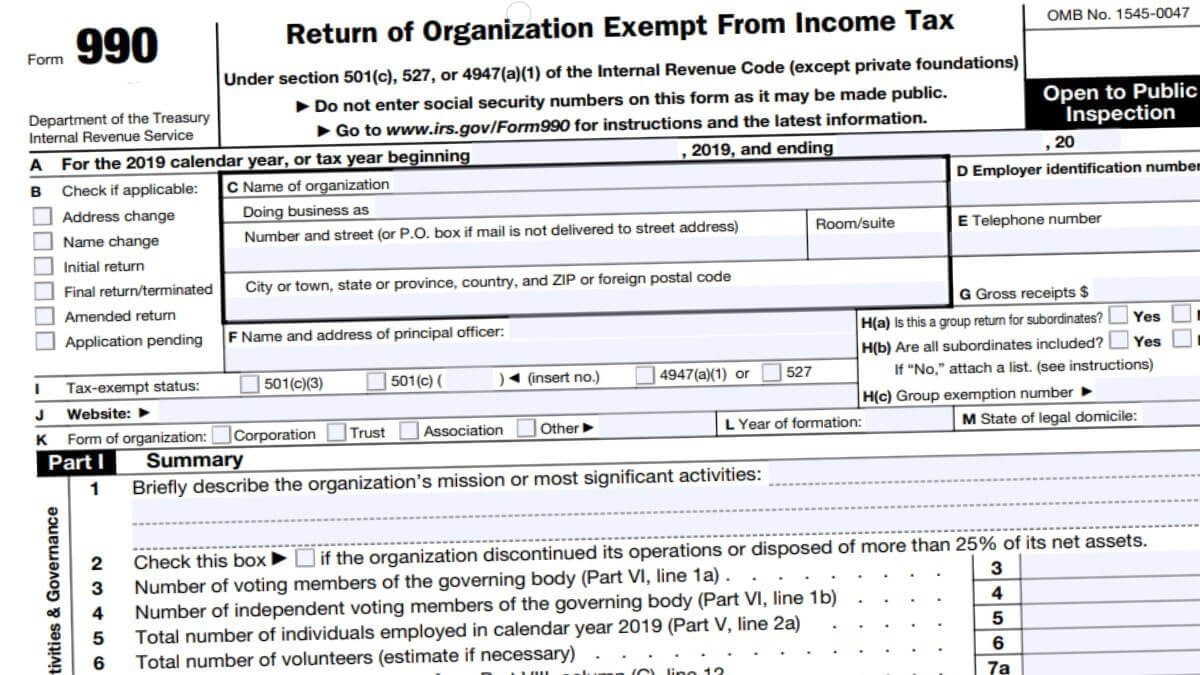

Form 990 N Extension

Form 990 N Extension - Thus, for a calendar year. Only submit original (no copies needed). Web use the table below to find the due date for extension form 8868. Web free to file form 8868 (request for extension). Free to file state forms in hi, mi and ny. Nonprofits filing this form must include the. Select your organization’s tax year period. All you need is the following information: Web up to 24% cash back the irs usually requires the extension to be filed on or before the due date of the nonprofit's tax return. Filing an extension only extends the time to file your return and does not extend the time to pay any tax due.

Web up to 24% cash back the irs usually requires the extension to be filed on or before the due date of the nonprofit's tax return. Web free to file form 8868 (request for extension). Review your application and fix any errors. Thus, for a calendar year. All you need is the following information: What to report | internal. Web what does it mean to file for an extension? Only submit original (no copies needed). Select your organization’s tax year period. Nonprofits filing this form must include the.

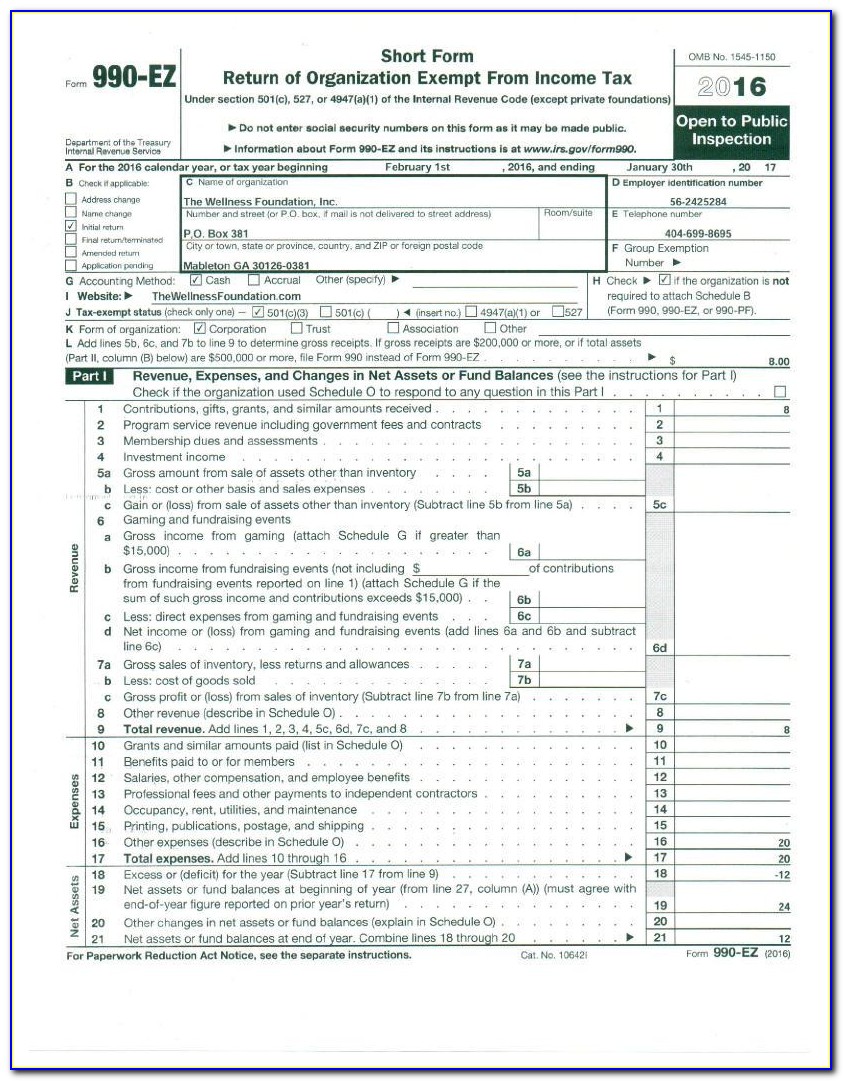

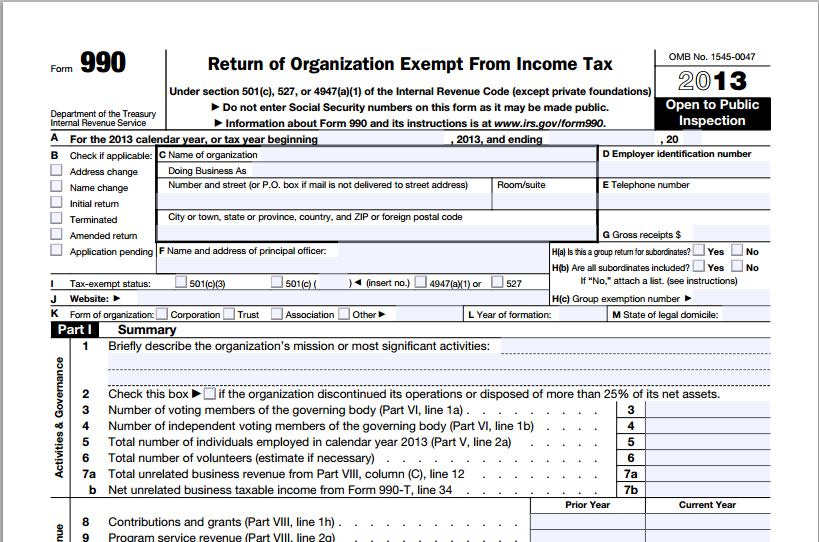

Select your organization’s tax year period. Filing an extension only extends the time to file your return and does not extend the time to pay any tax due. Only submit original (no copies needed). All you need is the following information: Form 990 nonprofits with gross receipts over $200,000 or total assets greater than $500,000 must file form 990. Web what does it mean to file for an extension? Web free to file form 8868 (request for extension). Thus, for a calendar year. Free to file state forms in hi, mi and ny. Review your application and fix any errors.

990 Form 2021

Click “submit filing” button, then “ok” (when you are ready to submit). Web what does it mean to file for an extension? Web up to 24% cash back the irs usually requires the extension to be filed on or before the due date of the nonprofit's tax return. Form 990 nonprofits with gross receipts over $200,000 or total assets greater.

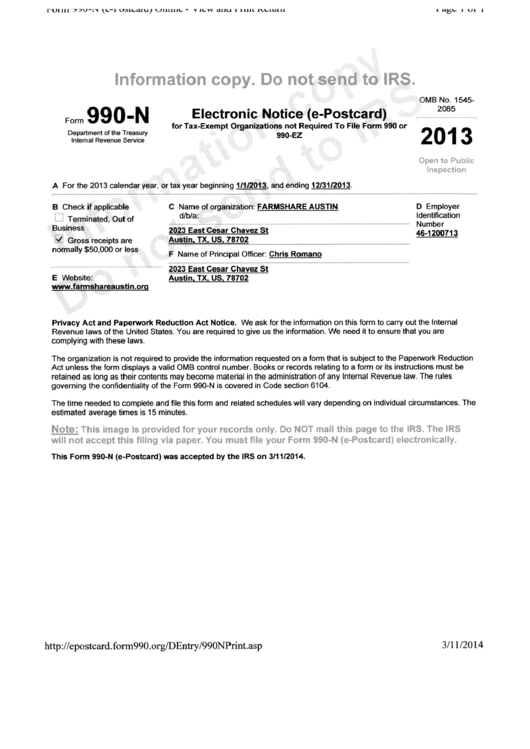

Form 990N Farmshare Austin printable pdf download

All you need is the following information: Free to file state forms in hi, mi and ny. Web what does it mean to file for an extension? What to report | internal. You pay any state fees you may owe directly to the state after you have completed the.

What is Form 990PF?

Thus, for a calendar year. Click “submit filing” button, then “ok” (when you are ready to submit). Private foundations filing a form 4720 for cy 2022 must. Review your application and fix any errors. Only submit original (no copies needed).

form 990 extension due date 2020 Fill Online, Printable, Fillable

Web free to file form 8868 (request for extension). Free to file state forms in hi, mi and ny. Only submit original (no copies needed). Filing an extension only extends the time to file your return and does not extend the time to pay any tax due. Select your organization’s tax year period.

Meet the May 17, 2021 EPostcard Form 990N Deadline In 3 Simple Steps

Form 990 nonprofits with gross receipts over $200,000 or total assets greater than $500,000 must file form 990. What to report | internal. Review your application and fix any errors. Select your organization’s tax year period. Free to file state forms in hi, mi and ny.

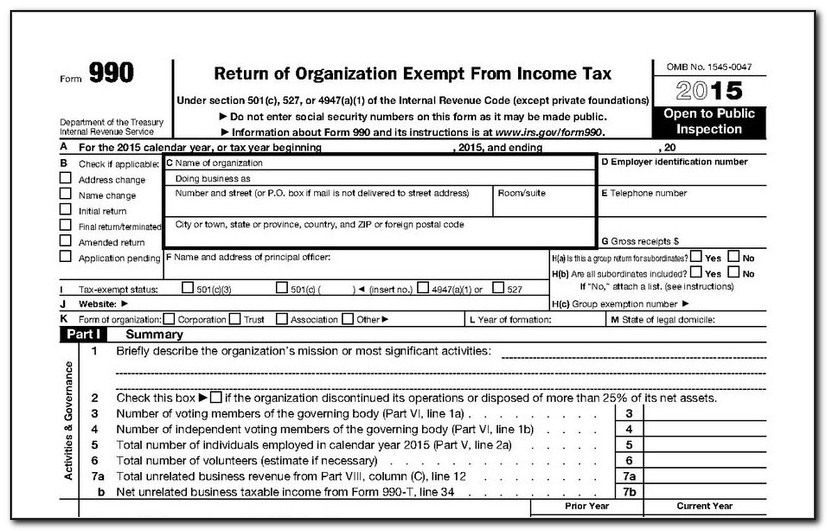

Tax Return Form 2015 Trinidad And Tobago Form Resume Examples

Filing an extension only extends the time to file your return and does not extend the time to pay any tax due. What to report | internal. Web what does it mean to file for an extension? Free to file state forms in hi, mi and ny. Web up to 24% cash back the irs usually requires the extension to.

How to File A LastMinute 990 Extension With Form 8868

What to report | internal. Filing an extension only extends the time to file your return and does not extend the time to pay any tax due. Click “submit filing” button, then “ok” (when you are ready to submit). Only submit original (no copies needed). Private foundations filing a form 4720 for cy 2022 must.

Form 990 Filing Extension Form Resume Examples GEOG2LE5Vr

Web use the table below to find the due date for extension form 8868. Web up to 24% cash back the irs usually requires the extension to be filed on or before the due date of the nonprofit's tax return. Web what does it mean to file for an extension? Review your application and fix any errors. Nonprofits filing this.

What Is A 990 N E Postcard hassuttelia

Click “submit filing” button, then “ok” (when you are ready to submit). Nonprofits filing this form must include the. Free to file state forms in hi, mi and ny. All you need is the following information: Private foundations filing a form 4720 for cy 2022 must.

Private Foundations Filing A Form 4720 For Cy 2022 Must.

Form 990 nonprofits with gross receipts over $200,000 or total assets greater than $500,000 must file form 990. Web what does it mean to file for an extension? What to report | internal. Free to file state forms in hi, mi and ny.

You Pay Any State Fees You May Owe Directly To The State After You Have Completed The.

Thus, for a calendar year. Review your application and fix any errors. Only submit original (no copies needed). Filing an extension only extends the time to file your return and does not extend the time to pay any tax due.

Web Free To File Form 8868 (Request For Extension).

Nonprofits filing this form must include the. Web use the table below to find the due date for extension form 8868. Select your organization’s tax year period. Web up to 24% cash back the irs usually requires the extension to be filed on or before the due date of the nonprofit's tax return.

Click “Submit Filing” Button, Then “Ok” (When You Are Ready To Submit).

All you need is the following information: