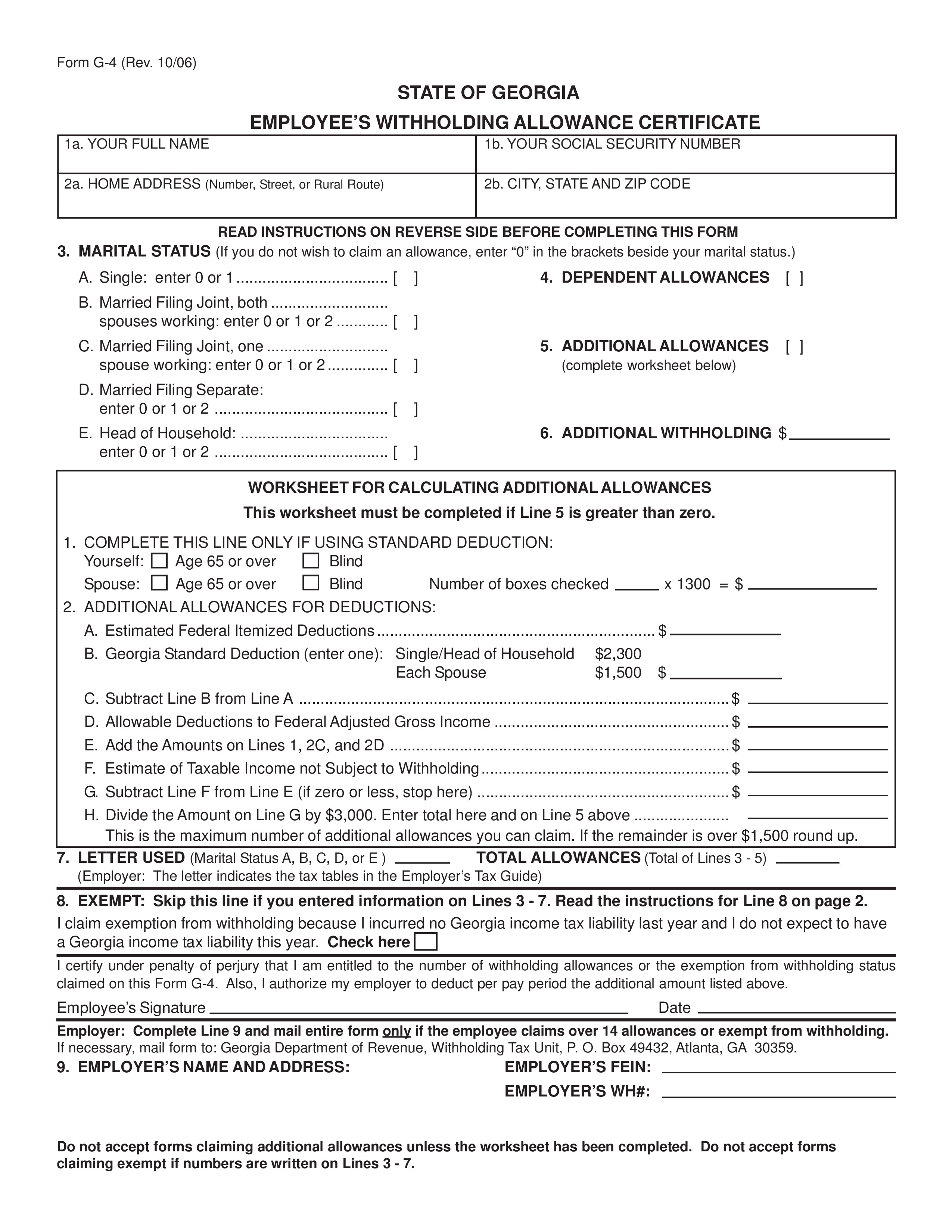

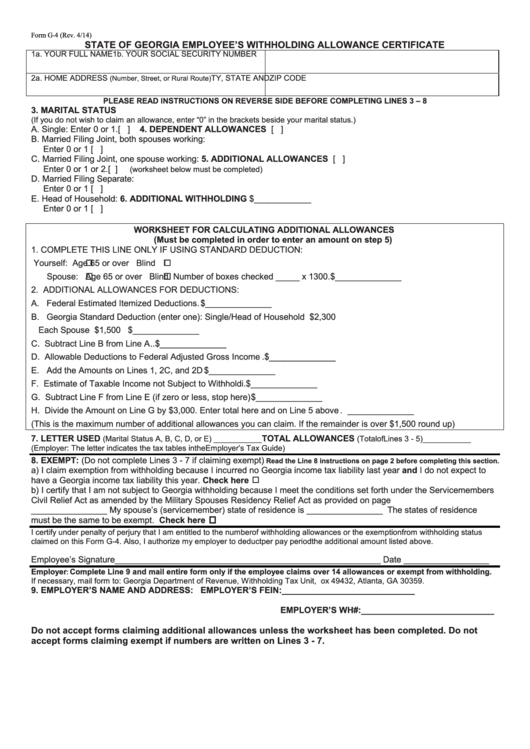

Form G-4

Form G-4 - The forms will be effective with the first paycheck. Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages. Ad access millions of ebooks, audiobooks, podcasts, and more. By correctly completing this form, you can adjust the amount of tax withheld to meet your tax liability. Use this form to tell payers whether to withhold income tax and on what basis. By correctly completing this form, you can adjust the amount of tax withheld to meet your tax liability. Try scribd free for 30 days. With scribd, you can take your ebooks and audibooks anywhere, even offline.

By correctly completing this form, you can adjust the amount of tax withheld to meet your tax liability. Ad access millions of ebooks, audiobooks, podcasts, and more. The forms will be effective with the first paycheck. Try scribd free for 30 days. By correctly completing this form, you can adjust the amount of tax withheld to meet your tax liability. Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages. With scribd, you can take your ebooks and audibooks anywhere, even offline. Use this form to tell payers whether to withhold income tax and on what basis.

By correctly completing this form, you can adjust the amount of tax withheld to meet your tax liability. Ad access millions of ebooks, audiobooks, podcasts, and more. Use this form to tell payers whether to withhold income tax and on what basis. Try scribd free for 30 days. The forms will be effective with the first paycheck. Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages. By correctly completing this form, you can adjust the amount of tax withheld to meet your tax liability. With scribd, you can take your ebooks and audibooks anywhere, even offline.

Saving PDF as JPG for zoom.it, Camtasia, Articulate, LMS course Geesh

Ad access millions of ebooks, audiobooks, podcasts, and more. Try scribd free for 30 days. Use this form to tell payers whether to withhold income tax and on what basis. The forms will be effective with the first paycheck. With scribd, you can take your ebooks and audibooks anywhere, even offline.

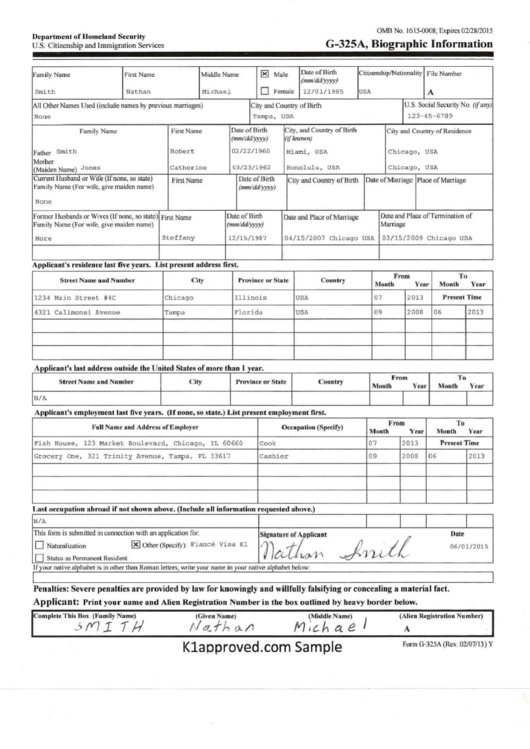

Form G325a Biographic Information printable pdf download

By correctly completing this form, you can adjust the amount of tax withheld to meet your tax liability. The forms will be effective with the first paycheck. By correctly completing this form, you can adjust the amount of tax withheld to meet your tax liability. Ad access millions of ebooks, audiobooks, podcasts, and more. Form (g4) is to be completed.

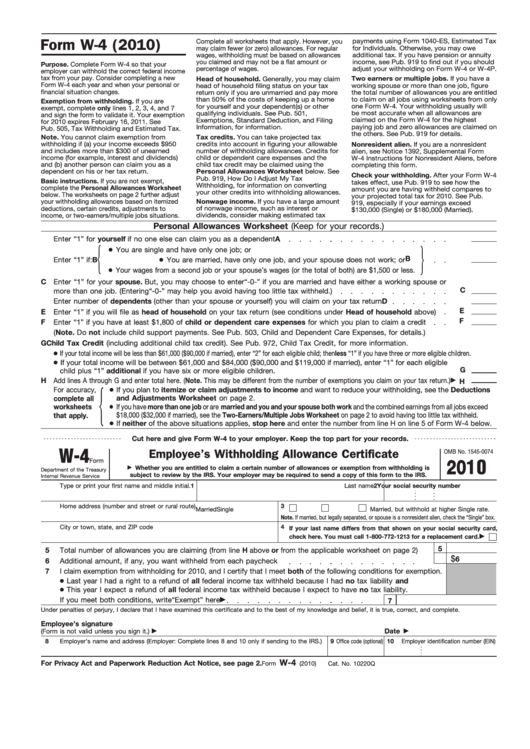

Form W4 Employee'S Withholding Allowance Certificate 2010, Form G

By correctly completing this form, you can adjust the amount of tax withheld to meet your tax liability. Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages. With scribd, you can take your ebooks and audibooks anywhere, even offline. Use this form to tell payers whether to withhold income.

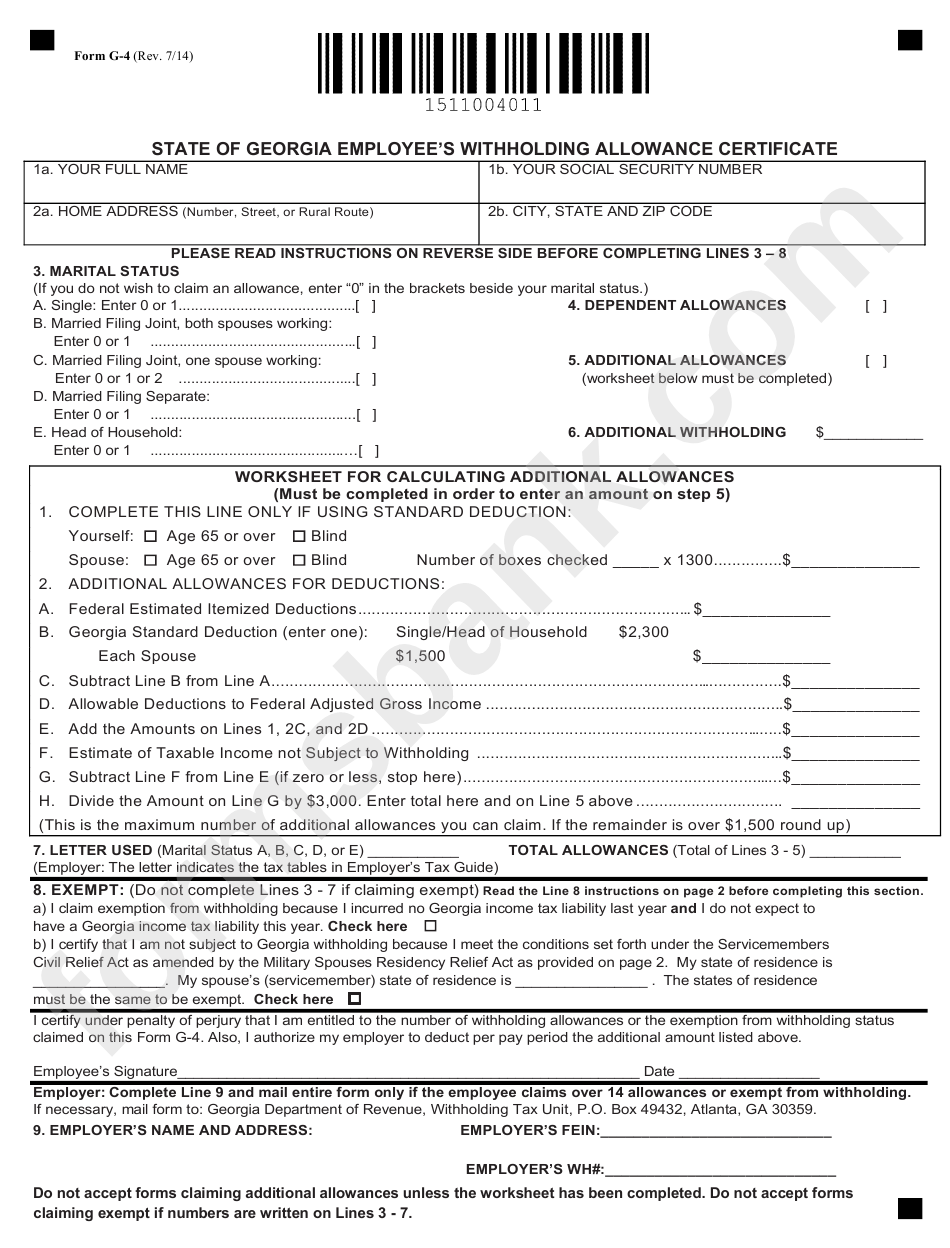

Form G4 State Of Employee'S Withholding Allowance

Use this form to tell payers whether to withhold income tax and on what basis. With scribd, you can take your ebooks and audibooks anywhere, even offline. By correctly completing this form, you can adjust the amount of tax withheld to meet your tax liability. Form (g4) is to be completed and submitted to your employer in order to have.

Form G28 YouTube

Try scribd free for 30 days. Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages. By correctly completing this form, you can adjust the amount of tax withheld to meet your tax liability. By correctly completing this form, you can adjust the amount of tax withheld to meet your.

WFR State Fixes 2022 Resourcing Edge

Use this form to tell payers whether to withhold income tax and on what basis. Ad access millions of ebooks, audiobooks, podcasts, and more. With scribd, you can take your ebooks and audibooks anywhere, even offline. By correctly completing this form, you can adjust the amount of tax withheld to meet your tax liability. Try scribd free for 30 days.

Fillable Form G4 State Of Employee'S Withholding Allowance

Use this form to tell payers whether to withhold income tax and on what basis. Try scribd free for 30 days. With scribd, you can take your ebooks and audibooks anywhere, even offline. The forms will be effective with the first paycheck. Ad access millions of ebooks, audiobooks, podcasts, and more.

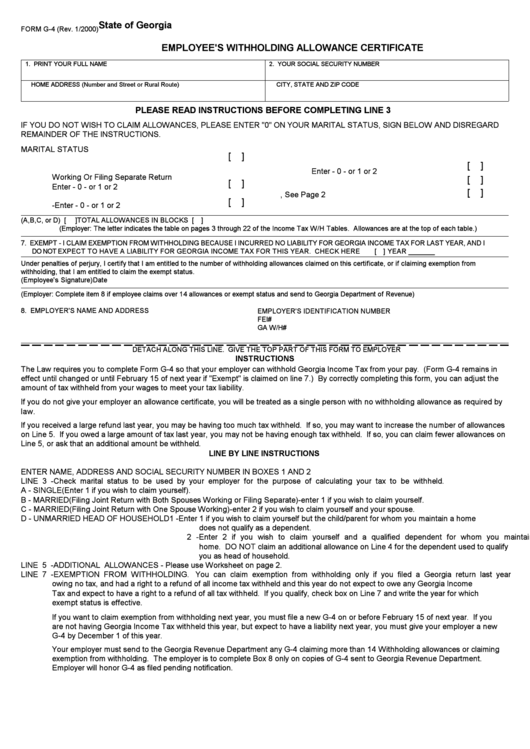

Download Form G4 for Free Page 2 FormTemplate

By correctly completing this form, you can adjust the amount of tax withheld to meet your tax liability. Use this form to tell payers whether to withhold income tax and on what basis. The forms will be effective with the first paycheck. Try scribd free for 30 days. By correctly completing this form, you can adjust the amount of tax.

Form G4 Employee'S Withholding Allowance Certificate January 2000

Use this form to tell payers whether to withhold income tax and on what basis. By correctly completing this form, you can adjust the amount of tax withheld to meet your tax liability. By correctly completing this form, you can adjust the amount of tax withheld to meet your tax liability. Form (g4) is to be completed and submitted to.

G4 App

By correctly completing this form, you can adjust the amount of tax withheld to meet your tax liability. Ad access millions of ebooks, audiobooks, podcasts, and more. Use this form to tell payers whether to withhold income tax and on what basis. With scribd, you can take your ebooks and audibooks anywhere, even offline. The forms will be effective with.

Ad Access Millions Of Ebooks, Audiobooks, Podcasts, And More.

By correctly completing this form, you can adjust the amount of tax withheld to meet your tax liability. By correctly completing this form, you can adjust the amount of tax withheld to meet your tax liability. Try scribd free for 30 days. With scribd, you can take your ebooks and audibooks anywhere, even offline.

The Forms Will Be Effective With The First Paycheck.

Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages. Use this form to tell payers whether to withhold income tax and on what basis.