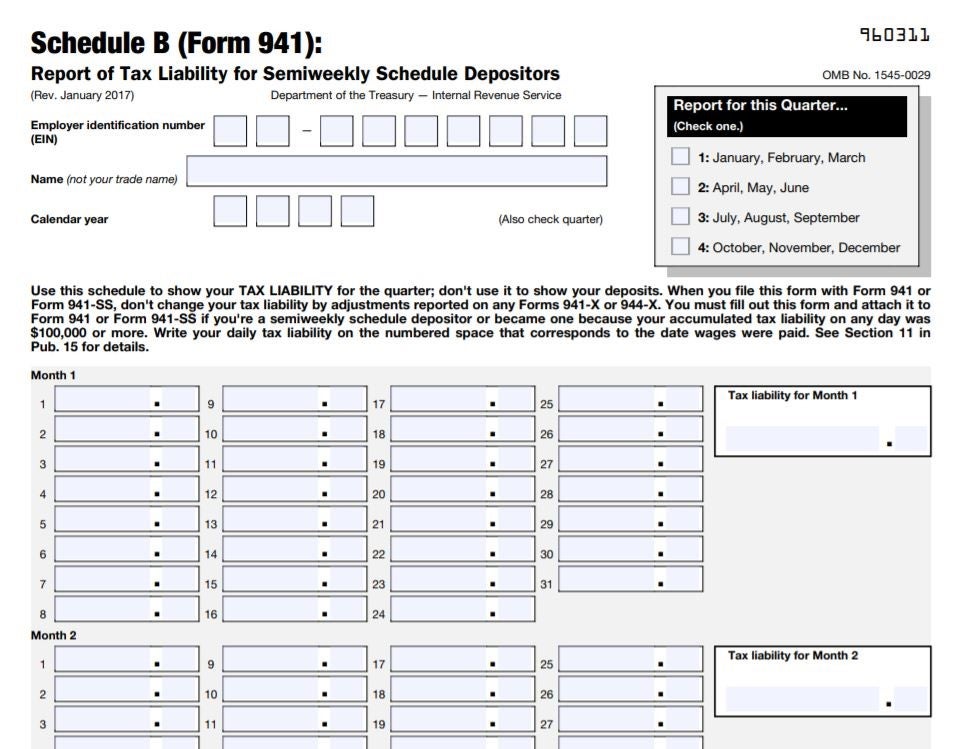

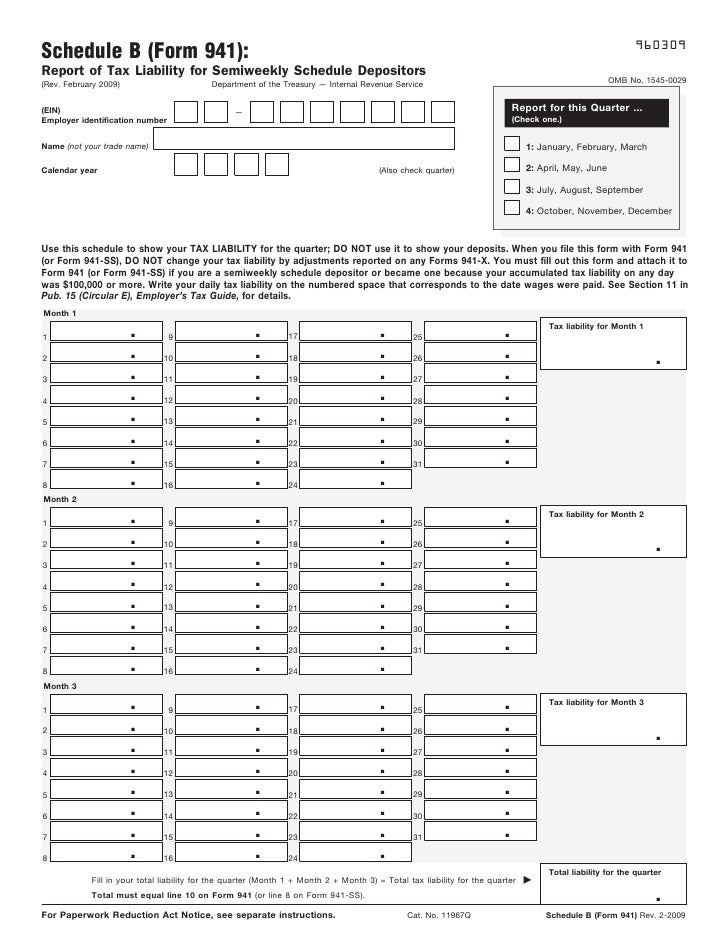

Form 941 For 2022 Schedule B

Form 941 For 2022 Schedule B - The 941 form reports the total amount of tax withheld during each quarter. In response to stakeholder input, the draft instructions provide a new filing exception as described on page 3 of the 2022. See deposit penalties in section 11 of pub. Review and transmit to the irs. The instructions were updated with requirements for claiming the remaining credits in 2022. January 2017) 2020 941 (schedule b) form 941 (schedule b) (rev. Fillable forms are variations of frequently made use of and/or modified papers that are readily available in digital style for very easy editing and enhancing. The importance of reconciliation and completed of not only the form 941 but schedule b is becoming increasingly important for employers to avoid costly disputes with the irs resulting in penalty and interest. Web fillable forms such as 2022 941 form schedule b fillable can be utilized in a variety of methods, from gathering call info to collecting responses on services and products. Don’t file schedule b as an attachment to form 944, employer's annual federal tax return.

Therefore, the due date of schedule b is the same as the due date for the applicable form 941. Web fillable forms such as 2022 941 form schedule b fillable can be utilized in a variety of methods, from gathering call info to collecting responses on services and products. Rock hill, sc / accesswire / july 28, 2023 / the next business day, monday, july 31, 2023, is the deadline for employers to file form 941 with the irs. Reported more than $50,000 of employment taxes in the lookback period. Review and transmit to the irs. Don’t file schedule b as an attachment to form 944, employer's annual federal tax return. Web the lookback period directly impacts the deposit schedule for form 941. Federal law requires an employer to withhold taxes. Therefore, the due date of schedule b is the same as the due date for the applicable form 941. Web schedule b is filed with form 941.

Fillable forms are variations of frequently made use of and/or modified papers that are readily available in digital style for very easy editing and enhancing. Review and transmit to the irs. Web form 941 schedule b 2022 focuses on documenting personal income tax, social security tax, and medicare tax withdrawn from an employee’s wages. Web the lookback period directly impacts the deposit schedule for form 941. Don’t file schedule b as an attachment to form 944, employer's annual federal tax return. Web form 941 for 2023: Web schedule b is filed with form 941. Web schedule b with form 941, the irs may propose an “averaged” ftd penalty. Don’t file schedule b as an attachment to form 944, employer's annual federal tax return. Web city state zip code foreign country name foreign province/county foreign postal code 950122 omb no.

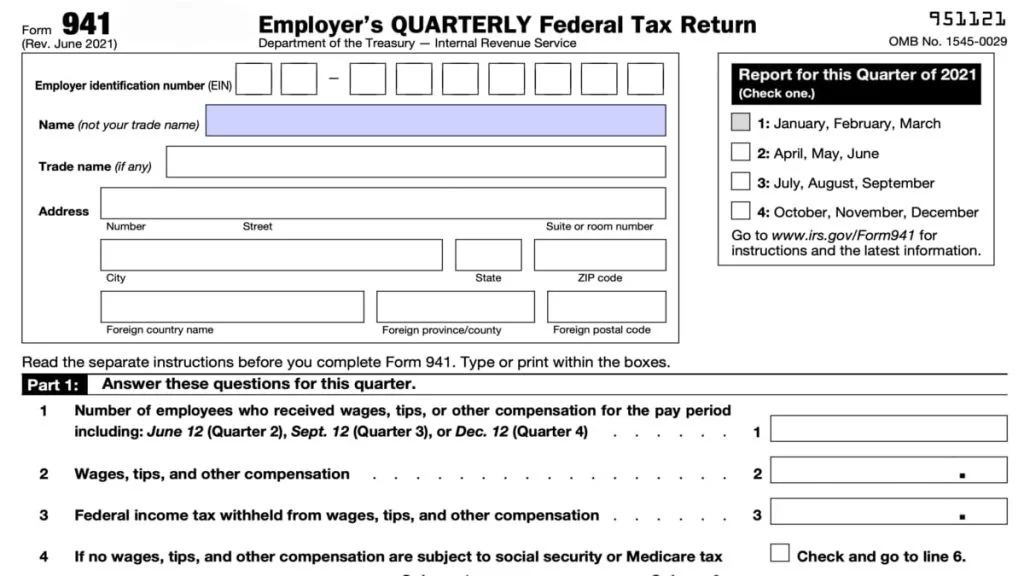

How to Fill Out 2020 Form 941 Employer’s Quarterly Federal Tax Return

You must complete all three pages of form 941 and sign it. Web 2022 941 (schedule b) form 941 (schedule b) (rev. File schedule b if you’re a semiweekly schedule depositor. January 2017) 2019 941 (schedule b). You have an accumulated tax liability of $100,000 or more on any given day in the current or prior.

2019 Form IRS 941 Fill Online, Printable, Fillable, Blank pdfFiller

Make sure payroll has the updated info for filing employment tax returns for the first quarter of 2022. Don’t file schedule b as an attachment to form 944, employer's annual federal tax return. The instructions were updated with requirements for claiming the remaining credits in 2022. The 941 form reports the total amount of tax withheld during each quarter. The.

941 Schedule B 2022

Fillable forms are variations of frequently made use of and/or modified papers that are readily available in digital style for very easy editing and enhancing. Web 2022 941 (schedule b) form 941 (schedule b) (rev. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name).

What is Form 941 Schedule B, Who Should Complete It? Blog TaxBandits

Web city state zip code foreign country name foreign province/county foreign postal code 950122 omb no. You are a semiweekly depositor if you: As well as quarters 1 and 2 in 2022: File schedule b if you’re a semiweekly schedule depositor. Therefore, the due date of schedule b is the same as the due date for the applicable form 941.

Form 941 (Schedule B) Report of Tax Liability for Semiweekly Schedul…

You must complete all three pages of form 941 and sign it. Reported more than $50,000 of employment taxes in the lookback period. Federal law requires an employer to withhold taxes. The instructions were updated with requirements for claiming the remaining credits in 2022. Web fillable forms such as 2022 941 form schedule b fillable can be utilized in a.

2014 Form IRS 941 Schedule B Fill Online, Printable, Fillable, Blank

The importance of reconciliation and completed of not only the form 941 but schedule b is becoming increasingly important for employers to avoid costly disputes with the irs resulting in penalty and interest. The credits for qualified paid sick and paid family leave wages may only be claimed for wages paid for. January 2017) 2021 941 (schedule b) form 941.

941 Form 2023

Web form 941 schedule b 2022 focuses on documenting personal income tax, social security tax, and medicare tax withdrawn from an employee’s wages. You must complete all three pages of form 941 and sign it. The 941 form reports the total amount of tax withheld during each quarter. January 2017) 2020 941 (schedule b) form 941 (schedule b) (rev. File.

File 941 Online Efile 941 for 4.95 IRS Form 941 for 2022

Web choose form 941 and enter the details. October, november, december go to www.irs.gov/form941 for instructions and the latest information. Employers are classified into one of two deposit schedules: Make sure payroll has the updated info for filing employment tax returns for the first quarter of 2022. Web fillable forms such as 2022 941 form schedule b fillable can be.

941 Schedule B 2022

You have an accumulated tax liability of $100,000 or more on any given day in the current or prior. Review and transmit to the irs. Web file schedule b (form 941) if you are a semiweekly schedule depositor. You are a semiweekly depositor if you: Web schedule b is filed with form 941.

anexo b formulario 941 pr 2022 Fill Online, Printable, Fillable Blank

Accumulated a tax liability of $100,000 or more on any given day in the current or prior calendar year. 15 or section 8 of pub. The 941 form reports the total amount of tax withheld during each quarter. January 2017) 2020 941 (schedule b) form 941 (schedule b) (rev. March 2023) employer’s quarterly federal tax return department of the treasury.

Taxbandits Also Offers Great Features Like Zero Tax Filing And 941 Schedule B.

The 941 form reports the total amount of tax withheld during each quarter. January 2017) 2021 941 (schedule b) form 941 (schedule b) (rev. You have an accumulated tax liability of $100,000 or more on any given day in the current or prior. Employers are classified into one of two deposit schedules:

Web Form 941 Schedule B 2022 Focuses On Documenting Personal Income Tax, Social Security Tax, And Medicare Tax Withdrawn From An Employee’s Wages.

As well as quarters 1 and 2 in 2022: Web 2022 941 (schedule b) form 941 (schedule b) (rev. See deposit penalties in section 11 of pub. January 2017) 2019 941 (schedule b).

The Employer Is Required To Withhold Federal Income Tax And Payroll Taxes From The Employee’s Paychecks.

The credits for qualified paid sick and paid family leave wages may only be claimed for wages paid for. You are a semiweekly depositor if you: Make sure payroll has the updated info for filing employment tax returns for the first quarter of 2022. You’re a semiweekly schedule depositor if you reported more than $50,000 of employment taxes in the

Web Choose Form 941 And Enter The Details.

You must complete all three pages of form 941 and sign it. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county Web in recent years several changes to the 941 form has made is difficult to understand. Web city state zip code foreign country name foreign province/county foreign postal code 950122 omb no.