How To Fill Out A Texas Homestead Exemption Form

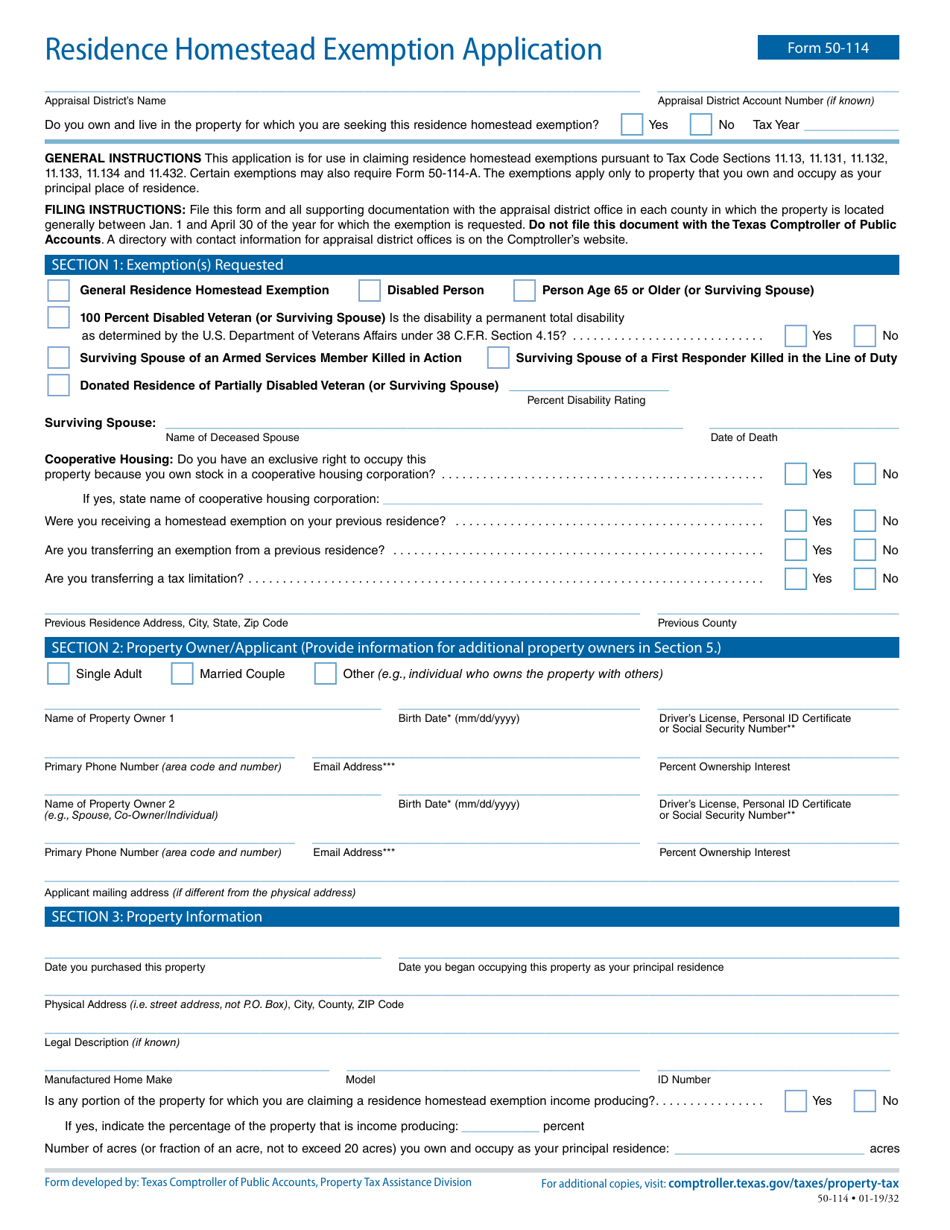

How To Fill Out A Texas Homestead Exemption Form - For filing with the appraisal district office in each county in which the property is located generally between jan. For homestead exemptions other than the age 65 and over or disabled person homestead exemptions provided in tax code §11.13(c) and (d), you. Web residence homestead exemption application. Go to your county's appraisal district. They include graphics, fillable form fields, scripts and functionality that work best with the free adobe reader. Web how do i get a general $40,000 residence homestead exemption? Complete, edit or print tax forms instantly. Web the homestead exemption allows homeowners to exempt a portion of the appraised value of their primary residence from taxation, so their tax burden is lower. It’s time to file for your texas homestead exemption. Web this form allows for exemption from property tax to some extent depending on the individual circumstances.

To apply for a homestead exemption, fill out of a copy of the homestead exemption application form and mail it, as well as copies of. Web the texas homestead exemption form or tex4141 is a form that determines whether an individual is eligible for the homestead exemption and how it benefits you. What is the deadline for filing a residence homestead exemption? Web start by requesting the application form from your county appraisal district, your mortgage company, or by downloading it yourself from texas’s comptroller website. Applying is free and only needs to be filed once. Web this form allows for exemption from property tax to some extent depending on the individual circumstances. The typical deadline for filing a county appraisal district. Web bought a primary residence within the past year in texas? The state of texas allows you to claim. Web how do you apply for a homestead exemption in texas?

Then, download the texas residence homestead exemption. Web 1.17k subscribers subscribe 224 share 22k views 5 years ago if you bought a home last year don’t forget to fill out your homestead exemption to lower your annual. Web the forms listed below are pdf files. For homestead exemptions other than the age 65 and over or disabled person homestead exemptions provided in tax code §11.13(c) and (d), you. The typical deadline for filing a county appraisal district. This form also allows for an exemption from the homestead. Complete, edit or print tax forms instantly. Web residence homestead exemption application. Web bought a primary residence within the past year in texas? Web the homestead exemption allows homeowners to exempt a portion of the appraised value of their primary residence from taxation, so their tax burden is lower.

How to Fill Out Homestead Exemption Form Texas Homestead Exemption

Web the homestead exemption allows homeowners to exempt a portion of the appraised value of their primary residence from taxation, so their tax burden is lower. Go to your county's appraisal district. What is the deadline for filing a residence homestead exemption? The application for residence homestead exemption is required to apply for a homestead exemption. For filing with the.

Form 50114 Download Fillable PDF or Fill Online Residence Homestead

Then, download the texas residence homestead exemption. Web download the application from the denton countyappraisal district’s website. Web how to fill out a homestead exemption form? Web how to fill out homestead exemption form in texas | homestead exemption harris county | houston texas in order to lower. Texas homestead exemption application deadline supporting documents for homestead exemption heir.

TEXAS HOMESTEAD EXEMPTION What You Need to Know YouTube

This form also allows for an exemption from the homestead. For filing with the appraisal district office in each county in which the property is located generally between jan. The state of texas allows you to claim. Web how to fill out homestead exemption form in texas | homestead exemption harris county | houston texas in order to lower. Web.

What is the Homestead Exemption in Texas? Facing Foreclosure Houston

To apply for a homestead exemption, fill out of a copy of the homestead exemption application form and mail it, as well as copies of. Go to your county's appraisal district. What is the deadline for filing a residence homestead exemption? Then, download the texas residence homestead exemption. The state of texas allows you to claim.

Texas Homestead Tax Exemption Form

Web bought a primary residence within the past year in texas? Web how do i get a general $40,000 residence homestead exemption? 1 and april 30 of the. Web start by requesting the application form from your county appraisal district, your mortgage company, or by downloading it yourself from texas’s comptroller website. Web download the application from the denton countyappraisal.

How to File for Homestead Exemption in Texas, Houston, Harris County

Complete, edit or print tax forms instantly. Web how do i get a general $40,000 residence homestead exemption? What is the deadline for filing a residence homestead exemption? Web 1.17k subscribers subscribe 224 share 22k views 5 years ago if you bought a home last year don’t forget to fill out your homestead exemption to lower your annual. Then, download.

Designation Of Homestead Request Form Texas

It’s time to file for your texas homestead exemption. Web first, fill out the application specific to your county appraisal district, then mail all of the documents to the appraisal district for your county. Then, download the texas residence homestead exemption. Web bought a primary residence within the past year in texas? Texas homestead exemption application deadline supporting documents for.

Brazos County Homestead Exemption Fill Online, Printable, Fillable

They include graphics, fillable form fields, scripts and functionality that work best with the free adobe reader. For filing with the appraisal district office in each county in which the property is located generally between jan. Web you must apply with your county appraisal district to apply for a homestead exemption. Web the homestead exemption allows homeowners to exempt a.

How to fill out your Texas homestead exemption form YouTube

Web start by requesting the application form from your county appraisal district, your mortgage company, or by downloading it yourself from texas’s comptroller website. Web how do you apply for a homestead exemption in texas? Web how to fill out homestead exemption form in texas | homestead exemption harris county | houston texas in order to lower. 1 and april.

Deadline to file homestead exemption in Texas is April 30

Web how to fill out a homestead exemption form? To apply for a homestead exemption, fill out of a copy of the homestead exemption application form and mail it, as well as copies of. Web first, fill out the application specific to your county appraisal district, then mail all of the documents to the appraisal district for your county. Then,.

Web Residence Homestead Exemption Application.

The state of texas allows you to claim. For homestead exemptions other than the age 65 and over or disabled person homestead exemptions provided in tax code §11.13(c) and (d), you. This form also allows for an exemption from the homestead. Web first, fill out the application specific to your county appraisal district, then mail all of the documents to the appraisal district for your county.

Web How To Fill Out Homestead Exemption Form In Texas | Homestead Exemption Harris County | Houston Texas In Order To Lower.

Web a qualified texas homeowner can file for the homestead exemption by filing the form that can be downloaded below. Web the homestead exemption allows homeowners to exempt a portion of the appraised value of their primary residence from taxation, so their tax burden is lower. Web bought a primary residence within the past year in texas? Web you must apply with your county appraisal district to apply for a homestead exemption.

Web Start By Requesting The Application Form From Your County Appraisal District, Your Mortgage Company, Or By Downloading It Yourself From Texas’s Comptroller Website.

Web first, you should check for specific instructions on your local county's tax appraisal website. Web this form allows for exemption from property tax to some extent depending on the individual circumstances. Then, download the texas residence homestead exemption. May i continue to receive the residence.

The Typical Deadline For Filing A County Appraisal District.

Web the forms listed below are pdf files. Web download the application from the denton countyappraisal district’s website. Web how to fill out a homestead exemption form? Go to your county's appraisal district.