Form 9465 Mailing Address

Form 9465 Mailing Address - Use form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). If you have already filed your return or you’re filing this form in response to a notice, file form 9465 by itself with the internal revenue service center using the address in the table below that applies to you. Web if you are mailing in your irs form 9465, it depends on where you live. All individual taxpayers who mail form 9465 separate from their returns and who file a form 1040 with schedule c, e, or f should mail their form 9465 to the address for their state shown in this table. Look for the forms menu, select this form, and fill it out. You can reference the irs addresses for form 9465. Web form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. Web attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. Web you can find a list of addresses by state on the form 9465 instruction page on the irs website under the section “where to file.” the installment agreement application fee when you mail 9465 is $107 (direct debit) or $225 (check, money order, debit/credit card). December 2018) go to www.irs.gov/form9465 for instructions and the latest information.

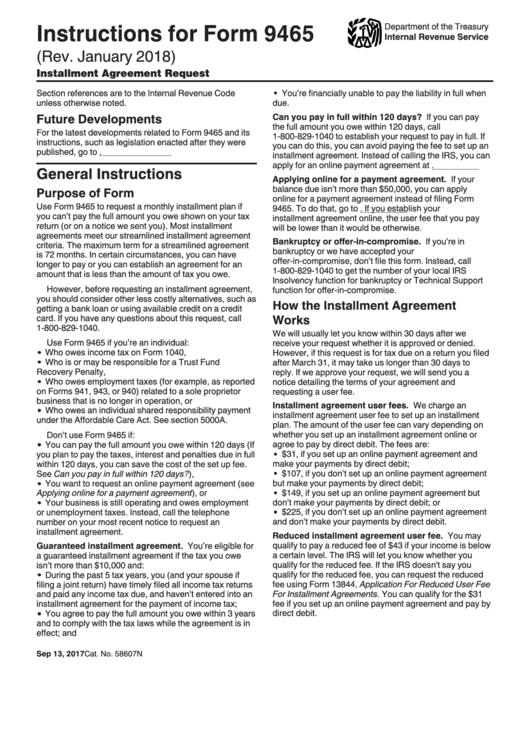

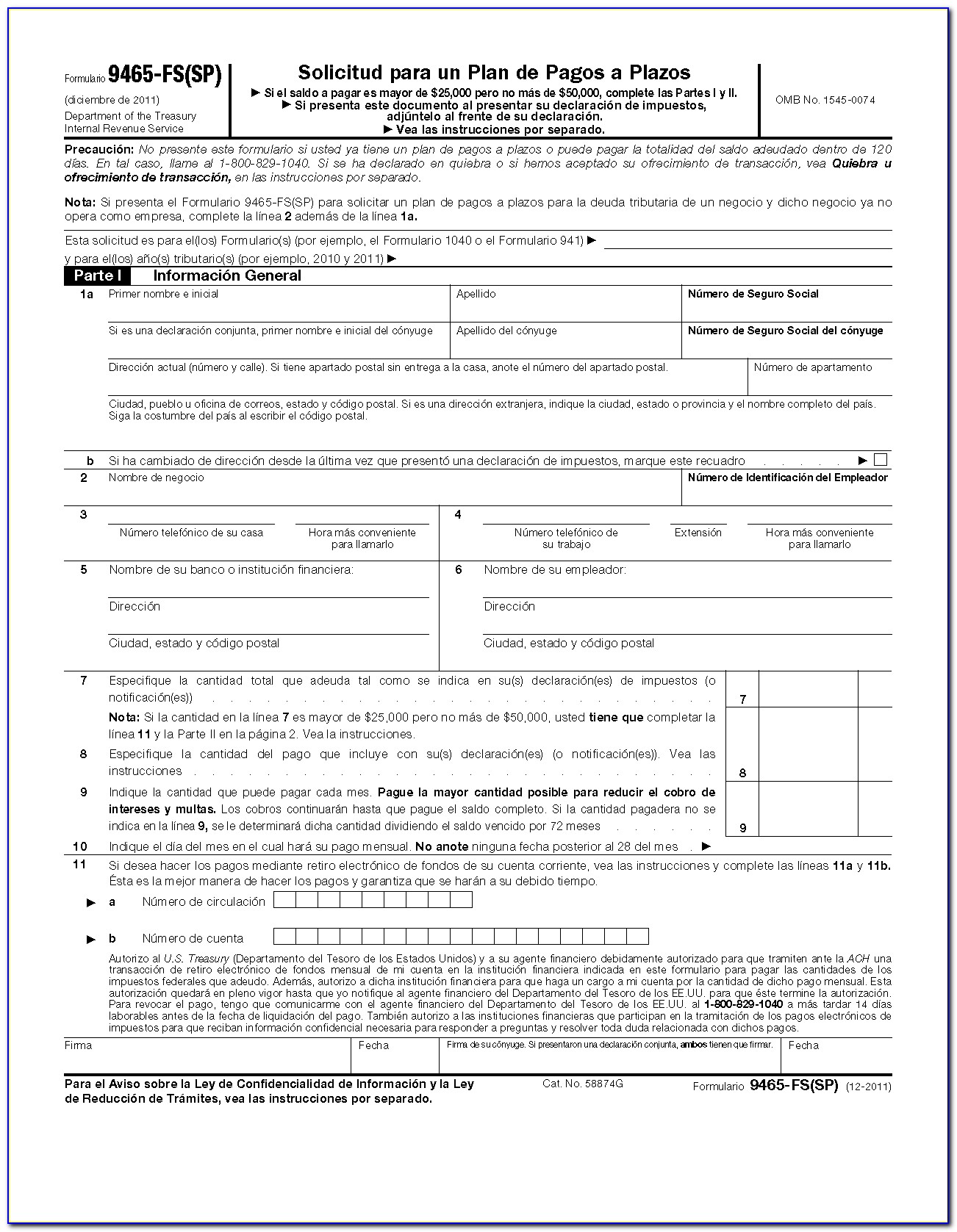

Use form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). If you have already filed your return or you’re filing this form in response to a notice, file form 9465 by itself with the internal revenue service center using the address in the table below that applies to you. The maximum term for a streamlined agreement is 72 months. Web attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. All individual taxpayers who mail form 9465 separate from their returns and who file a form 1040 with schedule c, e, or f should mail their form 9465 to the address for their state shown in this table. Web purpose of form use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Web installment agreement request form (rev. Most installment agreements meet our streamlined installment agreement criteria. Internal revenue service see separate instructions. Where to file:attach the forms 9465 to the front side of tax return and then send it to address given in the tax return booklet.

Look for the forms menu, select this form, and fill it out. Where to file:attach the forms 9465 to the front side of tax return and then send it to address given in the tax return booklet. December 2018) go to www.irs.gov/form9465 for instructions and the latest information. Web form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. Internal revenue service see separate instructions. *permanent residents of guam or the virgin islands cannot use form 9465. Web you can find a list of addresses by state on the form 9465 instruction page on the irs website under the section “where to file.” the installment agreement application fee when you mail 9465 is $107 (direct debit) or $225 (check, money order, debit/credit card). Some tax prep software also allows you to file form 9465. Use form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). Address city, state, and zip code address city, state, and zip code your work phone number best time for us to call 10 enter the amount of any payment you are making with your tax return (or notice).

Instructions For Form 9465 Installment Agreement Request printable

Where to file:attach the forms 9465 to the front side of tax return and then send it to address given in the tax return booklet. Most installment agreements meet our streamlined installment agreement criteria. Web if you are mailing in your irs form 9465, it depends on where you live. Web purpose of form use form 9465 to request a.

Irs.gov Form 941 Mailing Address Form Resume Examples w950jQVkor

Web installment agreement request form (rev. *permanent residents of guam or the virgin islands cannot use form 9465. You can reference the irs addresses for form 9465. December 2018) go to www.irs.gov/form9465 for instructions and the latest information. Web you can find a list of addresses by state on the form 9465 instruction page on the irs website under the.

Details about Never alone

Web form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. Most installment agreements meet our streamlined installment agreement criteria. Use form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice.

Irs Form 9465 Installment Agreement Request Software Free Download

Web purpose of form use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Look for the forms menu, select this form, and fill it out. You can reference the irs addresses for form 9465. Use form 9465.

Irs Payment Form 9465 Form Resume Examples EvkBqoxO2d

Look for the forms menu, select this form, and fill it out. Use form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). Web attach form 9465 to the front of your return and send it to the address shown in.

Federal Tax Form 941 Mailing Address prosecution2012

Look for the forms menu, select this form, and fill it out. All individual taxpayers who mail form 9465 separate from their returns and who file a form 1040 with schedule c, e, or f should mail their form 9465 to the address for their state shown in this table. Use form 9465 to request a monthly installment plan if.

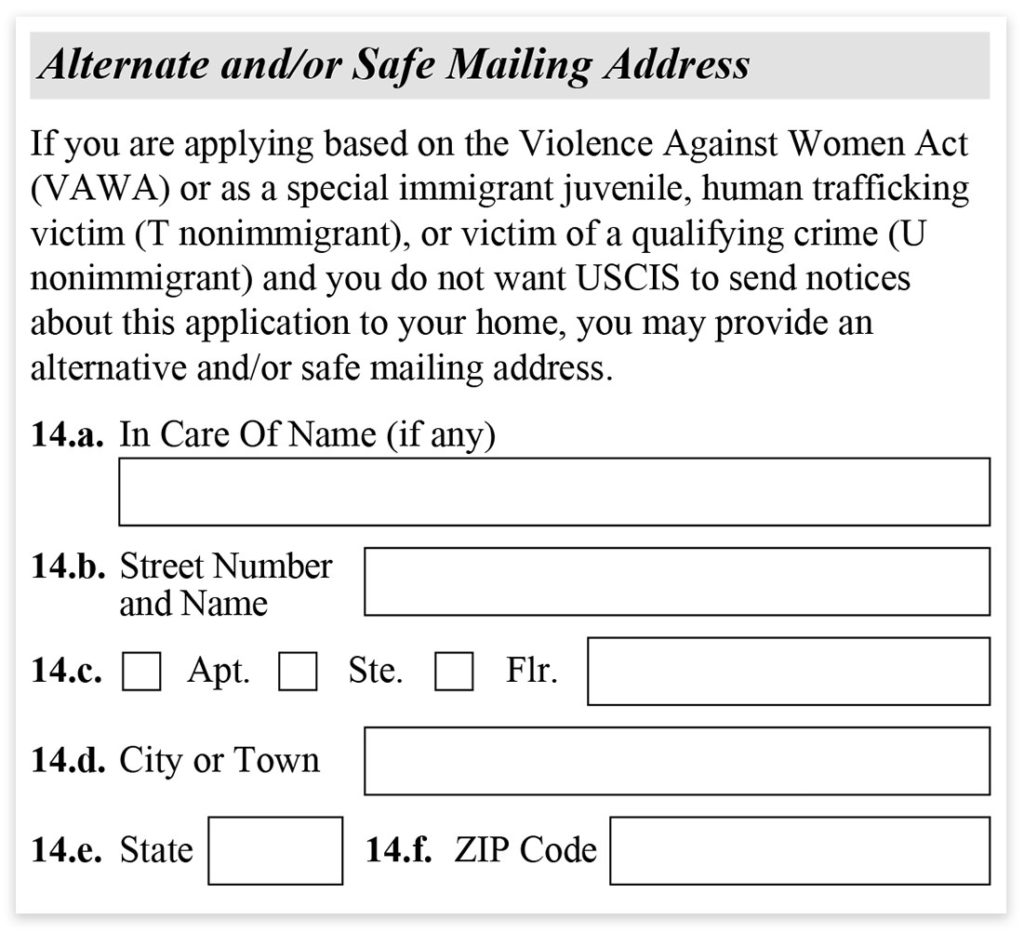

Form I485 Step by Step Instructions SimpleCitizen

December 2018) go to www.irs.gov/form9465 for instructions and the latest information. Address city, state, and zip code address city, state, and zip code your work phone number best time for us to call 10 enter the amount of any payment you are making with your tax return (or notice). Web installment agreement request form (rev. You can reference the irs.

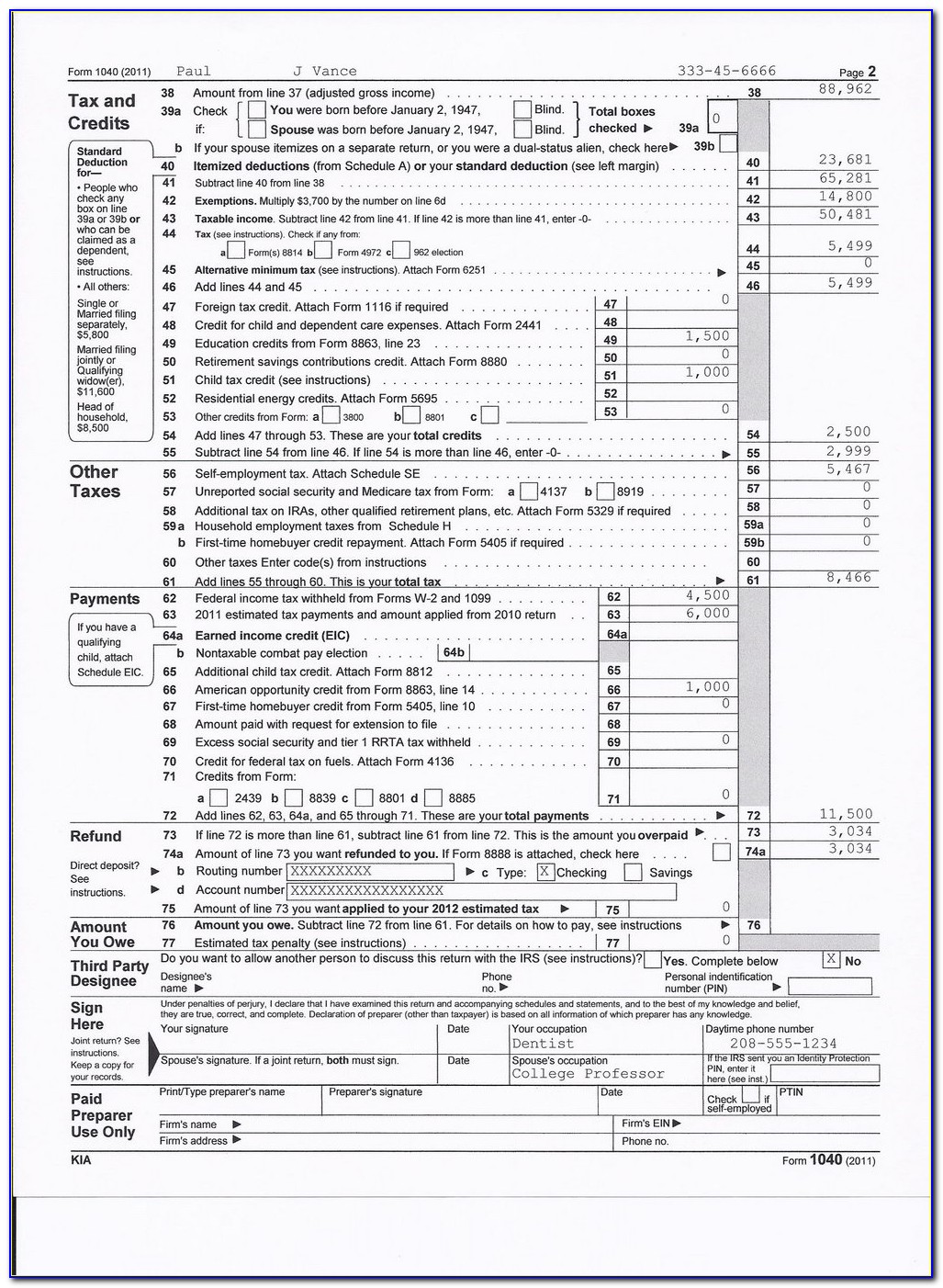

Sample Tax Form 1040ez Valid 35 Beautiful Irs Installment

Internal revenue service see separate instructions. Web installment agreement request form (rev. The maximum term for a streamlined agreement is 72 months. Look for the forms menu, select this form, and fill it out. If you have already filed your return or you’re filing this form in response to a notice, file form 9465 by itself with the internal revenue.

Federal Tax Form 941 Mailing Address prosecution2012

The maximum term for a streamlined agreement is 72 months. Address city, state, and zip code address city, state, and zip code your work phone number best time for us to call 10 enter the amount of any payment you are making with your tax return (or notice). Web installment agreement request form (rev. If you have already filed your.

Irs Installment Agreement Form 433 D Mailing Address Form Resume

Web attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. Look for the forms menu, select this form, and fill it out. If you have already filed your return or you’re filing this form in response to a notice, file form 9465 by itself with the internal revenue.

Where To File:attach The Forms 9465 To The Front Side Of Tax Return And Then Send It To Address Given In The Tax Return Booklet.

Some tax prep software also allows you to file form 9465. Address city, state, and zip code address city, state, and zip code your work phone number best time for us to call 10 enter the amount of any payment you are making with your tax return (or notice). All individual taxpayers who mail form 9465 separate from their returns and who file a form 1040 with schedule c, e, or f should mail their form 9465 to the address for their state shown in this table. You can reference the irs addresses for form 9465.

Use Form 9465 To Request A Monthly Installment Plan If You Cannot Pay The Full Amount You Owe Shown On Your Tax Return (Or On A Notice We Sent You).

The maximum term for a streamlined agreement is 72 months. Web purpose of form use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Internal revenue service see separate instructions. If you have already filed your return or you’re filing this form in response to a notice, file form 9465 by itself with the internal revenue service center using the address in the table below that applies to you.

Web Form 9465 Is Used By Taxpayers To Request A Monthly Installment Plan If They Cannot Pay The Full Amount Of Tax They Owe.

Web installment agreement request form (rev. Web you can find a list of addresses by state on the form 9465 instruction page on the irs website under the section “where to file.” the installment agreement application fee when you mail 9465 is $107 (direct debit) or $225 (check, money order, debit/credit card). *permanent residents of guam or the virgin islands cannot use form 9465. Most installment agreements meet our streamlined installment agreement criteria.

Web Attach Form 9465 To The Front Of Your Return And Send It To The Address Shown In Your Tax Return Booklet.

Look for the forms menu, select this form, and fill it out. December 2018) go to www.irs.gov/form9465 for instructions and the latest information. Web if you are mailing in your irs form 9465, it depends on where you live.