Form 926 Filing Requirement

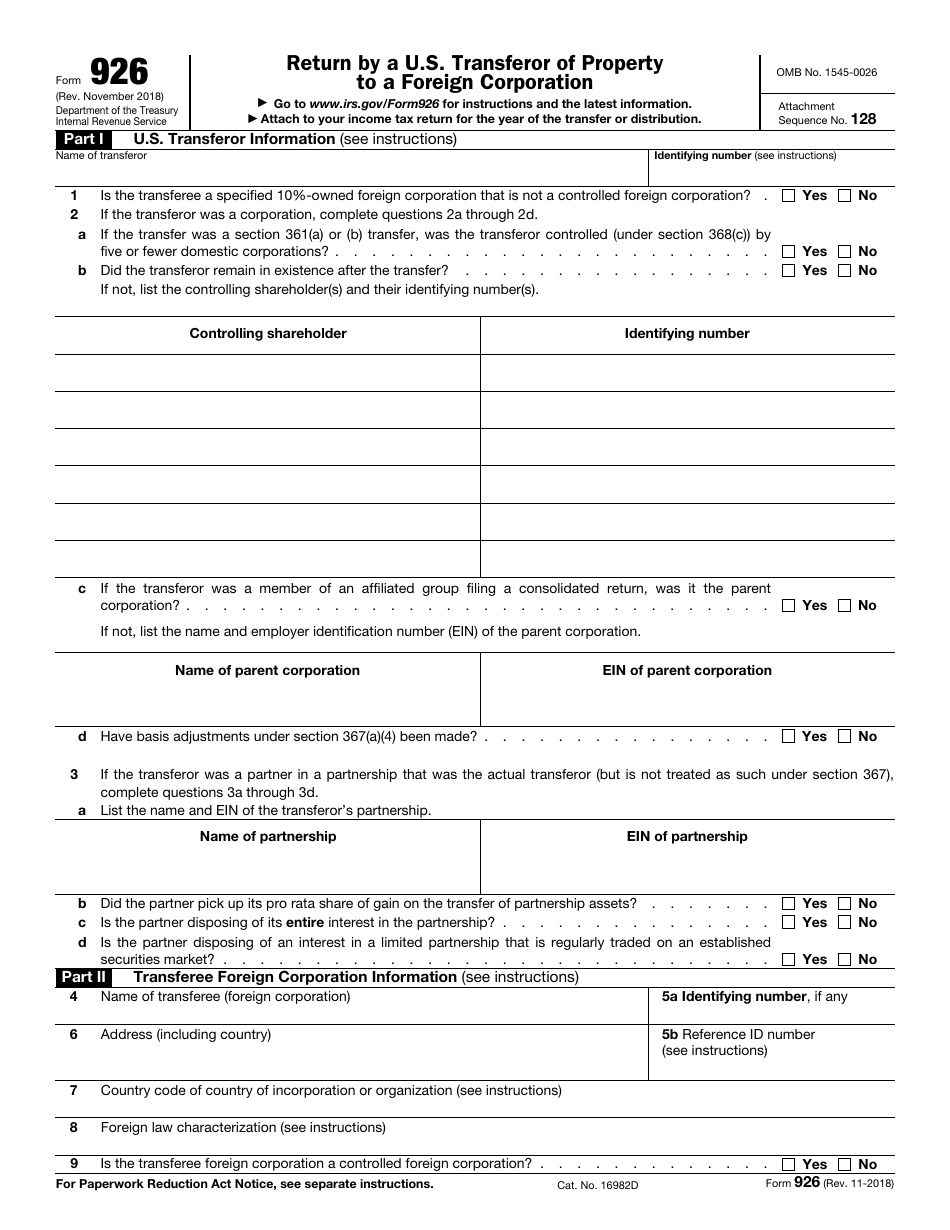

Form 926 Filing Requirement - Citizen or resident, a domestic corporation, or a domestic estate or trust must complete and file form 926 to report certain transfers of property. Web new form 926 filing requirements the irs and the treasury department have expanded the reporting requirements associated with form 926, return by a u.s. Web to fulfill this reporting obligation, the u.s. Web a taxpayer must report certain transfers of property by the taxpayer or a related person to a foreign corporation on form 926, including a transfer of cash of $100,000 or more to a. Transferors of property to a foreign corporation. Web october 25, 2022 resource center forms form 926 for u.s. This article will focus briefly on the. November 2018) department of the treasury internal revenue service. Expats at a glance learn more about irs form 926 and if you’re required to file for exchanging. The covered transfers are described in irc section.

Transferor of property to a foreign corporation. Expats at a glance learn more about irs form 926 and if you’re required to file for exchanging. Web this form applies to both domestic corporations as well as u.s. Web the irs requires certain u.s. Citizen or resident, a domestic corporation, or a domestic estate or trust must complete. Person who transfers property to a foreign. Web new form 926 filing requirements the irs and the treasury department have expanded the reporting requirements associated with form 926, return by a u.s. Web (ii) filing a form 926 (modified to reflect that the transferee is a partnership, not a corporation) with the taxpayer's income tax return (including a partnership return of. Form 926 must be filed by a u.s. Web taxpayers making these transfers must file form 926 and include the form with their individual income tax return in the year of the transfer.

Web the irs requires certain u.s. Transferor of property to a foreign corporation was filed by the partnership and sent to you for information. Special rule for a partnership interest owned on. Citizens and residents to file the form 926: Web october 25, 2022 resource center forms form 926 for u.s. Taxpayer must complete form 926, return by a u.s. You do not need to report. Form 926 must be filed by a u.s. Web new form 926 filing requirements the irs and the treasury department have expanded the reporting requirements associated with form 926, return by a u.s. The covered transfers are described in irc section.

Determination Of Tax Filing Requirement Form Division Of Taxation

Transferor of property to a foreign corporation. You do not need to report. Expats at a glance learn more about irs form 926 and if you’re required to file for exchanging. Transferor of property to a foreign corporation was filed by the partnership and sent to you for information. Web this form applies to both domestic corporations as well as.

Form 926 Filing Requirements New Jersey Accountant Tax Reduction

Form 926 must be filed by a u.s. Web new form 926 filing requirements the irs and the treasury department have expanded the reporting requirements associated with form 926, return by a u.s. Taxable income or (loss) before net operating loss deduction. Citizens, resident individuals, and trusts. Web a domestic distributing corporation making a distribution of the stock or securities.

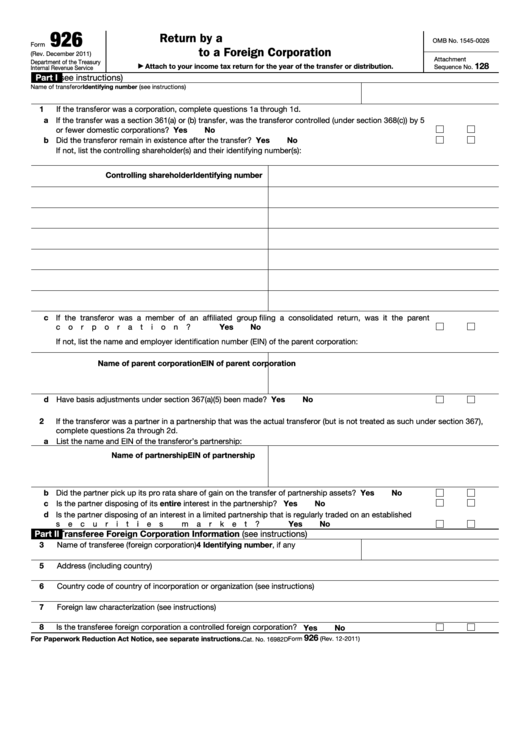

Fillable Form 926 (Rev. December 2011) Return By A U.s. Transferor Of

Web to fulfill this reporting obligation, the u.s. Special rule for a partnership interest owned on. Web (ii) filing a form 926 (modified to reflect that the transferee is a partnership, not a corporation) with the taxpayer's income tax return (including a partnership return of. This article will focus briefly on the. Transferor of property to a foreign corporation.

Form 926Return by a U.S. Transferor of Property to a Foreign Corpora…

Transferor of property to a foreign corporation. Enter the corporation's taxable income or (loss) before the nol deduction,. Web (ii) filing a form 926 (modified to reflect that the transferee is a partnership, not a corporation) with the taxpayer's income tax return (including a partnership return of. Citizen or resident, a domestic corporation, or a domestic estate or trust must.

AVOIDING TAX OFFSHORE WITH FORM 926 YouTube

Enter the corporation's taxable income or (loss) before the nol deduction,. Web to fulfill this reporting obligation, the u.s. Expats at a glance learn more about irs form 926 and if you’re required to file for exchanging. Form 926 must be filed by a u.s. The covered transfers are described in irc section.

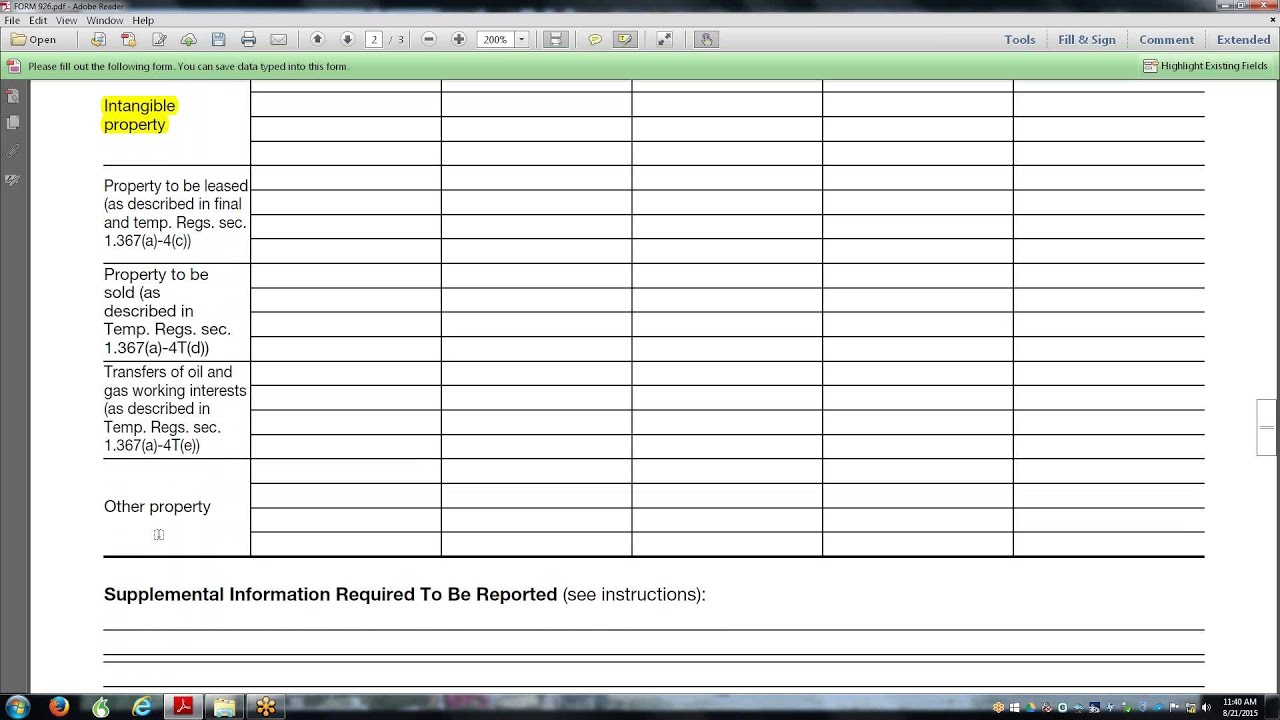

Form 926 Return by a U.S. Transferor of Property to a Foreign

Transferors of property to a foreign corporation. Person who transfers property to a foreign. Web new form 926 filing requirements the irs and the treasury department have expanded the reporting requirements associated with form 926, return by a u.s. You do not need to report. Taxpayer must complete form 926, return by a u.s.

IRS Form 926 Download Fillable PDF or Fill Online Return by a U.S

Transferors of property to a foreign corporation. Citizens and residents to file the form 926: Web a domestic distributing corporation making a distribution of the stock or securities of a domestic corporation under section 355 is not required to file a form 926, as described. Enter the corporation's taxable income or (loss) before the nol deduction,. Web to fulfill this.

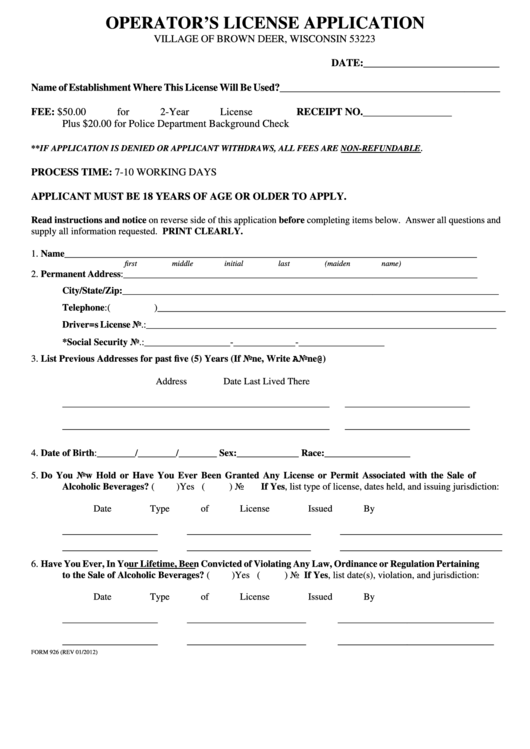

Form 926 Operator'S License Application Village Of Brown Deer

Transferor of property to a foreign corporation. This article will focus briefly on the. Web to fulfill this reporting obligation, the u.s. Web new form 926 filing requirements the irs and the treasury department have expanded the reporting requirements associated with form 926, return by a u.s. Citizens and residents to file the form 926:

Sample Form 2

Transferor of property to a foreign corporation. You do not need to report. Web to fulfill this reporting obligation, the u.s. Web (ii) filing a form 926 (modified to reflect that the transferee is a partnership, not a corporation) with the taxpayer's income tax return (including a partnership return of. The covered transfers are described in irc section.

Form 926Return by a U.S. Transferor of Property to a Foreign Corpora…

Web october 25, 2022 resource center forms form 926 for u.s. The covered transfers are described in irc section. Citizens, resident individuals, and trusts. Web a domestic distributing corporation making a distribution of the stock or securities of a domestic corporation under section 355 is not required to file a form 926, as described. Citizens and residents to file the.

This Article Will Focus Briefly On The.

Transferors of property to a foreign corporation. Citizens, resident individuals, and trusts. Expats at a glance learn more about irs form 926 and if you’re required to file for exchanging. Citizen or resident, a domestic corporation, or a domestic estate or trust must complete.

Web The Irs Requires Certain U.s.

The covered transfers are described in irc section. You do not need to report. Web october 25, 2022 resource center forms form 926 for u.s. Form 926 must be filed by a u.s.

Web New Form 926 Filing Requirements The Irs And The Treasury Department Have Expanded The Reporting Requirements Associated With Form 926, Return By A U.s.

Transferor of property to a foreign corporation was filed by the partnership and sent to you for information. Web taxpayers making these transfers must file form 926 and include the form with their individual income tax return in the year of the transfer. Transferor of property to a foreign corporation. Taxpayer must complete form 926, return by a u.s.

Web A Domestic Distributing Corporation Making A Distribution Of The Stock Or Securities Of A Domestic Corporation Under Section 355 Is Not Required To File A Form 926, As Described.

Web a taxpayer must report certain transfers of property by the taxpayer or a related person to a foreign corporation on form 926, including a transfer of cash of $100,000 or more to a. Transferor of property to a foreign corporation. Citizens and residents to file the form 926: Web a corporation (other than an s corporation) must complete and file form 8926 if it paid or accrued disqualified interest during the current tax year or had a.