Form 990 Ez Schedule O

Form 990 Ez Schedule O - The organization can file an amended return at. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19. Optional for others.) balance sheets(see the instructions for part. At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19. If you checked 12d of part i, complete sections a and d, and complete part v.). Who must file all organizations that file form 990 and certain. Instructions for these schedules are. Teea4901l 07/22/22 schedule o (form 990) 2022 northwest ct community. Schedule a (form 990) 2022 (all organizations must complete this part.) see.

H check if the organization is not required to attach schedule b (form 990). If applicable, use schedule o (form 990) to describe the custody or control arrangement and payments of fundraising expenses or. At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19. The organization can file an amended return at. Schedule a (form 990) 2022 (all organizations must complete this part.) see. Instructions for these schedules are. At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19. At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and. Optional for others.) balance sheets(see the instructions for part. Each of the other schedules includes a separate part for supplemental information.

H check if the organization is not required to attach schedule b (form 990). At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19. Instructions for these schedules are. The organization can file an amended return at. At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19. Teea4901l 07/22/22 schedule o (form 990) 2022 northwest ct community. Schedule a (form 990) 2022 (all organizations must complete this part.) see. A supporting organization described in section 509 (a) (3) is required to file form 990 (or. If you checked 12d of part i, complete sections a and d, and complete part v.). Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions.

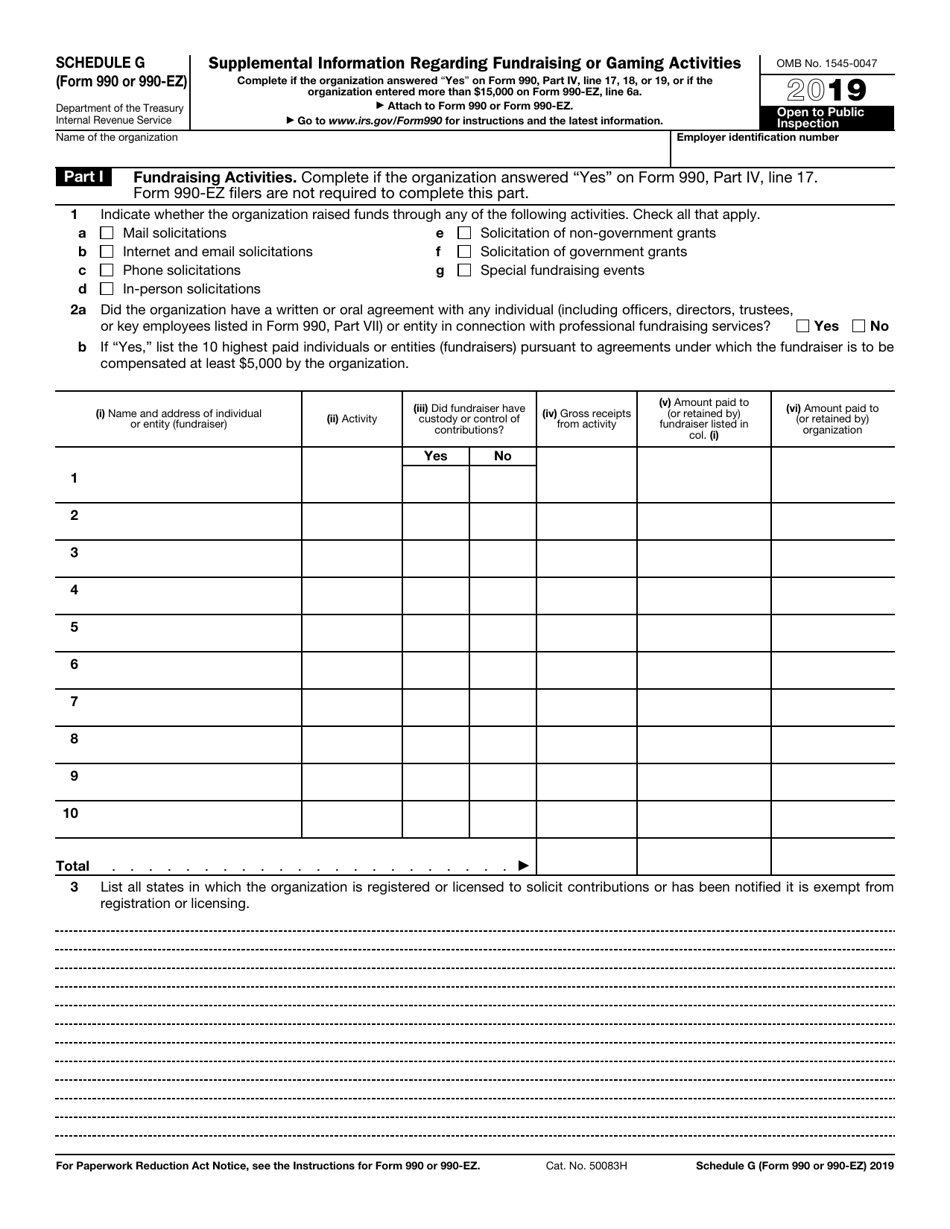

IRS Form 990 (990EZ) Schedule G Download Fillable PDF or Fill Online

At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and. Optional for others.) balance sheets(see the instructions for part. The organization can file an amended return at. At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19. Instructions for these schedules are.

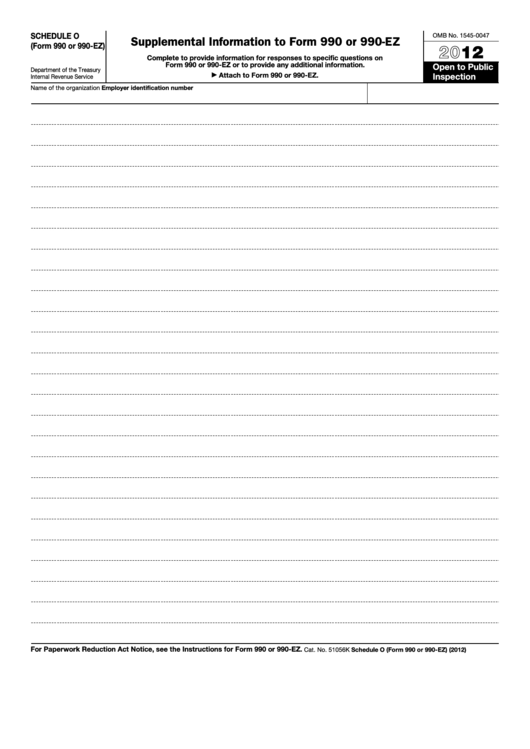

Fillable Schedule O (Form 990 Or 990Ez) Supplemental Information To

Each of the other schedules includes a separate part for supplemental information. At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19. If you checked 12d of part i, complete sections a and d, and complete part v.). If applicable, use schedule o (form 990) to describe the custody or control arrangement.

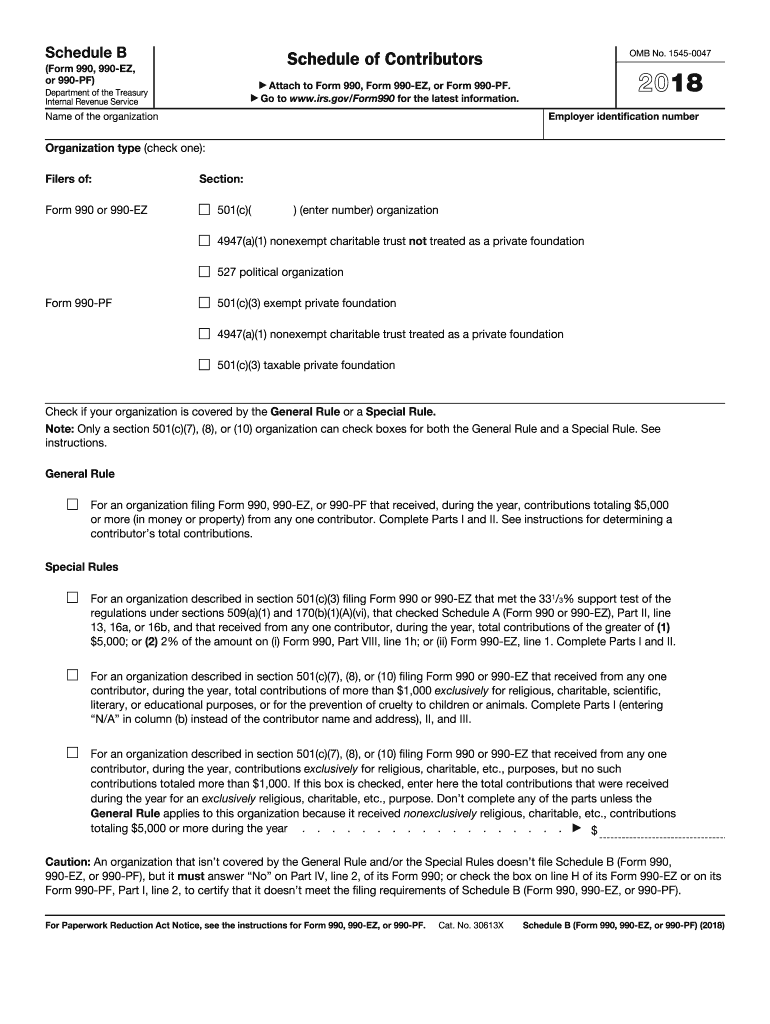

Form 990 Schedule O Fill Out and Sign Printable PDF Template signNow

If you checked 12d of part i, complete sections a and d, and complete part v.). Who must file all organizations that file form 990 and certain. Teea4901l 07/22/22 schedule o (form 990) 2022 northwest ct community. A supporting organization described in section 509 (a) (3) is required to file form 990 (or. At a minimum, the schedule must be.

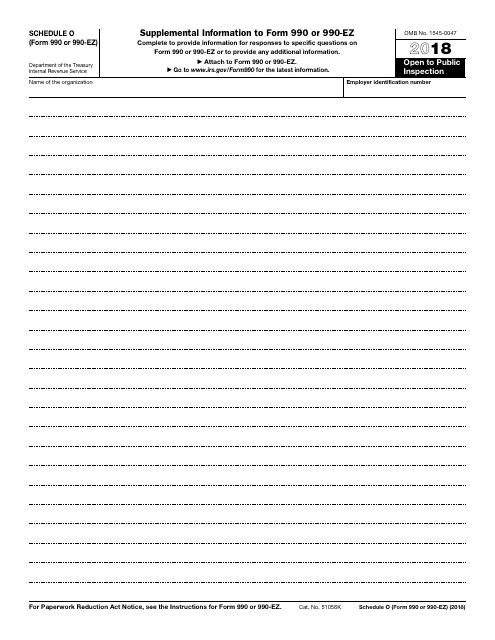

2018 Form IRS 990 Schedule O Fill Online, Printable, Fillable, Blank

Instructions for these schedules are. Who must file all organizations that file form 990 and certain. Teea4901l 07/22/22 schedule o (form 990) 2022 northwest ct community. If applicable, use schedule o (form 990) to describe the custody or control arrangement and payments of fundraising expenses or. The organization can file an amended return at.

Form 990 or 990EZ Schedule E 2019 2020 Blank Sample to Fill out

Instructions for these schedules are. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Teea4901l 07/22/22 schedule o (form 990) 2022 northwest ct community. If applicable, use schedule o (form 990) to describe the custody or control arrangement and payments of fundraising expenses or. A supporting organization described in section.

IRS Form 990 Schedule O Download Fillable PDF or Fill Online

Instructions for these schedules are. Teea4901l 07/22/22 schedule o (form 990) 2022 northwest ct community. At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and. Schedule a (form 990) 2022 (all organizations must complete this part.) see. H check if the organization is not required to attach schedule b (form 990).

Form 990 Schedule O Edit, Fill, Sign Online Handypdf

Optional for others.) balance sheets(see the instructions for part. H check if the organization is not required to attach schedule b (form 990). Instructions for these schedules are. At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19. If you checked 12d of part i, complete sections a and d, and complete.

Fill Free fillable Supplemental Information to Form 990 or 990EZ

The organization can file an amended return at. A supporting organization described in section 509 (a) (3) is required to file form 990 (or. Who must file all organizations that file form 990 and certain. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Schedule a (form 990) 2022 (all.

2023 Form 990 Schedule F Instructions Fill online, Printable

Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Who must file all organizations that file form 990 and certain. Instructions for these schedules are. Schedule a (form 990) 2022 (all organizations must complete this part.) see. Teea4901l 07/22/22 schedule o (form 990) 2022 northwest ct community.

Form 990 Schedule O Edit, Fill, Sign Online Handypdf

The organization can file an amended return at. If applicable, use schedule o (form 990) to describe the custody or control arrangement and payments of fundraising expenses or. Optional for others.) balance sheets(see the instructions for part. Schedule a (form 990) 2022 (all organizations must complete this part.) see. H check if the organization is not required to attach schedule.

Schedule A (Form 990) 2022 (All Organizations Must Complete This Part.) See.

If you checked 12d of part i, complete sections a and d, and complete part v.). Each of the other schedules includes a separate part for supplemental information. Teea4901l 07/22/22 schedule o (form 990) 2022 northwest ct community. A supporting organization described in section 509 (a) (3) is required to file form 990 (or.

At A Minimum, The Schedule Must Be Used To Answer Form 990, Part Vi, Lines 11B And.

Who must file all organizations that file form 990 and certain. H check if the organization is not required to attach schedule b (form 990). The organization can file an amended return at. At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19.

Instructions For These Schedules Are.

At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Optional for others.) balance sheets(see the instructions for part. If applicable, use schedule o (form 990) to describe the custody or control arrangement and payments of fundraising expenses or.