How Long Does It Take To Form An S Corp

How Long Does It Take To Form An S Corp - Must be a domestic corporation, operating in the united states may not have more than 100 shareholders must have only one class of stock must only have allowable shareholders. Form 2553 is due no more than two months and 15 days. General information about your business, including your date of incorporation and the date you elected s corp status your business activity code and your employer identification number (ein) a profit and loss statement and a balance sheet for your business Have no more than 100 shareholders. S corps can provide significant tax savings and have limited. Election by a small business corporation with the irs. Web you can start an s corporation (s corp) by forming a limited liability company (llc) or a corporation and electing s corp status from the irs by filing form 2553 election by a small business corporation when you apply for your employer identification number (ein). Web the ascent knowledge small business 4 steps to becoming an s corp updated aug. If you file paperwork and complete the process within two months and 15. May be individuals, certain trusts, and estates and.

Web to qualify for s corporation status, the corporation must meet the following requirements: Form 2553 is due no more than two months and 15 days. Web the ascent knowledge small business 4 steps to becoming an s corp updated aug. Election by a small business corporation with the irs. Ryan lasker many or all of the products here are from our partners. May be individuals, certain trusts, and estates and. S corps can provide significant tax savings and have limited. Must be a domestic corporation, operating in the united states may not have more than 100 shareholders must have only one class of stock must only have allowable shareholders. If you file paperwork and complete the process within two months and 15. Have no more than 100 shareholders.

Web to qualify for s corporation status, the corporation must meet the following requirements: Form 2553 is due no more than two months and 15 days. May be individuals, certain trusts, and estates and. Web the s corporation is a tax designation that a corporation or llc can elect by filing form 553: General information about your business, including your date of incorporation and the date you elected s corp status your business activity code and your employer identification number (ein) a profit and loss statement and a balance sheet for your business Ryan lasker many or all of the products here are from our partners. Election by a small business corporation with the irs. Have no more than 100 shareholders. Web you can start an s corporation (s corp) by forming a limited liability company (llc) or a corporation and electing s corp status from the irs by filing form 2553 election by a small business corporation when you apply for your employer identification number (ein). Must be a domestic corporation, operating in the united states may not have more than 100 shareholders must have only one class of stock must only have allowable shareholders.

How Long Does it Take to Form a New Habit? Rewire The Mind Online

Web the s corporation is a tax designation that a corporation or llc can elect by filing form 553: May be individuals, certain trusts, and estates and. Web you’ll need the following information on hand before filling out 1120s: If you file paperwork and complete the process within two months and 15. Election by a small business corporation with the.

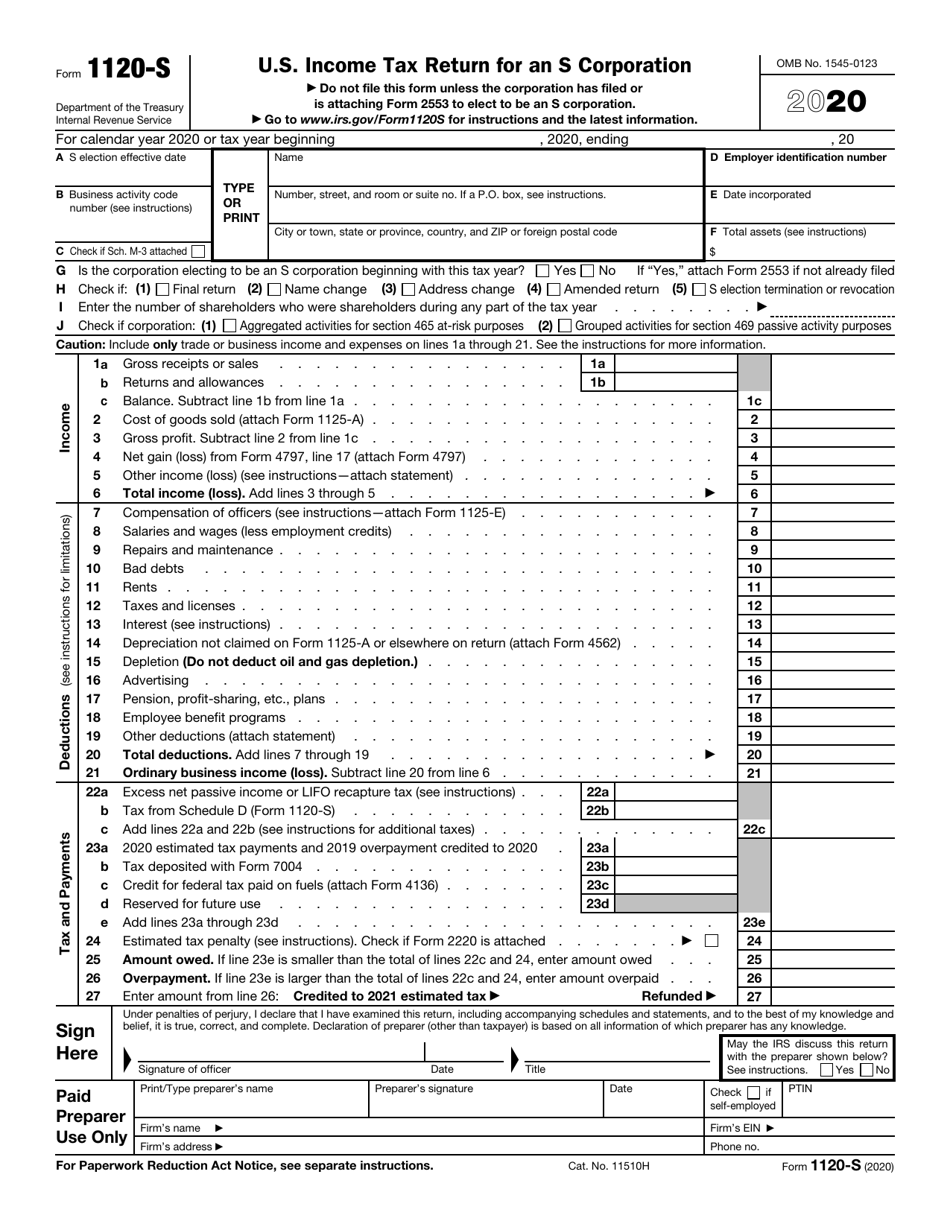

IRS Form 1120S Download Fillable PDF or Fill Online U.S. Tax

Must be a domestic corporation, operating in the united states may not have more than 100 shareholders must have only one class of stock must only have allowable shareholders. Web you can start an s corporation (s corp) by forming a limited liability company (llc) or a corporation and electing s corp status from the irs by filing form 2553.

What Is Business Name On W9

Web the ascent knowledge small business 4 steps to becoming an s corp updated aug. Ryan lasker many or all of the products here are from our partners. If you file paperwork and complete the process within two months and 15. Election by a small business corporation with the irs. General information about your business, including your date of incorporation.

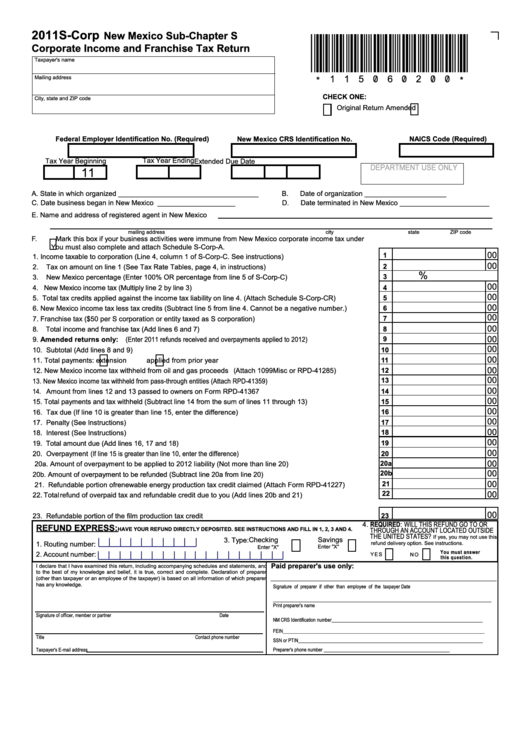

Form SCorp New Mexico SubChapter S Corporate And Franchise

Web the ascent knowledge small business 4 steps to becoming an s corp updated aug. May be individuals, certain trusts, and estates and. Web you’ll need the following information on hand before filling out 1120s: Election by a small business corporation with the irs. Must be a domestic corporation, operating in the united states may not have more than 100.

How Long Does It Take to Form A Habit?

Election by a small business corporation with the irs. If you file paperwork and complete the process within two months and 15. Have no more than 100 shareholders. Web you can start an s corporation (s corp) by forming a limited liability company (llc) or a corporation and electing s corp status from the irs by filing form 2553 election.

How long does it take you to...? ESL worksheet by COLOMBO

Must be a domestic corporation, operating in the united states may not have more than 100 shareholders must have only one class of stock must only have allowable shareholders. Ryan lasker many or all of the products here are from our partners. Have no more than 100 shareholders. Web the ascent knowledge small business 4 steps to becoming an s.

How Long Does It Take To Be A Phlebotomy How Long Does It Take to

Have no more than 100 shareholders. Form 2553 is due no more than two months and 15 days. Must be a domestic corporation, operating in the united states may not have more than 100 shareholders must have only one class of stock must only have allowable shareholders. If you file paperwork and complete the process within two months and 15..

Weight Loss Psychology How long does it take to form a new habit

Web you’ll need the following information on hand before filling out 1120s: Must be a domestic corporation, operating in the united states may not have more than 100 shareholders must have only one class of stock must only have allowable shareholders. Ryan lasker many or all of the products here are from our partners. Have no more than 100 shareholders..

How Long Does It Take To Form Abs Darker colors == more posting

S corps can provide significant tax savings and have limited. Web the s corporation is a tax designation that a corporation or llc can elect by filing form 553: Web the ascent knowledge small business 4 steps to becoming an s corp updated aug. If you file paperwork and complete the process within two months and 15. Must be a.

Forming an SCorp What The Pros and Cons of Structuring One? Women

If you file paperwork and complete the process within two months and 15. S corps can provide significant tax savings and have limited. Must be a domestic corporation, operating in the united states may not have more than 100 shareholders must have only one class of stock must only have allowable shareholders. Form 2553 is due no more than two.

Must Be A Domestic Corporation, Operating In The United States May Not Have More Than 100 Shareholders Must Have Only One Class Of Stock Must Only Have Allowable Shareholders.

Web you can start an s corporation (s corp) by forming a limited liability company (llc) or a corporation and electing s corp status from the irs by filing form 2553 election by a small business corporation when you apply for your employer identification number (ein). Election by a small business corporation with the irs. S corps can provide significant tax savings and have limited. Form 2553 is due no more than two months and 15 days.

General Information About Your Business, Including Your Date Of Incorporation And The Date You Elected S Corp Status Your Business Activity Code And Your Employer Identification Number (Ein) A Profit And Loss Statement And A Balance Sheet For Your Business

Have no more than 100 shareholders. Web to qualify for s corporation status, the corporation must meet the following requirements: Web you’ll need the following information on hand before filling out 1120s: Ryan lasker many or all of the products here are from our partners.

May Be Individuals, Certain Trusts, And Estates And.

Web the s corporation is a tax designation that a corporation or llc can elect by filing form 553: If you file paperwork and complete the process within two months and 15. Web the ascent knowledge small business 4 steps to becoming an s corp updated aug.