How To File Form 990 N

How To File Form 990 N - Congress enacted this filing requirement in 2007 to keep the irs up to date. 1 search organization’s ein 2 select filing year 3 review & transmit to the irs just. Private foundations must file form 990. Ad get ready for tax season deadlines by completing any required tax forms today. If gross receipts are normally $50,000 or less, it has the. Association of notre dame clubs, inc. Web filings as we established in our form 990 overview post, there are 5 versions of irs form 990, one or more of which is required to be filed annually by every 501 (c). Of course, this is primarily due to irs mandates, but the form is also important for a few. It cannot be filed until after the tax year ends. Complete, edit or print tax forms instantly.

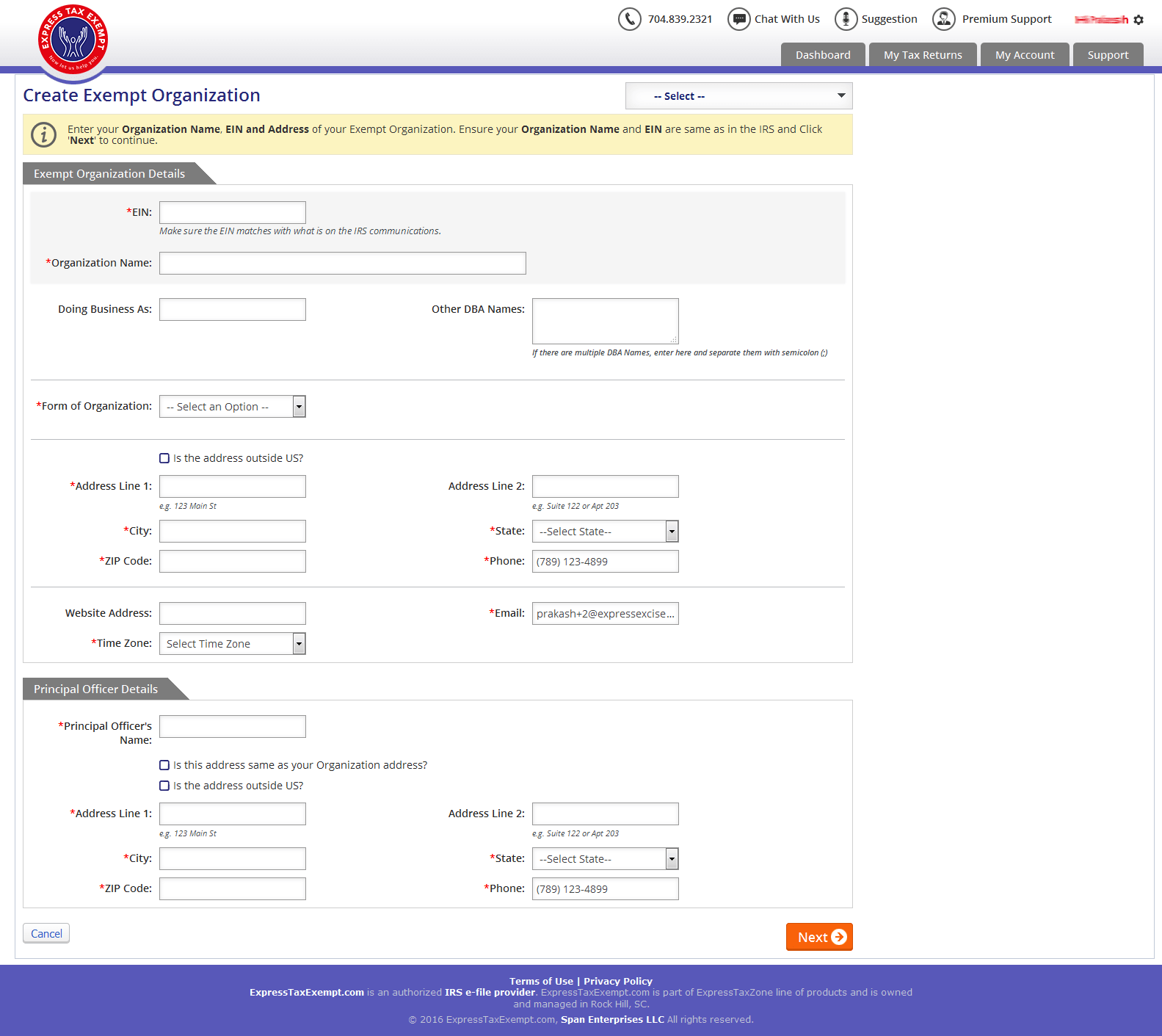

Private foundations must file form 990. Of course, this is primarily due to irs mandates, but the form is also important for a few. How often do i need to file? Congress enacted this filing requirement in 2007 to keep the irs up to date. Association of notre dame clubs, inc. If gross receipts are normally $50,000 or less, it has the. Ad get ready for tax season deadlines by completing any required tax forms today. Web filings as we established in our form 990 overview post, there are 5 versions of irs form 990, one or more of which is required to be filed annually by every 501 (c). 1 search organization’s ein 2 select filing year 3 review & transmit to the irs just. Web open the electronic filing page:

It cannot be filed until after the tax year ends. Web open the electronic filing page: Web filings as we established in our form 990 overview post, there are 5 versions of irs form 990, one or more of which is required to be filed annually by every 501 (c). Of course, this is primarily due to irs mandates, but the form is also important for a few. 1 search organization’s ein 2 select filing year 3 review & transmit to the irs just. Congress enacted this filing requirement in 2007 to keep the irs up to date. Private foundations must file form 990. Ad get ready for tax season deadlines by completing any required tax forms today. How often do i need to file? If gross receipts are normally $50,000 or less, it has the.

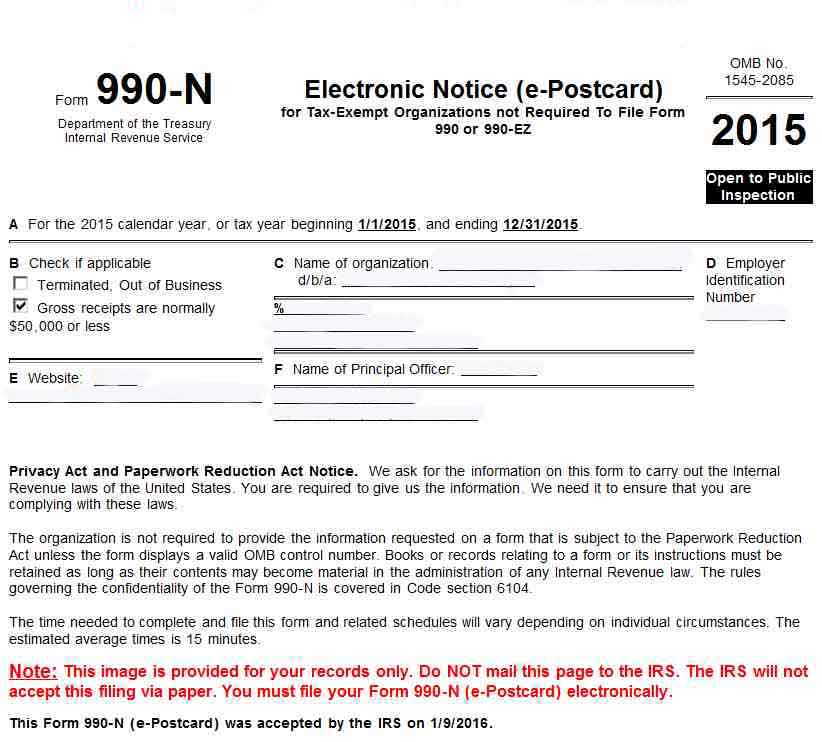

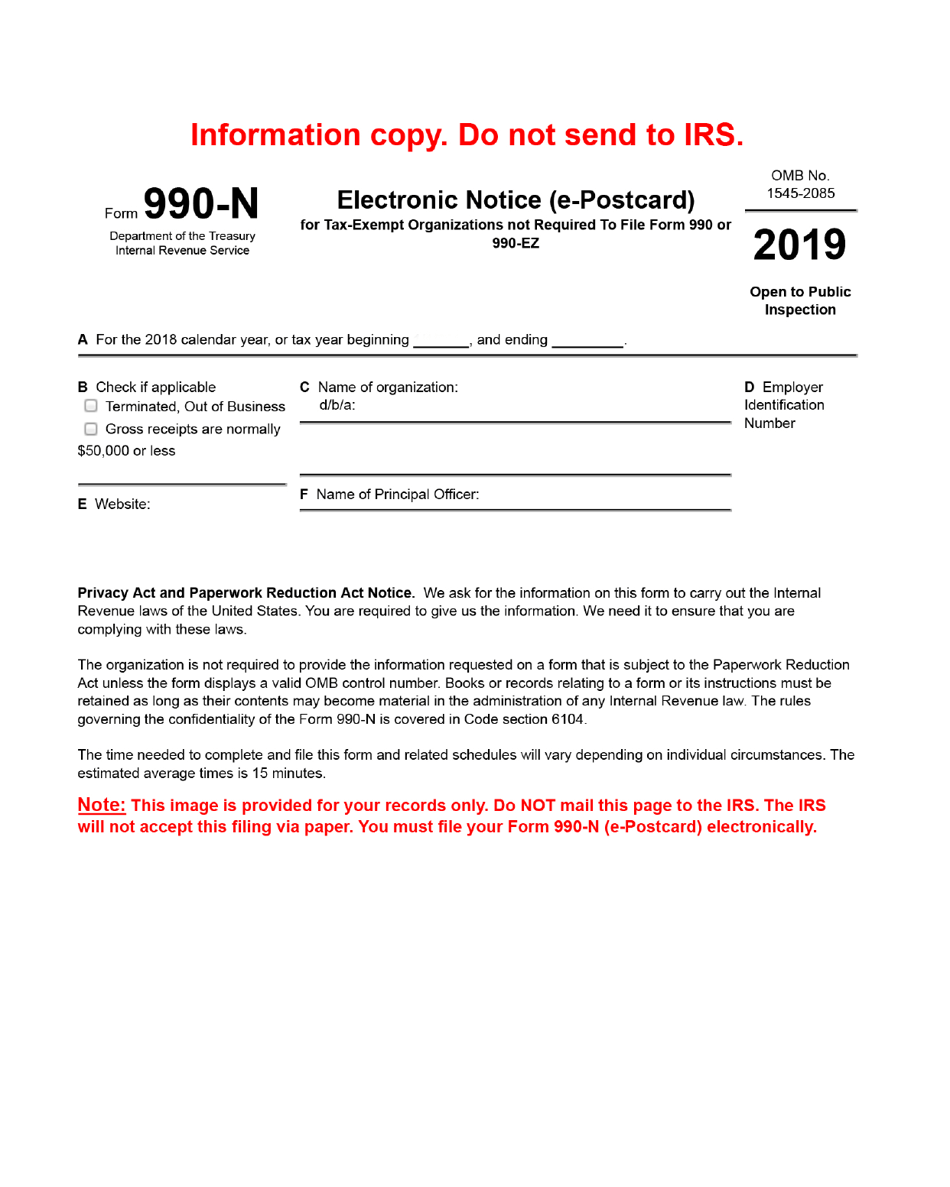

small taxexempt organizations to file form 990n (epostcard

How often do i need to file? Association of notre dame clubs, inc. 1 search organization’s ein 2 select filing year 3 review & transmit to the irs just. Web filings as we established in our form 990 overview post, there are 5 versions of irs form 990, one or more of which is required to be filed annually by.

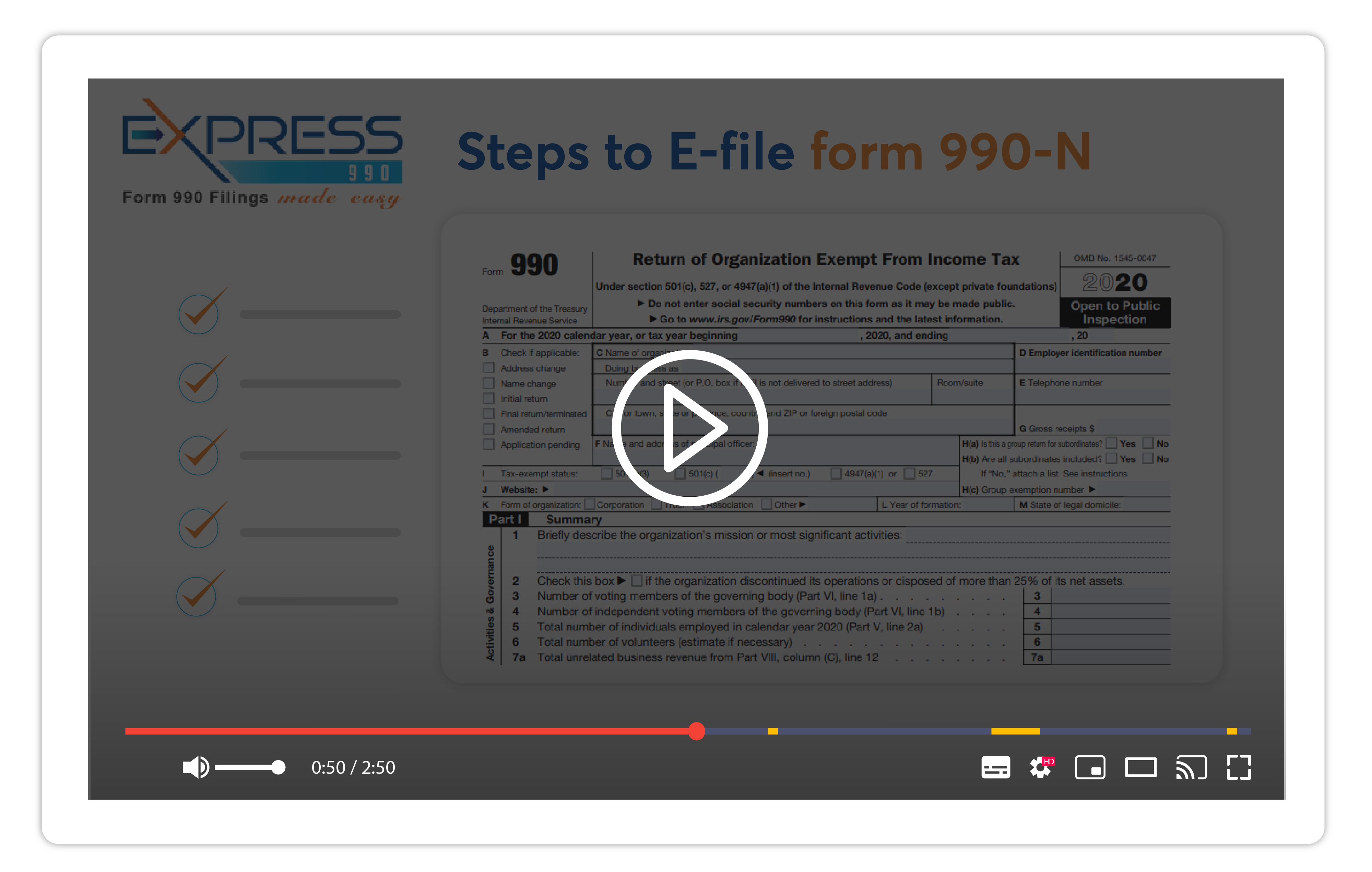

Form 990N (ePostcard) Online Efile 990N in 3Steps Prior Year

Of course, this is primarily due to irs mandates, but the form is also important for a few. Web open the electronic filing page: It cannot be filed until after the tax year ends. Association of notre dame clubs, inc. Ad get ready for tax season deadlines by completing any required tax forms today.

Form 990N ePostcard

Web filings as we established in our form 990 overview post, there are 5 versions of irs form 990, one or more of which is required to be filed annually by every 501 (c). Web open the electronic filing page: Private foundations must file form 990. It cannot be filed until after the tax year ends. Ad get ready for.

Efile Form 990N 2020 IRS Form 990N Online Filing

How often do i need to file? Web open the electronic filing page: 1 search organization’s ein 2 select filing year 3 review & transmit to the irs just. Congress enacted this filing requirement in 2007 to keep the irs up to date. It cannot be filed until after the tax year ends.

Printable 990 N Form Printable Form 2022

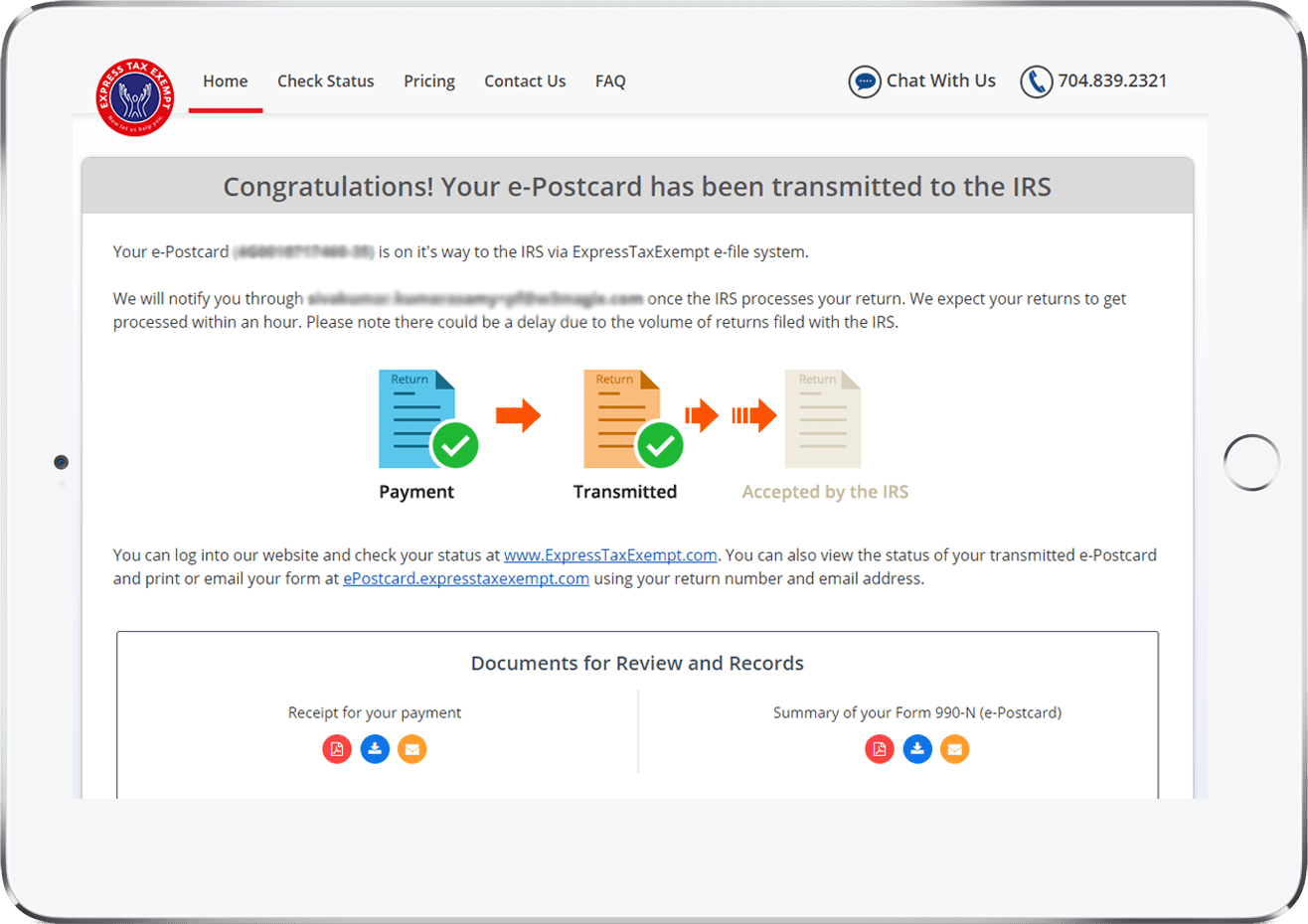

Web open the electronic filing page: It cannot be filed until after the tax year ends. Ad get ready for tax season deadlines by completing any required tax forms today. 1 search organization’s ein 2 select filing year 3 review & transmit to the irs just. Complete, edit or print tax forms instantly.

File Form 990N Online 990n e file Form 990N (ePostcard)

Web open the electronic filing page: Private foundations must file form 990. Association of notre dame clubs, inc. If gross receipts are normally $50,000 or less, it has the. It cannot be filed until after the tax year ends.

Meet the May 17, 2021 EPostcard Form 990N Deadline In 3 Simple Steps

Web open the electronic filing page: Private foundations must file form 990. It cannot be filed until after the tax year ends. Association of notre dame clubs, inc. Ad get ready for tax season deadlines by completing any required tax forms today.

Steps to EFile IRS Form 990N How to file ePostcard with the IRS

Of course, this is primarily due to irs mandates, but the form is also important for a few. Private foundations must file form 990. Web open the electronic filing page: How often do i need to file? It cannot be filed until after the tax year ends.

Failure To File Form 990N free download programs ealetitbit

It cannot be filed until after the tax year ends. Ad get ready for tax season deadlines by completing any required tax forms today. Congress enacted this filing requirement in 2007 to keep the irs up to date. How often do i need to file? Web open the electronic filing page:

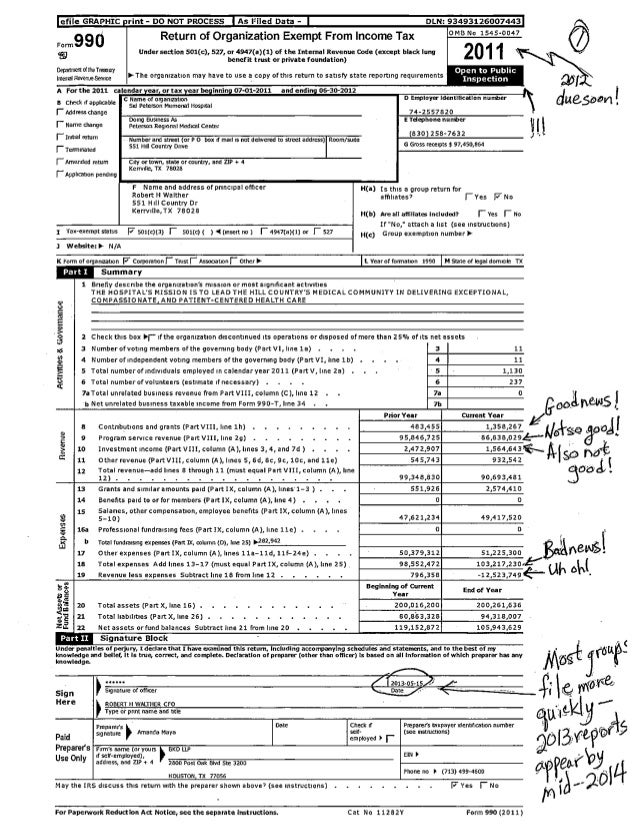

IRS Form 990N Download Printable PDF or Fill Online Electronic Notice

Association of notre dame clubs, inc. Congress enacted this filing requirement in 2007 to keep the irs up to date. If gross receipts are normally $50,000 or less, it has the. Private foundations must file form 990. Of course, this is primarily due to irs mandates, but the form is also important for a few.

1 Search Organization’s Ein 2 Select Filing Year 3 Review & Transmit To The Irs Just.

Complete, edit or print tax forms instantly. Private foundations must file form 990. Of course, this is primarily due to irs mandates, but the form is also important for a few. Congress enacted this filing requirement in 2007 to keep the irs up to date.

Web Filings As We Established In Our Form 990 Overview Post, There Are 5 Versions Of Irs Form 990, One Or More Of Which Is Required To Be Filed Annually By Every 501 (C).

Association of notre dame clubs, inc. It cannot be filed until after the tax year ends. How often do i need to file? Ad get ready for tax season deadlines by completing any required tax forms today.

Web Open The Electronic Filing Page:

If gross receipts are normally $50,000 or less, it has the.