Form 944 For 2022

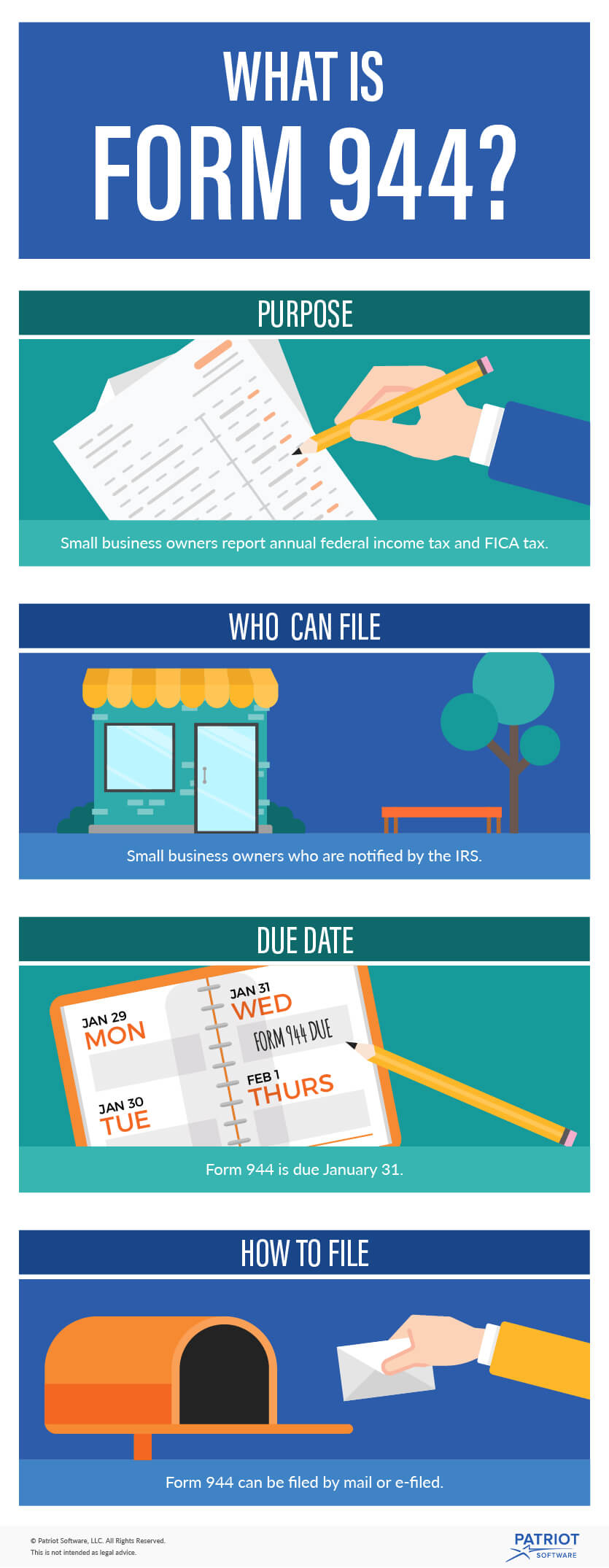

Form 944 For 2022 - If the deposits are made on time in full payment of the taxes, the return can be filed by february 10,. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. Complete, edit or print tax forms instantly. The form was introduced by the irs to give smaller employers a break in filing and paying federal. 944 (2022) this page intentionally left blank. Web this being said, the deadline to file form 944 is jan. Web drafts of forms 943 and 944 were released. Web irs form 944 is the employer's annual federal tax return. 31 for the previous tax year — the return covering the 2021 year, therefore, would be due jan. January 12, 2023 06:41 pm.

Web this being said, the deadline to file form 944 is jan. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. Try it for free now! If the deposits are made on time in full payment of the taxes, the return can be filed by february 10,. Web however, employers that pay qualified sick and family leave wages in 2022 for leave taken after march 31, 2020, and before october 1, 2021, are eligible to claim a credit on form. Complete, edit or print tax forms instantly. The form was introduced by the irs to give smaller employers a break in filing and paying federal. Web what is irs form 944 for 2022? Let's get your 941 changed to 944 forms in quickbooks online. Web drafts of forms 943 and 944 were released.

Try it for free now! Web for 2022, the due date for filing form 944 is january 31, 2023. Unlike those filing a 941, small business owners have the option to pay taxes when filing, rather than making. However, if you made deposits on time in full payment of the taxes due for the year, you may file the. Revised draft instructions for form 944. Web however, employers that pay qualified sick and family leave wages in 2022 for leave taken after march 31, 2020, and before october 1, 2021, are eligible to claim a credit on form. If you are eligible to claim a credit, you can read 2022irs instructions for form 944 page 14 to 16 to see how to complete line. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. Web form 944, employer’s annual federal tax return, reports federal income and fica (social security and medicare) tax on employee wages. Web for 2022, you have to file form 944 by january 31, 2023.

How To Fill Out Form I944 StepByStep Instructions [2021]

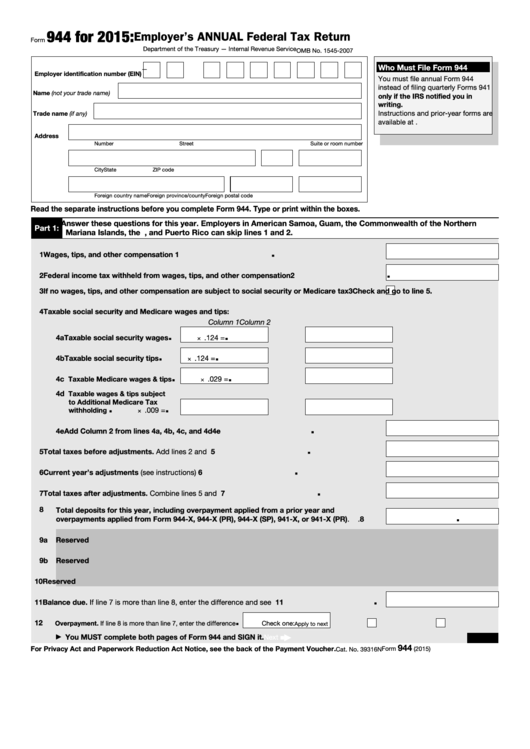

944 (2022) this page intentionally left blank. 31 for the previous tax year — the return covering the 2021 year, therefore, would be due jan. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. Let's get your 941 changed to 944 forms in quickbooks online. See page 6.

Form 944 2022 How To Fill it Out and What You Need To Know

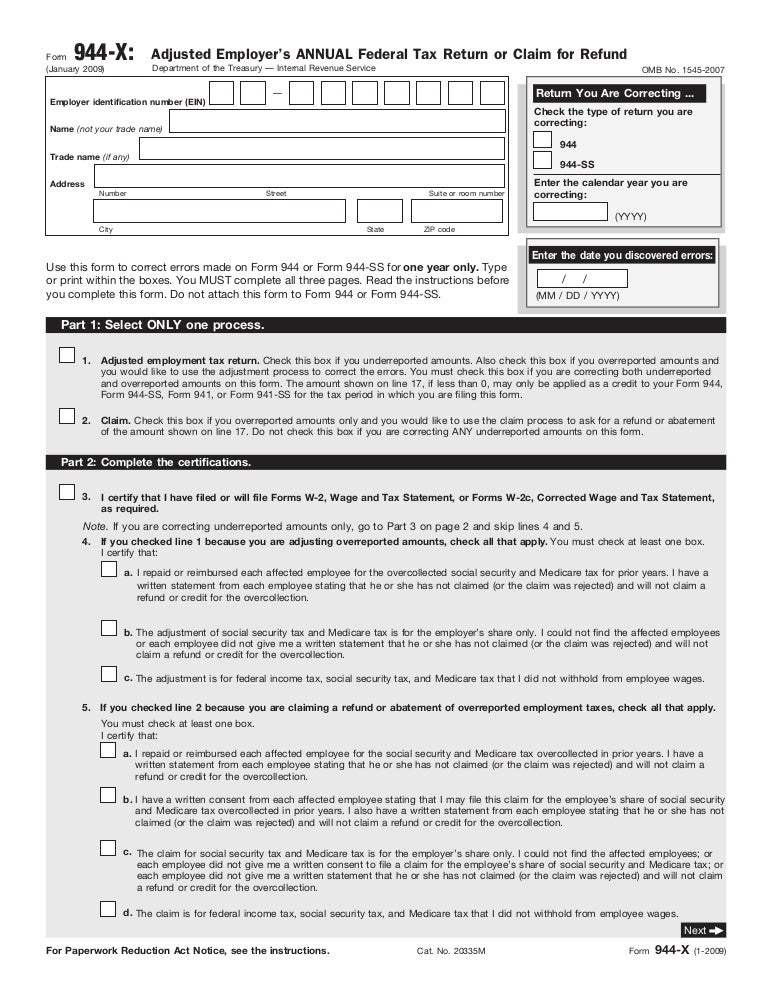

The forms no longer include lines pertaining to the employee retention credit or advance payments. Complete, edit or print tax forms instantly. Web however, employers that pay qualified sick and family leave wages in 2022 for leave taken after march 31, 2020, and before october 1, 2021, are eligible to claim a credit on form. Complete, edit or print tax.

What is Form 944? Reporting Federal & FICA Taxes

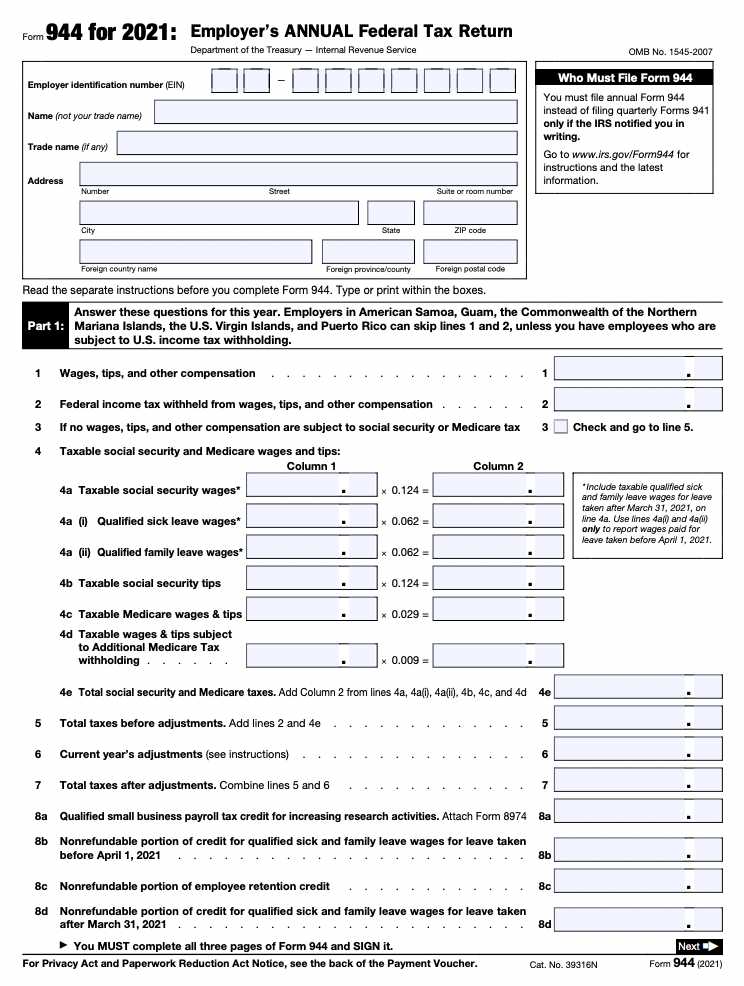

Ad upload, modify or create forms. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Web what is irs form 944 for 2022? 31 for the previous tax year — the return covering the 2021 year, therefore, would be due jan. Employer’s annual federal tax return department of the treasury — internal revenue service omb.

Form 944X Adjusted Employer's Annual Federal Tax Return or Claim fo…

Web tax liability falls on the employer rather than the employee. Unlike those filing a 941, small business owners have the option to pay taxes when filing, rather than making. Web employer’s annual federal tax return form 944 for 2021: Let's get your 941 changed to 944 forms in quickbooks online. Web information about form 944, employer's annual federal tax.

Mi Certificate Ownership Fill Out and Sign Printable PDF Template

Ad upload, modify or create forms. 944 (2022) this page intentionally left blank. Revised draft instructions for form 944. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. Complete, edit or print tax forms instantly.

Finance Archives XperimentalHamid

Let's get your 941 changed to 944 forms in quickbooks online. Edit, sign and save emp annual fed tax return form. However, if you made deposits on time in full payment of the taxes due for the year, you may file the. Web this being said, the deadline to file form 944 is jan. See page 6 for additional guidance,.

2016 Form IRS 944 Fill Online, Printable, Fillable, Blank pdfFiller

Web for 2022, the due date for filing form 944 is january 31, 2023. The forms no longer include lines pertaining to the employee retention credit or advance payments. Web employer’s annual federal tax return form 944 for 2021: However, if you made deposits on time in full payment of the taxes due for the year, you may file the..

The Sweet Beginning in USA Form I944 Declaration of SelfSufficiency

January 12, 2023 06:41 pm. Web irs form 944 is the employer's annual federal tax return. Irs form 944 becomes the mechanism to pay these taxes, taking the place of the irs form 941. Form 944 allows small employers. Through the payroll settings, we can.

Fillable Form 944 Employer'S Annual Federal Tax Return 2017

See page 6 for additional guidance, including information on how to treat employment tax credits and social security tax deferrals. 31 for the previous tax year — the return covering the 2021 year, therefore, would be due jan. 1 choose form and tax year 2 enter social security & medicare taxes 3 enter federal income tax. Complete, edit or print.

Try It For Free Now!

Web this being said, the deadline to file form 944 is jan. Employer’s annual federal tax return department of the treasury — internal revenue service omb no. The forms no longer include lines pertaining to the employee retention credit or advance payments. January 12, 2023 06:41 pm.

The Form Was Introduced By The Irs To Give Smaller Employers A Break In Filing And Paying Federal.

However, if you made deposits on time in full payment of the taxes due for the year, you may file the. 1 choose form and tax year 2 enter social security & medicare taxes 3 enter federal income tax. Web tax liability falls on the employer rather than the employee. Revised draft instructions for form 944.

Web For 2022, You Have To File Form 944 By January 31, 2023.

Web drafts of forms 943 and 944 were released. 31 for the previous tax year — the return covering the 2021 year, therefore, would be due jan. Web for 2022, the due date for filing form 944 is january 31, 2023. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file.

Let's Get Your 941 Changed To 944 Forms In Quickbooks Online.

If the deposits are made on time in full payment of the taxes, the return can be filed by february 10,. 944 (2022) this page intentionally left blank. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Web irs form 944 is the employer's annual federal tax return.

![How To Fill Out Form I944 StepByStep Instructions [2021]](https://self-lawyer.com/wp-content/uploads/2020/05/I-944-2-1024x572.png)