Form 990 Key Employee

Form 990 Key Employee - To be a current key employee all three tests must be met: Web form 990, part iv, line 28b: Web if the organization has over 20 employees who meet these tests, then it would only report the top 20 most highly compensated as key employees. Web which persons must be listed as officers, directors, trustees, key employees, and five highest compensated employees on the core form’s part vii? Web form 990 part vii officers directors trustees key employees highest compensated employees solved • by intuit • 2 • updated july 13, 2022 how do i. Web required individuals reported on the form 990 current directors & trustees let’s start with the members of the organization’s board or governing body. What is the difference between the public inspection copy and the copy of. Core form the definition of a key employee includes a three part test. Web first, enter the officer information in screen 2, officer, directors, trustees, managers. Current key employees ( over $150,000 of reportable compensation ).

Current officers, directors, and trustees ( no minimum compensation threshold ). Web a former trustee, director, officer, or key employee is any person (1) the organization reported as such on any of its five prior form 990s but did not serve in any. Open to screen 38.1, officers, directors, trustees compensation. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Questions for all filers which persons must be listed as officers, directors, trustees, key employees and five highest compensated employees on part vii of form. What are internet society’s legal responsibilities for posting the form 990? Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. For purposes of form 990, a current key employee is an employee of the organization (other than an. Web form 990, part iv, line 28b: What is the difference between the public inspection copy and the copy of.

What is a form 990? Questions for all filers which persons must be listed as officers, directors, trustees, key employees and five highest compensated employees on part vii of form. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Current key employees ( over $150,000 of reportable compensation ). Receives $150,000 or more in compensation for the calendar year from the organization and all. Irs form 990, part vii, section a requires nonprofits to disclose the names of the organization’s officers, directors, trustees (both individuals and organizations), key. What is the difference between the public inspection copy and the copy of. Web if the organization has over 20 employees who meet these tests, then it would only report the top 20 most highly compensated as key employees. Web form 990, part iv, line 28b:

The 411 on Form 990 Christy White

Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. What are internet society’s legal responsibilities for posting the form 990? A family member of a current or former officer, director, trustee, key employee, substantial contributor, or founder of the organization? What is a.

Postscript on accreditation transparency Basic financials of two

Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. What are internet society’s legal responsibilities for posting the form 990? Current key employees ( over $150,000 of reportable compensation ). Current officers, directors, and trustees ( no minimum compensation threshold ). Web first, enter the officer.

IRS Instructions 990 2018 2019 Printable & Fillable Sample in PDF

For purposes of form 990, a current key employee is an employee of the organization (other than an. Web schedule j (form 990) is used by an organization that files form 990 to report compensation information for certain officers, directors, individual trustees, key. A family member of a current or former officer, director, trustee, key employee, substantial contributor, or founder.

2018 Form 990 for National Correctional Employee Union Cause IQ

To be a current key employee all three tests must be met: For purposes of form 990, a current key employee is an employee of the organization (other than an. Current key employees ( over $150,000 of reportable compensation ). From form 990, part vii instructions: Web part vii lists the compensation paid to current and former officers, directors, trustees,.

Digitizing IRS Form 990 Data

Web if the organization has over 20 employees who meet these tests, then it would only report the top 20 most highly compensated as key employees. Web a former trustee, director, officer, or key employee is any person (1) the organization reported as such on any of its five prior form 990s but did not serve in any. Web schedule.

Form 990 Return of Organization Exempt from Tax (2014) Free

Web required individuals reported on the form 990 current directors & trustees let’s start with the members of the organization’s board or governing body. Irs form 990, part vii, section a requires nonprofits to disclose the names of the organization’s officers, directors, trustees (both individuals and organizations), key. Current key employees ( over $150,000 of reportable compensation ). Web form.

Form 990 (Schedule J2) Continuation Sheet (2009) Free Download

Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Web if the organization has over 20 employees who meet these tests, then it would only report the top 20 most highly compensated as key employees. Receives $150,000 or more in compensation for the.

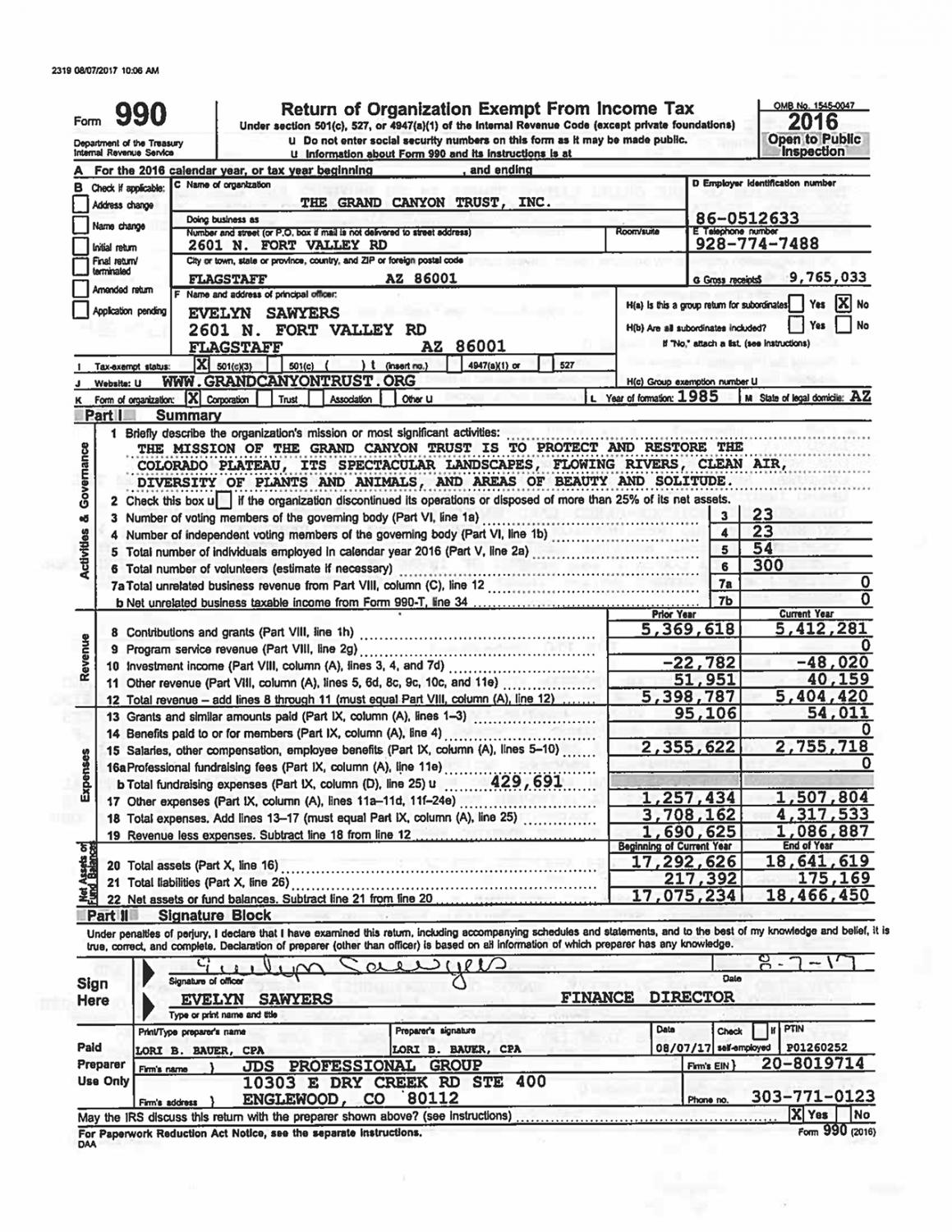

990 Form 2016 Grand Canyon Trust

Web schedule j (form 990) is used by an organization that files form 990 to report compensation information for certain officers, directors, individual trustees, key. Web how should an organization list in part vii, form 990, a person who is a current officer or director for part of the year and a former officer or director for. Core form the.

2009 Form 990 by Camfed International Issuu

Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Web form 990, part iv, line 28b: Current officers, directors, and trustees ( no minimum compensation threshold ). Core form the definition of a key employee includes a three part test. Web how should an organization list.

What Is A 990 Tax Form For Nonprofits Douroubi

Web schedule j (form 990) is used by an organization that files form 990 to report compensation information for certain officers, directors, individual trustees, key. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Irs form 990, part vii, section a requires nonprofits to disclose the.

Web Required Individuals Reported On The Form 990 Current Directors & Trustees Let’s Start With The Members Of The Organization’s Board Or Governing Body.

Open to screen 38.1, officers, directors, trustees compensation. Web part vii lists the compensation paid to current and former officers, directors, trustees, key employees, employees receiving more than $100,000 in compensation,. Web schedule j (form 990) is used by an organization that files form 990 to report compensation information for certain officers, directors, individual trustees, key. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file.

Receives $150,000 Or More In Compensation For The Calendar Year From The Organization And All.

Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Irs form 990, part vii, section a requires nonprofits to disclose the names of the organization’s officers, directors, trustees (both individuals and organizations), key. Web a former trustee, director, officer, or key employee is any person (1) the organization reported as such on any of its five prior form 990s but did not serve in any. Current key employees ( over $150,000 of reportable compensation ).

From Form 990, Part Vii Instructions:

Web if the organization has over 20 employees who meet these tests, then it would only report the top 20 most highly compensated as key employees. Web form 990, part iv, line 28b: Web first, enter the officer information in screen 2, officer, directors, trustees, managers. Current officers, directors, and trustees ( no minimum compensation threshold ).

Core Form The Definition Of A Key Employee Includes A Three Part Test.

What is the difference between the public inspection copy and the copy of. What is a form 990? Web how should an organization list in part vii, form 990, a person who is a current officer or director for part of the year and a former officer or director for. What are internet society’s legal responsibilities for posting the form 990?

.PNG)