Form 941 2016

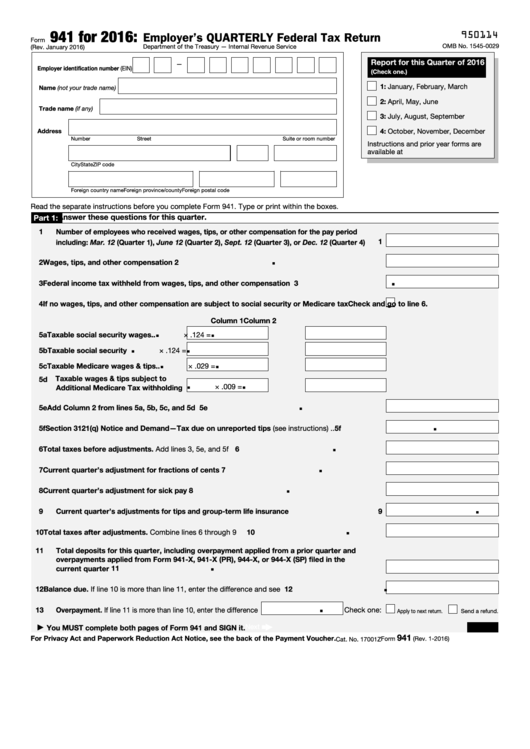

Form 941 2016 - Employee's withholding certificate form 941; Web file schedule b (form 941) if you are a semiweekly schedule depositor. Web form 941, employer's quarterly federal tax return, is used by businesses who file their taxes on a quarterly basis. Create a blank & editable 941 form, fill it. Employer’s quarterly federal tax return form 950114941 for 2016: October, november, december go to www.irs.gov/form941 for instructions and the latest. Reported more than $50,000 of employment taxes in the. Add and customize text, pictures, and fillable areas, whiteout unnecessary details, highlight the significant ones,. Generally, any person or business that pays wages to. Web the form 941 reports quarterly the various federal tax returns required of an employer’s employees.

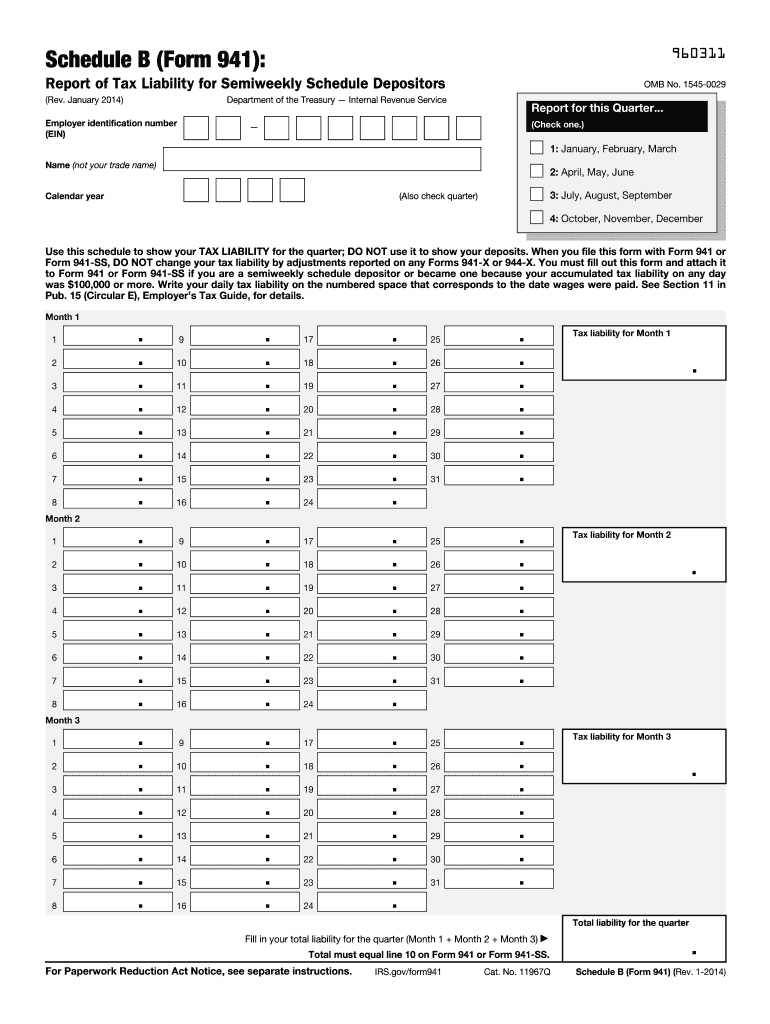

Web the form 941 reports quarterly the various federal tax returns required of an employer’s employees. January 2016)department of the treasury — internal revenue. Web file schedule b (form 941) if you are a semiweekly schedule depositor. Who must file form 941. Web form 941, employer's quarterly federal tax return, was updated with multiple new and revised lines in order to incorporate provisions of the american rescue plan act. Add and customize text, pictures, and fillable areas, whiteout unnecessary details, highlight the significant ones,. Web utilize the upper and left panel tools to edit 2016 941 form. Get ready for this year's tax season quickly and safely with pdffiller! Get form for the latest information about developments related to form 941 and its. Web up to $40 cash back fill 941 form 2020 pdf, edit online.

For tax years beginning before january 1, 2023, a qualified small business may elect to. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Web qualified small business payroll tax credit for increasing research activities. Web form 950114 941 for 2016: Web up to $40 cash back easily complete a printable irs 941 form 2016 online. Instructions for form 941, employer's quarterly federal tax return 2017 inst 941 (schedule b) instructions for schedule b (form 941), report of tax liability for. Web form 941, employer's quarterly federal tax return, was updated with multiple new and revised lines in order to incorporate provisions of the american rescue plan act. It reports information related to certain withholdings: October, november, december go to www.irs.gov/form941 for instructions and the latest. Employee's withholding certificate form 941;

Irs Form 941 Instructions 2016

Add and customize text, pictures, and fillable areas, whiteout unnecessary details, highlight the significant ones,. Web form 941, employer's quarterly federal tax return, is used by businesses who file their taxes on a quarterly basis. Instructions for form 941, employer's quarterly federal tax return 2017 inst 941 (schedule b) instructions for schedule b (form 941), report of tax liability for..

How to Complete Form 941 in 5 Simple Steps

Web use a 2016 form 941 2020 template to make your document workflow more streamlined. Employer’s quarterly federal tax return form 950114941 for 2016: For tax years beginning before january 1, 2023, a qualified small business may elect to. Web form 950114 941 for 2016: Add and customize text, pictures, and fillable areas, whiteout unnecessary details, highlight the significant ones,.

What Is Form 941 and How Do I File It? Ask Gusto

Get form for the latest information about developments related to form 941 and its. Web qualified small business payroll tax credit for increasing research activities. Employers engaged in a trade or business who. Reported more than $50,000 of employment taxes in the. Employee's withholding certificate form 941;

2016 Form IRS 941 Fill Online, Printable, Fillable, Blank PDFfiller

Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Web the form 941 reports quarterly the various federal tax returns required of an employer’s employees. Web use a 2016 form 941 2020 template to make your document workflow more streamlined. January 2016)american samoa, guam, the commonwealth of the northern department of the. Employer’s quarterly federal tax.

Fillable Form 941 Employer's Quarterly Federal Tax Return 2016

Employee's withholding certificate form 941; Who must file form 941. For tax years beginning before january 1, 2023, a qualified small business may elect to. October, november, december go to www.irs.gov/form941 for instructions and the latest. A separate form 941 is necessary to be filed for each quarter.

IRS Form 941 2016 Irs forms, How to make box, How to apply

It reports information related to certain withholdings: Web form 950114 941 for 2016: Reported more than $50,000 of employment taxes in the. Create a blank & editable 941 form, fill it. A separate form 941 is necessary to be filed for each quarter.

IRS Form 941 2016 Irs forms, Employer identification number, Irs

Get form for the latest information about developments related to form 941 and its. October, november, december go to www.irs.gov/form941 for instructions and the latest. Get ready for this year's tax season quickly and safely with pdffiller! It reports information related to certain withholdings: Create a blank & editable 941 form, fill it.

Irs.gov Form 941 For 2016 Universal Network

Web form 950114 941 for 2016: Employers engaged in a trade or business who. Web the form 941 reports quarterly the various federal tax returns required of an employer’s employees. Web use a 2016 form 941 2020 template to make your document workflow more streamlined. Employer’s quarterly federal tax return form 950114941 for 2016:

2016 Form Il941, Illinois Withholding Tax Return Edit, Fill

Web up to $40 cash back fill 941 form 2020 pdf, edit online. Create a blank & editable 941 form, fill it. January 2016)american samoa, guam, the commonwealth of the northern department of the. Web up to $40 cash back easily complete a printable irs 941 form 2016 online. Web form 941, employer's quarterly federal tax return, is used by.

Tax Form 941 Line 1 Number of Employees Video YouTube

It reports information related to certain withholdings: Web form 941, employer's quarterly federal tax return, was updated with multiple new and revised lines in order to incorporate provisions of the american rescue plan act. Get form for the latest information about developments related to form 941 and its. Who must file form 941. Web utilize the upper and left panel.

Web The Form 941 Reports Quarterly The Various Federal Tax Returns Required Of An Employer’s Employees.

Get ready for this year's tax season quickly and safely with pdffiller! Web up to $40 cash back fill 941 form 2020 pdf, edit online. Web qualified small business payroll tax credit for increasing research activities. Web form 941, employer's quarterly federal tax return, is used by businesses who file their taxes on a quarterly basis.

You Are A Semiweekly Depositor If You:

Web form 950114 941 for 2016: Employee's withholding certificate form 941; Who must file form 941. It reports information related to certain withholdings:

Web Form 941, Employer's Quarterly Federal Tax Return, Was Updated With Multiple New And Revised Lines In Order To Incorporate Provisions Of The American Rescue Plan Act.

Web utilize the upper and left panel tools to edit 2016 941 form. Reported more than $50,000 of employment taxes in the. For tax years beginning before january 1, 2023, a qualified small business may elect to. Web each form 941 you file reports the total amount of tax you withheld during the quarter.

January 2016)Department Of The Treasury — Internal Revenue.

October, november, december go to www.irs.gov/form941 for instructions and the latest. Add and customize text, pictures, and fillable areas, whiteout unnecessary details, highlight the significant ones,. Web up to $40 cash back easily complete a printable irs 941 form 2016 online. A separate form 941 is necessary to be filed for each quarter.