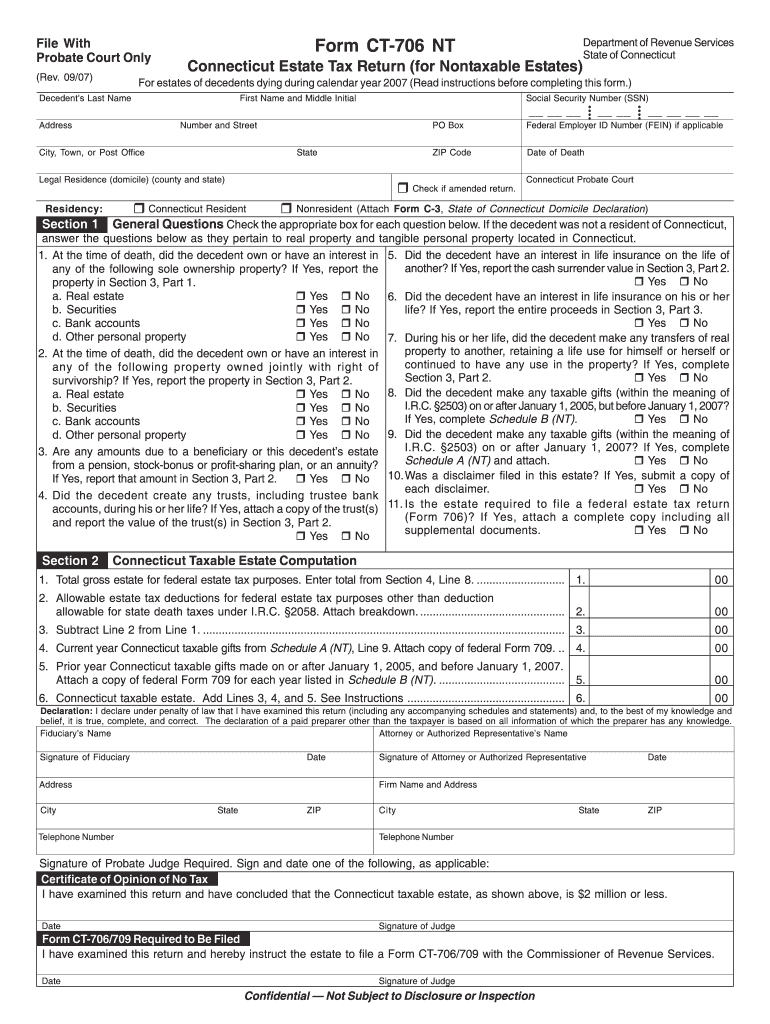

Form Ct 706 Nt

Form Ct 706 Nt - Connecticut estate tax return (for nontaxable estates) for estates of decedents dying during calendar year 2022 (read instructions before completing this. Connecticut estate tax return (for nontaxable estates) for estates of decedents dying during calendar year 2017 (read instructions before completing this. Tips on how to complete the get and sign ct 706. This form is due today. Application for certificate releasing connecticut estate tax lien for estates of decedents dying on or after january 1, 2005: Web the following tips can help you fill in ct 706 nt instructions easily and quickly: Any reference to probate court means the connecticut probate court. We were told bythe probate judge that all accounts that were joint that they did. 2021 application for estate and gift tax return filing extension and for estate tax. Web in order for form ct‑706 nt to be considered a complete return copies of the following documents must be attached:

Estates which must file with the. Tips on how to complete the get and sign ct 706. A pro forma federal form 709 or form 706, completed as if federal tax law allowed a marital deduction to civil union partners or spouses in a marriage. Application for certificate releasing connecticut estate tax lien for estates of decedents dying on or after january 1, 2005: Web in order for form ct‑706 nt to be considered a complete return copies of the following documents must be attached: • for each decedent who, at the time of death, was a nonresident. • each decedent who, at the time of death, was a connecticut resident; Connecticut estate tax return (for nontaxable estates) for estates of decedents dying during calendar year 2017 (read instructions before completing this. Connecticut estate tax return (for nontaxable estates) for estates of decedents dying during calendar year 2022 (read instructions before completing this. If there is more than one fiduciary,.

Web in order for form ct‑706 nt to be considered a complete return copies of the following documents must be attached: Connecticut estate tax return (for nontaxable estates) for estates of decedents dying during calendar year 2022 (read instructions before completing this. I have it all set but i have a couple of concerns. Connecticut estate tax return (for nontaxable estates) for estates of decedents dying during calendar year 2017 (read instructions before completing this. Tips on how to complete the get and sign ct 706. • for each decedent who, at the time of death, was a nonresident. 2021 application for estate and gift tax return filing extension and for estate tax. A pro forma federal form 709 or form 706, completed as if federal tax law allowed a marital deduction to civil union partners or spouses in a marriage. We were told bythe probate judge that all accounts that were joint that they did. • each decedent who, at the time of death, was a connecticut resident;

Form 706NA Edit, Fill, Sign Online Handypdf

• recorded deed for any real property. Connecticut estate tax return (for nontaxable estates) for estates of decedents dying during calendar year 2017 (read instructions before completing this. This form is due today. Application for certificate releasing connecticut estate tax lien for estates of decedents dying on or after january 1, 2005: Web in order for form ct‑706 nt to.

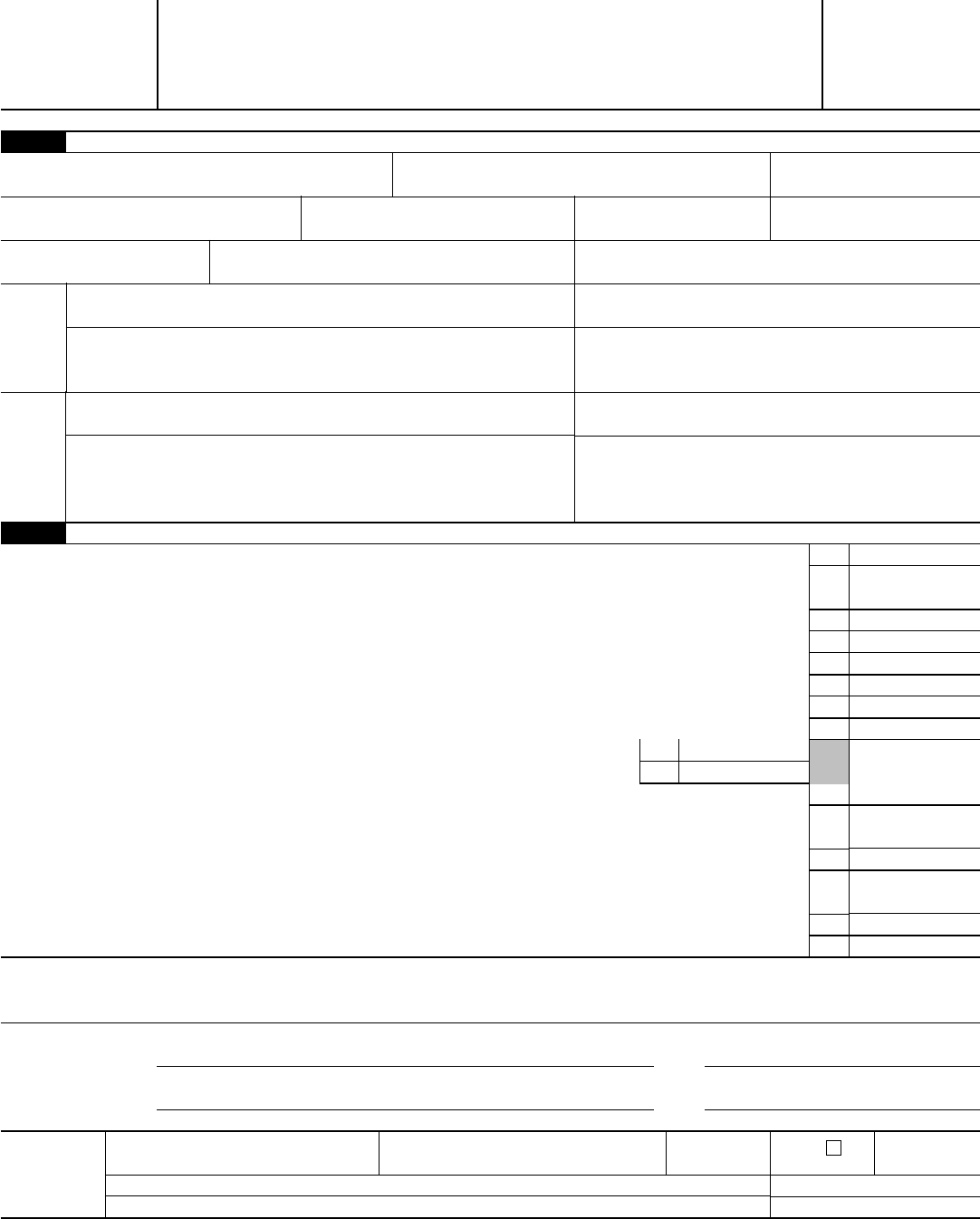

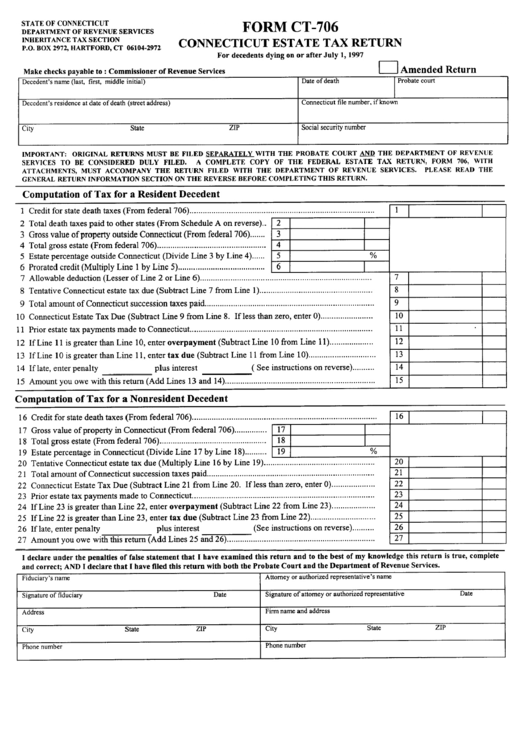

Fillable Form Ct706 Connecticut Estate Tax Return printable pdf download

Estates which must file with the. Connecticut estate tax return (for nontaxable estates) for estates of decedents dying during calendar year 2017 (read instructions before completing this. This form is due today. We were told bythe probate judge that all accounts that were joint that they did. Tips on how to complete the get and sign ct 706.

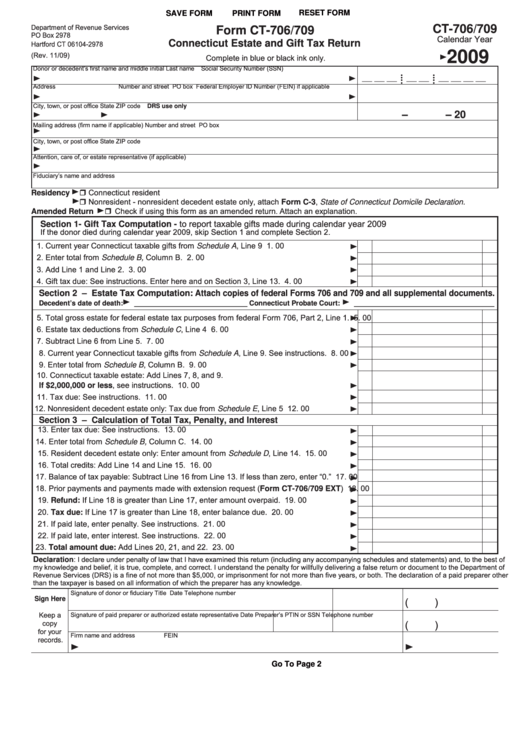

CT CT706/709 Instructions 2020 Fill out Tax Template Online US

If there is more than one fiduciary,. Web in order for form ct‑706 nt to be considered a complete return copies of the following documents must be attached: 2021 application for estate and gift tax return filing extension and for estate tax. • recorded deed for any real property. Connecticut estate tax return (for nontaxable estates) for estates of decedents.

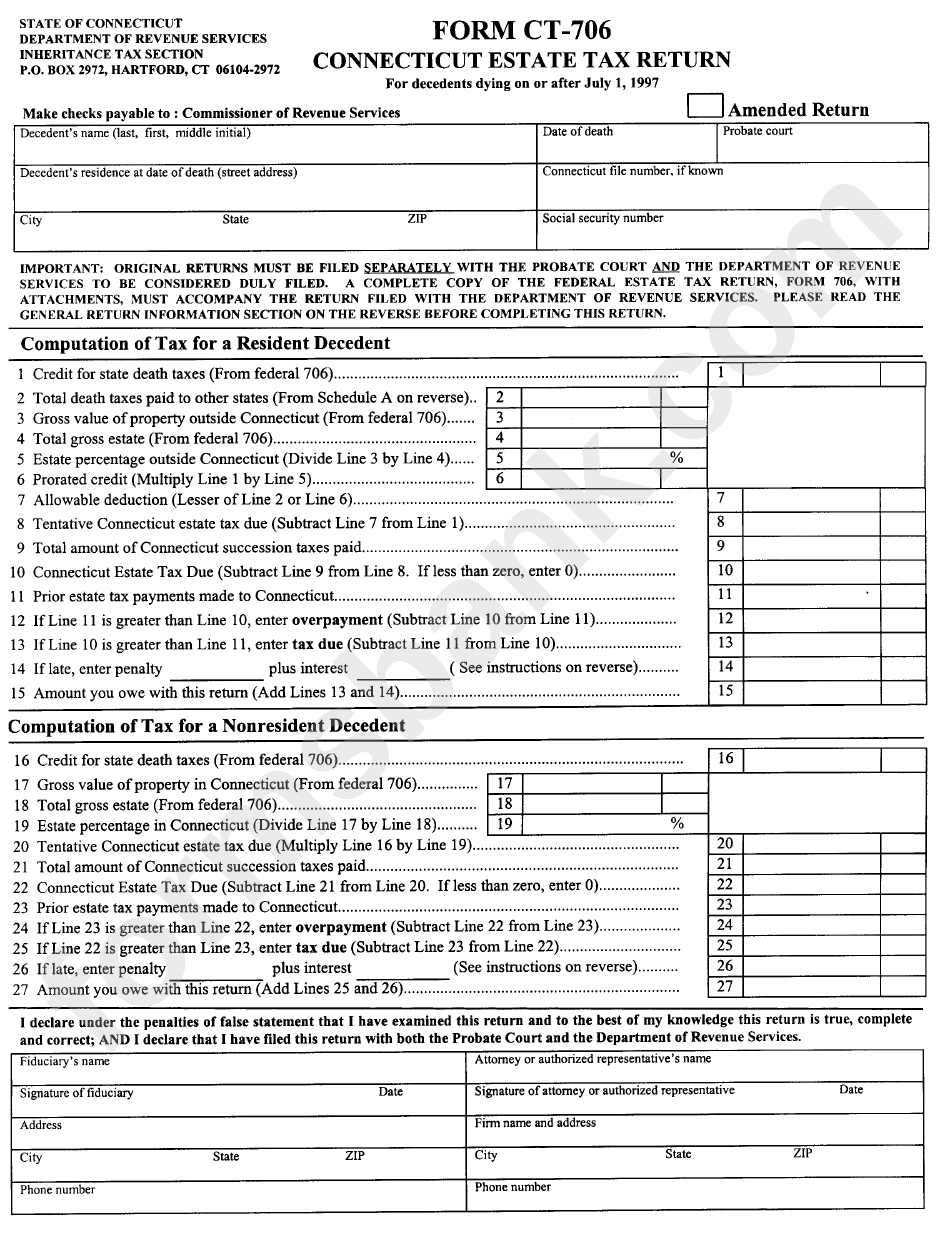

Fillable Form Ct706/709 Ext Application For Estate And Gift Tax

Tips on how to complete the get and sign ct 706. Web in order for form ct‑706 nt to be considered a complete return copies of the following documents must be attached: Application for certificate releasing connecticut estate tax lien for estates of decedents dying on or after january 1, 2005: I have it all set but i have a.

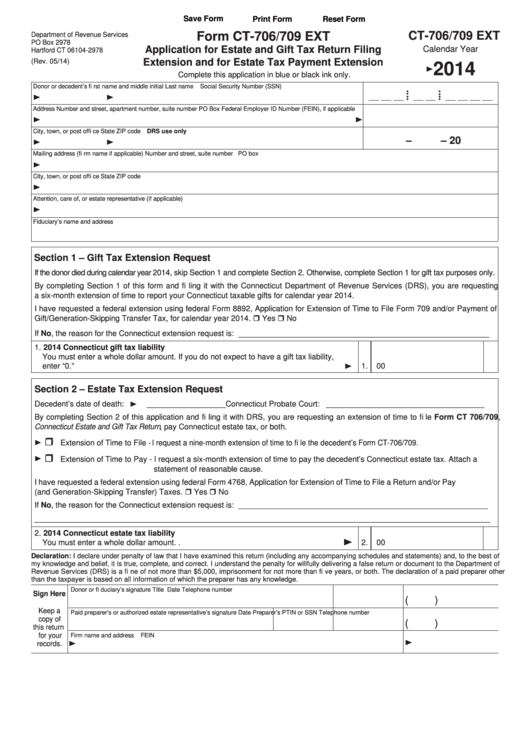

Form Ct706 Nt Ext Application For Extension Of Time For Filing Form

Tips on how to complete the get and sign ct 706. 2021 application for estate and gift tax return filing extension and for estate tax. • for each decedent who, at the time of death, was a nonresident. If there is more than one fiduciary,. This form is due today.

Fillable Form Ct706 Connecticut Estate Tax Return printable pdf download

Web the following tips can help you fill in ct 706 nt instructions easily and quickly: • recorded deed for any real property. Any reference to probate court means the connecticut probate court. A pro forma federal form 709 or form 706, completed as if federal tax law allowed a marital deduction to civil union partners or spouses in a.

Ct 706 Nt 20202021 Fill and Sign Printable Template Online US

Connecticut estate tax return (for nontaxable estates) for estates of decedents dying during calendar year 2017 (read instructions before completing this. I have it all set but i have a couple of concerns. Estates which must file with the. Application for certificate releasing connecticut estate tax lien for estates of decedents dying on or after january 1, 2005: • each.

Fillable Form Ct706/709 Connecticut Estate And Gift Tax Return

• for each decedent who, at the time of death, was a nonresident. • recorded deed for any real property. We were told bythe probate judge that all accounts that were joint that they did. This form is due today. 2021 application for estate and gift tax return filing extension and for estate tax.

2007 Form CT DRS CT706 NT Fill Online, Printable, Fillable, Blank

We were told bythe probate judge that all accounts that were joint that they did. 2021 application for estate and gift tax return filing extension and for estate tax. Any reference to probate court means the connecticut probate court. Application for certificate releasing connecticut estate tax lien for estates of decedents dying on or after january 1, 2005: This form.

1825 Ct Tax Forms And Templates free to download in PDF

Web the following tips can help you fill in ct 706 nt instructions easily and quickly: 2021 application for estate and gift tax return filing extension and for estate tax. If there is more than one fiduciary,. • each decedent who, at the time of death, was a connecticut resident; Tips on how to complete the get and sign ct.

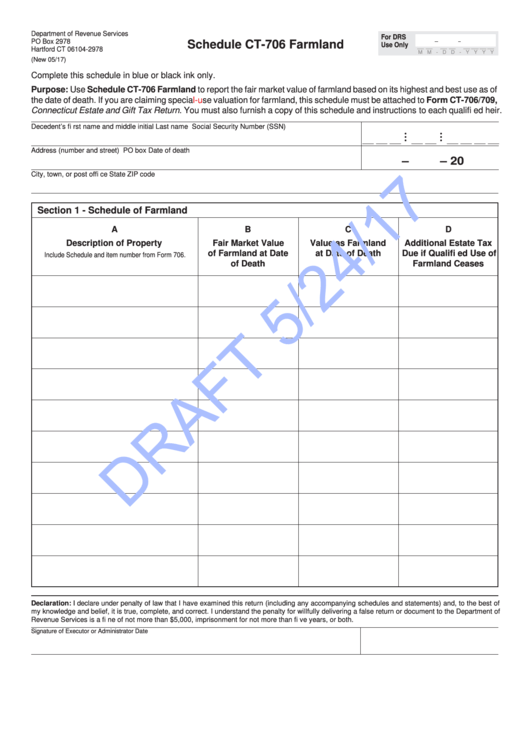

2021 Application For Estate And Gift Tax Return Filing Extension And For Estate Tax.

Web in order for form ct‑706 nt to be considered a complete return copies of the following documents must be attached: Connecticut estate tax return (for nontaxable estates) for estates of decedents dying during calendar year 2017 (read instructions before completing this. Any reference to probate court means the connecticut probate court. Application for certificate releasing connecticut estate tax lien for estates of decedents dying on or after january 1, 2005:

I Have It All Set But I Have A Couple Of Concerns.

• recorded deed for any real property. Estates which must file with the. This form is due today. • each decedent who, at the time of death, was a connecticut resident;

A Pro Forma Federal Form 709 Or Form 706, Completed As If Federal Tax Law Allowed A Marital Deduction To Civil Union Partners Or Spouses In A Marriage.

We were told bythe probate judge that all accounts that were joint that they did. Tips on how to complete the get and sign ct 706. Connecticut estate tax return (for nontaxable estates) for estates of decedents dying during calendar year 2022 (read instructions before completing this. Web the following tips can help you fill in ct 706 nt instructions easily and quickly:

If There Is More Than One Fiduciary,.

• for each decedent who, at the time of death, was a nonresident.