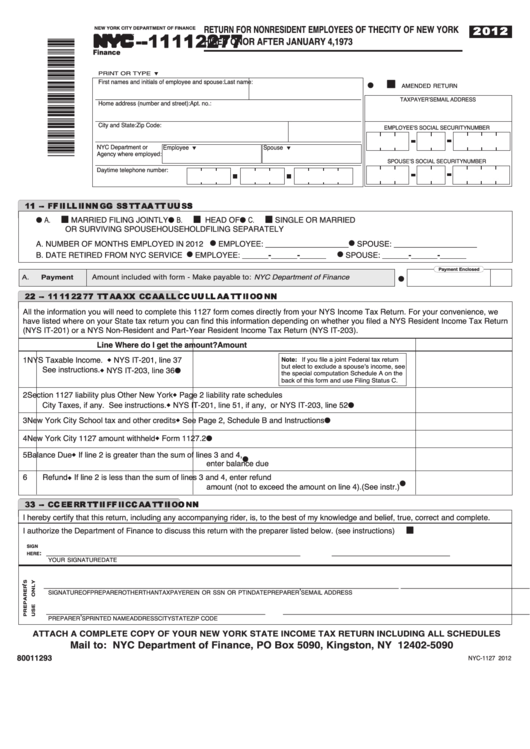

Form Nyc 1127

Form Nyc 1127 - Create legally binding electronic signatures on any device. Shouldn't it be reported on line 5 as a local income tax? You can get the form online or by mail. Today, most americans prefer to do their own income taxes and, in fact, to fill in forms in electronic format. An 1127 in most return. Web ment of a particular york city employees a nonresident of the city (the five your employer, you would have to file tax year must an 1127 return. Then, you get to go to st new york city individual. If you manage to master that i'll let you know the hoops you have to jump through to efile a ny amended return. It contains information on the income and expenses of the owner, as well as details about tenants who occupy any part of your building or land. The nyc 1127 form is a detailed document that all property owners must fill out.

The nyc 1127 form is a detailed document that all property owners must fill out. Web any new york city employee who was a nonresident of the city (the five nyc boroughs) during any part of a particular tax year must file an 1127 return. Web ment of a particular york city employees a nonresident of the city (the five your employer, you would have to file tax year must an 1127 return. An 1127 in most return. It contains information on the income and expenses of the owner, as well as details about tenants who occupy any part of your building or land. If you manage to master that i'll let you know the hoops you have to jump through to efile a ny amended return. Today, most americans prefer to do their own income taxes and, in fact, to fill in forms in electronic format. Web apply to new york state or new york city personal income tax. Shouldn't it be reported on line 5 as a local income tax? Section 1127 of the new york city charter does not apply to you if you work for the department of education, city university of new york, district attorneys offices, or new york city housing authority.

Today, most americans prefer to do their own income taxes and, in fact, to fill in forms in electronic format. Shouldn't it be reported on line 5 as a local income tax? Create legally binding electronic signatures on any device. Change of residence if you were a resident of the city of new york during part of 2022 and a nonresident subject to the provisions of section 1127 of the new york city charter during all or part of the remainder of 2022, you must Web apply to new york state or new york city personal income tax. Web any new york city employee who was a nonresident of the city (the five nyc boroughs) during any part of a particular tax year must file an 1127 return. If you manage to master that i'll let you know the hoops you have to jump through to efile a ny amended return. Web follow the simple instructions below: The nyc 1127 form is a detailed document that all property owners must fill out. Web to find the 1127 you have to go into st new york individual.

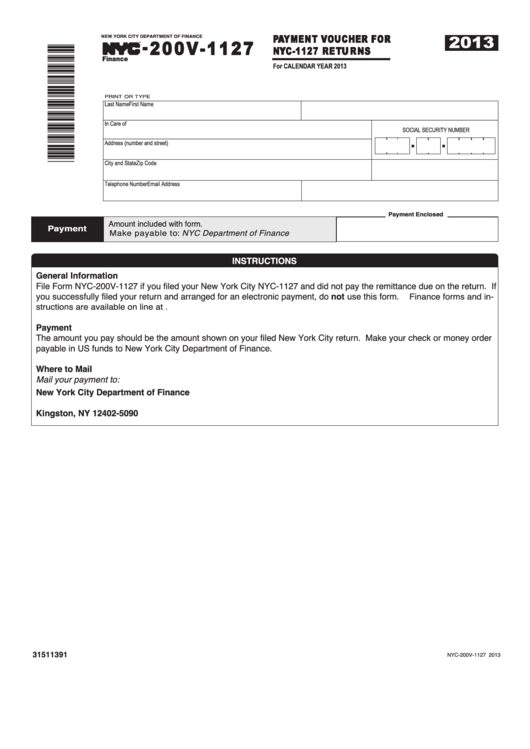

Form Nyc200v1127 Payment Voucher For Nyc1127 Returns 2013

Web to find the 1127 you have to go into st new york individual. Web ment of a particular york city employees a nonresident of the city (the five your employer, you would have to file tax year must an 1127 return. If you manage to master that i'll let you know the hoops you have to jump through to.

Tax Refund Tax Refund Nys Status

The nyc 1127 form is a detailed document that all property owners must fill out. Create legally binding electronic signatures on any device. Now it will take at most thirty minutes, and you can do it from any place. Web apply to new york state or new york city personal income tax. In most cases, if you received an 1127.2.

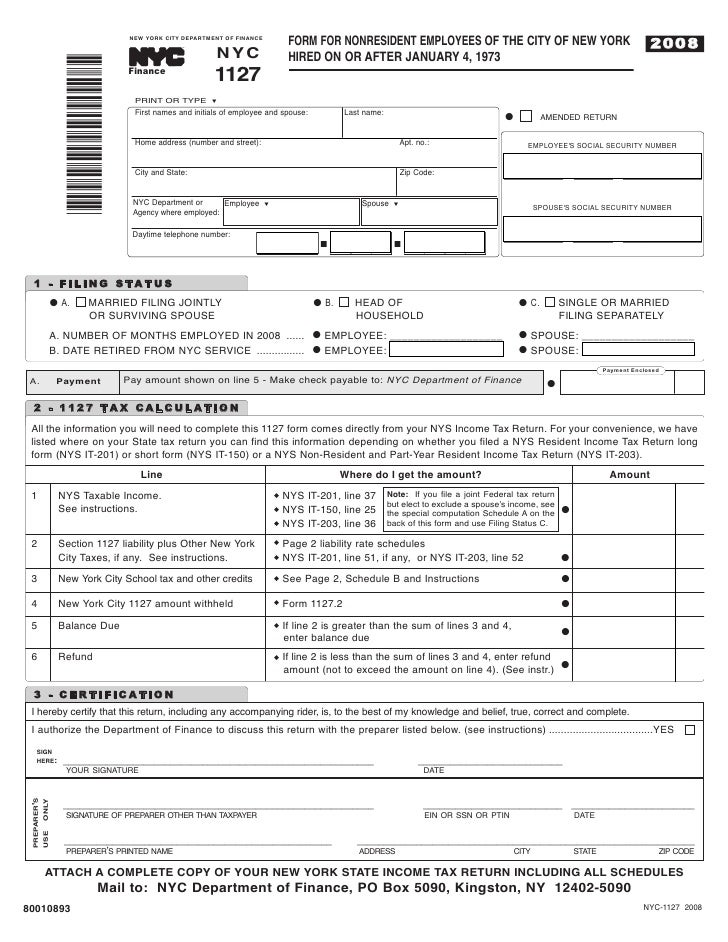

NYC1127 Form for Nonresident Employees of the City of New York Hired…

Then, you get to go to st new york city individual. It contains information on the income and expenses of the owner, as well as details about tenants who occupy any part of your building or land. Today, most americans prefer to do their own income taxes and, in fact, to fill in forms in electronic format. Web ment of.

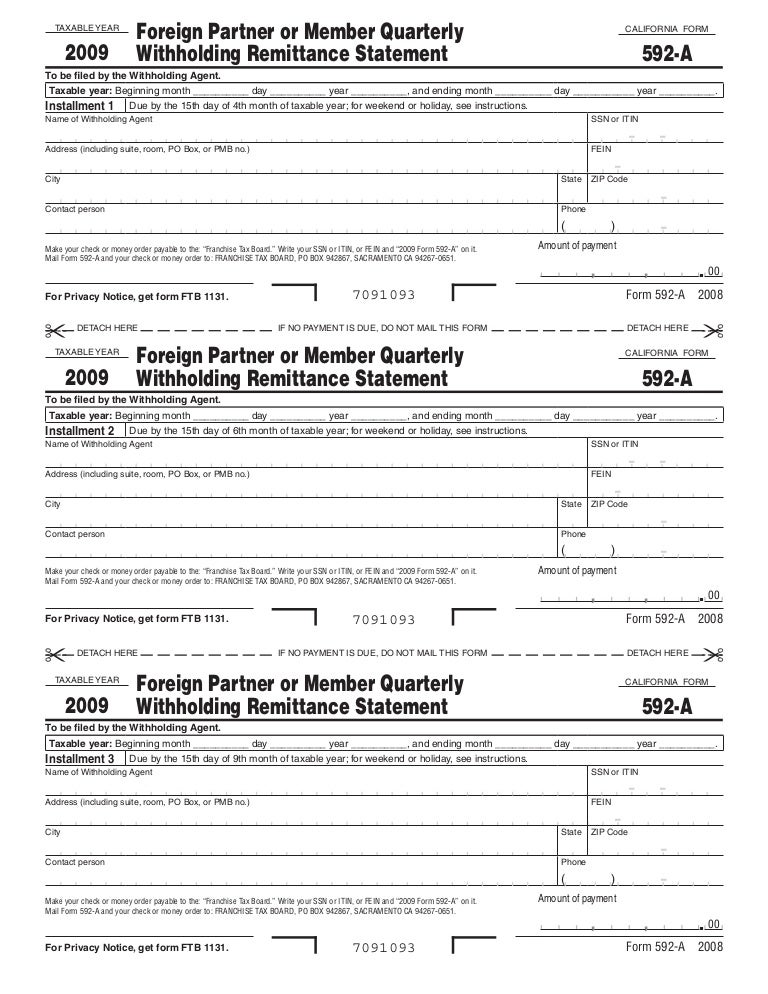

ftb.ca.gov forms 09_592a

Shouldn't it be reported on line 5 as a local income tax? Then, you get to go to st new york city individual. If you manage to master that i'll let you know the hoops you have to jump through to efile a ny amended return. Section 1127 of the new york city charter does not apply to you if.

Fillable Form NYC1127 (2017) Fillable forms, Employee management

Section 1127 of the new york city charter does not apply to you if you work for the department of education, city university of new york, district attorneys offices, or new york city housing authority. Filling out this form has never been simpler. If you manage to master that i'll let you know the hoops you have to jump through.

Checklist old — MG Tax

Today, most americans prefer to do their own income taxes and, in fact, to fill in forms in electronic format. An 1127 in most return. Then, you get to go to st new york city individual. Web follow the simple instructions below: In most cases, if you received an 1127.2 statement from your employer, you must file an 1127 return.

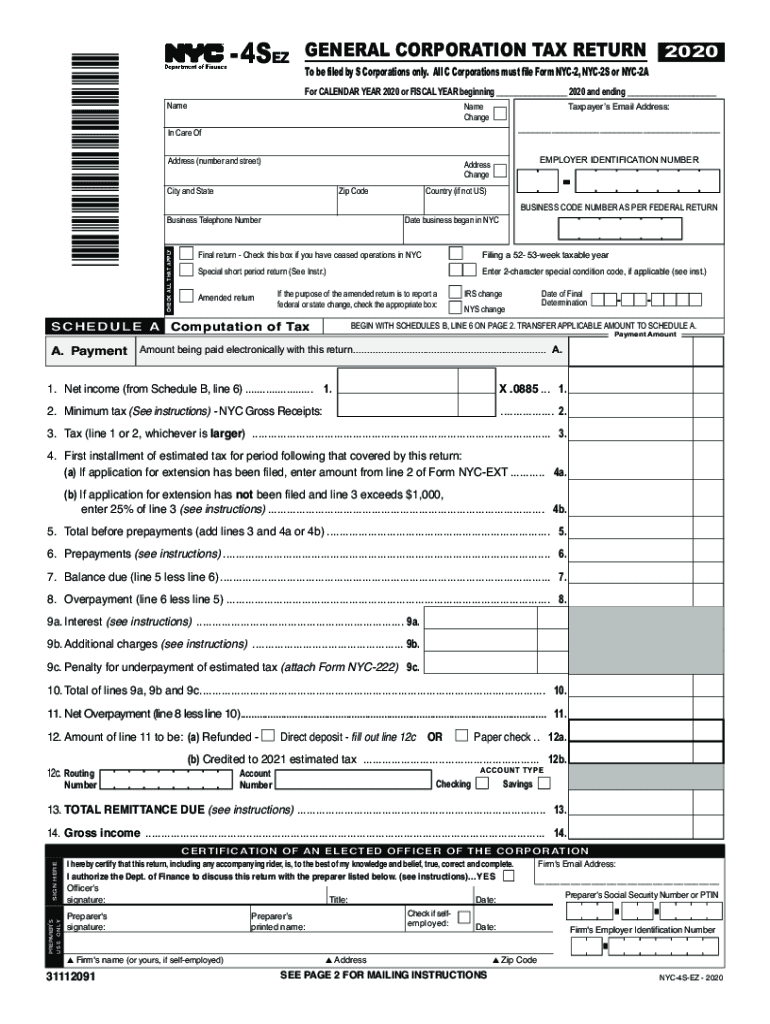

2020 Form NYC DoF NYC4SEZ Fill Online, Printable, Fillable, Blank

Then, you get to go to st new york city individual. You can get the form online or by mail. In most cases, if you received an 1127.2 statement from your employer, you must file an 1127 return. Web ment of a particular york city employees a nonresident of the city (the five your employer, you would have to file.

Fillable Form Nyc1127 Return For Nonresident Employees Of The City

Shouldn't it be reported on line 5 as a local income tax? If you manage to master that i'll let you know the hoops you have to jump through to efile a ny amended return. In most cases, if you received an 1127.2 statement from your employer, you must file an 1127 return. Section 1127 of the new york city.

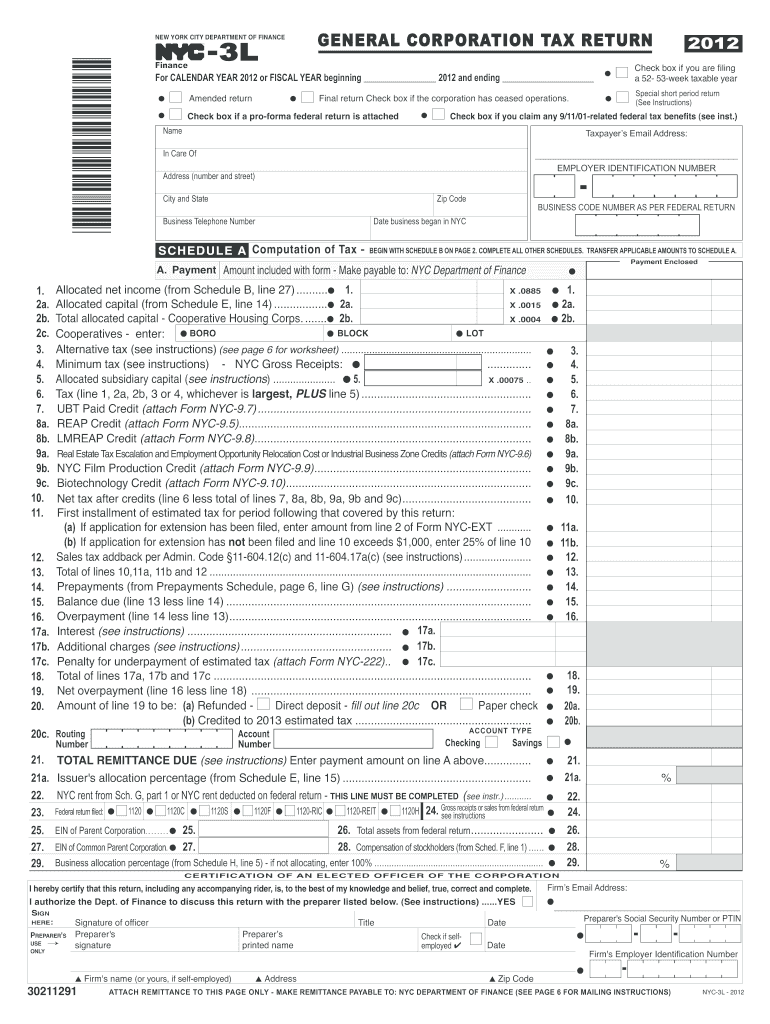

2012 Form NYC DoF NYC3L Fill Online, Printable, Fillable, Blank

Web follow the simple instructions below: Create legally binding electronic signatures on any device. In most cases, if you received an 1127.2 statement from your employer, you must file an 1127 return. Shouldn't it be reported on line 5 as a local income tax? Web ment of a particular york city employees a nonresident of the city (the five your.

NYC1127 Form for Nonresident Employees of the City of New York Hired…

Complete, edit or print tax forms instantly. An 1127 in most return. Now it will take at most thirty minutes, and you can do it from any place. In most cases, if you received an 1127.2 statement from your employer, you must file an 1127 return. Web follow the simple instructions below:

Create Legally Binding Electronic Signatures On Any Device.

Web follow the simple instructions below: In most cases, if you received an 1127.2 statement from your employer, you must file an 1127 return. Shouldn't it be reported on line 5 as a local income tax? The nyc 1127 form is a detailed document that all property owners must fill out.

Then, You Get To Go To St New York City Individual.

Complete, edit or print tax forms instantly. Filling out this form has never been simpler. It contains information on the income and expenses of the owner, as well as details about tenants who occupy any part of your building or land. Today, most americans prefer to do their own income taxes and, in fact, to fill in forms in electronic format.

Web Any New York City Employee Who Was A Nonresident Of The City (The Five Nyc Boroughs) During Any Part Of A Particular Tax Year Must File An 1127 Return.

Web ment of a particular york city employees a nonresident of the city (the five your employer, you would have to file tax year must an 1127 return. Web apply to new york state or new york city personal income tax. An 1127 in most return. Now it will take at most thirty minutes, and you can do it from any place.

Web To Find The 1127 You Have To Go Into St New York Individual.

You can get the form online or by mail. Section 1127 of the new york city charter does not apply to you if you work for the department of education, city university of new york, district attorneys offices, or new york city housing authority. If you manage to master that i'll let you know the hoops you have to jump through to efile a ny amended return. Change of residence if you were a resident of the city of new york during part of 2022 and a nonresident subject to the provisions of section 1127 of the new york city charter during all or part of the remainder of 2022, you must