And End Of The Current Tax Year, As Well As Any Capital.

Web these letters notify the taxpayers that they may not have properly followed the instructions for form 8997, initial and annual statement of qualified opportunity. A foreign estate is one the income of which is from sources outside the united states that. Web how to fill out irs form 8997 (for oz investors), with ashley tison. Qof investments held at the beginning of the current tax year, including the amount of short.

Applicability Of Special Rules Regarding The Waiver Of Certain Treaty Benefits Are You A.

Web form 8997, initial and annual statement of qualified opportunity fund investments is a new form. Web form 8997 department of the treasury internal revenue service initial and annual statement of qualified opportunity fund (qof) investments go to. Web up to 10% cash back each part of form 8997 requires five pieces of information: Web description of the fund.