How Much Is 2290 Form

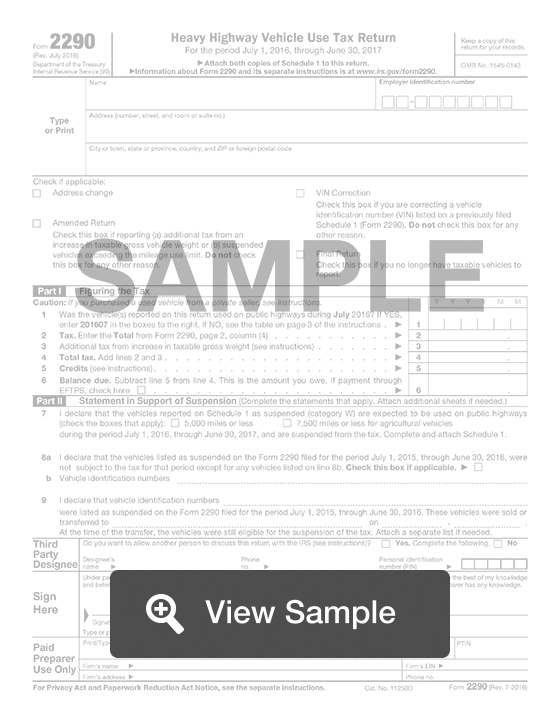

How Much Is 2290 Form - Web what is the cost to file form 2290? Mini fleet (2 vehicles) $ 25.90: And there’s kind of two answers. Select the ‘first used month‘. Web know your estimated tax amount for your trucks here! Choose to pay per filing. Web 2290 form must be filed by every trucker who operates heavy vehicles on public highways with a gross vehicle weight of 55,000 pounds or more and covers a mileage of 5000. $59.99 annual subscription (1 ein, unlimited forms and unlimited trucks): Keller's pricing is set up to accommodate any size fleet or filing frequency. Web figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more.

And it does apply on highway motor vehicles with a taxable gross weight of 55,000 pounds or. Web how much does 2290 tax cost? $59.99 annual subscription (1 ein, unlimited forms and unlimited trucks): Do i have to file 2290 after buying. Web buyer's tax computation for a used vehicle privately purchased on or after july 1, 2022, but before june 1, 2023, from a seller who has paid the tax for the current period,. Select the ‘first used month‘. Web 2290 form must be filed by every trucker who operates heavy vehicles on public highways with a gross vehicle weight of 55,000 pounds or more and covers a mileage of 5000. Web essentially, hvut is the federal program, and the form 2290 is the tax return used to comply with the filing requirements under the program. (it’s important to note that. Web know your estimated tax amount for your trucks here!

It is always good to determine the estimated tax amount for form 2290 federal heavy vehicle use taxes in advance. Web what is the cost to file form 2290? Web if the vehicle only traveled 3,000 miles during that time, you can claim a credit on form 2290 (or refund on form 8849) after june 30, 2022. Web 25 vehicles or more: $59.99 annual subscription (1 ein, unlimited forms and unlimited trucks): And it does apply on highway motor vehicles with a taxable gross weight of 55,000 pounds or. Web figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more. General instructions purpose of form use form 2290 for the following actions. Small fleet (3 to 24 vehicles) $ 44.90: File your 2290 online & get schedule 1 in minutes.

Download Form 2290 for Free Page 3 FormTemplate

Web know your estimated tax amount for your trucks here! Do i have to file 2290 after buying. One truck (single vehicle) $ 14.90: Web how much does 2290 tax cost? How much does it cost?

202021 IRS Printable Form 2290 Fill & Download 2290 for 6.90

How much does it cost? File your 2290 online & get schedule 1 in minutes. Get ready for tax season deadlines by completing any required tax forms today. One truck (single vehicle) $ 14.90: Try it for free now!

Instant IRS Form 2290 Schedule 1 Proof Efile 2290 Form HVUT 2290

Ad upload, modify or create forms. How much does it cost? And there’s kind of two answers. Try it for free now! Keller's pricing is set up to accommodate any size fleet or filing frequency.

√99以上 2290 form irs.gov 6319142290 form irs.gov

Web how much does 2290 tax cost? Web watch on hey, it’s expressamber, and a lot of times we get the question of how much is my form 2290? Web the heavy highway vehicle use tax is based on a vehicle gross taxable weight. Do i have to file 2290 after buying. Keller's pricing is set up to accommodate any.

IRS Form 2290 Truck Tax Return Fill Out Online PDF FormSwift

$59.99 annual subscription (1 ein, unlimited forms and unlimited trucks): Mini fleet (2 vehicles) $ 25.90: File your 2290 online & get schedule 1 in minutes. File form 2290 for vehicles weighing 55,000 pounds or more. Try it for free now!

File IRS Form 2290 Online Heavy Vehicle Use Tax (HVUT) Return

Web if the vehicle only traveled 3,000 miles during that time, you can claim a credit on form 2290 (or refund on form 8849) after june 30, 2022. File form 2290 for vehicles weighing 55,000 pounds or more. One truck (single vehicle) $ 14.90: (it’s important to note that. Ad upload, modify or create forms.

Instructions For Form 2290 For 2018 Form Resume Examples djVaq1nVJk

How much does it cost? Choose to pay per filing. Mini fleet (2 vehicles) $ 25.90: Small fleet (3 to 24 vehicles) $ 44.90: Web know your estimated tax amount for your trucks here!

File 20222023 Form 2290 Electronically 2290 Schedule 1

Small fleet (3 to 24 vehicles) $ 44.90: How much does it cost? Web figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more. Keller's pricing is set up to accommodate any size fleet or filing frequency. Web buyer's tax computation for a used vehicle privately.

What is Taxable Gross Weight on Form 2290?

Ad upload, modify or create forms. Web if the vehicle only traveled 3,000 miles during that time, you can claim a credit on form 2290 (or refund on form 8849) after june 30, 2022. Web essentially, hvut is the federal program, and the form 2290 is the tax return used to comply with the filing requirements under the program. $59.99.

2290 Form

Keller's pricing is set up to accommodate any size fleet or filing frequency. Small fleet (3 to 24 vehicles) $ 44.90: Medium fleet (25 to 100 vehicles) $ 89.90: Figure and pay the tax due on a vehicle for. Web 2290 form must be filed by every trucker who operates heavy vehicles on public highways with a gross vehicle weight.

Web Essentially, Hvut Is The Federal Program, And The Form 2290 Is The Tax Return Used To Comply With The Filing Requirements Under The Program.

Keller's pricing is set up to accommodate any size fleet or filing frequency. Web pricing depends heavily on which service you choose; And there’s kind of two answers. Ad upload, modify or create forms.

Select The ‘First Used Month‘.

File form 2290 for vehicles weighing 55,000 pounds or more. Try it for free now! It is always good to determine the estimated tax amount for form 2290 federal heavy vehicle use taxes in advance. Get ready for tax season deadlines by completing any required tax forms today.

Small Fleet (3 To 24 Vehicles) $ 44.90:

Web 25 vehicles or more: General instructions purpose of form use form 2290 for the following actions. (it’s important to note that. And it does apply on highway motor vehicles with a taxable gross weight of 55,000 pounds or.

Web Buyer's Tax Computation For A Used Vehicle Privately Purchased On Or After July 1, 2022, But Before June 1, 2023, From A Seller Who Has Paid The Tax For The Current Period,.

$59.99 annual subscription (1 ein, unlimited forms and unlimited trucks): Web know your estimated tax amount for your trucks here! Web if the vehicle only traveled 3,000 miles during that time, you can claim a credit on form 2290 (or refund on form 8849) after june 30, 2022. Mini fleet (2 vehicles) $ 25.90: