Home Equity Loan During Chapter 13

Home Equity Loan During Chapter 13 - Check out top home equity loan options within minutes. Filling out loan applications can be tedious. Pick your best rate and save. The only restriction is that the “loan” (the case) would need to be paid back within 5 years. Check your three credit reports for free at. Presumably, the value of your home when you took on these debts was at least equal. However, your home equity can affect chapter. Instead of handing over your house or other nonexempt property to a chapter 7 trustee, you can keep the property in this chapter. Web august 3, 2022 chapter 13 can serve the same purpose as a home equity loan. Web it is something that a “pro se” (no attorney) debtor will find out the hard way—after filing the chapter 13 bankruptcy case.

Web exempting equity in chapter 13 you don't lose property in chapter 13if you can afford to keep it. Pick your best rate and save. Your credit score and equity in. If you are unable to get a home equity loan or refinance, you can use chapter 13 instead to achieve nearly identical goals. Web in general, home equity loans can be pursued shortly after purchasing a home, often within the first year — but each lender has unique requirements for approval. Web home equity and chapter 13 bankruptcy. In either case, the payment is sent to your bankruptcy trustee, and the bankruptcy trustee will disburse the funds to your mortgage. By tony guerra updated sep 5, 2012 7:34 a.m. Web usually, losing your home to foreclosure is not a concern during chapter 13 bankruptcy unless you offer your home as part of the repayment agreement. Web how does a home equity loan affect filing chapter 13?

Stripping off helocs in chapter 13 if the market value of your home is less than the balance on your first mortgage, you can. Once again, things are a little different if you go for chapter 13 bankruptcy. But if you only apply with one lender, you won’t be able to compare your offer with others, which limits your. Check your three credit reports for free at. Web a chapter 13 case begins by filing a petition with the bankruptcy court serving the area where the debtor has a domicile or residence. If you are unable to get a home equity loan or refinance, you can use chapter 13 instead to achieve nearly identical goals. Ad don't overpay on your loan. Web exempting equity in chapter 13 you don't lose property in chapter 13if you can afford to keep it. Web if you can't exempt all of your home equity, you risk losing your home in chapter 7 or paying back more unsecured debts in chapter 13. Web it is something that a “pro se” (no attorney) debtor will find out the hard way—after filing the chapter 13 bankruptcy case.

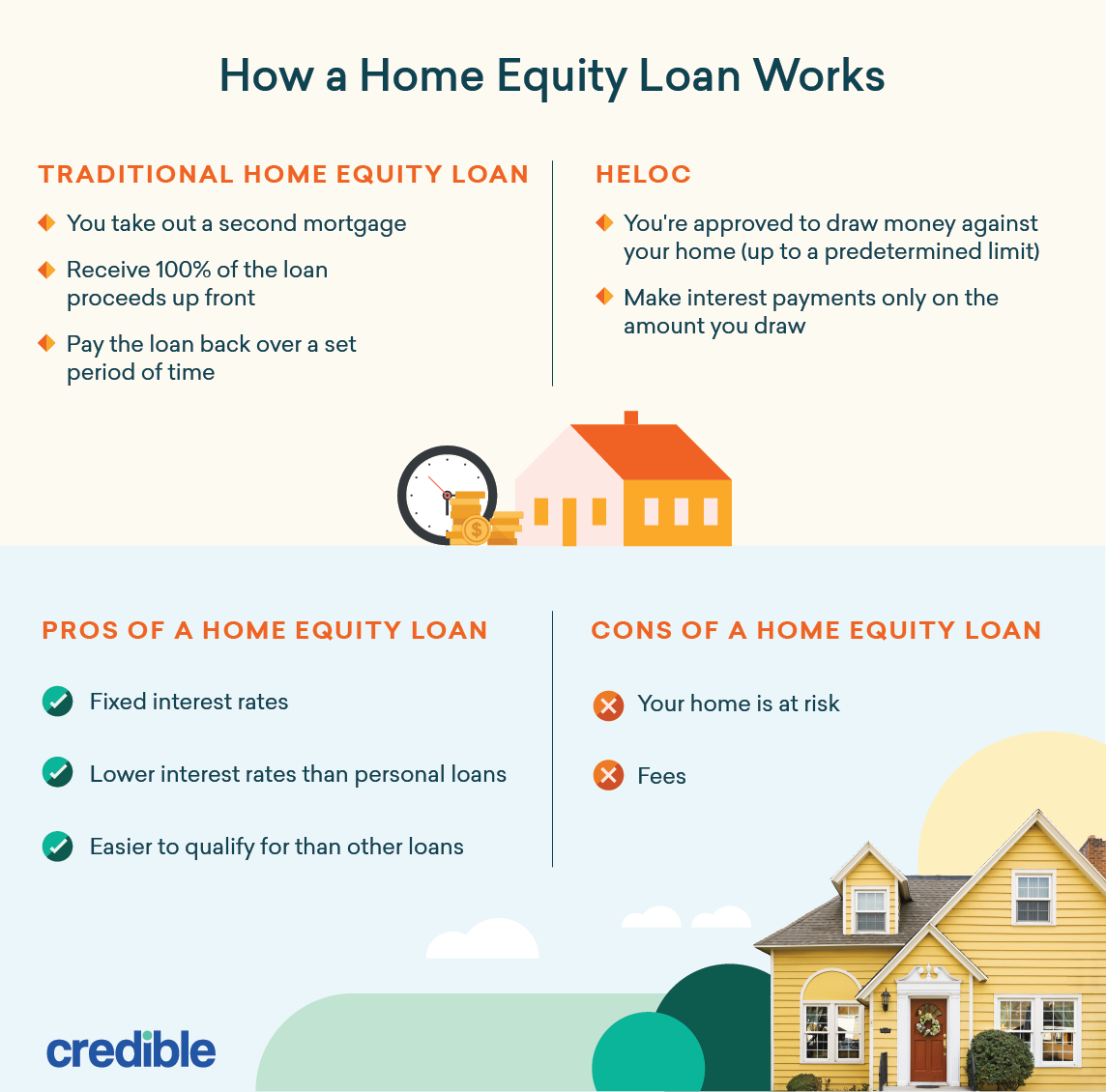

How Does A Home Equity Loan Work And How To Get One?

However, it may still take a while. However, your home equity can affect chapter. Compare the 5 best home equity loan companies of 2023. Once again, things are a little different if you go for chapter 13 bankruptcy. Web in general, home equity loans can be pursued shortly after purchasing a home, often within the first year — but each.

5 Reasons to Tap Into Your Home Equity

Filling out loan applications can be tedious. Pick your best rate and save. Web chapter 13 bankruptcy. These figures appear in the state's bankruptcy exemptions. Pick your best rate and save.

Equity Loan Interest Rate >

Web in chapter 13 bankruptcy, you pay all or a portion of your debts over time through a repayment plan. Filling out loan applications can be tedious. Compare the 5 best home equity loan companies of 2023. Unless the court orders otherwise, the debtor must also file with the court: Web yes, if you have kept your credit clean, and.

Should You Use A Home Equity Loan For Debt Consolidation?

Web home equity and chapter 13 bankruptcy. Ease of obtaining a home equity loan after release. But if you only apply with one lender, you won’t be able to compare your offer with others, which limits your. These figures appear in the state's bankruptcy exemptions. Once again, things are a little different if you go for chapter 13 bankruptcy.

Understanding the Home Equity Loan Affiliated Home Solutions, LLC

Luckily, most states allow you to protect a certain amount of equity in your home. Are you in a chapter 13 bankruptcy? Web usually, losing your home to foreclosure is not a concern during chapter 13 bankruptcy unless you offer your home as part of the repayment agreement. Pick your best rate and save. Pick your best rate and save.

Fixed Rate Home Equity Line >

Web options for navigating a home loan while in chapter 13 bankruptcy. Once again, things are a little different if you go for chapter 13 bankruptcy. Luckily, most states allow you to protect a certain amount of equity in your home. Check your three credit reports for free at. Ad don't overpay on your loan.

Using a Home Equity Loan for Debt Consolidation NextAdvisor with TIME

Web during chapter 13, your monthly payments will be made either voluntarily, or directly through a paycheck withdrawal. But if you only apply with one lender, you won’t be able to compare your offer with others, which limits your. Web the rule that requires a chapter 13 debtor to pay an amount equal to any nonexempt equity is known as.

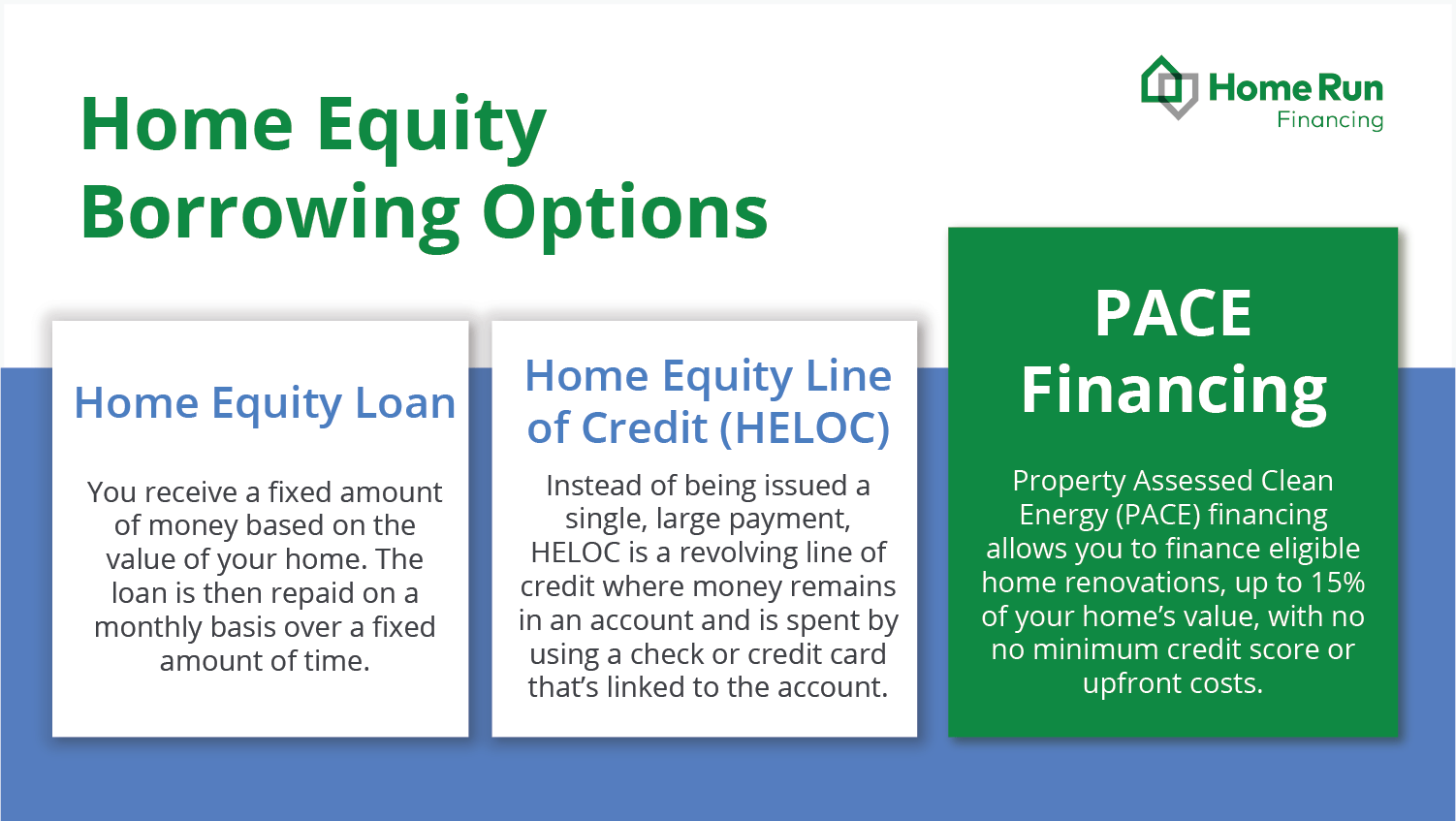

What Home Equity Is & How to Use It Home Run Financing

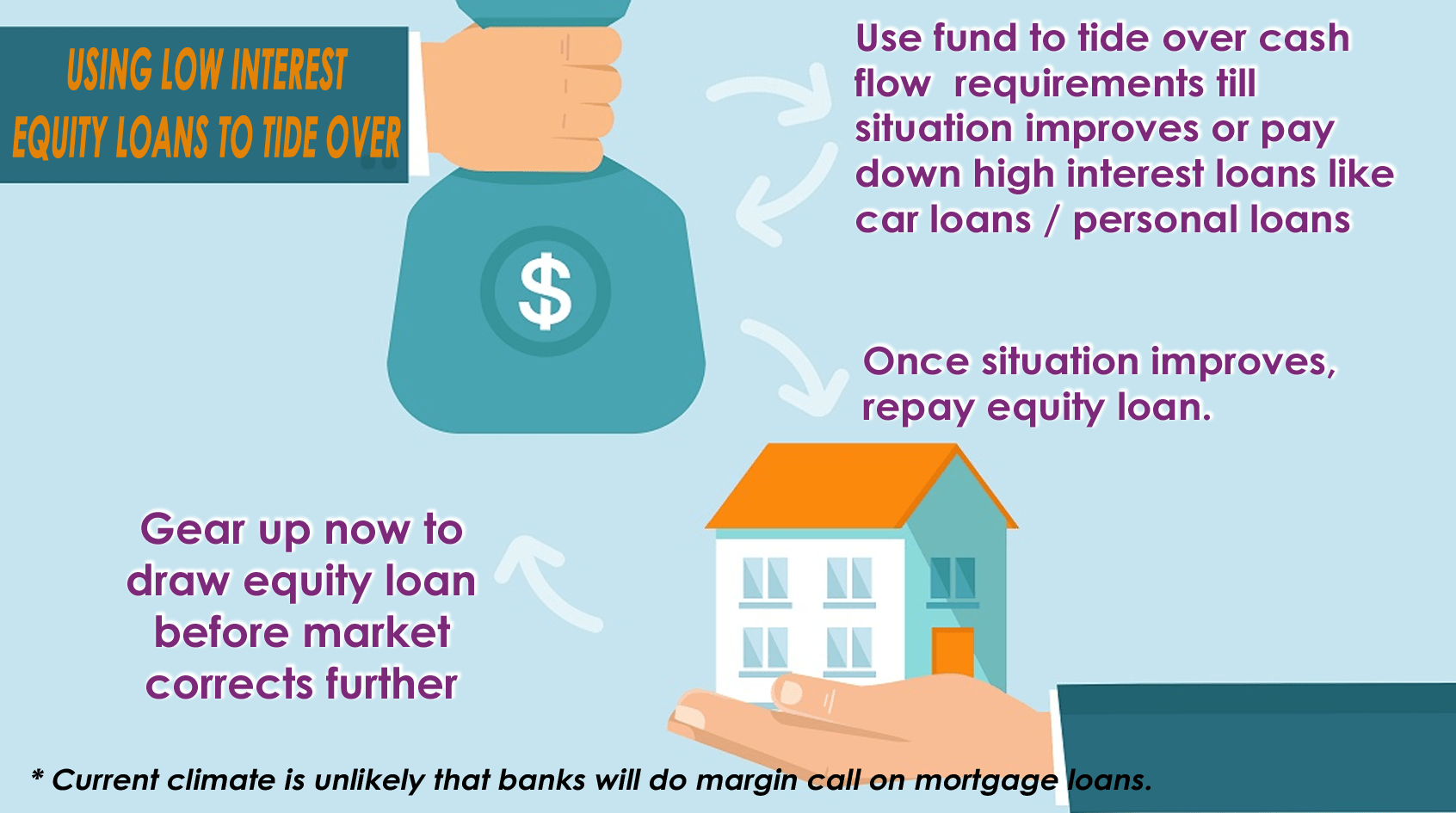

Pick your best rate and save. Each state decides the type of property filers can protect, including the amount of home equity. Get more from your home equity line of credit. The only restriction is that the “loan” (the case) would need to be paid back within 5 years. A heloc can sometimes be eliminated through chapter 13 bankruptcy.

A Complete Guide To Home Equity Loans Revenues & Profits

Home equity in chapter 13 bankruptcy: If you are unable to get a home equity loan or refinance, you can use chapter 13 instead to achieve nearly identical goals. These figures appear in the state's bankruptcy exemptions. Pick your best rate and save. Web it is something that a “pro se” (no attorney) debtor will find out the hard way—after.

How a home equity term loan might save you from cash flow issue without

But if you only apply with one lender, you won’t be able to compare your offer with others, which limits your. Compare the 5 best home equity loan companies of 2023. Web yes, if you have kept your credit clean, and if you have enough equity in your home, you will be able to get a heloc after chapter 13.

Check Out Top Home Equity Loan Options Within Minutes.

By tony guerra updated sep 5, 2012 7:34 a.m. Currently own a home and have equity? Luckily, most states allow you to protect a certain amount of equity in your home. Check out top home equity loan options within minutes.

Pick Your Best Rate And Save.

Get more from your home equity line of credit. Check your three credit reports for free at. Ad don't overpay on your loan. Web home equity and chapter 13 bankruptcy.

Web How Does A Home Equity Loan Affect Filing Chapter 13?

A heloc can sometimes be eliminated through chapter 13 bankruptcy. Web the rule that requires a chapter 13 debtor to pay an amount equal to any nonexempt equity is known as the best interest of creditors test. However, your home equity can affect chapter. Web chapter 13 provides two advantages in dealing with a heloc in certain situations.

Compare The 5 Best Home Equity Loan Companies Of 2023.

Each state decides the type of property filers can protect, including the amount of home equity. Compare & save with lendingtree Since the impact on your credit of a chapter 13 bankruptcy is less than that of a chapter 7, you will have a lot more. These figures appear in the state's bankruptcy exemptions.