Goodwill Itemized Donation Form

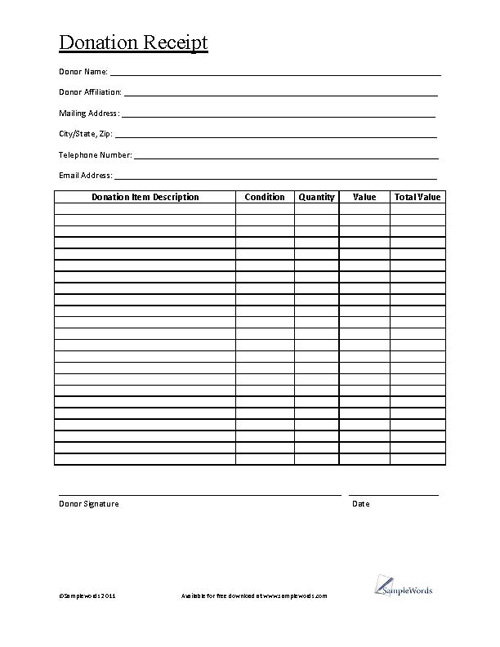

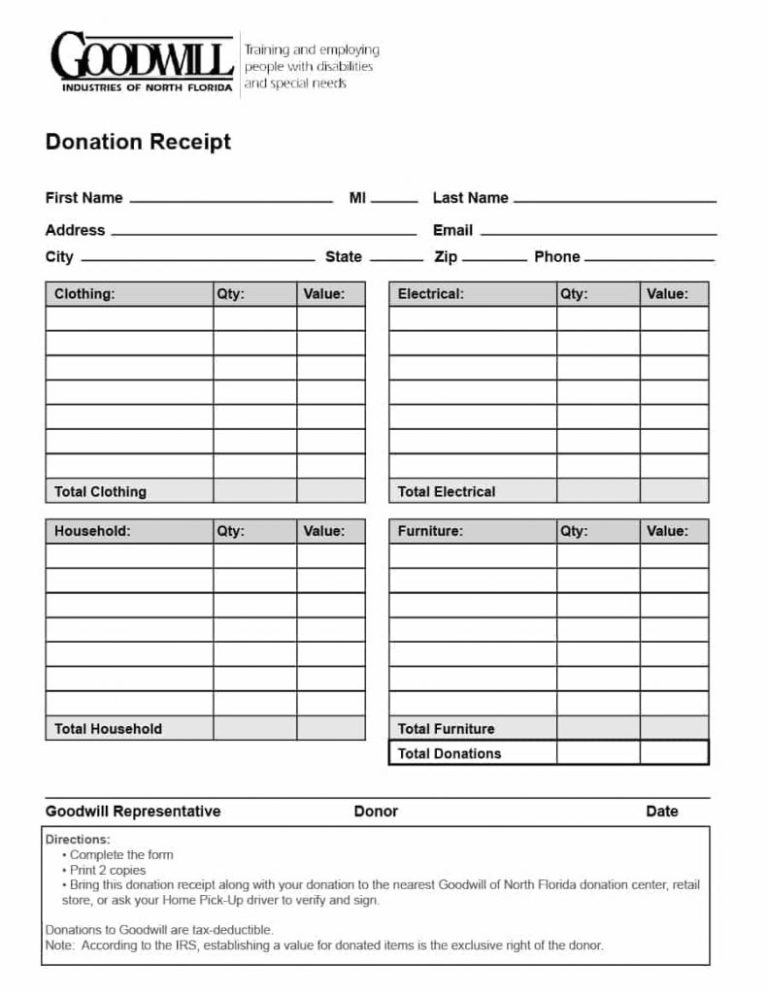

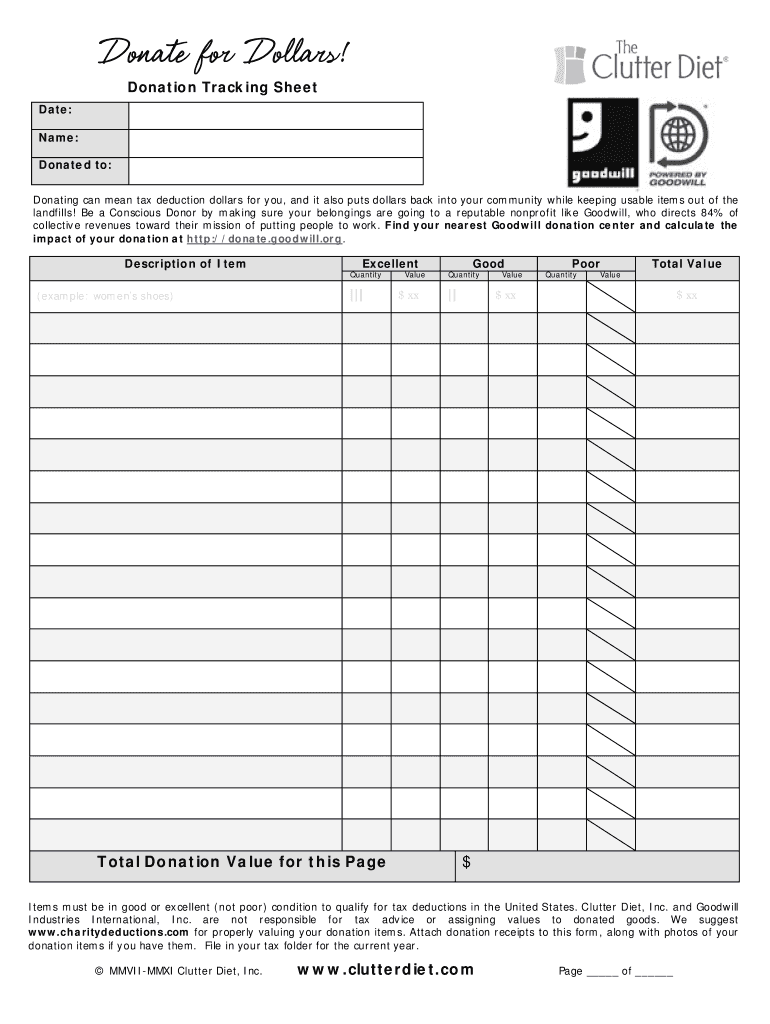

Goodwill Itemized Donation Form - You don’t have to donate money to claim a deduction — other kinds of gifts also qualify. Web donate stuff when you donate new and gently used items, your local goodwill sells them in stores and online using the revenue generated to provided valuable employment training and job placement services for people in your local community. Try it for free now! Number of bags of clothing, boxes of housewares, furniture, computer items, etc.) you may attach your own list. Web after you make a donation to goodwill, ask for a donation receipt. Ad edit pdfs, create forms, collect data, collaborate with your team, secure docs and more. A donor is responsible for valuing the donated items and it’s important not to abuse or overvalue such items in the event of a tax audit. A donation receipt is an itemized list of the items that you donated, that includes the item, fair market value, and basic personal information (name, city, address, state, zip). Prices are only estimated values. Ad edit pdfs, create forms, collect data, collaborate with your team, secure docs and more.

A donation receipt is an itemized list of the items that you donated, that includes the item, fair market value, and basic personal information (name, city, address, state, zip). Web after you make a donation to goodwill, ask for a donation receipt. Web please list the items you donated to goodwill in the space below (i.e. You don’t have to donate money to claim a deduction — other kinds of gifts also qualify. Web we happily accept donations of new or gently used items, including: Web tax information taxes and your donations donors are responsible for valuing their donations. For any advice regarding the preparation of your taxes, please consult a reputable tax advisor. Clothing and shoes coats and boots books, records, cds, videotapes, and dvds housewares, dishes, glassware, and small appliances collectibles and home décor working home electronics, flat screen tvs and more! Upload, modify or create forms. Assume the following items are in good condition, and remember:

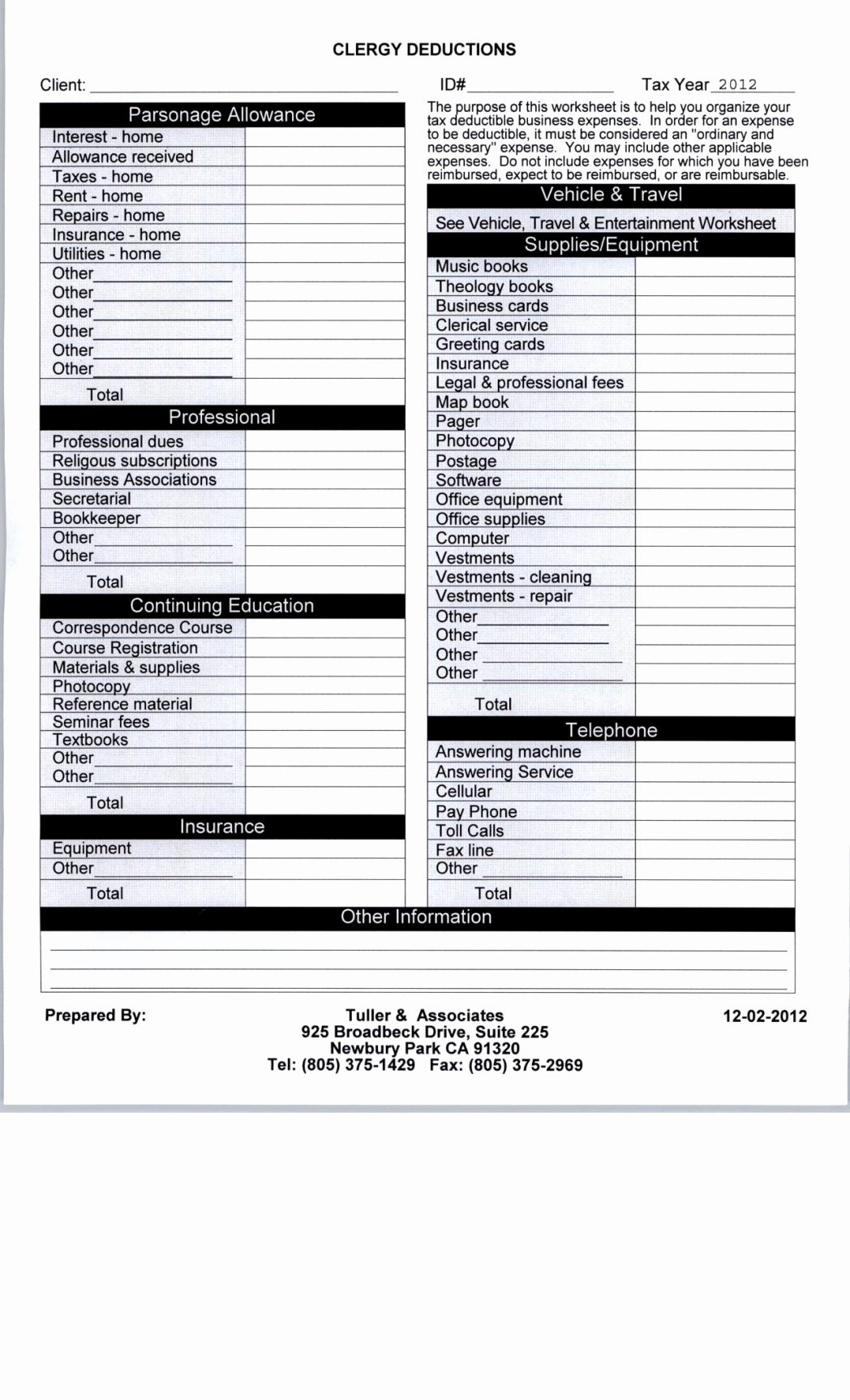

Web tax information taxes and your donations donors are responsible for valuing their donations. A donor is responsible for valuing the donated items and it’s important not to abuse or overvalue such items in the event of a tax audit. For any advice regarding the preparation of your taxes, please consult a reputable tax advisor. You don’t have to donate money to claim a deduction — other kinds of gifts also qualify. Assume the following items are in good condition, and remember: Thank you for supporting our mission! Try it for free now! Prices are only estimated values. Number of bags of clothing, boxes of housewares, furniture, computer items, etc.) you may attach your own list. Clothing and shoes coats and boots books, records, cds, videotapes, and dvds housewares, dishes, glassware, and small appliances collectibles and home décor working home electronics, flat screen tvs and more!

Printable Donation Form Template For Concessions Printable Forms Free

Upload, modify or create forms. Ad edit pdfs, create forms, collect data, collaborate with your team, secure docs and more. To help guide you, goodwill industries international has compiled a list providing price ranges for items commonly sold in goodwill® stores. A donation receipt is an itemized list of the items that you donated, that includes the item, fair market.

Goodwill Donation Spreadsheet Template —

Web if you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. You may be able to deduct the value of your donations if you choose to itemize them on your taxes. Want to know just how much good your donations are doing? Fill out the donation receipt form.

Charitable Donation Spreadsheet throughout Charitable Donation

According to the internal revenue service (irs), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and so forth. Try it for free now! Web a goodwill donation receipt is used to claim a tax deduction for clothing and household property that are itemized on an individual’s taxes. Ad edit pdfs, create forms,.

16 New Goodwill Donation Values Worksheet

Web we happily accept donations of new or gently used items, including: You may be able to deduct the value of your donations if you choose to itemize them on your taxes. According to the internal revenue service (irs), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and so forth. For any.

Goodwill Clothing Donation Form Template Donation form, Goodwill

Upload, modify or create forms. Web we happily accept donations of new or gently used items, including: Web donate stuff when you donate new and gently used items, your local goodwill sells them in stores and online using the revenue generated to provided valuable employment training and job placement services for people in your local community. Web please list the.

Goodwill Donation Spreadsheet Template With Regard To Goodwill Donation

Web donate stuff when you donate new and gently used items, your local goodwill sells them in stores and online using the revenue generated to provided valuable employment training and job placement services for people in your local community. You don’t have to donate money to claim a deduction — other kinds of gifts also qualify. For any advice regarding.

Goodwill Itemized Donation Form Fill Out and Sign Printable PDF

A donation receipt is an itemized list of the items that you donated, that includes the item, fair market value, and basic personal information (name, city, address, state, zip). Web we happily accept donations of new or gently used items, including: A word of warning regarding donation bins generally, we recommend donating at donation centers staffed by attendants. Web after.

Goodwill Donation Spreadsheet Template —

Web please list the items you donated to goodwill in the space below (i.e. Web we happily accept donations of new or gently used items, including: A donation receipt is an itemized list of the items that you donated, that includes the item, fair market value, and basic personal information (name, city, address, state, zip). Try it for free now!.

How to fill out a Goodwill Donation Tax Receipt Goodwill NNE For

Web we happily accept donations of new or gently used items, including: Assume the following items are in good condition, and remember: Ad edit pdfs, create forms, collect data, collaborate with your team, secure docs and more. Web a goodwill donation receipt is used to claim a tax deduction for clothing and household property that are itemized on an individual’s.

Charitable Donation Itemization Worksheet

A donation receipt is an itemized list of the items that you donated, that includes the item, fair market value, and basic personal information (name, city, address, state, zip). Clothing and shoes coats and boots books, records, cds, videotapes, and dvds housewares, dishes, glassware, and small appliances collectibles and home décor working home electronics, flat screen tvs and more! That’s.

A Donation Receipt Is An Itemized List Of The Items That You Donated, That Includes The Item, Fair Market Value, And Basic Personal Information (Name, City, Address, State, Zip).

According to the internal revenue service (irs), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and so forth. Prices are only estimated values. Ad edit pdfs, create forms, collect data, collaborate with your team, secure docs and more. Ad edit pdfs, create forms, collect data, collaborate with your team, secure docs and more.

Web Tax Information Taxes And Your Donations Donors Are Responsible For Valuing Their Donations.

Try it for free now! Web a goodwill donation receipt is used to claim a tax deduction for clothing and household property that are itemized on an individual’s taxes. You may be able to deduct the value of your donations if you choose to itemize them on your taxes. To help guide you, goodwill industries international has compiled a list providing price ranges for items commonly sold in goodwill® stores.

Web Donate Stuff When You Donate New And Gently Used Items, Your Local Goodwill Sells Them In Stores And Online Using The Revenue Generated To Provided Valuable Employment Training And Job Placement Services For People In Your Local Community.

Assume the following items are in good condition, and remember: You don’t have to donate money to claim a deduction — other kinds of gifts also qualify. Try it for free now! A donor is responsible for valuing the donated items and it’s important not to abuse or overvalue such items in the event of a tax audit.

Web Please List The Items You Donated To Goodwill In The Space Below (I.e.

Upload, modify or create forms. For any advice regarding the preparation of your taxes, please consult a reputable tax advisor. A word of warning regarding donation bins generally, we recommend donating at donation centers staffed by attendants. Internal revenue service (irs) requires donors to value their items.