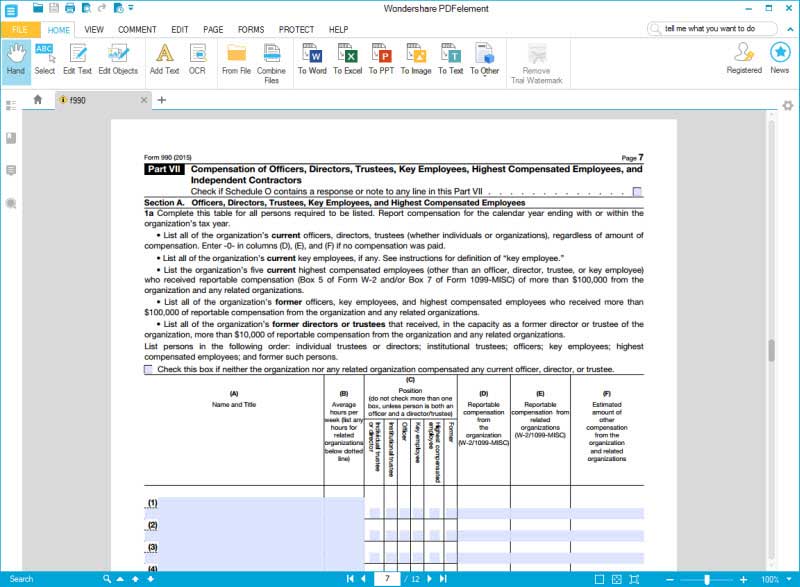

Form 990 Part Vii Instructions

Form 990 Part Vii Instructions - Web form 990, part vii requires the listing of the organization’s current or former officers, directors, trustees, key employees, and highest compensated employees, and current independent contractors, and reporting of certain compensation information relating to such persons. Do not list any individuals in schedule j, part ii, that aren't listed on form 990, part vii, section a. However, the 2019 instructions are contradictory on this point because the specific instructions for line 1a of part vii continue to tell filers to list persons by order of position. Web all current key employees listed on form 990, part vii, section a, must also be reported on schedule j, part ii, because their reportable compensation, by definition, exceeds $150,000. Web the 2020 form 990 instructions explain that ppp loans may be reported as contributions from a government unit in the year the loans are forgiven for purposes of the revenue statement (part viii, line 1e) and public support calculations (schedule a, parts ii and iii). Web determine the organization's officers, directors, trustees, key employees, and five highest compensated employees required to be listed on form 990, part vii, section a. But first, who are considered officers, directors, key employees and highly compensated employees? The key to completing this section depends on the organization’s understanding of how the irs defines each of these. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form as it may be made public. Department of the treasury internal revenue service.

Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form as it may be made public. Web determine the organization's officers, directors, trustees, key employees, and five highest compensated employees required to be listed on form 990, part vii, section a. Web the 2020 form 990 instructions explain that ppp loans may be reported as contributions from a government unit in the year the loans are forgiven for purposes of the revenue statement (part viii, line 1e) and public support calculations (schedule a, parts ii and iii). Return of organization exempt from income tax. Web all current key employees listed on form 990, part vii, section a, must also be reported on schedule j, part ii, because their reportable compensation, by definition, exceeds $150,000. Department of the treasury internal revenue service. Complete item g in the heading section of form 990, on page 1. Web rather, the 2019 form 990 instructions now tell filers to list persons in part vii from highest to lowest compensation. Do not list any individuals in schedule j, part ii, that aren't listed on form 990, part vii, section a. Web part vii, section a of the form 990 requires an organization to list officers, directors, key employees and other highly compensated employees who exceed certain thresholds, as described below.

Web all current key employees listed on form 990, part vii, section a, must also be reported on schedule j, part ii, because their reportable compensation, by definition, exceeds $150,000. Web part vii, section a of the form 990 requires an organization to list officers, directors, key employees and other highly compensated employees who exceed certain thresholds, as described below. But first, who are considered officers, directors, key employees and highly compensated employees? Web determine the organization's officers, directors, trustees, key employees, and five highest compensated employees required to be listed on form 990, part vii, section a. Do not list any individuals in schedule j, part ii, that aren't listed on form 990, part vii, section a. However, the 2019 instructions are contradictory on this point because the specific instructions for line 1a of part vii continue to tell filers to list persons by order of position. The key to completing this section depends on the organization’s understanding of how the irs defines each of these. Web form 990, part vii requires the listing of the organization’s current or former officers, directors, trustees, key employees, and highest compensated employees, and current independent contractors, and reporting of certain compensation information relating to such persons. Department of the treasury internal revenue service. Complete parts iii, v, vii, xi, and xii of form 990.

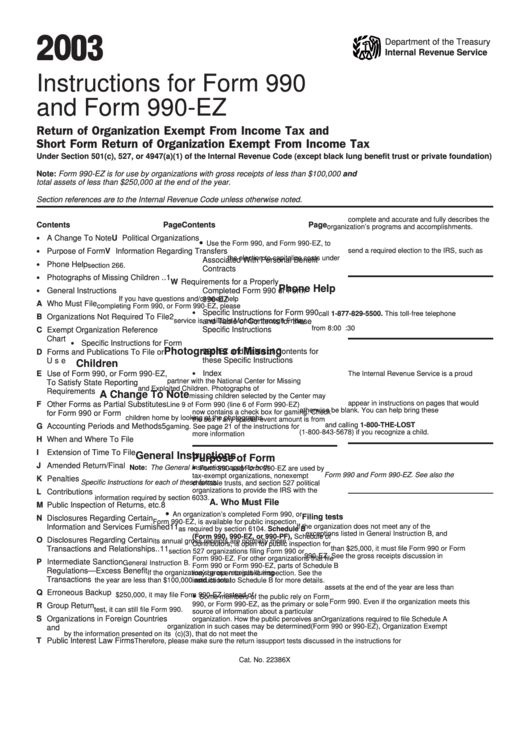

Instructions For Form 990 And Form 990Ez 2003 printable pdf download

Web all current key employees listed on form 990, part vii, section a, must also be reported on schedule j, part ii, because their reportable compensation, by definition, exceeds $150,000. Complete item g in the heading section of form 990, on page 1. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter.

IRS Form 990 Let Wondershare PDFelement help you

Web rather, the 2019 form 990 instructions now tell filers to list persons in part vii from highest to lowest compensation. Web determine the organization's officers, directors, trustees, key employees, and five highest compensated employees required to be listed on form 990, part vii, section a. Return of organization exempt from income tax. Web the 2020 form 990 instructions explain.

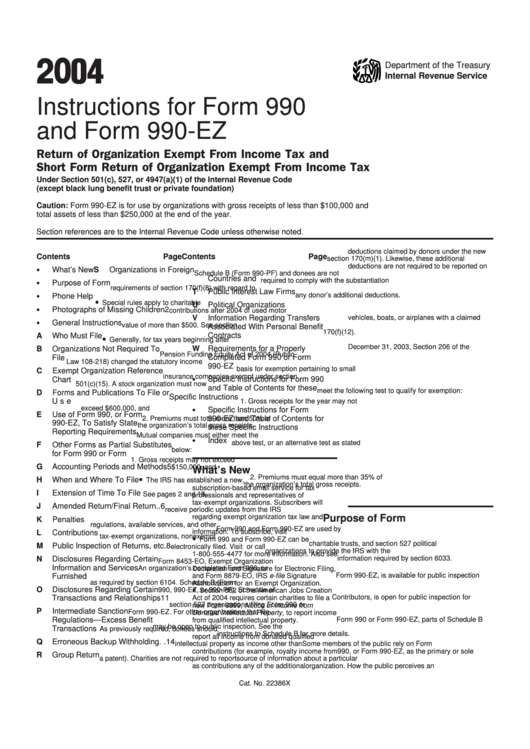

Instructions For Form 990 And Form 990Ez 2004 printable pdf download

However, the 2019 instructions are contradictory on this point because the specific instructions for line 1a of part vii continue to tell filers to list persons by order of position. Web all current key employees listed on form 990, part vii, section a, must also be reported on schedule j, part ii, because their reportable compensation, by definition, exceeds $150,000..

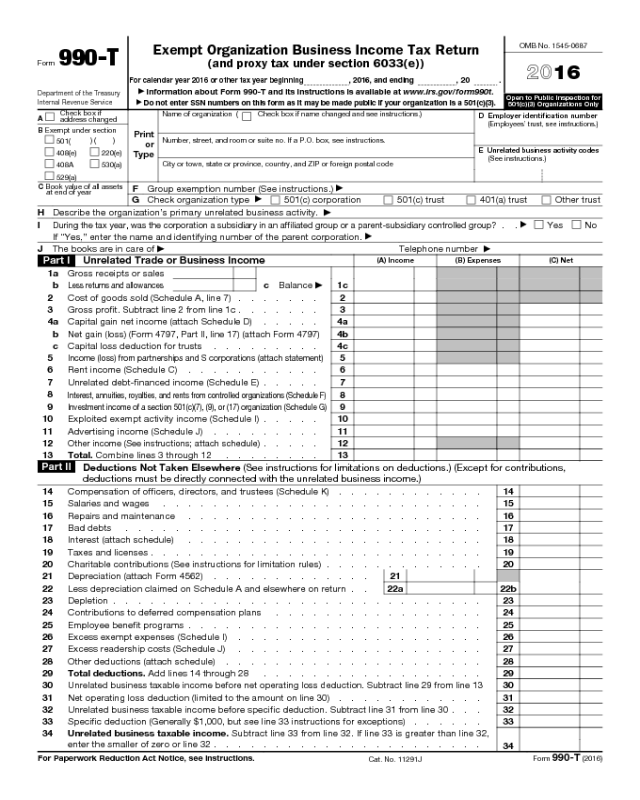

Form 990T Edit, Fill, Sign Online Handypdf

Web form 990, part vii, section a instructions say to list persons in a particular order, beginning with trustees or directors, followed by officers, then key employees, then highest compensated employees, then former such persons. Web determine the organization's officers, directors, trustees, key employees, and five highest compensated employees required to be listed on form 990, part vii, section a..

2014 Form 990 for Guthrie Corning Hospital Cause IQ

Return of organization exempt from income tax. Web part vii, section a of the form 990 requires an organization to list officers, directors, key employees and other highly compensated employees who exceed certain thresholds, as described below. Web form 990, part vii requires the listing of the organization’s current or former officers, directors, trustees, key employees, and highest compensated employees,.

2019 Form 990 for Jezreel International Cause IQ

Do not list any individuals in schedule j, part ii, that aren't listed on form 990, part vii, section a. Complete item g in the heading section of form 990, on page 1. However, the 2019 instructions are contradictory on this point because the specific instructions for line 1a of part vii continue to tell filers to list persons by.

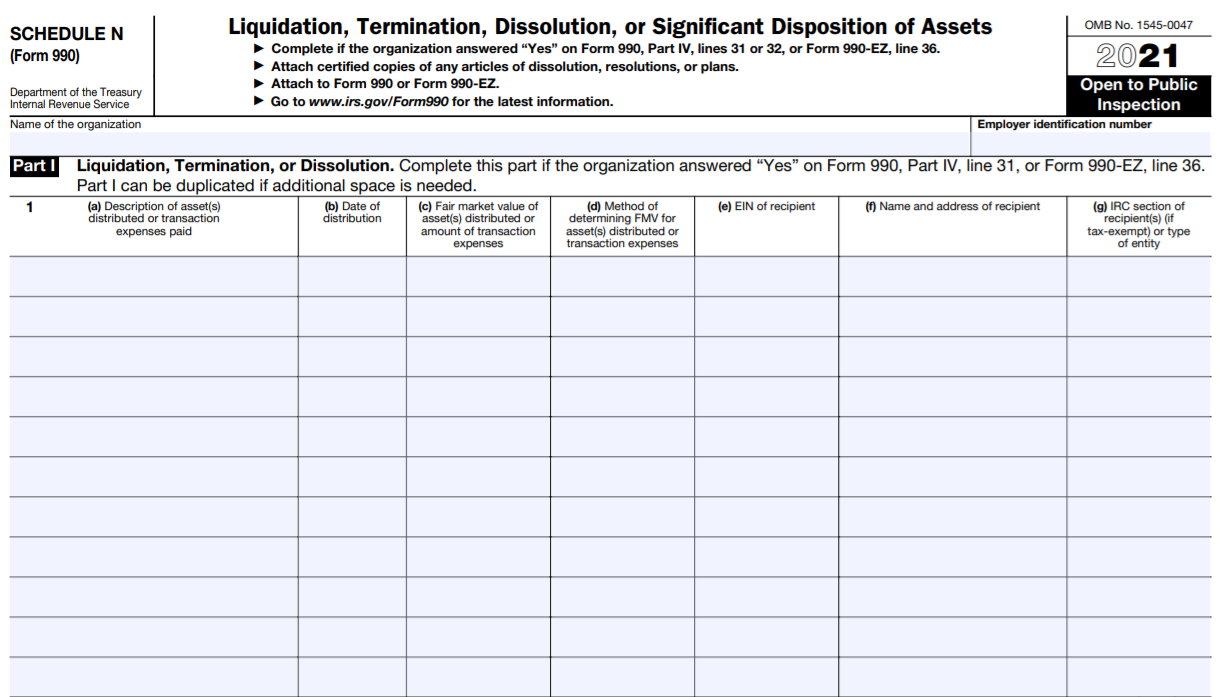

IRS Form 990/990EZ Schedule N Instructions Liquidation, Termination

However, the 2019 instructions are contradictory on this point because the specific instructions for line 1a of part vii continue to tell filers to list persons by order of position. Complete parts viii, ix, and x of form 990. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on.

Part VIII Statement of Revenue Form 990 Dustin K MacDonald

However, the 2019 instructions are contradictory on this point because the specific instructions for line 1a of part vii continue to tell filers to list persons by order of position. Web form 990, part vii, section a instructions say to list persons in a particular order, beginning with trustees or directors, followed by officers, then key employees, then highest compensated.

Editable IRS Instructions 990PF 2018 2019 Create A Digital Sample

Department of the treasury internal revenue service. Return of organization exempt from income tax. Web rather, the 2019 form 990 instructions now tell filers to list persons in part vii from highest to lowest compensation. Web part vii, section a of the form 990 requires an organization to list officers, directors, key employees and other highly compensated employees who exceed.

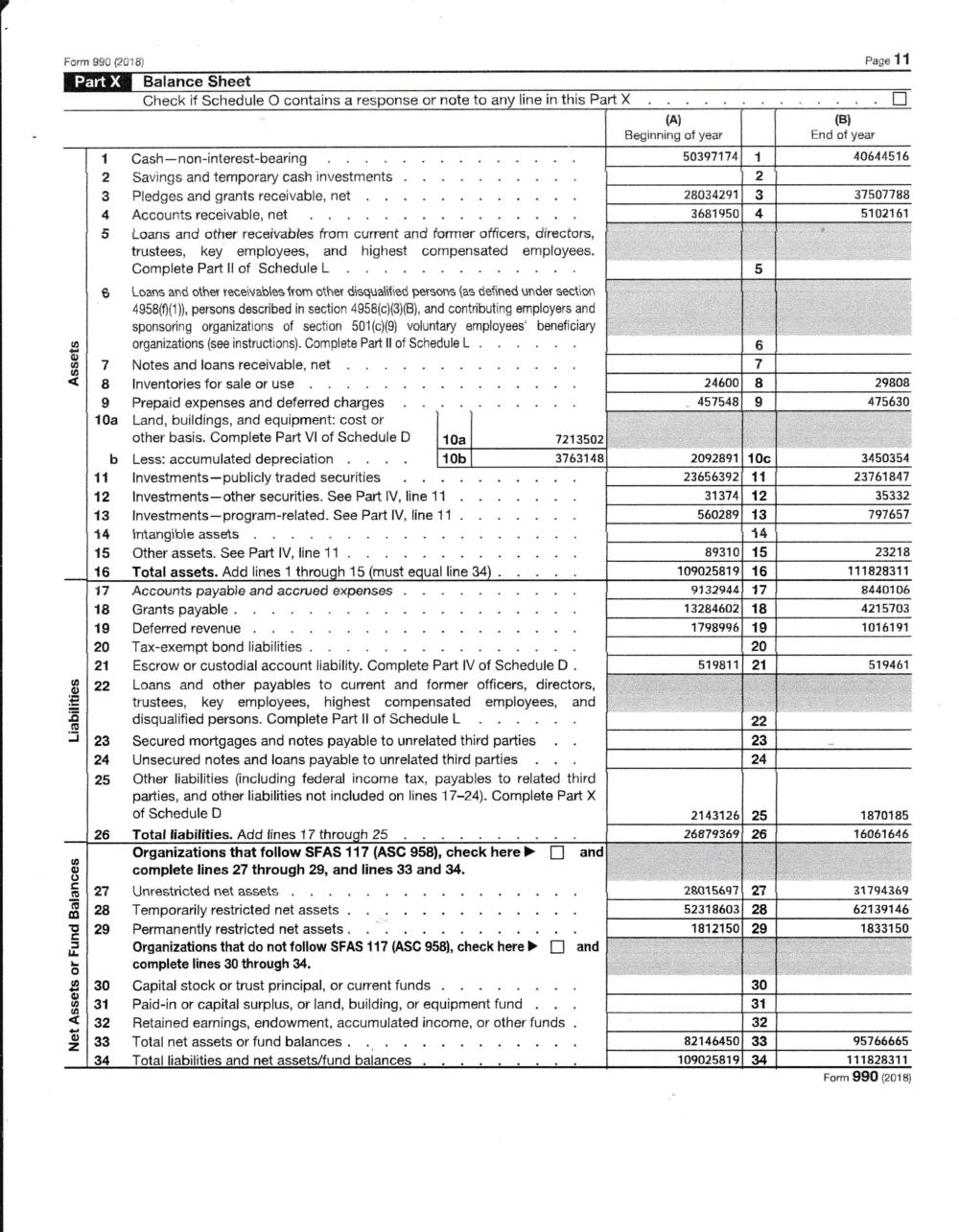

Use 2015 Form 990 and the 2016 annual report for

Department of the treasury internal revenue service. Do not list any individuals in schedule j, part ii, that aren't listed on form 990, part vii, section a. Web part vii, section a of the form 990 requires an organization to list officers, directors, key employees and other highly compensated employees who exceed certain thresholds, as described below. Web the 2020.

Do Not List Any Individuals In Schedule J, Part Ii, That Aren't Listed On Form 990, Part Vii, Section A.

Web part vii, section a of the form 990 requires an organization to list officers, directors, key employees and other highly compensated employees who exceed certain thresholds, as described below. The key to completing this section depends on the organization’s understanding of how the irs defines each of these. Web all current key employees listed on form 990, part vii, section a, must also be reported on schedule j, part ii, because their reportable compensation, by definition, exceeds $150,000. Web the 2020 form 990 instructions explain that ppp loans may be reported as contributions from a government unit in the year the loans are forgiven for purposes of the revenue statement (part viii, line 1e) and public support calculations (schedule a, parts ii and iii).

Web Form 990, Part Vii, Section A Instructions Say To List Persons In A Particular Order, Beginning With Trustees Or Directors, Followed By Officers, Then Key Employees, Then Highest Compensated Employees, Then Former Such Persons.

Complete item g in the heading section of form 990, on page 1. Web rather, the 2019 form 990 instructions now tell filers to list persons in part vii from highest to lowest compensation. Return of organization exempt from income tax. But first, who are considered officers, directors, key employees and highly compensated employees?

Complete Parts Iii, V, Vii, Xi, And Xii Of Form 990.

Web determine the organization's officers, directors, trustees, key employees, and five highest compensated employees required to be listed on form 990, part vii, section a. Complete parts viii, ix, and x of form 990. Web form 990, part vii requires the listing of the organization’s current or former officers, directors, trustees, key employees, and highest compensated employees, and current independent contractors, and reporting of certain compensation information relating to such persons. Department of the treasury internal revenue service.

Under Section 501(C), 527, Or 4947(A)(1) Of The Internal Revenue Code (Except Private Foundations) Do Not Enter Social Security Numbers On This Form As It May Be Made Public.

However, the 2019 instructions are contradictory on this point because the specific instructions for line 1a of part vii continue to tell filers to list persons by order of position.