Form 941 Rev March 2022

Form 941 Rev March 2022 - Web internal revenue service (form 941) (rev. Fill in the blank fields; Web form 941 for 2023: Web form 941 for the first quarter of 2022. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web form 941 for 2022: Don't use an earlier revision to report taxes for 2023. March 2022), employer’s quarterly federal tax return. Engaged parties names, places of residence and numbers etc. Please feel free to save or share this link to refer back to this offering.

April 2022) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. March 2022), employer’s quarterly federal tax return. Web future developments for the latest information about developments related to form 941 and its instructions, such as legislation enacted after they were published, go to. Columns m, s, t, and v are “reserved for future use” because the corresponding lines on form 941 are “reserved for future use.” see the. This webinar covers the irs form 941 and its accompanying form schedule b for the first quarter of 2022. Web form 941, employer's quarterly federal tax return; Upload, modify or create forms. Web a draft version of the 2022 form 941, employer’s quarterly federal tax return, was released jan. Form 941 is used by employers. It discusses what is new for the 2022 initial version as well as.

Engaged parties names, places of residence and numbers etc. Web form 941 for 2023: This webinar covers the irs form 941 and its accompanying form schedule b for the first quarter of 2022. Web form 941 for the first quarter of 2022. Web future developments for the latest information about developments related to form 941 and its instructions, such as legislation enacted after they were published, go to. Web a draft version of the 2022 form 941, employer’s quarterly federal tax return, was released jan. Web on february 28, 2022, the irs published instructions for form 941 (rev. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Web future developments for the latest information about developments related to form 941 and its instructions, such as legislation enacted after they were published, go to. April 2022) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no.

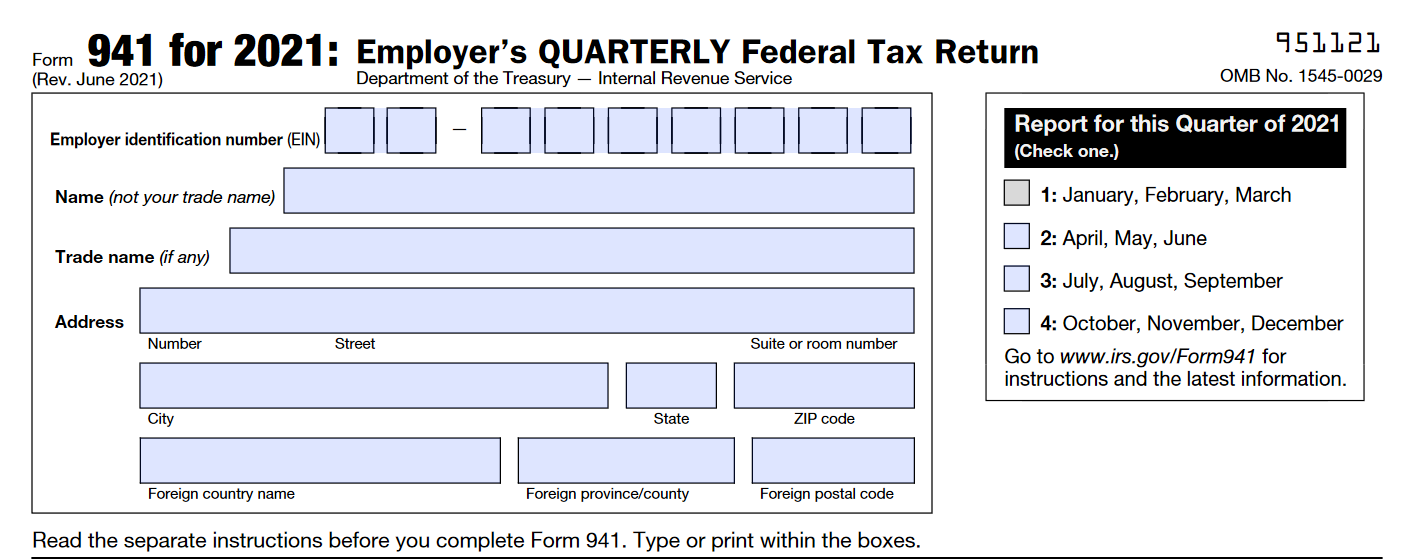

IRS Form 941 Instructions for 2021 How to fill out Form 941

Don't use an earlier revision to report taxes for 2023. Fill in the blank fields; Web employers must use the march 2022 form 941 version only to report taxes for the quarter ending march 31, 2022. For in depth information or for scheduling,. Web a draft version of the 2022 form 941, employer’s quarterly federal tax return, was released jan.

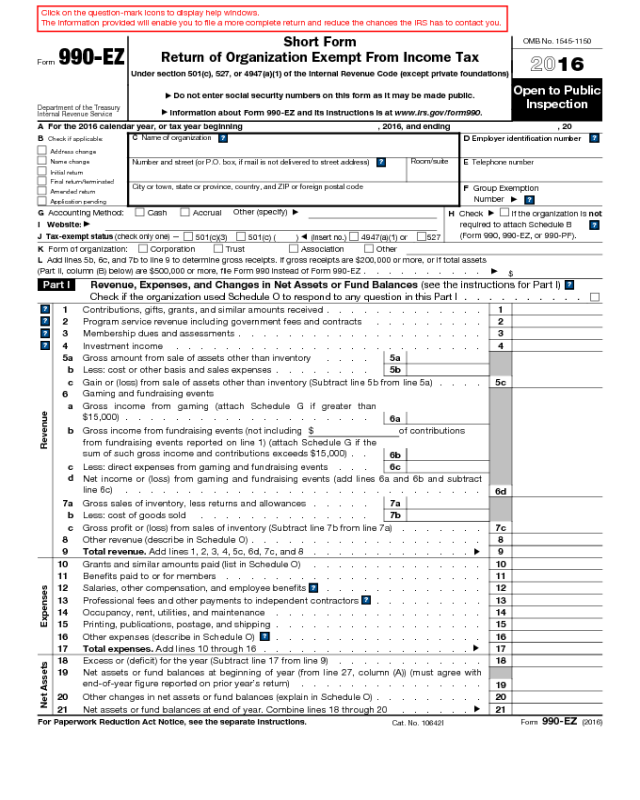

IRS Form 941X Complete & Print 941X for 2021

Web on february 28, 2022, the irs published instructions for form 941 (rev. Web form 941 for 2023: Form 941 is used by employers. Engaged parties names, places of residence and numbers etc. At this time, the irs expects the march.

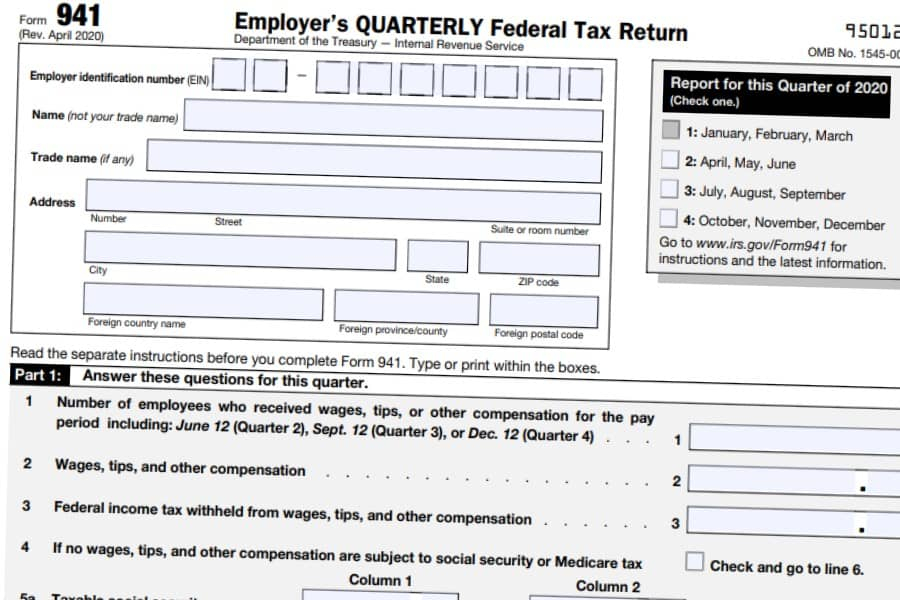

Draft of Revised Form 941 Released by IRS Includes FFCRA and CARES

March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number. Web form 941 for 2022: Complete, edit or print tax forms instantly. Columns m, s, t, and v are “reserved for future use” because the corresponding lines on form 941 are “reserved for future use.” see the. The draft form 941 ,.

How to fill out IRS Form 941 2019 PDF Expert

Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Fill in the blank fields; Complete, edit or print tax forms instantly. Web report for this quarter of 2022 (check one.) 1: Web employers must use the march 2022 form 941 version only to report taxes for the quarter.

Irs Form 941 Instructions 2016

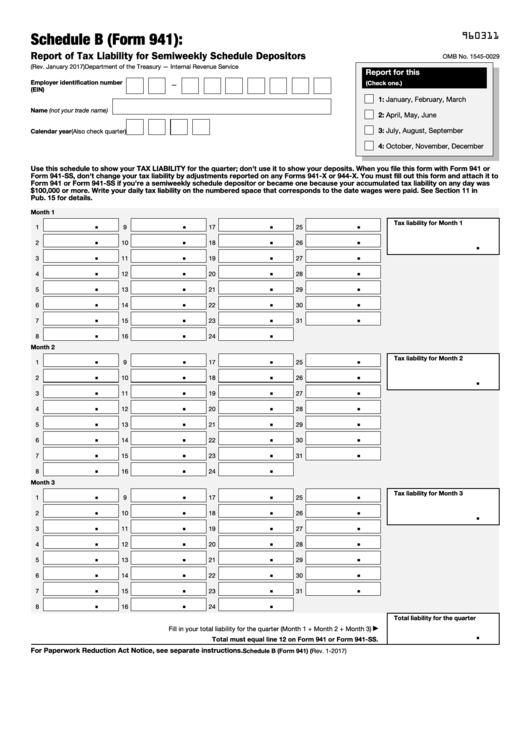

Web form 941, employer's quarterly federal tax return; March 2022) use with the january 2017 revision of schedule b (form 941) report of tax liability for semiweekly. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Web find the irs 941 you need. Upload, modify or create forms.

Printable 941 Tax Form 2021 Printable Form 2022

Web future developments for the latest information about developments related to form 941 and its instructions, such as legislation enacted after they were published, go to. Web internal revenue service (form 941) (rev. March 2022) use with the january 2017 revision of schedule b (form 941) report of tax liability for semiweekly. Web future developments for the latest information about.

Fillable Schedule B (Form 941) Report Of Tax Liability For Semiweekly

It discusses what is new for the 2022 initial version as well as. Form 941, which has a revision date of march 2022, must be used only for the first quarter of 2022 as the other quarters are grayed out. Web future developments for the latest information about developments related to form 941 and its instructions, such as legislation enacted.

[Solved] Form 941 for 2021 Employer's QUARTERLY Federal Tax Return

The draft form 941 ,. March 2022), employer’s quarterly federal tax return. April 2022) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Web future developments for the latest information about developments related to form 941 and its instructions, such as legislation enacted after they were published, go to..

Form 941PR (Rev. March 2021) Internal Revenue Service Fill and

Web form 941 for the first quarter of 2022. The draft form 941 ,. Fill in the blank fields; April 2022) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Web form 941 for 2023:

Draft of Revised Form 941 Released by IRS Includes FFCRA and CARES

Please feel free to save or share this link to refer back to this offering. Web form 941 for 2023: March 2022) use with the january 2017 revision of schedule b (form 941) report of tax liability for semiweekly. The draft form 941 ,. Web use the march 2023 revision of form 941 to report taxes for the first quarter.

Web Internal Revenue Service (Form 941) (Rev.

Web 2022 form 941 (rev. Engaged parties names, places of residence and numbers etc. For in depth information or for scheduling,. 2022 employer’s quarterly federal tax return form 941 revised march 2022 (doc id 2849953.1) last updated on april 12, 2022.

Web Form 941 For 2023:

Web future developments for the latest information about developments related to form 941 and its instructions, such as legislation enacted after they were published, go to. Upload, modify or create forms. Web march 21, 2022 at 11:50 am · 3 min read rock hill, sc / accesswire / march 21, 2022 / the first quarter of 2022 is almost complete, which means it's time for. Columns m, s, t, and v are “reserved for future use” because the corresponding lines on form 941 are “reserved for future use.” see the.

March 2022) Employer’s Quarterly Federal Tax Return Department Of The Treasury — Internal Revenue Service 950122 Omb No.

Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Web form 941, employer's quarterly federal tax return; Try it for free now! The draft form 941 ,.

March 2022), Employer’s Quarterly Federal Tax Return.

March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number. 26 by the internal revenue service. Schedule b (form 941), report of tax liability for semiweekly schedule depositors (referred to in this revenue procedure. This webinar covers the irs form 941 and its accompanying form schedule b for the first quarter of 2022.