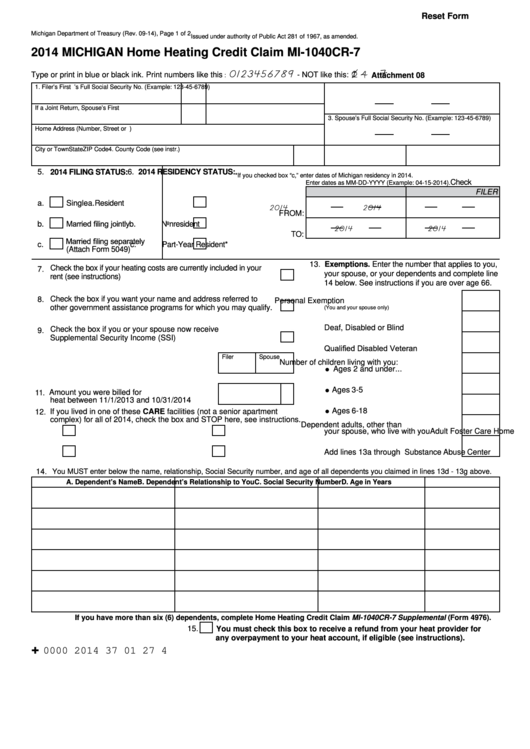

Home Heating Credit Form Michigan

Home Heating Credit Form Michigan - Web the michigan department of treasury’s home heating credit application is due friday, sept. Pdffiller allows users to edit, sign, fill & share all type of documents online. You can apply for a home heating credit for the 2022 tax year if you meet income requirements. If you need assistance paying for your home heating. This application helps pay energy bills for those who qualify —. The credit may be issued directly to your heat provider, or may be issued directly to you as a draft or check. The number of exemptions (persons) occupying the residence. Please use the link below. Web (1) subject to subsections (18) and (19), a claimant may claim a credit for heating fuel costs for the claimant's homestead in this state. Homes with seniors, disabled individuals, or children under 5.

Web how do i file for a home heating credit? Forms and instructional materials are available on the internet at. Web we last updated the home heating credit claim supplemental in february 2023, so this is the latest version of form 4976, fully updated for tax year 2022. Use get form or simply click on the template preview to open it in the editor. Web households who received home heating credits for the 2021 tax year qualify for the additional credit. Web you can apply for a home heating credit by filing your application with the michigan department of treasury before sept. Ad signnow allows users to edit, sign, fill and share all type of documents online. The credit may be issued directly to your heat provider, or may be issued directly to you as a draft or check. Web the home heating credit can be calculated using one of two methods: Heat type code (see instructions) *if you checked box “c,” enter dates of michigan residency in 2020.

An adult foster care home, nursing home,. Please use the link below to download. The cost of heating, calculated from nov. Web how do i file for a home heating credit? Web you can apply for a home heating credit by filing your application with the michigan department of treasury before sept. If you need assistance paying for your. You can apply for a home heating credit for the 2022 tax year if you meet income requirements. Web if you have more than four (4) household members, complete home heating credit claim : This application helps pay energy bills for those who qualify —. Web we last updated the home heating credit claim supplemental in february 2023, so this is the latest version of form 4976, fully updated for tax year 2022.

1999 Form MI MI1040CR7 Fill Online, Printable, Fillable, Blank

Web the home heating credit can be calculated using one of two methods: Use get form or simply click on the template preview to open it in the editor. This application helps pay energy bills for those who qualify —. To find out if you qualify, or to. To apply for the credit, file your application with the michigan.

Home Heating Credit For Michigan Homeowners & Renters Apply by

Web you can apply for a home heating credit by filing your application with the michigan department of treasury before sept. Web how do i file for a home heating credit? Web michigan — home heating credit instruction booklet download this form print this form it appears you don't have a pdf plugin for this browser. Pdffiller allows users to.

2018 Form MI MI1040CR7 Fill Online, Printable, Fillable, Blank

Create legally binding electronic signatures on any device. Web households who received home heating credits for the 2021 tax year qualify for the additional credit. To apply for the credit, file your application with the michigan. If you do not see a. Issued under authority of public act 281 of 1967, as amended.

Home Heating Credit Form 2020 Fill Online, Printable, Fillable, Blank

Web how do i file for a home heating credit? Please use the link below to download. To get an applications for the home heating. This application helps pay energy bills for those who qualify —. You can apply for a home heating credit for the 2022 tax year if you meet income requirements.

Fillable Form Mi1040cr7 Michigan Home Heating Credit Claim 2014

This application helps pay energy bills for those who qualify —. To apply for the credit, file your application with the michigan. Create legally binding electronic signatures on any device. Web if you have more than four (4) household members, complete home heating credit claim : Web michigan — home heating credit claim download this form print this form it.

288,000 Michigan Residents to Receive Additional Home Heating Credit

Please use the link below to download. Web we last updated the home heating credit claim supplemental in february 2023, so this is the latest version of form 4976, fully updated for tax year 2022. Web the home heating credit can be calculated using one of two methods: Web households who received home heating credits for the 2021 tax year.

Home Heating Credit Heintzelman Accounting Services

Ad signnow allows users to edit, sign, fill and share all type of documents online. Heat provider name code (see instructions) 7. You must check this box to receive a. The number of exemptions (persons) occupying the residence. Please use the link below.

Fillable Online Printable 2020 Michigan Form 4976 (Home Heating Credit

An adult foster care home, nursing home,. If you need assistance paying for your. If you do not see a. The cost of heating, calculated from nov. Please use the link below.

See if You Qualify for Michigan's Home Heating Credit

Type or print in blue or black ink. Web michigan — home heating credit claim download this form print this form it appears you don't have a pdf plugin for this browser. If you need assistance paying for your. Web how do i file for a home heating credit? Web you can apply for a home heating credit by filing.

Applicants wanted for home heating credit Michigan News

Web you can apply for a home heating credit by filing your application with the michigan department of treasury before sept. To find out if you qualify, or to. Ad signnow allows users to edit, sign, fill and share all type of documents online. If you do not see a. Use get form or simply click on the template preview.

Web (1) Subject To Subsections (18) And (19), A Claimant May Claim A Credit For Heating Fuel Costs For The Claimant's Homestead In This State.

Please use the link below to download. If you need assistance paying for your. The number of exemptions (persons) occupying the residence. Web michigan — home heating credit claim download this form print this form it appears you don't have a pdf plugin for this browser.

The Credit May Be Issued Directly To Your Heat Provider, Or May Be Issued Directly To You As A Draft Or Check.

Edit, sign and save michigan home heating credit form. Web the michigan department of treasury’s home heating credit application is due friday, sept. Issued under authority of public act 281 of 1967, as amended. Pdffiller allows users to edit, sign, fill & share all type of documents online.

An Adult Foster Care Home, Nursing Home,.

To find out if you qualify, or to. To get an applications for the home heating. Homes with seniors, disabled individuals, or children under 5. Heat type code (see instructions) *if you checked box “c,” enter dates of michigan residency in 2020.

Web Households Who Received Home Heating Credits For The 2021 Tax Year Qualify For The Additional Credit.

Heat provider name code (see instructions) 7. Web we last updated the home heating credit claim supplemental in february 2023, so this is the latest version of form 4976, fully updated for tax year 2022. To apply for the credit, file your application with the michigan. Web the home heating credit can be calculated using one of two methods: