Ga Form 500 Schedule 1 Instructions

Ga Form 500 Schedule 1 Instructions - 08/02/21) schedule 1 adjustments to income 2021 (approved web2 version).00, ,.00, ,.00.00.00.00, ,.00, ,, ,, ,, ,.00.00, ,.00, ,,. Web forms in tax booklet: Submitting this form for a prior tax year, will delay the processing of your return. You can download or print current. Web georgia department of revenue save form. Web schedule 1 georgia form500 page 1 (rev. Your social security number 39. 08/02/21) schedule 1 adjustments to income 2021 (approved web2 version).00, ,.00, ,.00.00.00.00, ,.00, ,, ,, ,, ,.00.00, ,.00, ,,. Other adjustments (specify) other5 (specify) 3. Schedule 1, line 14 must be completed in order for line 9 on form 500 page 2 to populate.

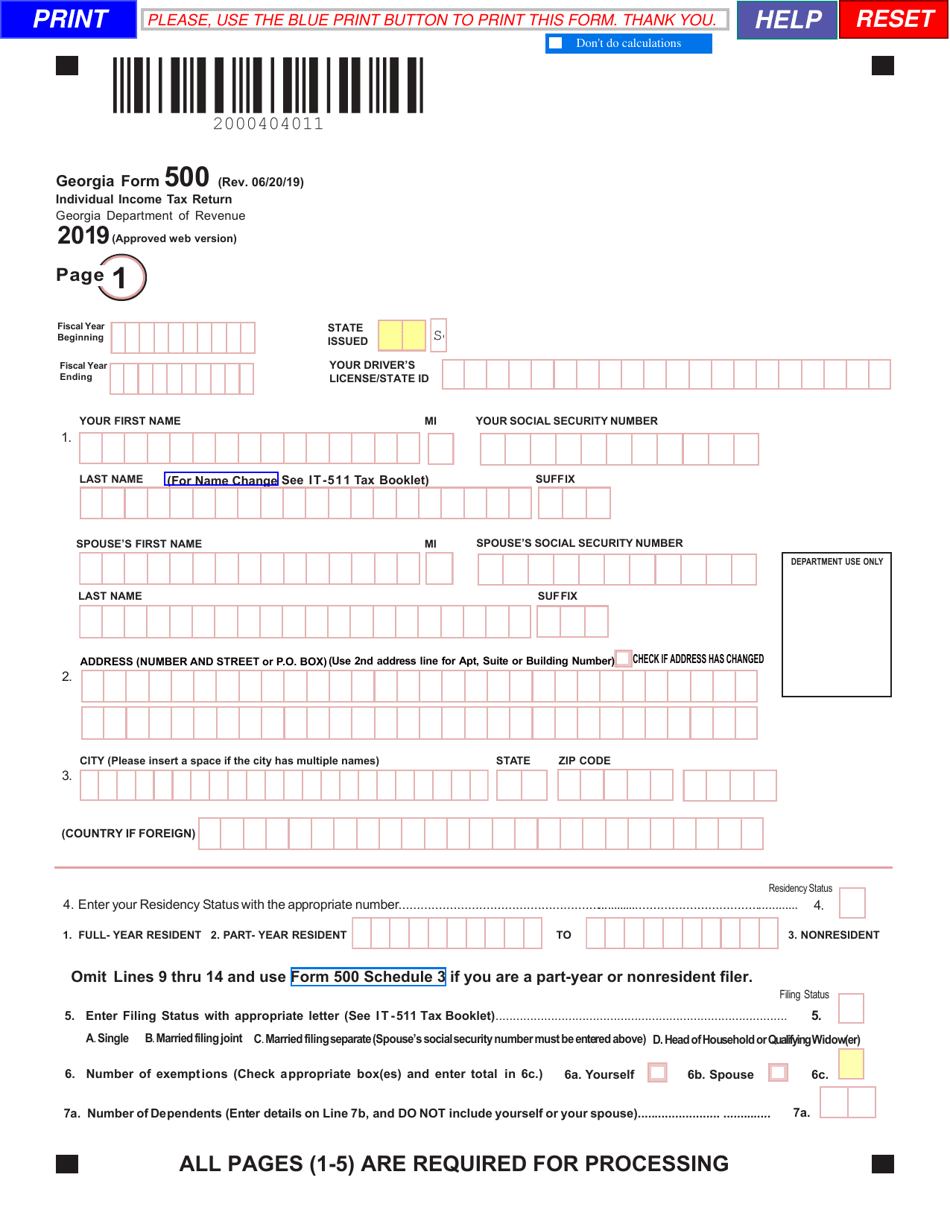

Web georgia department of revenue save form. 08/02/21) schedule 1 adjustments to income 2021 (approved web2 version).00, ,.00, ,.00.00.00.00, ,.00, ,, ,, ,, ,.00.00, ,.00, ,,. Web schedule 1 georgia form500 page 1 (rev. Web general instructions where do you file? Web we last updated the individual income tax return in january 2023, so this is the latest version of form 500, fully updated for tax year 2022. Web georgia department of revenue use this form for the 2019 tax year only. Web georgia form 500, schedule 1 adjustments to income turbotax added an entry on my georgia schedule 1 form (adjustments to income), line 5 (other) that. Web schedule 1 adjustments to income based on georgia law 12. Submitting this form for a prior tax year, will delay the processing of your return. Schedule 1, line 14 must be completed in order for line 9 on form 500 page 2 to populate.

Schedule 1, line 14 must be completed in order for line 9 on. Web forms in tax booklet: Web georgia department of revenue use this form for the 2019 tax year only. Print blank form > georgia department of revenue. Web schedule 1 adjustments to income based on georgia law 12. Web schedule 1 georgia form500 page 1 (rev. Web georgia department of revenue save form. Date of birth date of. 2021 (approved web version) additions to income. 08/02/21) schedule 1 adjustments to income 2021 (approved web2 version).00, ,.00, ,.00.00.00.00, ,.00, ,, ,, ,, ,.00.00, ,.00, ,,.

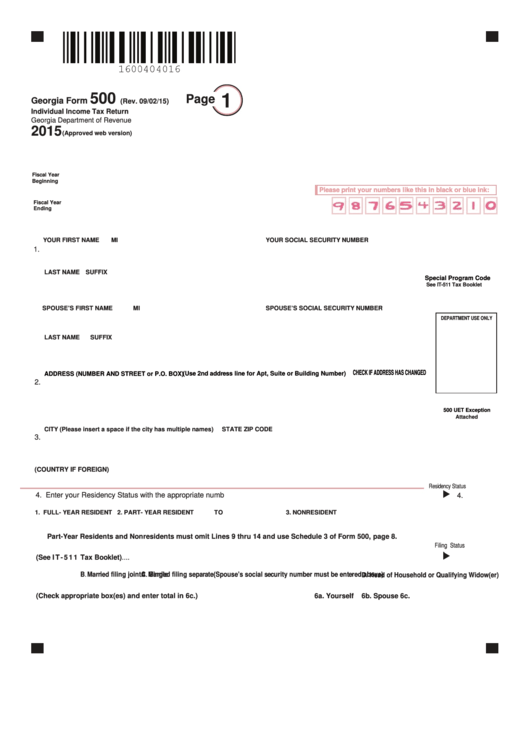

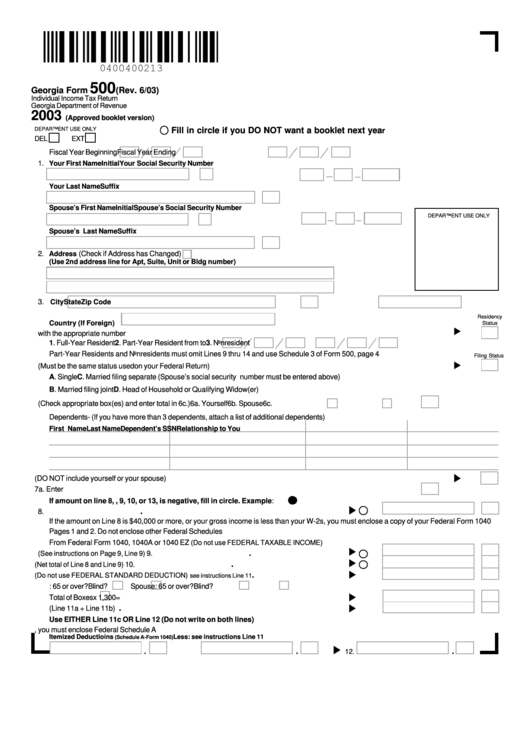

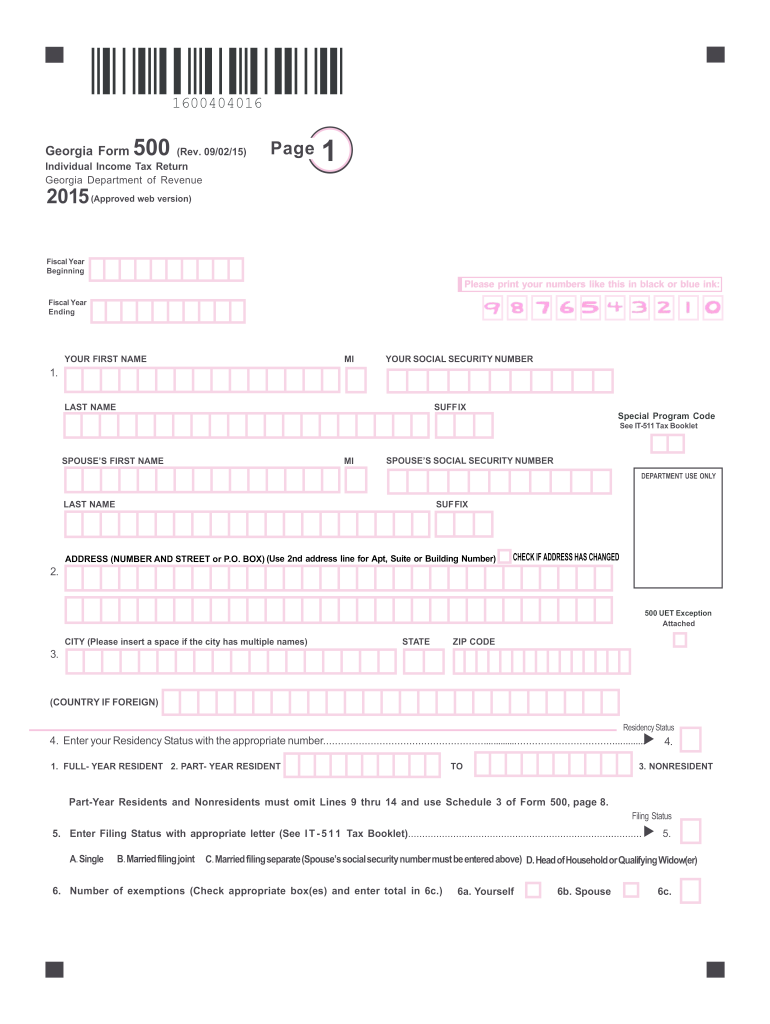

Fillable Form 500 Indvidual Tax Form

Web georgia department of revenue save form. Schedule 1, line 14 must be completed in order for line 9 on. Date of birth date of. Web schedule 1 adjustments to income based on georgia law 12. Schedule 1, line 14 must be completed in order for line 9 on form 500 page 2 to populate.

Form 500 Download Fillable PDF or Fill Online Individual Tax

Web schedule 1 adjustments to income based on georgia law 12. Submitting this form for a prior tax year, will delay the processing of your return. 2021 (approved web version) additions to income. Web schedule 1 georgia form500 page 1 (rev. You can download or print current.

500ez Tax Table 2017 Elcho Table

Other adjustments (specify) other5 (specify) 3. Web forms in tax booklet: Web georgia department of revenue use this form for the 2019 tax year only. Your social security number 39. Date of birth date of.

State Tax Form 500ez bestkup

Web schedule 1 adjustments to income based on georgia law 12. Web georgia department of revenue save form. Web schedule 1 georgia form500 page 1 (rev. Schedule 1, line 14 must be completed in order for line 9 on form 500 page 2 to populate. Submitting this form for a prior tax year, will delay the processing of your return.

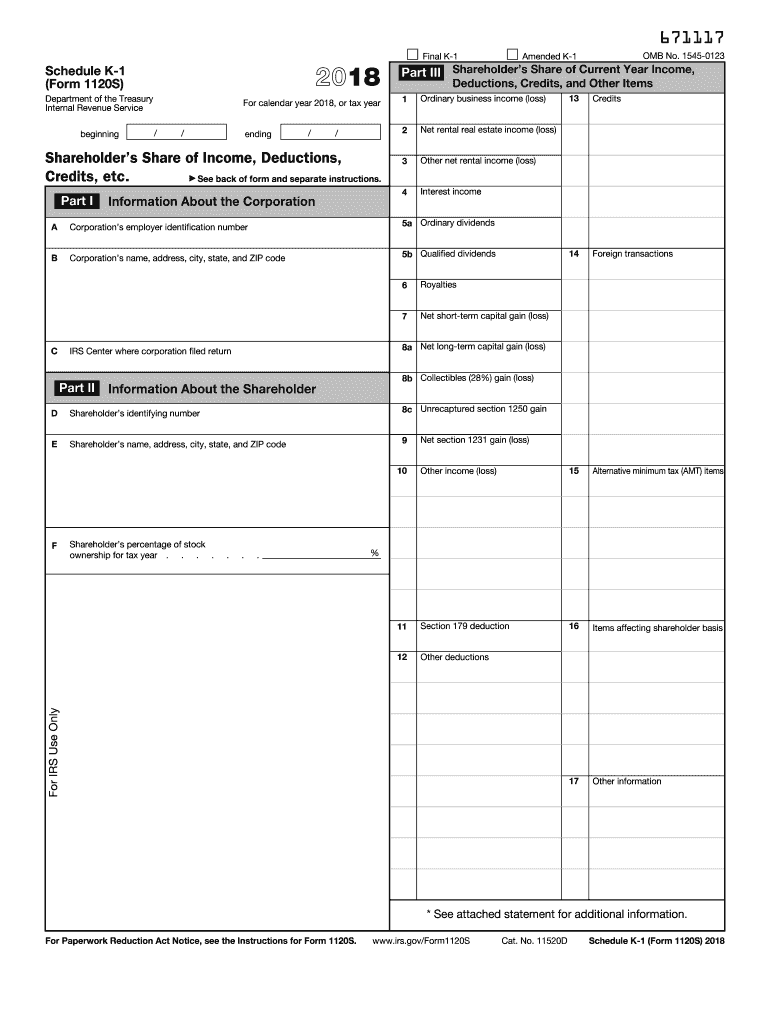

2018 form fillable k 1 Fill out & sign online DocHub

Submitting this form for a prior tax year, will delay the processing of your return. Web georgia department of revenue save form. Web we last updated the individual income tax return in january 2023, so this is the latest version of form 500, fully updated for tax year 2022. Date of birth date of. 08/02/21) schedule 1 adjustments to income.

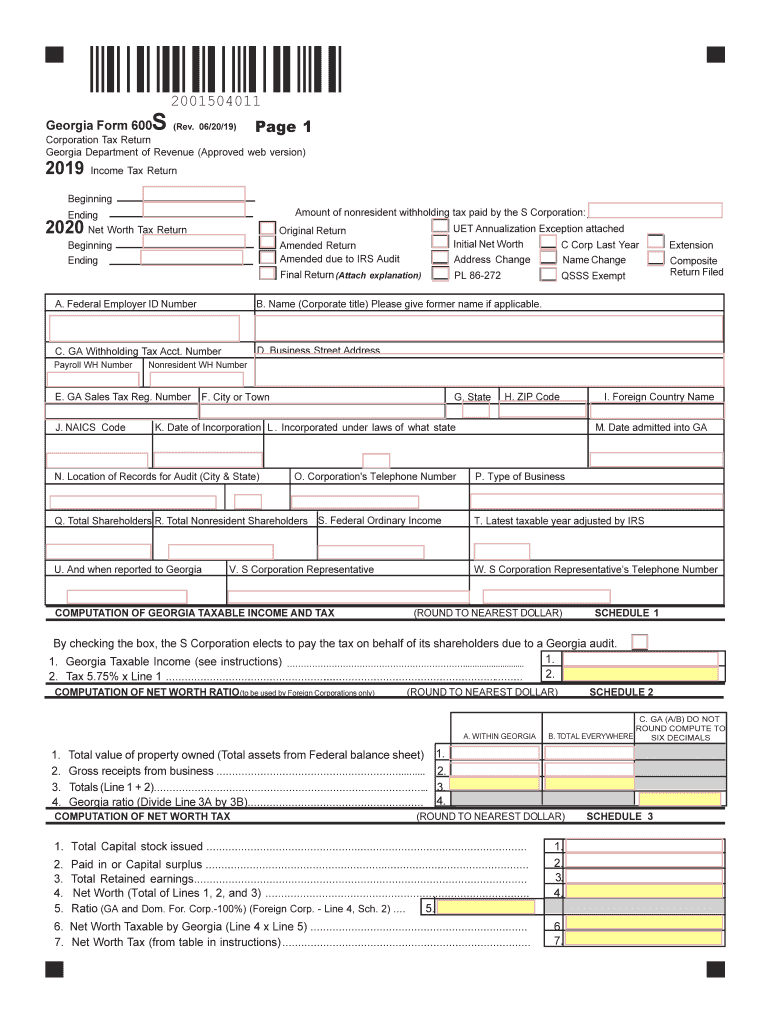

GA DoR 600S 20192022 Fill out Tax Template Online US Legal Forms

Web georgia department of revenue use this form for the 2019 tax year only. Web georgia form 500, schedule 1 adjustments to income turbotax added an entry on my georgia schedule 1 form (adjustments to income), line 5 (other) that. You can download or print current. Web we last updated the individual income tax return in january 2023, so this.

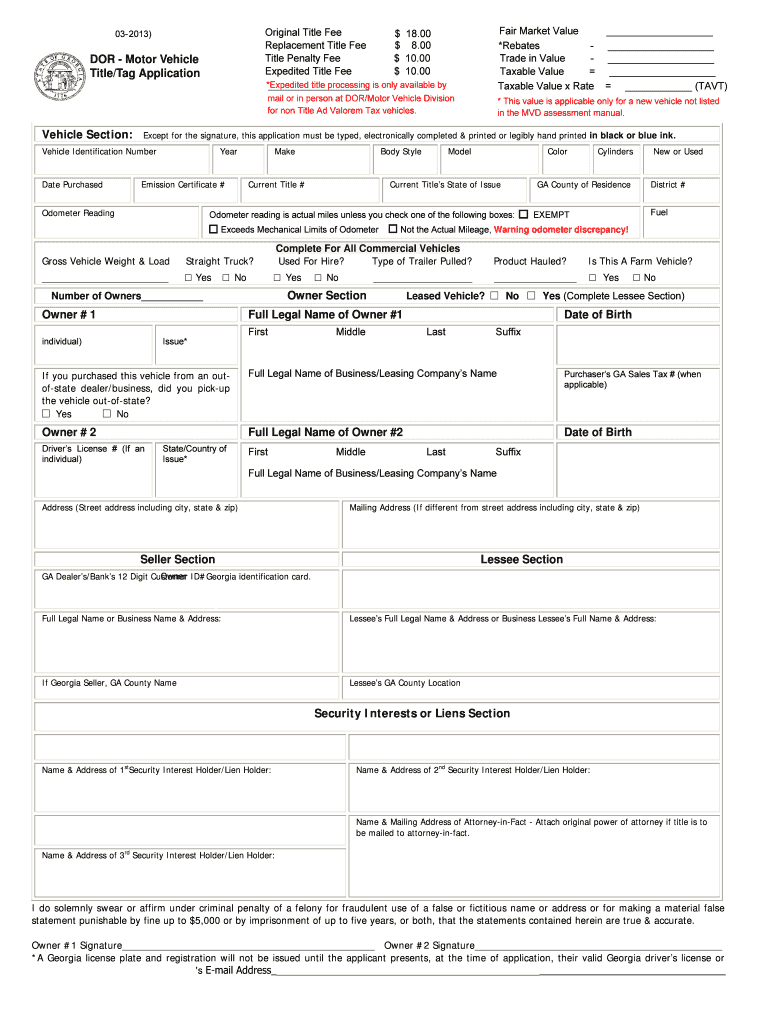

2006 Form GA MV1 Fill Online, Printable, Fillable, Blank PDFfiller

Web georgia department of revenue use this form for the 2019 tax year only. Web general instructions where do you file? Web schedule 1 georgia form500 page 1 (rev. Web schedule 1 adjustments to income based on georgia law 12. Web we last updated the individual income tax return in january 2023, so this is the latest version of form.

form 500 Fill out & sign online DocHub

08/02/21) schedule 1 adjustments to income 2021 (approved web2 version).00, ,.00, ,.00.00.00.00, ,.00, ,, ,, ,, ,.00.00, ,.00, ,,. 08/02/21) schedule 1 adjustments to income 2021 (approved web2 version).00, ,.00, ,.00.00.00.00, ,.00, ,, ,, ,, ,.00.00, ,.00, ,,. Print blank form > georgia department of revenue. Web schedule 1 georgia form500 page 1 (rev. Web schedule 1 georgia form500 page.

500 Tax Form Fill Out and Sign Printable PDF Template signNow

Schedule 1, line 14 must be completed in order for line 9 on. Print blank form > georgia department of revenue. Schedule 1, line 14 must be completed in order for line 9 on form 500 page 2 to populate. Web forms in tax booklet: Web georgia department of revenue save form.

2019 Form GA DoR 500NOL Fill Online, Printable, Fillable, Blank

Web general instructions where do you file? Web forms in tax booklet: Schedule 1, line 14 must be completed in order for line 9 on form 500 page 2 to populate. You can download or print current. Print blank form > georgia department of revenue.

08/02/21) Schedule 1 Adjustments To Income 2021 (Approved Web2 Version).00, ,.00, ,.00.00.00.00, ,.00, ,, ,, ,, ,.00.00, ,.00, ,,.

Web schedule 1 georgia form500 page 1 (rev. Other adjustments (specify) other5 (specify) 3. You can download or print current. Web georgia department of revenue save form.

Web General Instructions Where Do You File?

Web georgia department of revenue use this form for the 2019 tax year only. Web georgia form 500, schedule 1 adjustments to income turbotax added an entry on my georgia schedule 1 form (adjustments to income), line 5 (other) that. Web forms in tax booklet: Web we last updated the individual income tax return in january 2023, so this is the latest version of form 500, fully updated for tax year 2022.

2021 (Approved Web Version) Additions To Income.

Web schedule 1 georgia form500 page 1 (rev. Date of birth date of. Schedule 1, line 14 must be completed in order for line 9 on. Web schedule 1 adjustments to income based on georgia law 12.

Print Blank Form > Georgia Department Of Revenue.

Submitting this form for a prior tax year, will delay the processing of your return. 08/02/21) schedule 1 adjustments to income 2021 (approved web2 version).00, ,.00, ,.00.00.00.00, ,.00, ,, ,, ,, ,.00.00, ,.00, ,,. Your social security number 39. Schedule 1, line 14 must be completed in order for line 9 on form 500 page 2 to populate.