Georgia Property Tax Appeal Form

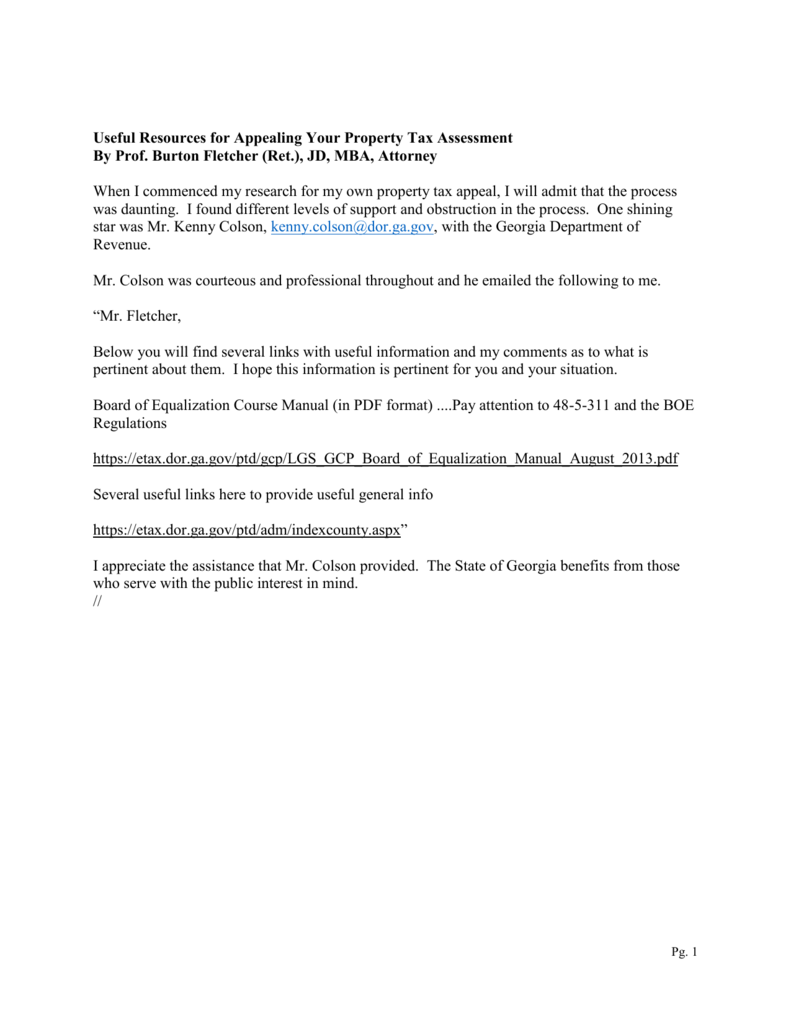

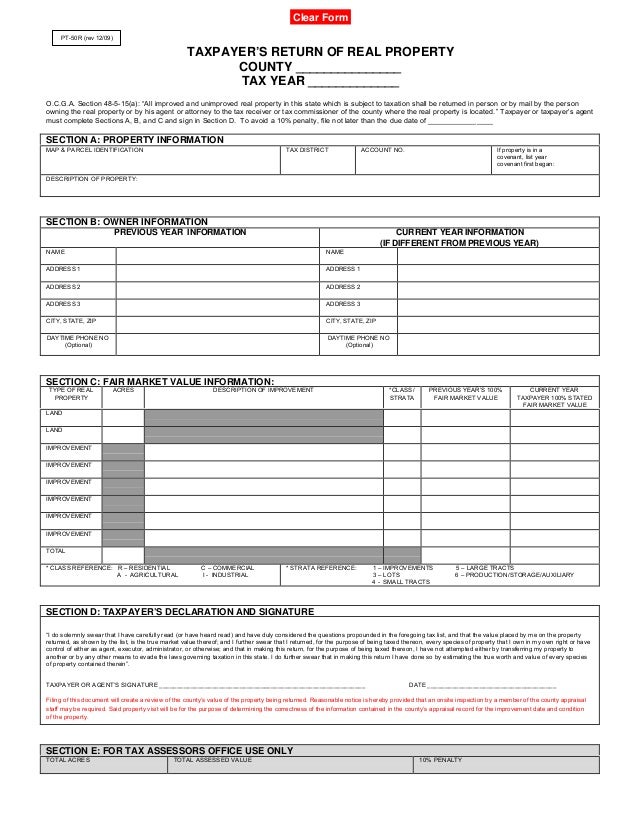

Georgia Property Tax Appeal Form - When are property taxes due? The deadline for appealing an assessment is exactly 45 days after the notice of assessment was mailed by the county tax commissioner. For even more information, visit the georgia tax center website. Can i get a copy of my property tax bill? In the initial written dispute, property owners must indicate their preferred method of appeal. The property owner must declare their chosen method of appeal. Web the document shown below is the standard georgia department of revenue tax appeal form designated for use by all georgia counties. Web while we encourage online filing, if you wish to file an appeal manually, click the link below to access an appeal form. Personal motor vehicle manufactured home. Web how do i appeal an annual notice of assessment of my property?

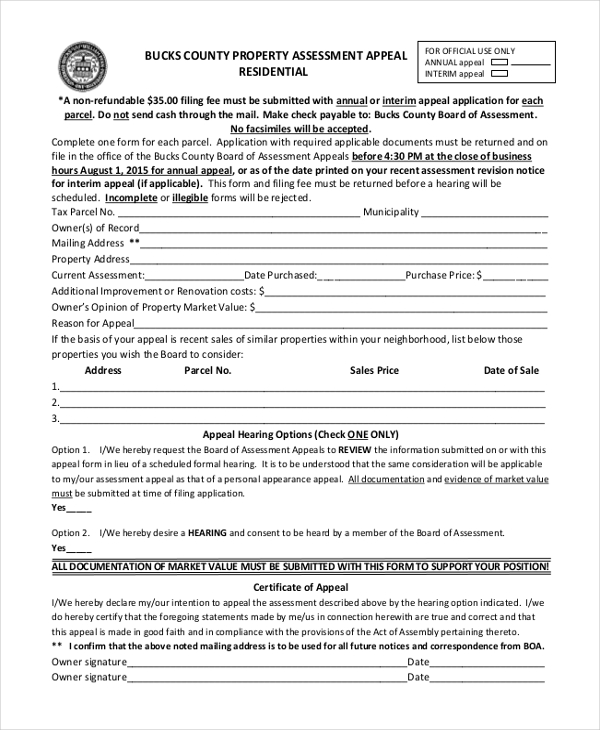

To protest by mail : The state of georgia provides a uniform appeal form for use by property owners. For even more information, visit the georgia tax center website. _____________ name address address city state home phone work phone email address zip property / appeal type (check one) real property id number property description specify grounds for appeal: Web you may not appeal a proposed assessment with the georgia tax tribunal. Web how to appeal a property tax assessment in georgia. This form is to filed with your county board of tax assessors within 45 days of the date of the notice. Can i get a copy of my property tax bill? Web the document shown below is the standard georgia department of revenue tax appeal form designated for use by all georgia counties. Web the state of georgia provides a uniform appeal form for use by property owners.

How do i figure the tax on my home? To protest by mail : Can i research the values of property in my county online? This form is to filed with your county board of tax assessors within 45 days of the date of the notice. The property owner must declare their chosen method of appeal. Web you may not appeal a proposed assessment with the georgia tax tribunal. Web how do i appeal an annual notice of assessment of my property? Web the state of georgia provides a uniform appeal form for use by property owners. Here's the really confusing part. Taxpayers may file a property tax return (declaration of value) in one of two ways:

Part 2 how to appeal your property taxes Michelle Hatch Realtor

Web how do i appeal an annual notice of assessment of my property? Web while we encourage online filing, if you wish to file an appeal manually, click the link below to access an appeal form. The deadline for appealing an assessment is exactly 45 days after the notice of assessment was mailed by the county tax commissioner. In the.

Http Dor Gov Documents Property Tax Appeal Assessment Form

Web how do i appeal an annual notice of assessment of my property? Taxpayers may file a property tax return (declaration of value) in one of two ways: _____________ name address address city state home phone work phone email address zip property / appeal type (check one) real property id number property description specify grounds for appeal: How do i.

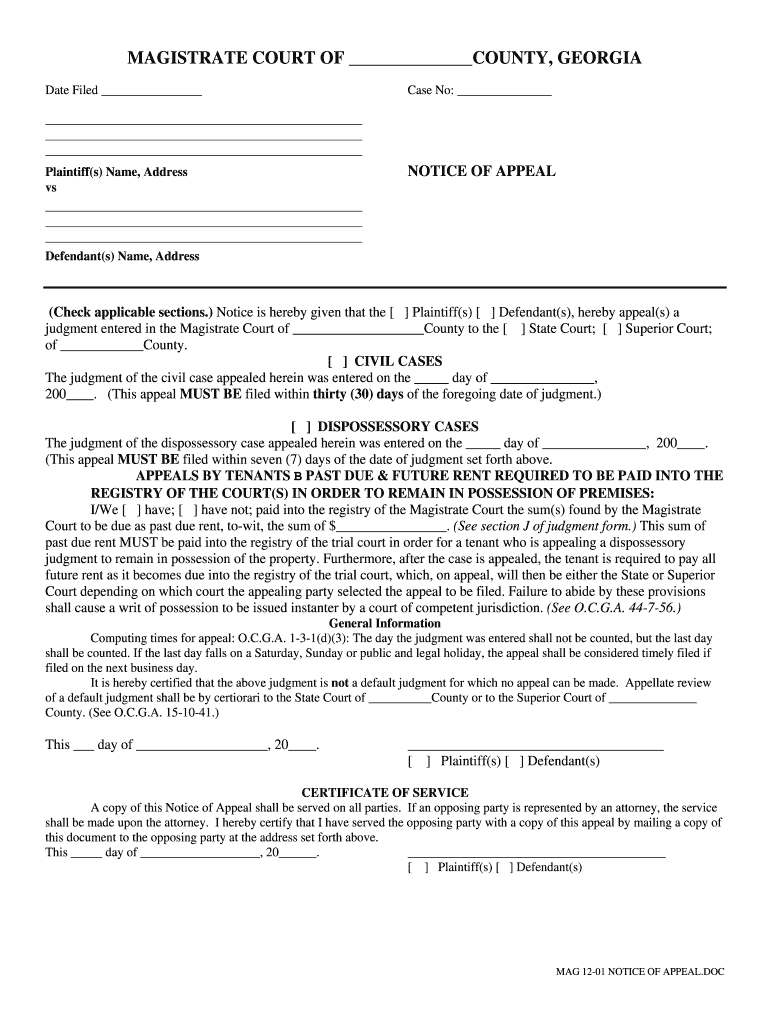

Notice Of Appeal Sample Fill Out and Sign Printable PDF

When are property taxes due? The deadline for appealing an assessment is exactly 45 days after the notice of assessment was mailed by the county tax commissioner. Can i get a copy of my property tax bill? Web the state of georgia provides a uniform appeal form for use by property owners. How do i figure the tax on my.

Property Tax Appeals in a Nutshell by Jon M. Ripans

Log on to the georgia tax center. This form is to filed with your county board of tax assessors within 45 days of the date of the notice. _____________ name address address city state home phone work phone email address zip property / appeal type (check one) real property id number property description specify grounds for appeal: To protest by.

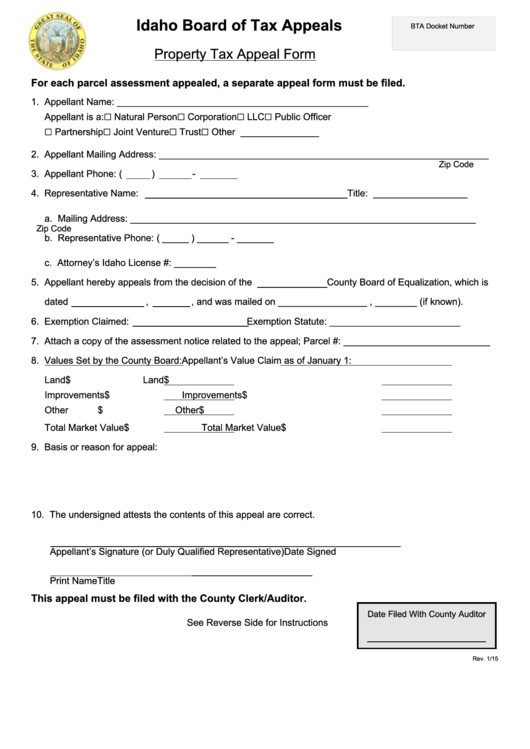

Fillable Property Tax Appeal Form Idaho Board Of Tax Appeals

How do i figure the tax on my home? Log on to the georgia tax center. Personal motor vehicle manufactured home. Web the document shown below is the standard georgia department of revenue tax appeal form designated for use by all georgia counties. The state of georgia provides a uniform appeal form for use by property owners.

FREE 9+ Sample Property Assessment Forms in PDF MS Word

To protest by mail : Can i get a copy of my property tax bill? Web while we encourage online filing, if you wish to file an appeal manually, click the link below to access an appeal form. Here's the really confusing part. When are property taxes due?

How to Fill Out Tax Appeal Form (GA PT311A) YouTube

Georgia law provides a procedure for filing property tax returns and property tax appeals at the county level. The property owner must declare their chosen method of appeal. Web how do i appeal an annual notice of assessment of my property? To protest by mail : Log on to the georgia tax center.

How to Appeal Excessive Property Tax Assessments YouTube

The state of georgia provides a uniform appeal form for use by property owners. Personal motor vehicle manufactured home. Web how do i appeal an annual notice of assessment of my property? This form is to filed with your county board of tax assessors within 45 days of the date of the notice. _____________ name address address city state home.

Here's how to appeal property tax assessments

In the initial written dispute, property owners must indicate their preferred method of appeal. By paying taxes in the prior year on their property the value which was the basis for tax. Log on to the georgia tax center. The deadline for appealing an assessment is exactly 45 days after the notice of assessment was mailed by the county tax.

ad valorem tax family member Onerous Ejournal Image Database

_____________ name address address city state home phone work phone email address zip property / appeal type (check one) real property id number property description specify grounds for appeal: Web how to appeal a property tax assessment in georgia. Personal motor vehicle manufactured home. In the initial written dispute, property owners must indicate their preferred method of appeal. The property.

Web The Document Shown Below Is The Standard Georgia Department Of Revenue Tax Appeal Form Designated For Use By All Georgia Counties.

The state of georgia provides a uniform appeal form for use by property owners. Personal motor vehicle manufactured home. Taxpayers may file a property tax return (declaration of value) in one of two ways: Georgia law provides a procedure for filing property tax returns and property tax appeals at the county level.

Log On To The Georgia Tax Center.

The property owner must declare their chosen method of appeal. Web you may not appeal a proposed assessment with the georgia tax tribunal. To protest by mail : How do i figure the tax on my home?

Here's The Really Confusing Part.

Web how to appeal a property tax assessment in georgia. Can i research the values of property in my county online? Web how do i appeal an annual notice of assessment of my property? This form is to filed with your county board of tax assessors within 45 days of the date of the notice.

Web The State Of Georgia Provides A Uniform Appeal Form For Use By Property Owners.

The deadline for appealing an assessment is exactly 45 days after the notice of assessment was mailed by the county tax commissioner. _____________ name address address city state home phone work phone email address zip property / appeal type (check one) real property id number property description specify grounds for appeal: Can i get a copy of my property tax bill? By paying taxes in the prior year on their property the value which was the basis for tax.