How To Enter Form 3922 In Turbotax

How To Enter Form 3922 In Turbotax - Keep the form for your records because you’ll need the information when you sell, assign, or. Web solved • by intuit • 415 • updated july 14, 2022. Until you sell the unites, you don’t have to enter information from form 3921 into your tax return. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Transfer of stock acquired through an employee stock purchase plan under section 423(c) copy a. Web get your taxes done i have tax form 3922 did the information on this page answer your question? From our tax experts and community. Or even do your taxes for you. Select form 3922 from your dashboard. Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in.

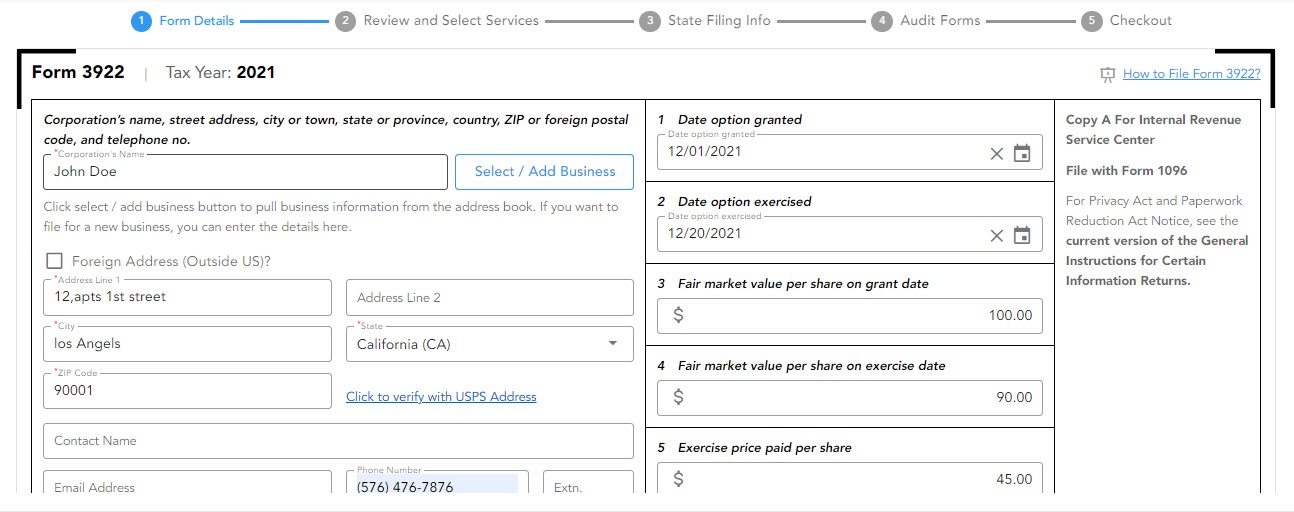

Web only if you sold stock that was purchased through an espp (employee stock purchase plan). Web irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), is a form a taxpayer receives if they have. Web form 3922 reporting is for informational purposes but will be needed when an individual sells the stock in order to calculate the gain or loss of the sale or disposition, thus, this form is. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your. Account number the account number is required if you have multiple accounts for a transferor for whom you are filing more than. Web solved • by intuit • 415 • updated july 14, 2022. Or even do your taxes for you. Enter the required information to file form 3922. Form 3922 is an informational statement and would not be entered into the tax return. Select form 3922 from your dashboard.

Web solved • by intuit • 415 • updated july 14, 2022. From our tax experts and community. Form 3922 is issued for. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web only if you sold stock that was purchased through an espp (employee stock purchase plan). Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your return. Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in. Form 3922 is an informational statement and would not be entered into the tax return. Web save this form with your investment records. Keep the form for your records because you’ll need the information when you sell, assign, or.

Documents to Bring To Tax Preparer Tax Documents Checklist

Keep the form for your records because you’ll need the information when you sell, assign, or. Web get your taxes done i have tax form 3922 did the information on this page answer your question? Or even do your taxes for you. It is for your personal records. If you purchased espp shares, your employer will send you form 3922,.

How To Upload Your Form 1099 To Turbotax Turbo Tax

Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), including recent updates, related. Form 3922 is issued for. Web irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), is a form a taxpayer receives if they have. Form 3922 is an informational statement.

Where Do I Enter a 1098 Tax Form in TurboTax Online TurboTax Support

Web save this form with your investment records. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your return. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered.

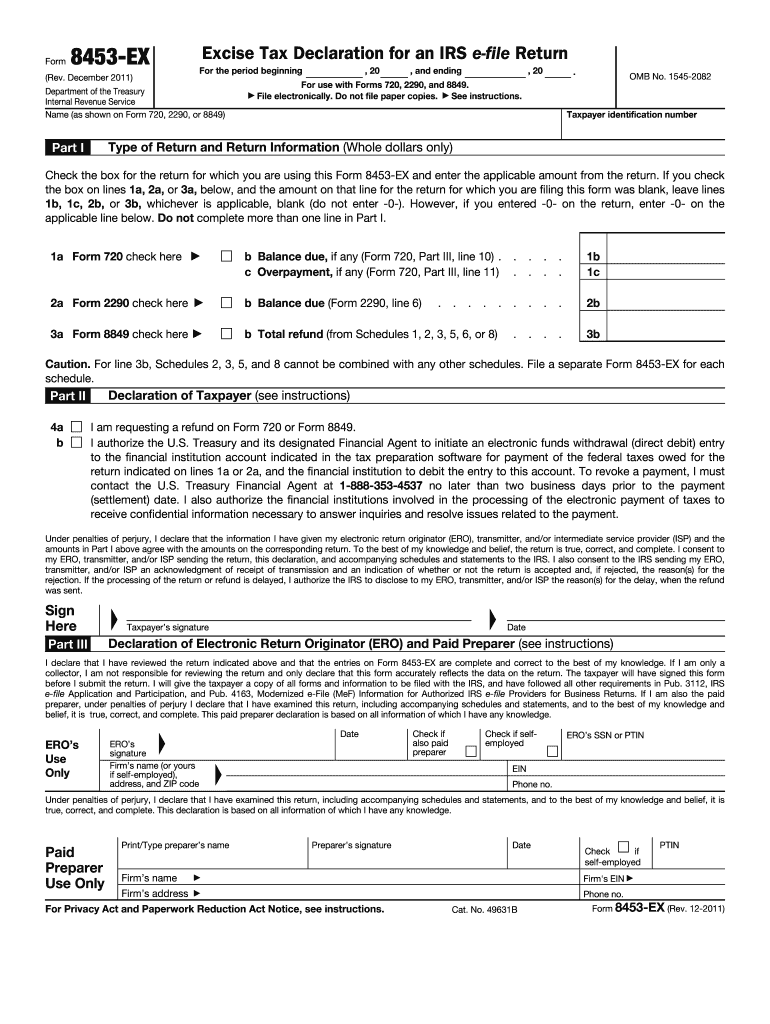

File IRS Form 3922 Online EFile Form 3922 for 2022

Account number the account number is required if you have multiple accounts for a transferor for whom you are filing more than. Web get your taxes done i have tax form 3922 did the information on this page answer your question? Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that.

A Quick Guide to Form 3922 YouTube

Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in. Web only if you sold stock that was purchased through an espp (employee stock purchase plan). Enter the required information to file form 3922. Transfer of stock acquired through an employee stock.

IRS Form 3922 Software 289 eFile 3922 Software

Web form 3922 reporting is for informational purposes but will be needed when an individual sells the stock in order to calculate the gain or loss of the sale or disposition, thus, this form is. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web solved •.

3922, Tax Reporting Instructions & Filing Requirements for Form 3922

Web enter the name, address, and tin of the transferor. Keep the form for your records because you’ll need the information when you sell, assign, or. Web get your taxes done i have tax form 3922 did the information on this page answer your question? Web you are not required to enter form 3922 on your return. Enter the required.

IRS Form 3922

Until you sell the unites, you don’t have to enter information from form 3921 into your tax return. Web save this form with your investment records. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your return. Keep the form for your records because.

How to Enter 1099MISC Fellowship into TurboTax Evolving

Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your return. Web solved • by intuit • 415 • updated july 14, 2022. Web irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), is a form.

What is an IRS 1099 Form? TurboTax Tax Tips & Videos Irs, Turbotax, Tax

Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. Web you are not required to enter form 3922 on your return. Transfer of stock acquired through an employee stock purchase plan under section 423(c) copy a. Web form 3922 reporting is.

Web Information About Form 3922, Transfer Of Stock Acquired Through An Employee Stock Purchase Plan Under Section 423(C), Including Recent Updates, Related.

Transfer of stock acquired through an employee stock purchase plan under section 423(c) copy a. Select form 3922 from your dashboard. Web only if you sold stock that was purchased through an espp (employee stock purchase plan). Enter the required information to file form 3922.

It Is For Your Personal Records.

Form 3922 is issued for. Web enter the name, address, and tin of the transferor. Account number the account number is required if you have multiple accounts for a transferor for whom you are filing more than. Until you sell the unites, you don’t have to enter information from form 3921 into your tax return.

From Our Tax Experts And Community.

Form 3922 is an informational statement and would not be entered into the tax return. Web you are not required to enter form 3922 on your return. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your.

Web Get Your Taxes Done I Have Tax Form 3922 Did The Information On This Page Answer Your Question?

Web solved • by intuit • 415 • updated july 14, 2022. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your return. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. Or even do your taxes for you.