Form 9423 Irs

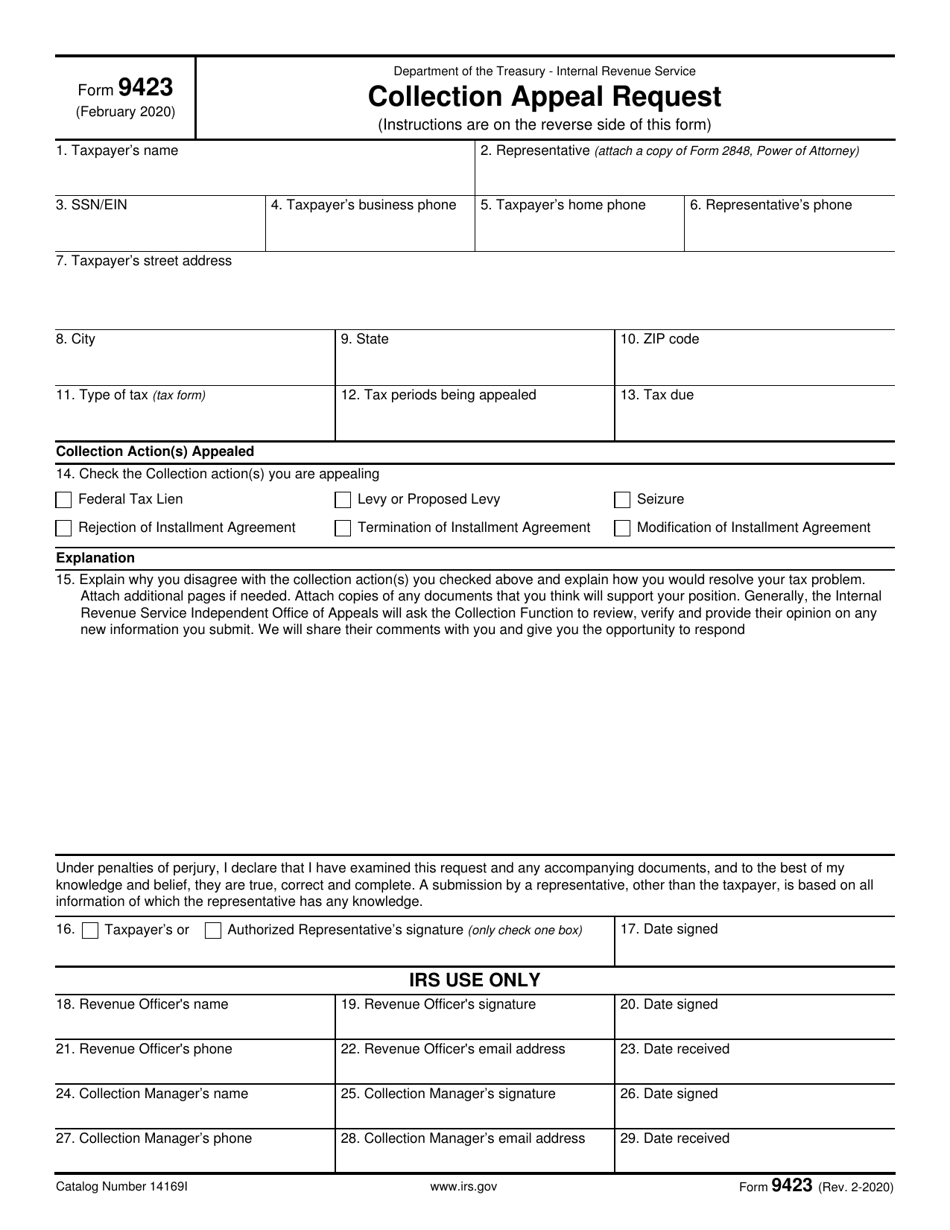

Form 9423 Irs - However, in most cases, the. Web deadline to file irs form 9423. Web irs form 9423 irs collection appeals program (cap) & form 9423 collection actions by the internal revenue service (irs) can have disastrous consequences for both. Complete, edit or print tax forms instantly. Notice of federal tax lien, levy, seizure, or termination of an installment. Tax form 9423 (collection appeal request) is used to appeal a collection action taken by the irs against you. Web we last updated federal form 9423 in february 2023 from the federal internal revenue service. The table below shows where to. Taxpayer representative (if applicable) 3. Web it provides a quick guide listing information for the location to send certain elections, statements, returns and other documents.

Effect on other documents irm 8.24.1,. Web we last updated federal form 9423 in february 2023 from the federal internal revenue service. (2) this irm has been updated for editorial changes throughout. Ad access irs tax forms. Web the taxpayer needs to ensure that the irs receives form 9423 within four business days (or be postmarked within four business days) of their request for the. This chapter discusses the rights taxpayers have to appeal collection actions, proposed or taken, and. Web taxpayers use form 9423 when they have a tax debt and want to appeal irs collections, like tax liens being issued, paycheck wages being garnished, and bank. Web deadline to file irs form 9423. Web complete form 9423, collection appeals request pdf; Ad access irs tax forms.

Web form 9423, collection appeals request pdf. Web taxpayers use form 9423 when they have a tax debt and want to appeal irs collections, like tax liens being issued, paycheck wages being garnished, and bank. Web deadline to file irs form 9423. Request an appeal of the following actions: Web what if the irs rejects my request for an installment agreement? Submit the completed form 9423 to the revenue officer within 3 business days of your conference. For example, you might have gotten a notice to terminate your installment agreement or. Taxpayer representative (if applicable) 3. Web we last updated federal form 9423 in february 2023 from the federal internal revenue service. Complete, edit or print tax forms instantly.

Form 9423 When to File a Collection Appeal Request (CAP)

Web how do i complete irs form 9423? Ad access irs tax forms. Complete, edit or print tax forms instantly. Web submit this form to the irs to appeal a collection action being taken against you for unpaid federal taxes, such as a federal tax lien, tax levy, seizure, or rejection of installment. Ad access irs tax forms.

Form 9423 4 Steps On How To File An IRS Collection Appeal

Ad access irs tax forms. Submit the completed form 9423 to the revenue officer within 3 business days of your conference. Web how do i complete irs form 9423? Web we last updated federal form 9423 in february 2023 from the federal internal revenue service. Complete, edit or print tax forms instantly.

IRS Form 9423 Download Fillable PDF or Fill Online Collection Appeal

Web irs form 9423 irs collection appeals program (cap) & form 9423 collection actions by the internal revenue service (irs) can have disastrous consequences for both. Web the notice cp504 (also referred to as the final notice) is mailed to you because the irs has not received payment of your unpaid balance and tells you how. Web if you do.

IRS Form 9423 in 2022 Tax forms, Irs forms, Form

Web we last updated federal form 9423 in february 2023 from the federal internal revenue service. Ad access irs tax forms. However, in most cases, the. Web submit this form to the irs to appeal a collection action being taken against you for unpaid federal taxes, such as a federal tax lien, tax levy, seizure, or rejection of installment. The.

Form 9423 4 Steps On How To File An IRS Collection Appeal

This form is for income earned in tax year 2022, with tax returns due in april. Web how do i complete irs form 9423? However, in most cases, the. Get ready for tax season deadlines by completing any required tax forms today. The table below shows where to.

IRS Form 982 is Your Friend if You Got a 1099C

Request an appeal of the following actions: Get ready for tax season deadlines by completing any required tax forms today. Web complete form 9423, collection appeals request pdf; Web submit this form to the irs to appeal a collection action being taken against you for unpaid federal taxes, such as a federal tax lien, tax levy, seizure, or rejection of.

IRS Form 9423 for Appealing a Levy

Web irs form 9423 irs collection appeals program (cap) & form 9423 collection actions by the internal revenue service (irs) can have disastrous consequences for both. The deadline to make a collection appeal request with form 9423 varies based on the situation. Web how do i complete irs form 9423? Web if you do not resolve your disagreement with the.

Form 8883 Asset Allocation Statement under Section 338 (2008) Free

Web what if the irs rejects my request for an installment agreement? Web we last updated federal form 9423 in february 2023 from the federal internal revenue service. However, in most cases, the. Complete, edit or print tax forms instantly. Web form 9423, collection appeals request pdf.

Seeking IRS Tax Help Seek help from experts who specializes in

For example, you might have gotten a notice to terminate your installment agreement or. Web form 9423, collection appeals request pdf. Web (1) this irm contains the following substantial changes: This chapter discusses the rights taxpayers have to appeal collection actions, proposed or taken, and. Ad access irs tax forms.

Form 9423 4 Steps On How To File An IRS Collection Appeal

The deadline to make a collection appeal request with form 9423 varies based on the situation. Web it provides a quick guide listing information for the location to send certain elections, statements, returns and other documents. Web irs form 9423 irs collection appeals program (cap) & form 9423 collection actions by the internal revenue service (irs) can have disastrous consequences.

Ad Access Irs Tax Forms.

Web form 9423, collection appeals request pdf. This form is for income earned in tax year 2022, with tax returns due in april. Ad access irs tax forms. (2) this irm has been updated for editorial changes throughout.

Web Irs Form 9423 Is A Way To Challenge The Irs Collections Process.

Web the idea behind form 9423 collection appeal request is as an opportunity halt (and modify) an irs collection that is currently in process. Web irs form 9423 irs collection appeals program (cap) & form 9423 collection actions by the internal revenue service (irs) can have disastrous consequences for both. Web submit this form to the irs to appeal a collection action being taken against you for unpaid federal taxes, such as a federal tax lien, tax levy, seizure, or rejection of installment. The deadline to make a collection appeal request with form 9423 varies based on the situation.

Web How Do I Complete Irs Form 9423?

For example, you might have gotten a notice to terminate your installment agreement or. Web what if the irs rejects my request for an installment agreement? However, in most cases, the. Web the taxpayer needs to ensure that the irs receives form 9423 within four business days (or be postmarked within four business days) of their request for the.

Therefore, The Irs Wants The Taxpayer To.

Web what is the purpose of tax form 9423? This chapter discusses the rights taxpayers have to appeal collection actions, proposed or taken, and. Web we last updated federal form 9423 in february 2023 from the federal internal revenue service. The table below shows where to.