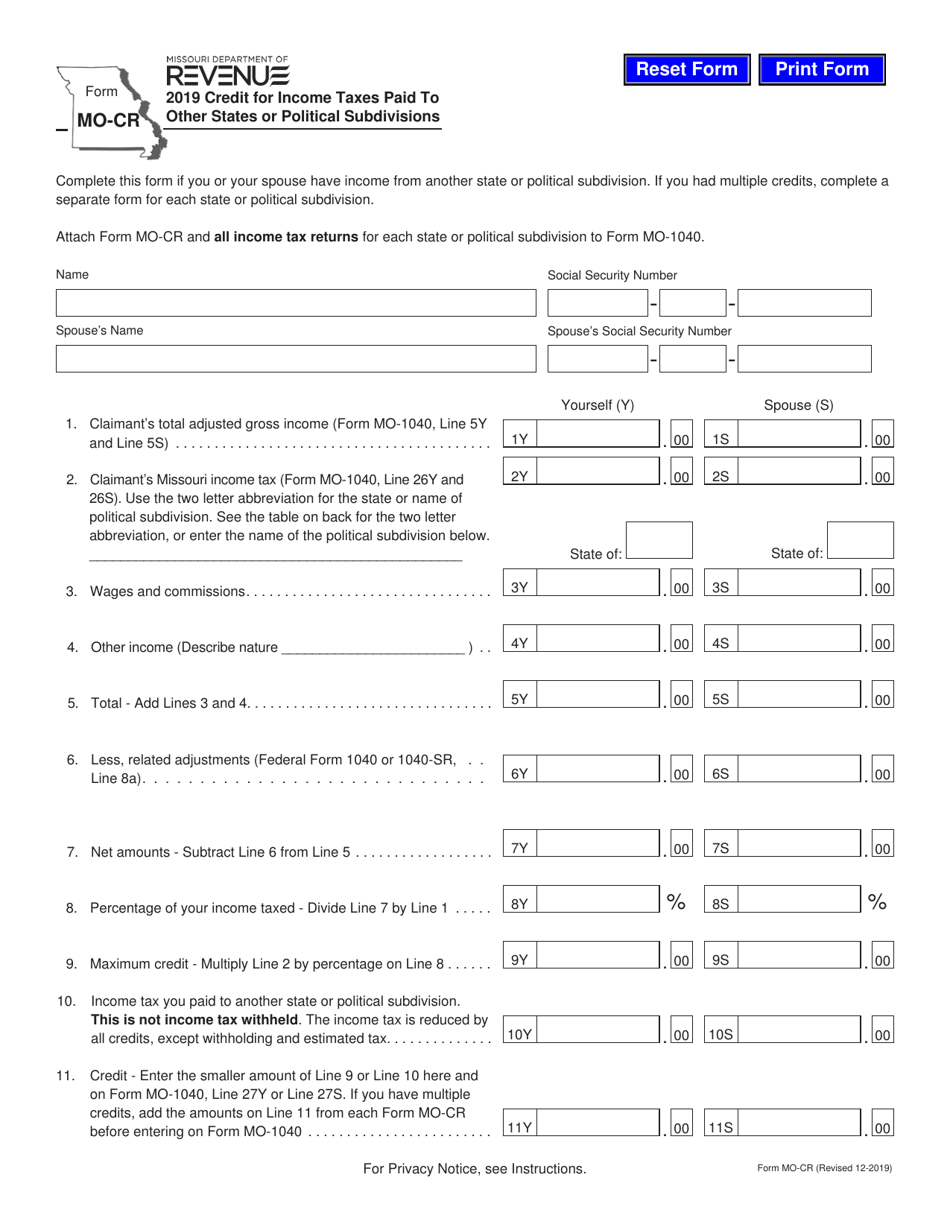

Form Mo Cr

Form Mo Cr - Click state, then click missouri under the expanded state menu. This form may be used by a resident individual, resident estate or resident trust. This form is for income earned in tax year 2022, with tax returns due in april. Web complete this form if you or your spouse have income from another state or political subdivision. Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. Complete this form if you or your spouse have income from another state or political subdivision. From within your taxact return ( online or desktop), click state, then click. Compute the missouri resident credit as follows: If you had multiple credits, complete a separate form for each state or. Click other credits to expand the category, then click taxes paid to other state credit.

Complete this form if you or your spouse have income from another. Yes no did you live in another state for part of the year?. Web complete this form if you or your spouse have income from another state or political subdivision. Compute the missouri resident credit as follows: Complete this form if you or your spouse have income from another state or political subdivision. This form is for income earned in tax year 2022, with tax returns due in april. If you had multiple credits, complete a. This form may be used by a resident individual, resident estate or resident trust. Web attach a copy of your federal extension (federal form 4868) with your missouri income tax return when you file. Click on the state q&a tab, then click missouri directly below the blue tabs;

This form is for income earned in tax year 2022, with tax returns due in april. Web 15 rows driver license forms and manuals find your form to search, type a keyword. If you had multiple credits, complete a separate form for each state or. This form may be used by a resident individual, resident estate or resident trust. From within your taxact return ( online or desktop), click state, then click. Yes no did you live in another state for part of the year?. Compute the missouri resident credit as follows: Click state, then click missouri under the expanded state menu. Click other credits to expand the category, then click taxes paid to other. Click other credits to expand the category, then click taxes paid to other state credit.

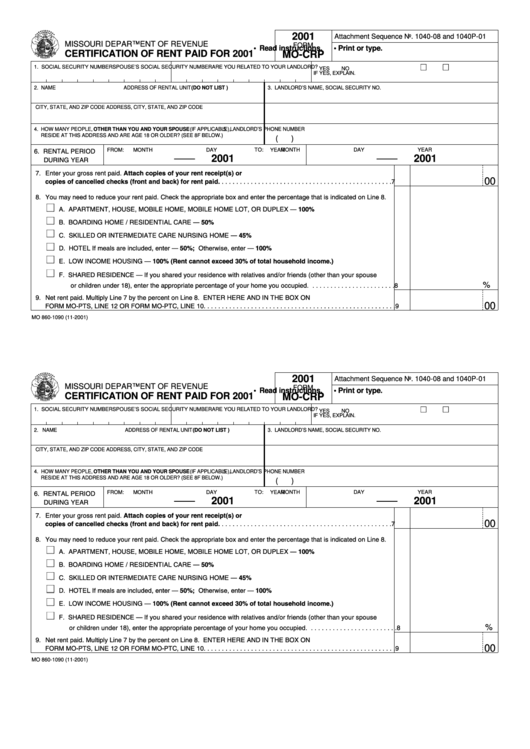

Form MoCrp Certification Of Rent Paid For 2001 printable pdf download

Yes no did you live in another state for part of the year?. If you had multiple credits, complete a separate form for each state or. This form is for income earned in tax year 2022, with tax returns due in april. Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. This form may be used by.

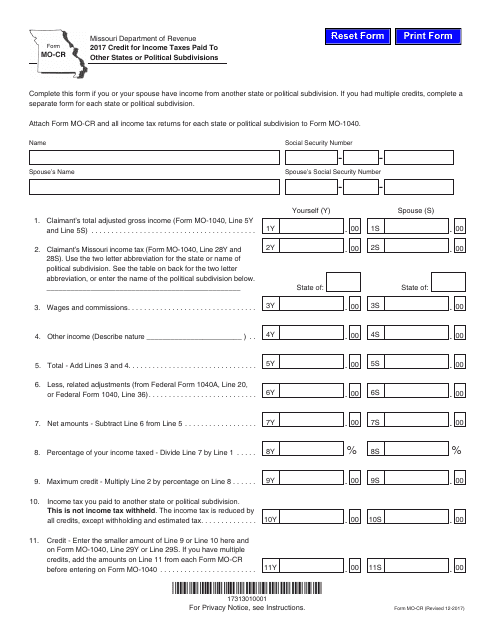

Form MOCR Download Fillable PDF or Fill Online Credit for Taxes

Click other credits to expand the category, then click taxes paid to other. Compute the missouri resident credit as follows: Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. Web complete this form if you or your spouse have income from another state or political subdivision. If you had multiple credits, complete a separate form for each.

MolybdenumonChromium Dual Coating on Steel

Complete this form if you or your spouse have income from another. Click state, then click missouri under the expanded state menu. Web complete this form if you or your spouse have income from another state or political subdivision. Compute the missouri resident credit as follows: Web complete this form if you or your spouse have income from another state.

Form Mo1120S 2015 SCorporation Tax Return Edit, Fill, Sign

Click other credits to expand the category, then click taxes paid to other state credit. Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. If you had multiple credits, complete a. Complete this form if you or your spouse have income from another. Yes no did you live in another state for part of the year?.

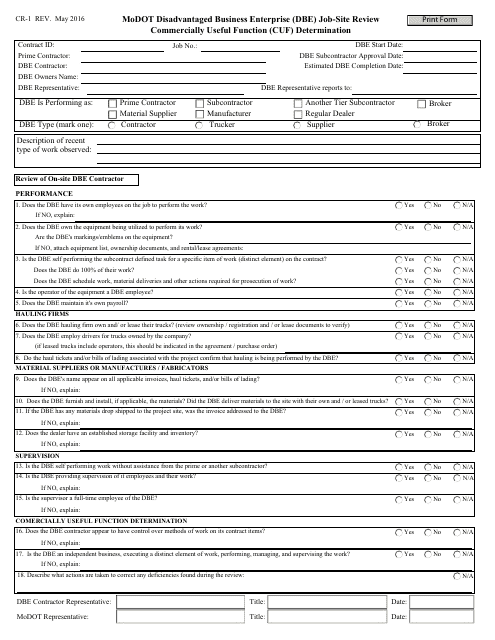

Form CR1 Download Fillable PDF or Fill Online Modot Disadvantaged

Compute the missouri resident credit as follows: Click other credits to expand the category, then click taxes paid to other. Web attach a copy of your federal extension (federal form 4868) with your missouri income tax return when you file. Click on the state q&a tab, then click missouri directly below the blue tabs; Web complete this form if you.

MO MOCRP 2020 Fill out Tax Template Online US Legal Forms

Click state, then click missouri under the expanded state menu. If you had multiple credits, complete a. Yes no did you live in another state for part of the year?. If you had multiple credits, complete a separate form for each state or. Web complete this form if you or your spouse have income from another state or political subdivision.

Form MOCR Download Fillable PDF or Fill Online Credit for Taxes

Web complete this form if you or your spouse have income from another state or political subdivision. Click other credits to expand the category, then click taxes paid to other state credit. If you had multiple credits, complete a. Web 15 rows driver license forms and manuals find your form to search, type a keyword. This form may be used.

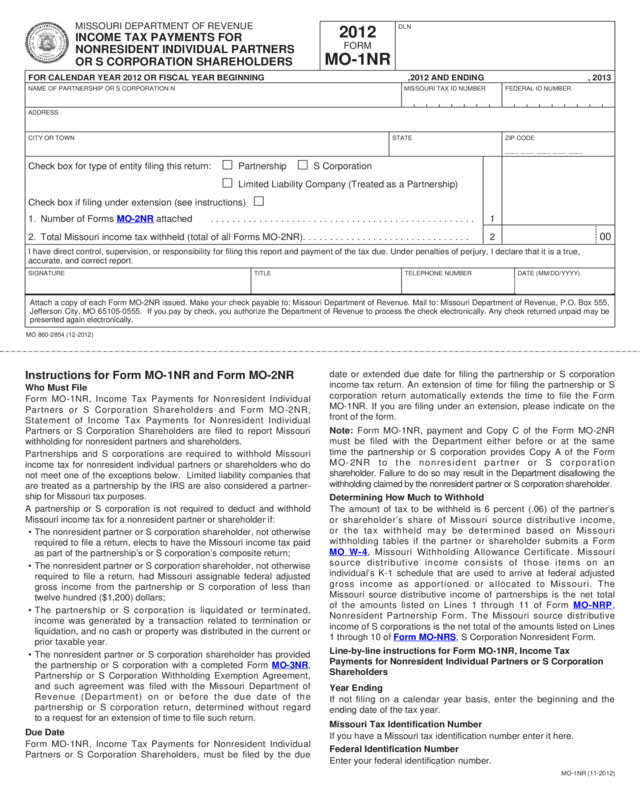

Form Mo1Nr Tax Payments For Nonresident Individual Partners

Yes no did you live in another state for part of the year?. Click on the state q&a tab, then click missouri directly below the blue tabs; Compute the missouri resident credit as follows: Complete this form if you or your spouse have income from another. Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64.

20152020 Form MO MO941 Fill Online, Printable, Fillable, Blank

Click on the state q&a tab, then click missouri directly below the blue tabs; Web missouri department of insurance Web attach a copy of your federal extension (federal form 4868) with your missouri income tax return when you file. If you had multiple credits, complete a. Complete this form if you or your spouse have income from another.

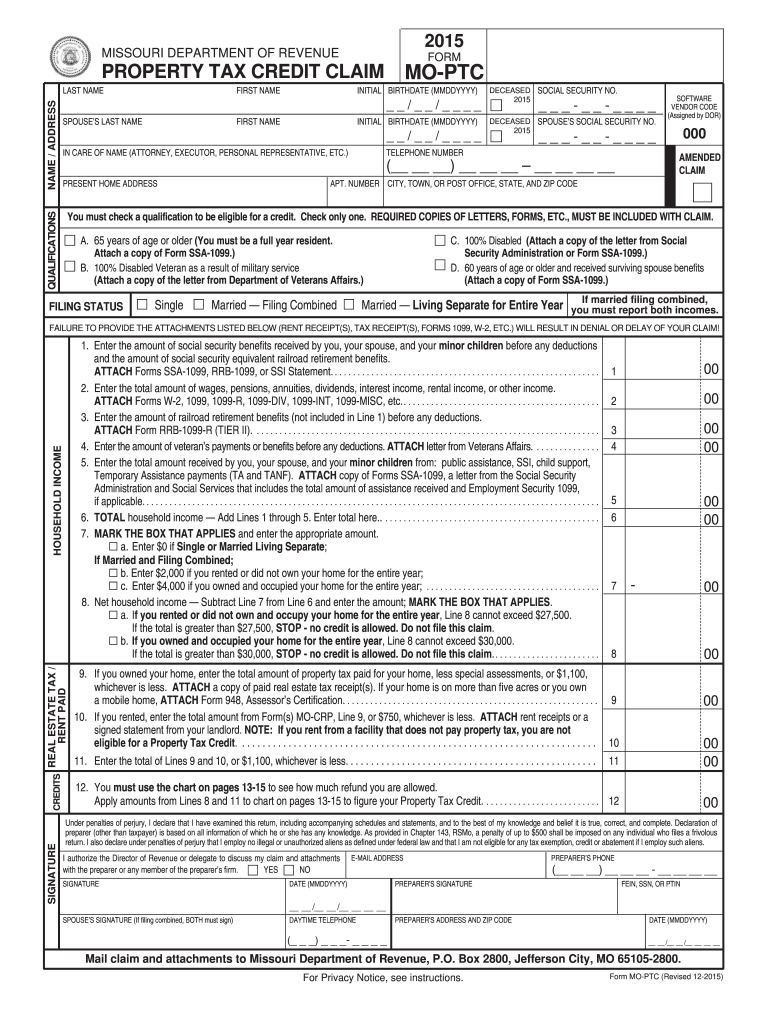

2015 Form MO MOPTC Fill Online, Printable, Fillable, Blank pdfFiller

Web complete this form if you or your spouse have income from another state or political subdivision. If you had multiple credits, complete a. Click state, then click missouri under the expanded state menu. Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. If you had multiple credits, complete a separate form for each state or.

If You Had Multiple Credits, Complete A.

Web 15 rows driver license forms and manuals find your form to search, type a keyword. Click other credits to expand the category, then click taxes paid to other. Web complete this form if you or your spouse have income from another state or political subdivision. Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April.

Compute the missouri resident credit as follows: If you had multiple credits, complete a separate form for each state or. Click state, then click missouri under the expanded state menu. This form may be used by a resident individual, resident estate or resident trust.

Yes No Did You Live In Another State For Part Of The Year?.

Complete this form if you or your spouse have income from another state or political subdivision. Click other credits to expand the category, then click taxes paid to other state credit. Web attach a copy of your federal extension (federal form 4868) with your missouri income tax return when you file. Web complete this form if you or your spouse have income from another state or political subdivision.

Web Missouri Department Of Insurance

Complete this form if you or your spouse have income from another. If you had multiple credits, complete a separate form for each state or. From within your taxact return ( online or desktop), click state, then click. Click on the state q&a tab, then click missouri directly below the blue tabs;