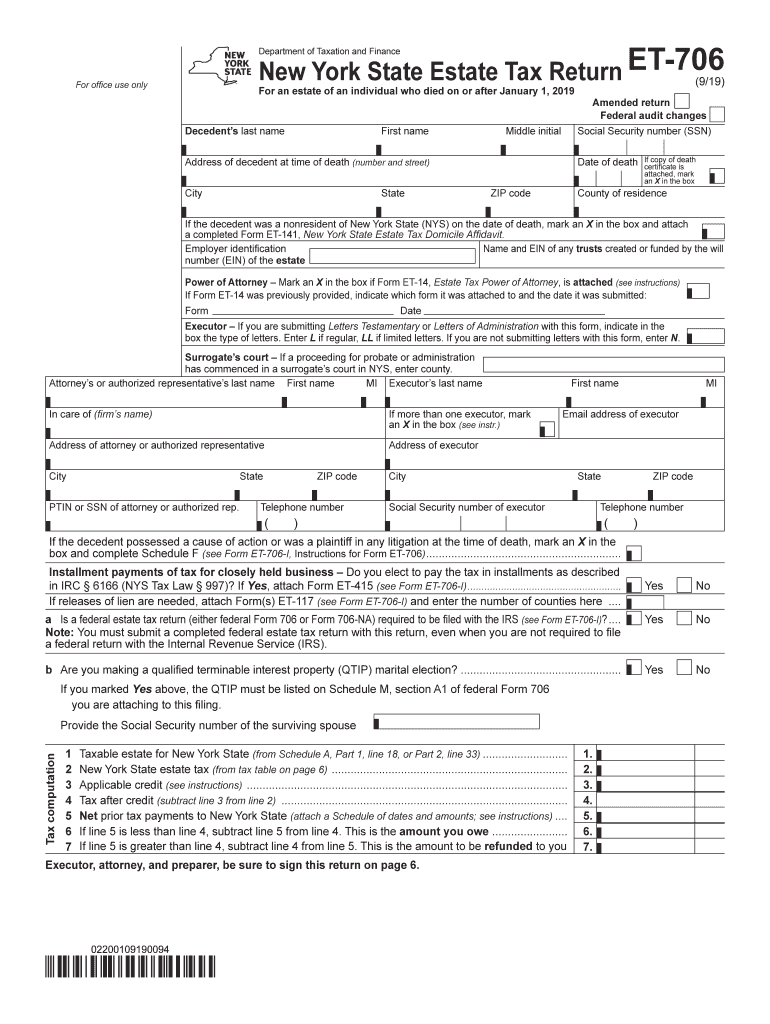

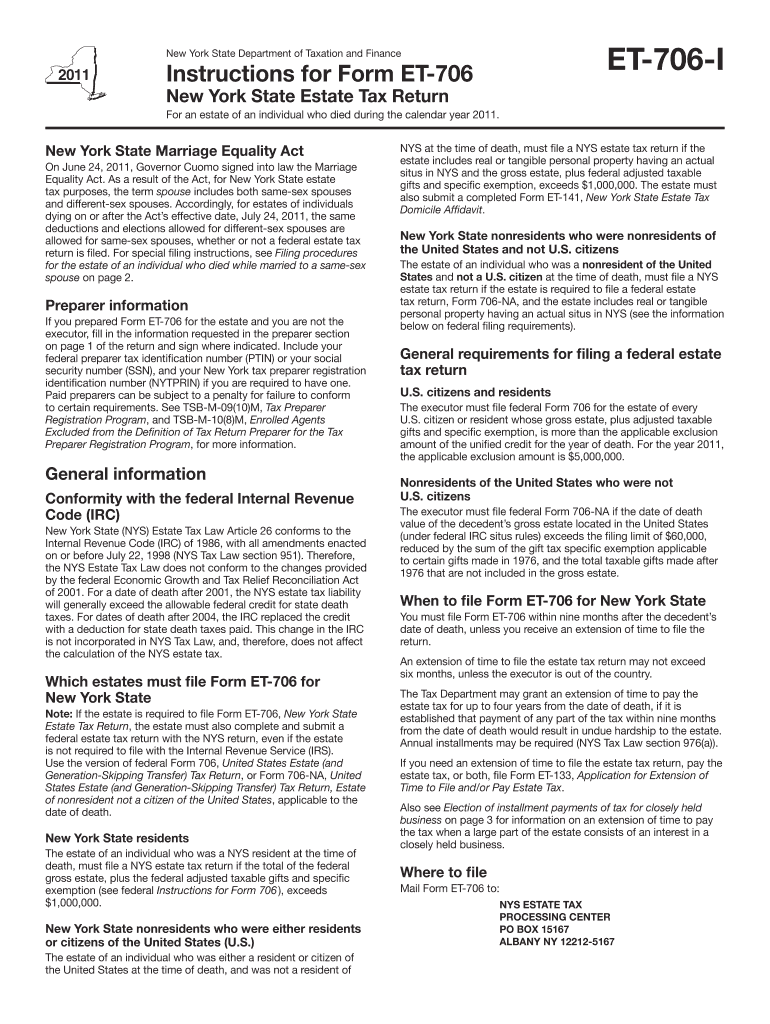

Form Et 706

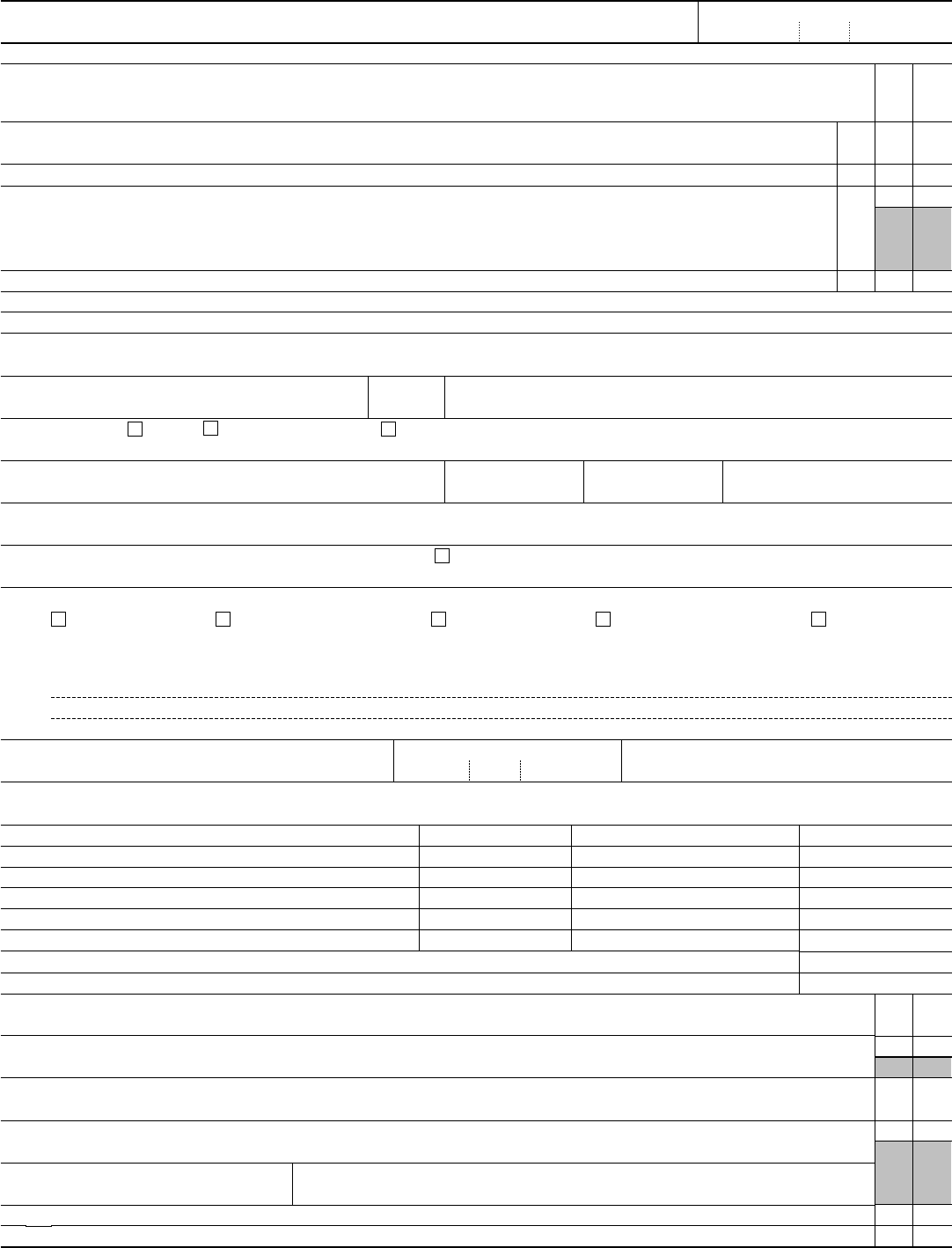

Form Et 706 - If copy of death certificate is attached, mark an x in the box name and ein of any trusts created or funded by the will If copy of death certificate is attached, mark an x in the box name and ein of any trusts created or funded by the will If you are unable to file form 706 by the due date, you may receive an extension of time to file. Web estate tax return to determine the correct new york state estate tax. Web you must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. Web general information chapter 60 of the laws of 2016 (part y) amended the new york estate tax to provide that charitable contributions and charitable activities may not be used in any manner to determine where an individual was domiciled at the time of his or her death. Web form 706 is used by an executor of an estate to calculate the amount of tax owed on estates valued at more than $12.06 million if the decedent died in 2022 ($12.92 million in 2023). If you downloaded this form before that date, note the following: You must submit a completed federal estate tax return with this return, even when you are not required to file with the federal internal revenue service.

If you downloaded this form before that date, note the following: If copy of death certificate is attached, mark an x in the box name and ein of any trusts created or funded by the will If copy of death certificate is attached, mark an x in the box name and ein of any trusts created or funded by the will Web form 706 is used by an executor of an estate to calculate the amount of tax owed on estates valued at more than $12.06 million if the decedent died in 2022 ($12.92 million in 2023). If you are unable to file form 706 by the due date, you may receive an extension of time to file. You must submit a completed federal estate tax return with this return, even when you are not required to file with the federal internal revenue service. Web general information chapter 60 of the laws of 2016 (part y) amended the new york estate tax to provide that charitable contributions and charitable activities may not be used in any manner to determine where an individual was domiciled at the time of his or her death. Web you must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. Web estate tax return to determine the correct new york state estate tax.

Web estate tax return to determine the correct new york state estate tax. Web form 706 is used by an executor of an estate to calculate the amount of tax owed on estates valued at more than $12.06 million if the decedent died in 2022 ($12.92 million in 2023). If you are unable to file form 706 by the due date, you may receive an extension of time to file. You must submit a completed federal estate tax return with this return, even when you are not required to file with the federal internal revenue service. Web you must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. If you downloaded this form before that date, note the following: If copy of death certificate is attached, mark an x in the box name and ein of any trusts created or funded by the will If copy of death certificate is attached, mark an x in the box name and ein of any trusts created or funded by the will Web general information chapter 60 of the laws of 2016 (part y) amended the new york estate tax to provide that charitable contributions and charitable activities may not be used in any manner to determine where an individual was domiciled at the time of his or her death.

20192022 Form NY DTF ET706 Fill Online, Printable, Fillable, Blank

You must submit a completed federal estate tax return with this return, even when you are not required to file with the federal internal revenue service. If copy of death certificate is attached, mark an x in the box name and ein of any trusts created or funded by the will Web estate tax return to determine the correct new.

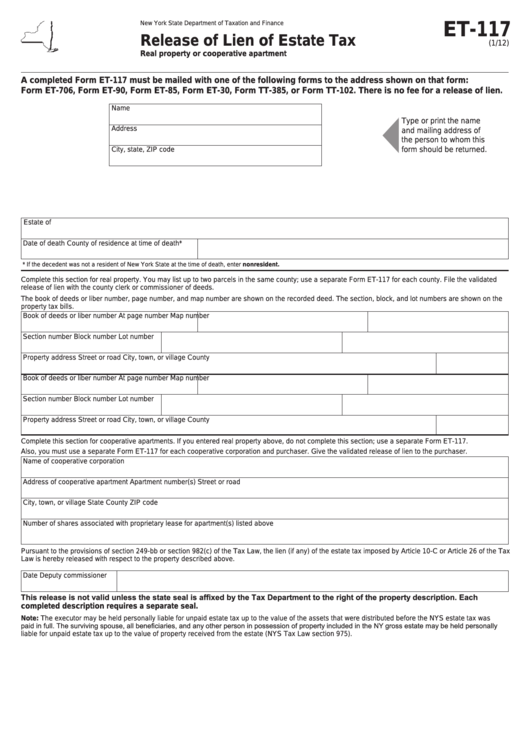

Form Et117 Release Of Lien Of Estate Tax printable pdf download

Web estate tax return to determine the correct new york state estate tax. If copy of death certificate is attached, mark an x in the box name and ein of any trusts created or funded by the will If you are unable to file form 706 by the due date, you may receive an extension of time to file. You.

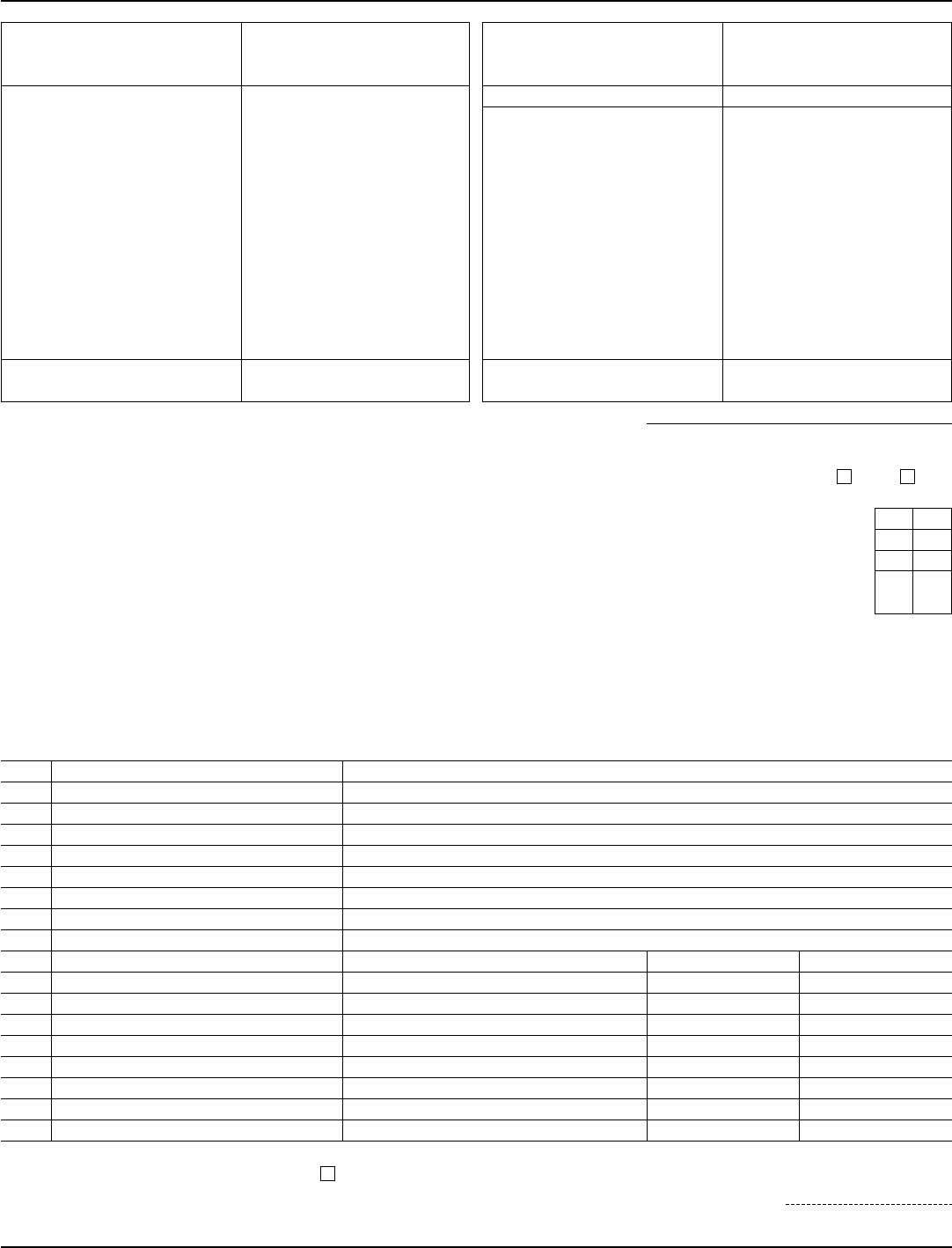

Form 706 Edit, Fill, Sign Online Handypdf

Web estate tax return to determine the correct new york state estate tax. Web general information chapter 60 of the laws of 2016 (part y) amended the new york estate tax to provide that charitable contributions and charitable activities may not be used in any manner to determine where an individual was domiciled at the time of his or her.

Form 706 Fillable Tax Return Templates in PDF

If copy of death certificate is attached, mark an x in the box name and ein of any trusts created or funded by the will Web general information chapter 60 of the laws of 2016 (part y) amended the new york estate tax to provide that charitable contributions and charitable activities may not be used in any manner to determine.

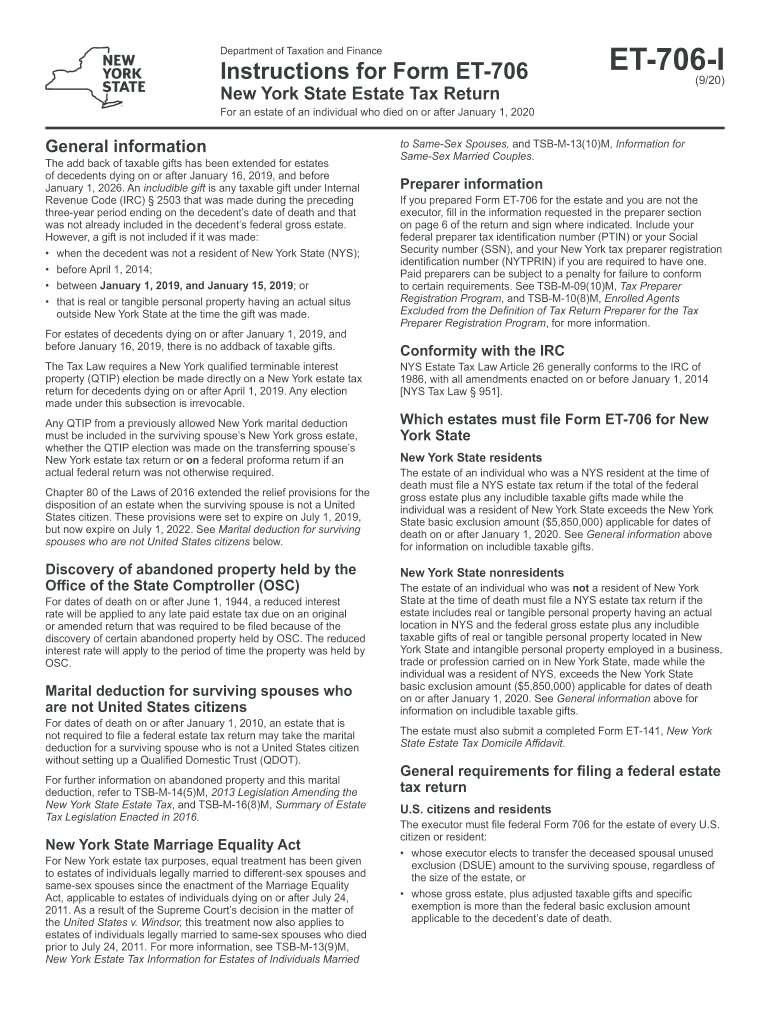

Et 706 Fill Out and Sign Printable PDF Template signNow

Web general information chapter 60 of the laws of 2016 (part y) amended the new york estate tax to provide that charitable contributions and charitable activities may not be used in any manner to determine where an individual was domiciled at the time of his or her death. If copy of death certificate is attached, mark an x in the.

Form 706 Na Instructions

Web general information chapter 60 of the laws of 2016 (part y) amended the new york estate tax to provide that charitable contributions and charitable activities may not be used in any manner to determine where an individual was domiciled at the time of his or her death. Web estate tax return to determine the correct new york state estate.

Et 706 Fill Out and Sign Printable PDF Template signNow

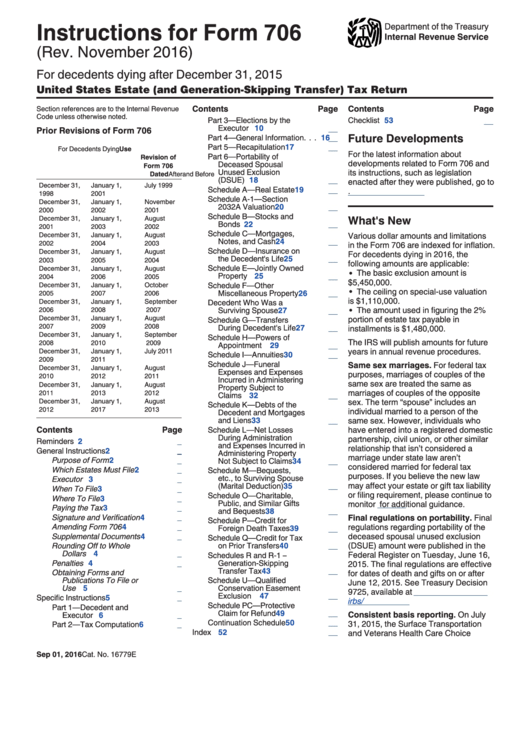

Web you must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. Web estate tax return to determine the correct new york state estate tax. If you are unable to file form 706 by the due date, you may receive an extension of time to file. If you downloaded this.

Instructions For Form 706 2016 printable pdf download

You must submit a completed federal estate tax return with this return, even when you are not required to file with the federal internal revenue service. If you are unable to file form 706 by the due date, you may receive an extension of time to file. If copy of death certificate is attached, mark an x in the box.

Form 706 Edit, Fill, Sign Online Handypdf

Web you must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. If copy of death certificate is attached, mark an x in the box name and ein of any trusts created or funded by the will You must submit a completed federal estate tax return with this return, even.

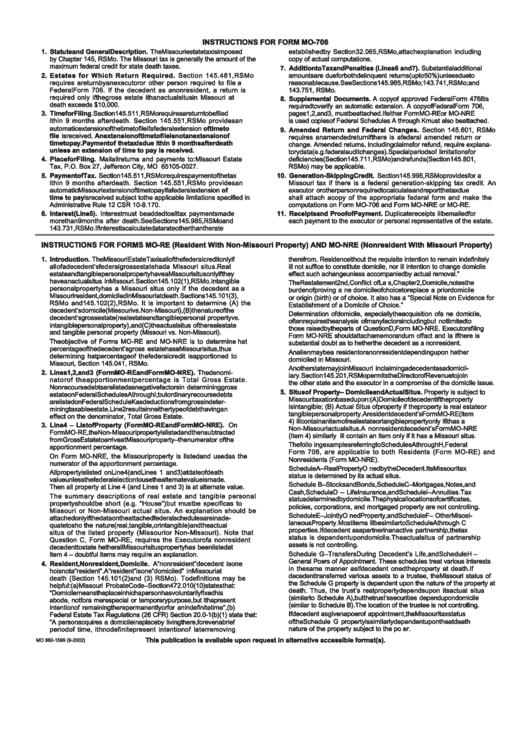

Instructions For Form Mo706 printable pdf download

You must submit a completed federal estate tax return with this return, even when you are not required to file with the federal internal revenue service. Web you must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. If copy of death certificate is attached, mark an x in the.

Web Form 706 Is Used By An Executor Of An Estate To Calculate The Amount Of Tax Owed On Estates Valued At More Than $12.06 Million If The Decedent Died In 2022 ($12.92 Million In 2023).

If you downloaded this form before that date, note the following: If copy of death certificate is attached, mark an x in the box name and ein of any trusts created or funded by the will Web you must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. Web estate tax return to determine the correct new york state estate tax.

If You Are Unable To File Form 706 By The Due Date, You May Receive An Extension Of Time To File.

Web general information chapter 60 of the laws of 2016 (part y) amended the new york estate tax to provide that charitable contributions and charitable activities may not be used in any manner to determine where an individual was domiciled at the time of his or her death. If copy of death certificate is attached, mark an x in the box name and ein of any trusts created or funded by the will You must submit a completed federal estate tax return with this return, even when you are not required to file with the federal internal revenue service.