Ga Tax Exemption Form

Ga Tax Exemption Form - United states tax exemption form form #: These sales are subject to all local sales and use taxes. The payment methods that are applicable to the exemption of this sales tax are either a state of georgia issued credit card or payments made by directly billing the governmental organization. You can find resale certificates for other states here. Web tax exemptions save money, and georgia tax exemptions can save lots of money. General services administration home reference forms united states tax exemption form title: Agricultural certificate of sales tax exemption. Web we have six georgia sales tax exemption forms available for you to print or save as a pdf file. Qualifying sales are exempt from the 4% state sales tax. Download adobe reader ™ print page email page last.

Web electronically through the georgia tax center. Web we have six georgia sales tax exemption forms available for you to print or save as a pdf file. If any of these links are broken, or you can't find the form you need, please let us know. Web to receive the homestead exemption for the current tax year, the homeowner must have owned the property on january 1 and filed the homestead application by the same date property tax returns are due in the county. Exemptions offered by the state and counties. Web tax exemptions save money, and georgia tax exemptions can save lots of money. Download adobe reader ™ print page email page last. Agricultural certificate of sales tax exemption. The payment methods that are applicable to the exemption of this sales tax are either a state of georgia issued credit card or payments made by directly billing the governmental organization. Web georgia department of revenue

Web tax exemptions save money, and georgia tax exemptions can save lots of money. Web georgia depreciation and amortization form, includes information on listed property. 500 individual income tax return what's new? Download adobe reader ™ print page email page last. Qualifying sales are exempt from the 4% state sales tax. Agricultural certificate of sales tax exemption. Complete, save and print the form online using your browser. You can find resale certificates for other states here. Web electronically through the georgia tax center. Exemptions offered by the state and counties.

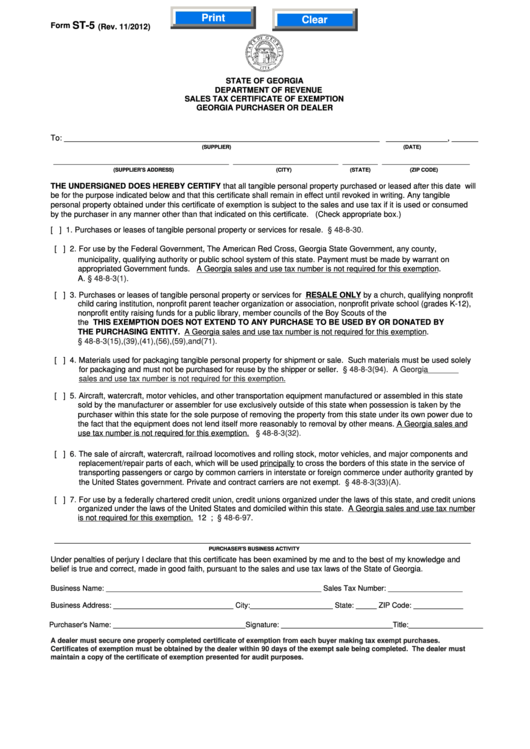

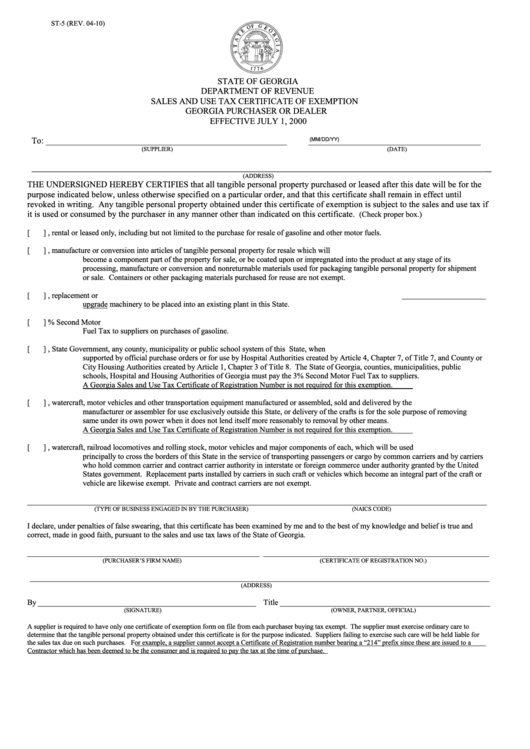

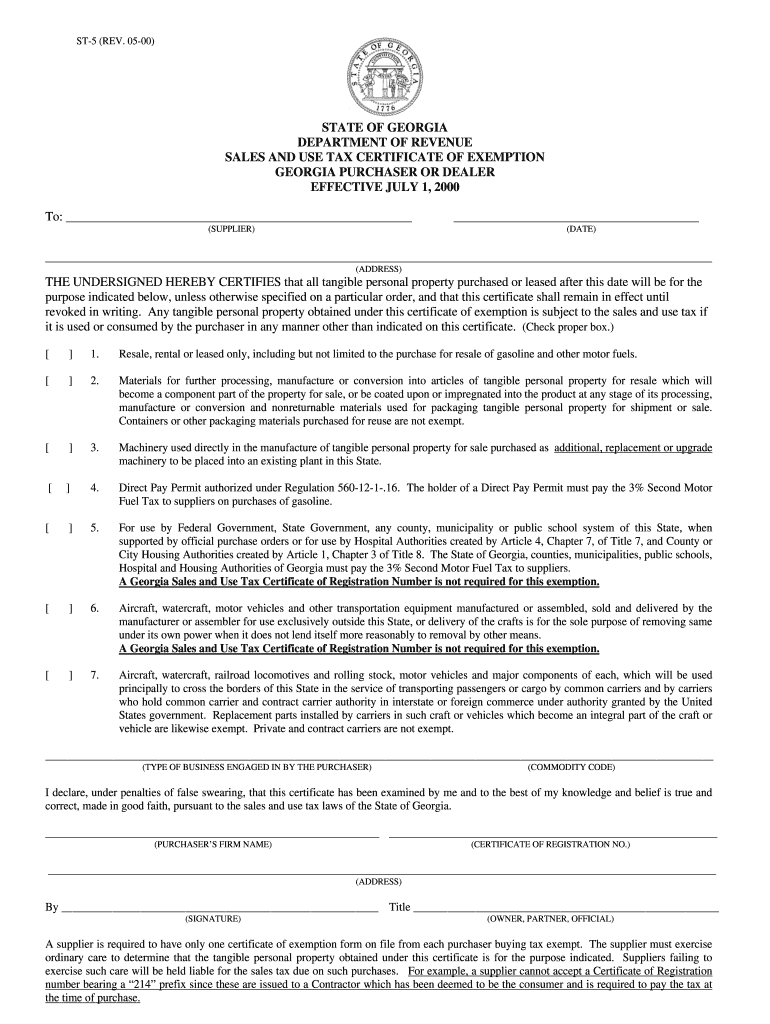

Fillable Form St5 Sales Tax Certificate Of Exemption

The payment methods that are applicable to the exemption of this sales tax are either a state of georgia issued credit card or payments made by directly billing the governmental organization. Web we have six georgia sales tax exemption forms available for you to print or save as a pdf file. Agricultural certificate of sales tax exemption. Complete, save and.

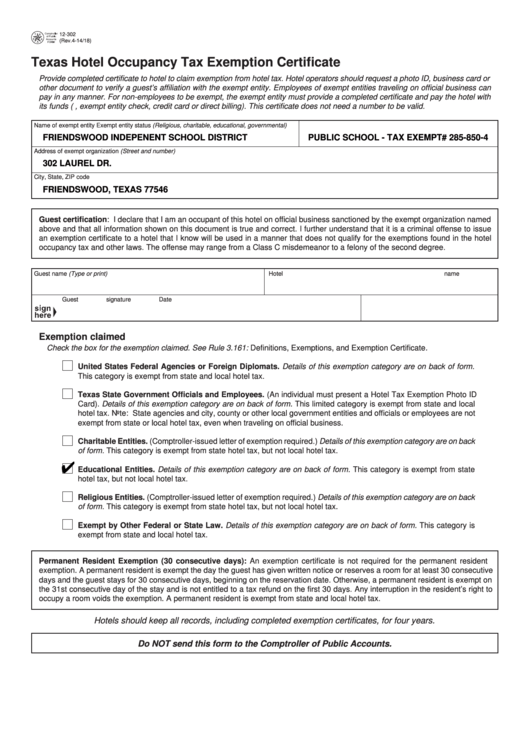

Fillable Form 12302, Hotel Occupancy Tax Exemption Certificate

Web electronically through the georgia tax center. General services administration home reference forms united states tax exemption form title: Web georgia depreciation and amortization form, includes information on listed property. The payment methods that are applicable to the exemption of this sales tax are either a state of georgia issued credit card or payments made by directly billing the governmental.

Printable Tax Exempt Form Fill Online, Printable, Fillable, Blank

Agricultural certificate of sales tax exemption. Web tax exemptions save money, and georgia tax exemptions can save lots of money. Web electronically through the georgia tax center. United states tax exemption form form #: Web to receive the homestead exemption for the current tax year, the homeowner must have owned the property on january 1 and filed the homestead application.

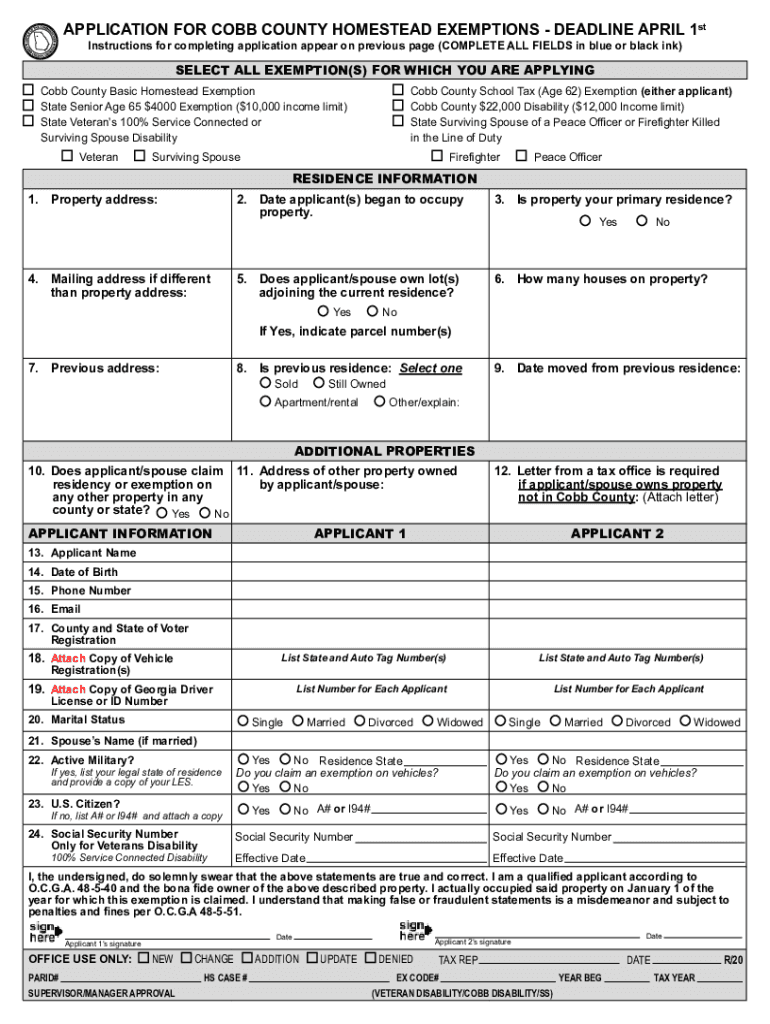

GA Application for Cobb County Homestead Exemptions 20202022 Fill

Download adobe reader ™ print page email page last. Qualifying sales are exempt from the 4% state sales tax. The payment methods that are applicable to the exemption of this sales tax are either a state of georgia issued credit card or payments made by directly billing the governmental organization. Web tax exemptions save money, and georgia tax exemptions can.

How to get a Sales Tax Certificate of Exemption in

Download adobe reader ™ print page email page last. 500 individual income tax return what's new? These sales are subject to all local sales and use taxes. Web we have six georgia sales tax exemption forms available for you to print or save as a pdf file. Complete, save and print the form online using your browser.

Power Of Attorney Pdf Uk

Download adobe reader ™ print page email page last. You can find resale certificates for other states here. These sales are subject to all local sales and use taxes. Web georgia department of revenue Web to receive the homestead exemption for the current tax year, the homeowner must have owned the property on january 1 and filed the homestead application.

GA Application for Basic Homestead Exemption Fulton County 2015

Web we have six georgia sales tax exemption forms available for you to print or save as a pdf file. Web georgia department of revenue United states tax exemption form form #: Download adobe reader ™ print page email page last. You can find resale certificates for other states here.

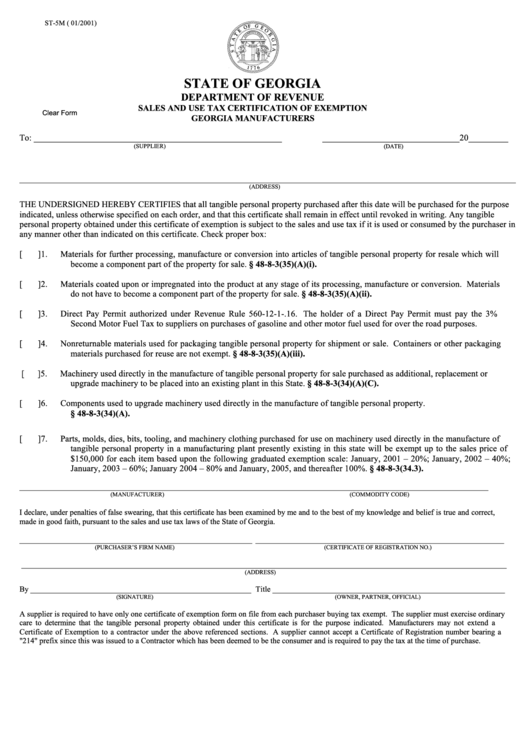

Fillable Form St5m Sales And Use Tax Certification Of Exemption

Download adobe reader ™ print page email page last. Agricultural certificate of sales tax exemption. Web tax exemptions save money, and georgia tax exemptions can save lots of money. Exemptions offered by the state and counties. Complete, save and print the form online using your browser.

Fillable Form St5 Sales And Use Tax Certificate Of Exemption

United states tax exemption form form #: Web we have six georgia sales tax exemption forms available for you to print or save as a pdf file. Web to receive the homestead exemption for the current tax year, the homeowner must have owned the property on january 1 and filed the homestead application by the same date property tax returns.

GA DoR ST5 2000 Fill out Tax Template Online US Legal Forms

Web to receive the homestead exemption for the current tax year, the homeowner must have owned the property on january 1 and filed the homestead application by the same date property tax returns are due in the county. Web georgia department of revenue 500 individual income tax return what's new? Download adobe reader ™ print page email page last. Complete,.

Web Tax Exemptions Save Money, And Georgia Tax Exemptions Can Save Lots Of Money.

You can find resale certificates for other states here. 500 individual income tax return what's new? These sales are subject to all local sales and use taxes. Exemptions offered by the state and counties.

Web Electronically Through The Georgia Tax Center.

General services administration home reference forms united states tax exemption form title: Download adobe reader ™ print page email page last. If any of these links are broken, or you can't find the form you need, please let us know. The payment methods that are applicable to the exemption of this sales tax are either a state of georgia issued credit card or payments made by directly billing the governmental organization.

Qualifying Sales Are Exempt From The 4% State Sales Tax.

Agricultural certificate of sales tax exemption. Complete, save and print the form online using your browser. United states tax exemption form form #: Web georgia depreciation and amortization form, includes information on listed property.

Web We Have Six Georgia Sales Tax Exemption Forms Available For You To Print Or Save As A Pdf File.

Web to receive the homestead exemption for the current tax year, the homeowner must have owned the property on january 1 and filed the homestead application by the same date property tax returns are due in the county. Web georgia department of revenue