How To Fill Out Form 7004

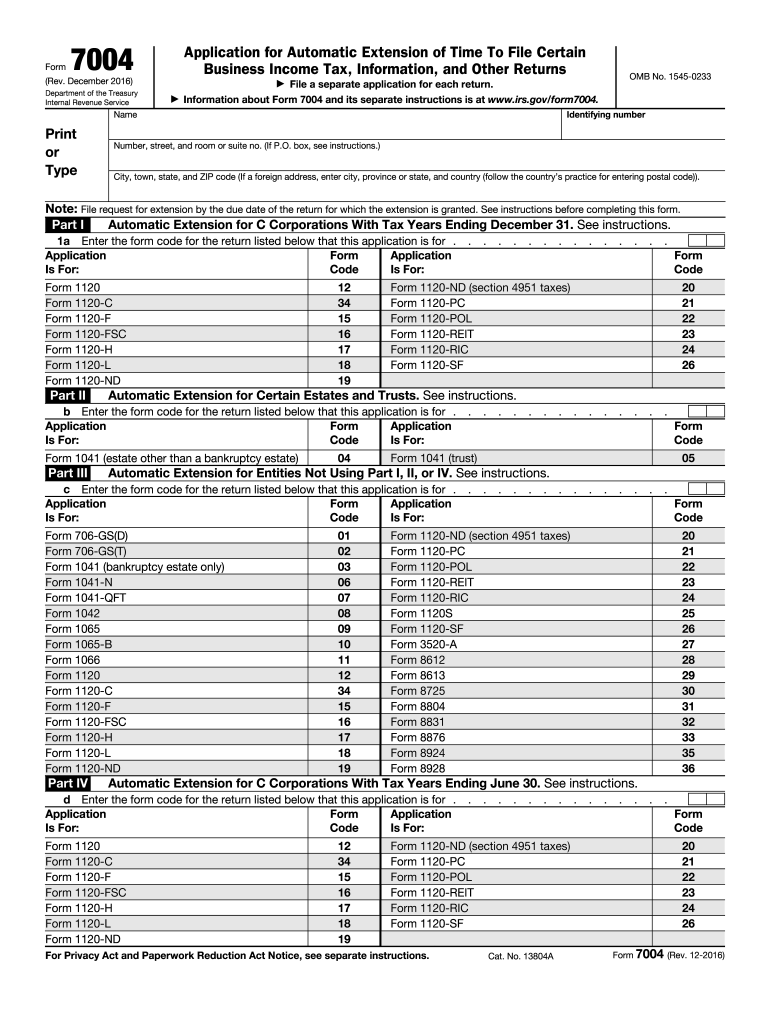

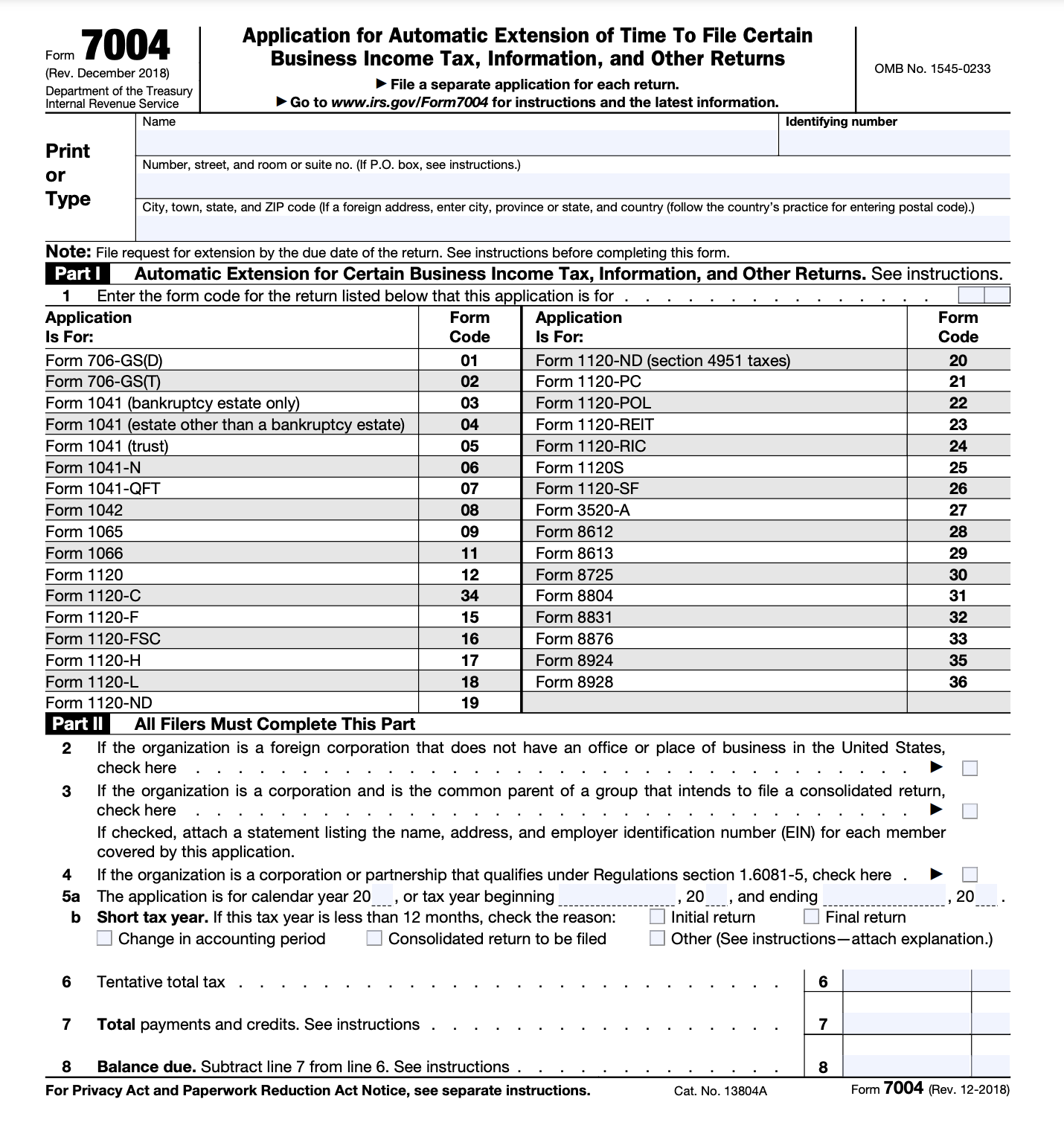

How To Fill Out Form 7004 - Web form 7004 can be filed electronically for most returns. • select the appropriate form code in part i to. Web to successfully use form 7004, you’ll have to: Select the appropriate form from the table below to determine where to. So the deadline to file is march 15 and if you need a little extra time, this will. • at the top of the form, enter your company name, tax identification number, and address. Web fill out form 7004 as follows: Web key takeaways what is form 7004? Web how to file form 7004? Web filling out the blank pdf correctly can be a straightforward process if you follow these irs 7004 form instructions.

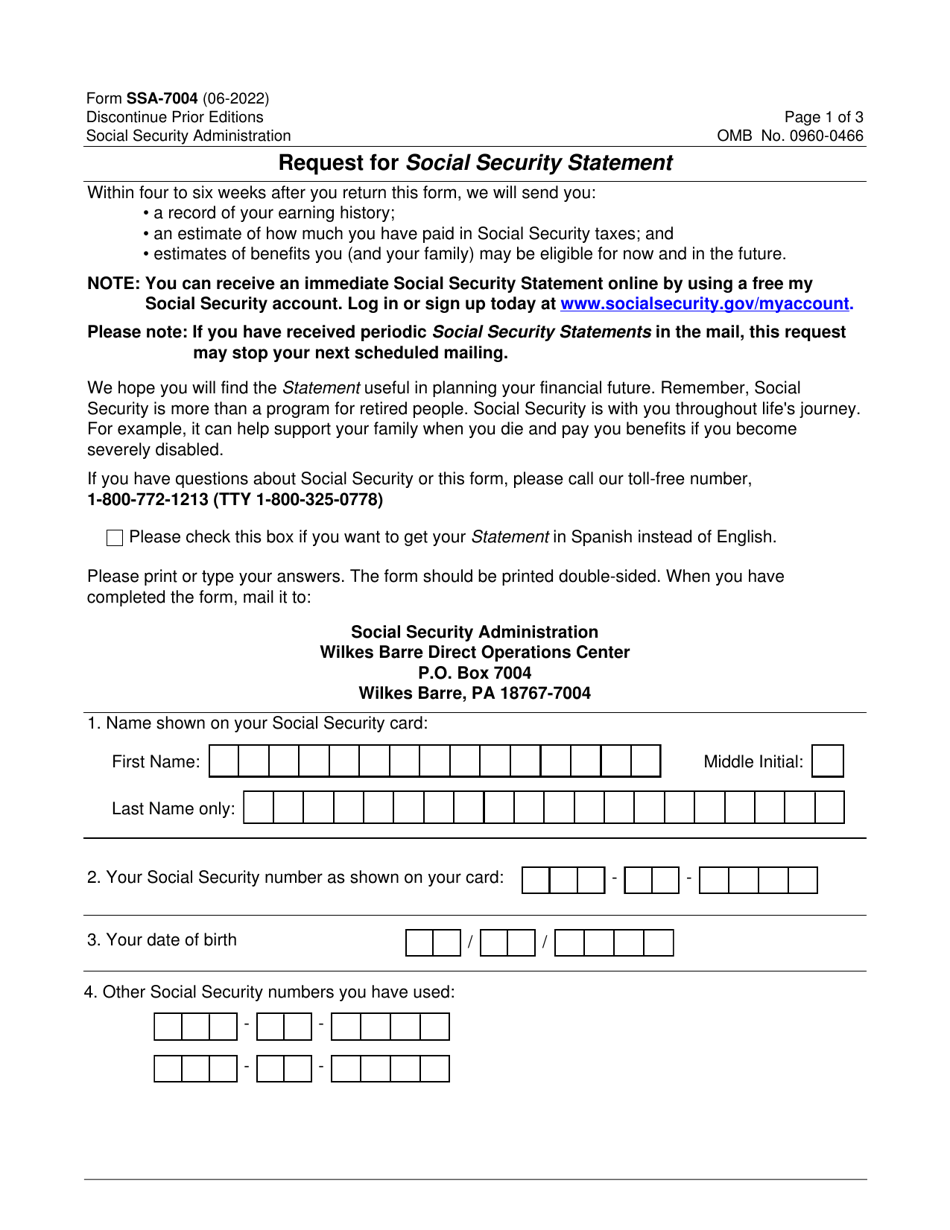

Here what you need to start: Select the appropriate form from the table below to determine where to. Irs 7004 inst & more fillable forms, register and subscribe now! Enter the name of your business on form 7004 as you entered it on the previous year's. Find the federal tax form either. Ad access irs tax forms. Complete form 7004 estimate and pay the taxes you owe file form 7004 before or on the deadline of the. Web form 7004 can be filed electronically for most returns. Web quick and easy filing automatic extension instant irs approval file from any device volume based pricing for tax pros us based support apply extension now instructions. Web request for social security statement within four to six weeks after you return this form, we will send you:

Select the appropriate form from the table below to determine where to. A record of your earning history; Web request for social security statement within four to six weeks after you return this form, we will send you: Web how to complete form 7004 the tax form has three different parts. Enter the name of your business on form 7004 as you entered it on the previous year's. Web fill out form 7004 as follows: An estimate of how much you have paid in. Web use the chart to determine where to file form 7004 based on the tax form you complete. Name shown on your social security card fill in your first name, middle initial, and last name, as they appear on your social security card. Complete form 7004 estimate and pay the taxes you owe file form 7004 before or on the deadline of the.

How To Fill Out Property Tax Form Property Walls

So the deadline to file is march 15 and if you need a little extra time, this will. Web how to fill out form 7004 form 7004 is a relatively short form by irs standards. • select the appropriate form code in part i to. Web request for social security statement within four to six weeks after you return this.

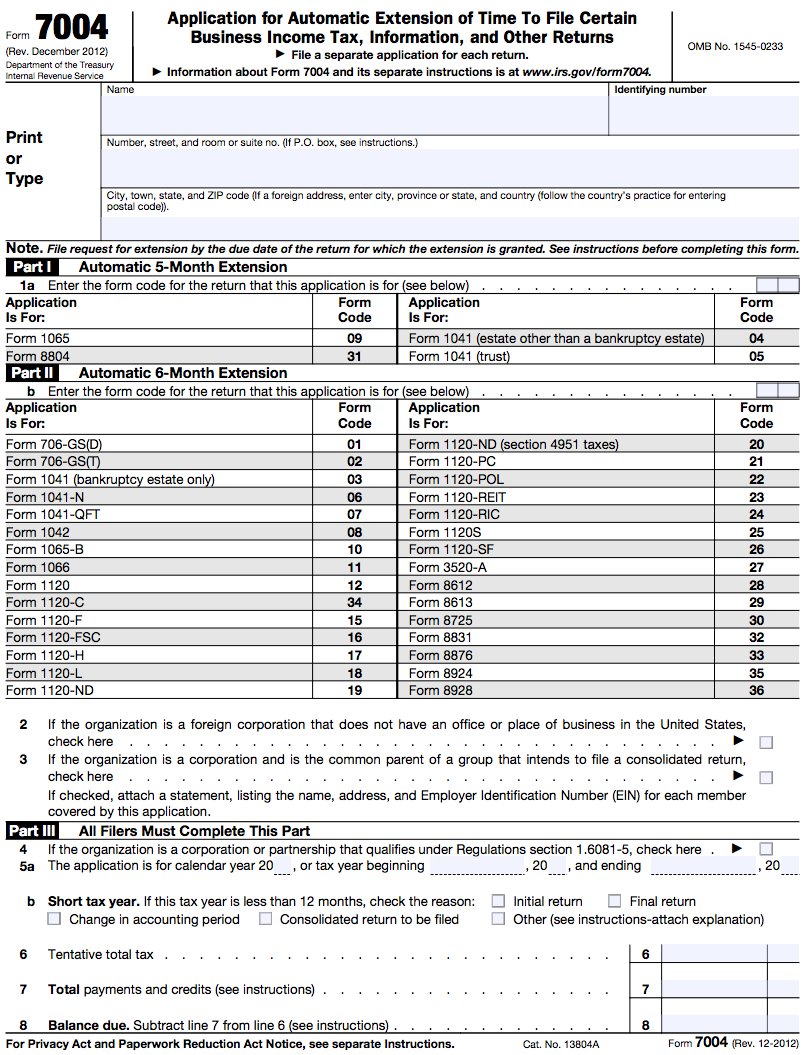

Fillable Form 7004 Application For Automatic Extension Of Time To

Here what you need to start: Enter the name of your business on form 7004 as you entered it on the previous year's. • select the appropriate form code in part i to. Web use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Irs 7004 inst & more fillable.

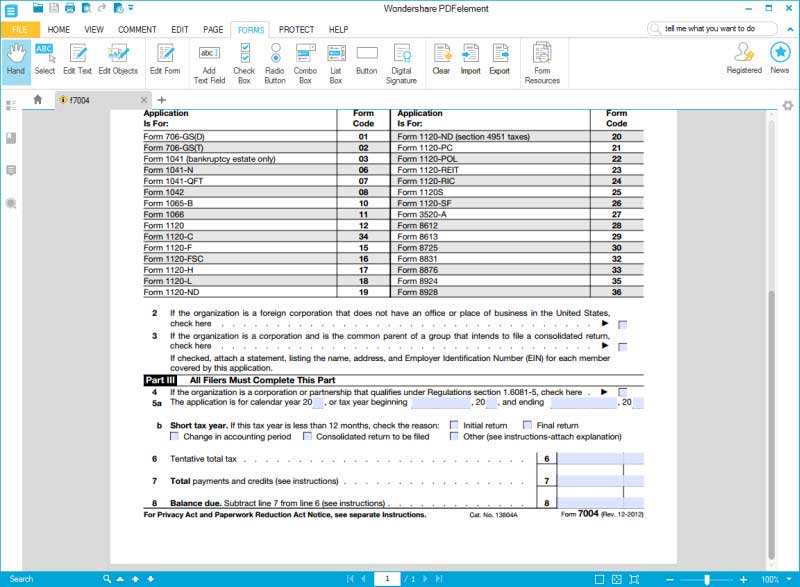

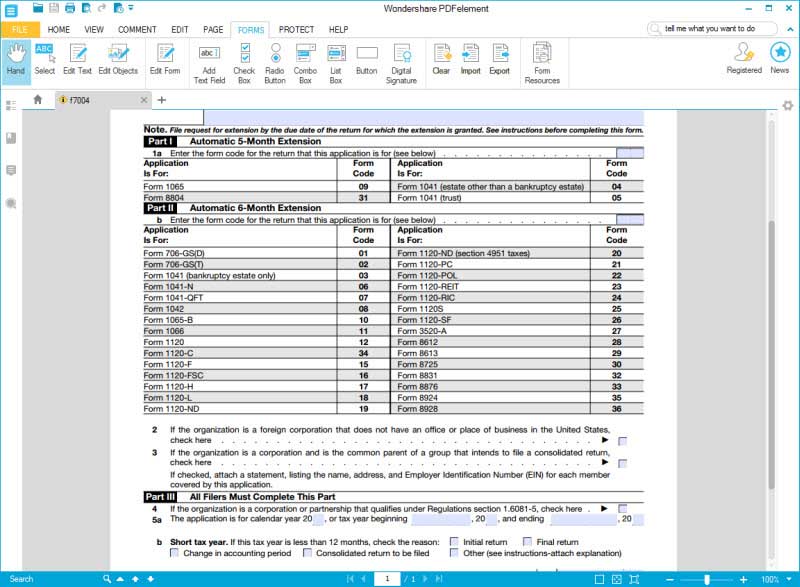

Instructions for How to Fill in IRS Form 7004

Web to successfully use form 7004, you’ll have to: Taxpayers will require information such as name, address, contact information of taxpayer, business entity type, total tax amount one. Web how to complete form 7004 the tax form has three different parts. Web filling out the blank pdf correctly can be a straightforward process if you follow these irs 7004 form.

Instructions for How to Fill in IRS Form 7004

Web how to complete form 7004 the tax form has three different parts. • at the top of the form, enter your company name, tax identification number, and address. Web how to fill out form 7004 form 7004 is a relatively short form by irs standards. Web quick and easy filing automatic extension instant irs approval file from any device.

Form SSA7004 Download Fillable PDF or Fill Online Request for Social

An estimate of how much you have paid in. Here what you need to start: Web use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Web filling out the blank pdf correctly can be a straightforward process if you follow these irs 7004 form instructions. Select the appropriate form.

Form 7004 Fill Out and Sign Printable PDF Template signNow

Web quick and easy filing automatic extension instant irs approval file from any device volume based pricing for tax pros us based support apply extension now instructions. Web how to file form 7004? Enter the name of your business on form 7004 as you entered it on the previous year's. Irs 7004 inst & more fillable forms, register and subscribe.

What is Form 7004 and How to Fill it Out Bench Accounting

Find the federal tax form either. Ad access irs tax forms. Web fill out form 7004 as follows: Web request for social security statement within four to six weeks after you return this form, we will send you: Taxpayers will require information such as name, address, contact information of taxpayer, business entity type, total tax amount one.

File Form 1065 Extension Online Partnership Tax Extension

Web use the chart to determine where to file form 7004 based on the tax form you complete. Name shown on your social security card fill in your first name, middle initial, and last name, as they appear on your social security card. Web to successfully use form 7004, you’ll have to: Ad irs 7004 inst & more fillable forms,.

Get an Extension on Your Business Taxes with Form 7004 Excel Capital

The second needs to be. Web how to fill out form 7004 form 7004 is a relatively short form by irs standards. Web filling out the blank pdf correctly can be a straightforward process if you follow these irs 7004 form instructions. Web how to complete form 7004 the tax form has three different parts. A record of your earning.

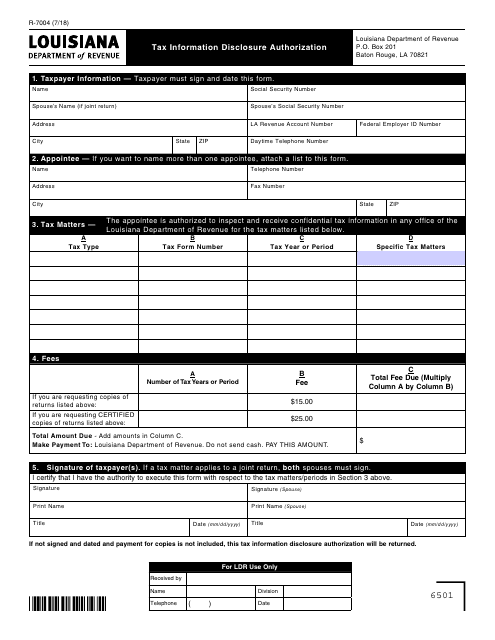

Form R7004 Download Fillable PDF or Fill Online Tax Information

Web use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. So the deadline to file is march 15 and if you need a little extra time, this will. Complete, edit or print tax forms instantly. Web fill out form 7004 as follows: An estimate of how much you have.

Here What You Need To Start:

Irs 7004 inst & more fillable forms, register and subscribe now! • at the top of the form, enter your company name, tax identification number, and address. The second needs to be. Ad access irs tax forms.

Web Quick And Easy Filing Automatic Extension Instant Irs Approval File From Any Device Volume Based Pricing For Tax Pros Us Based Support Apply Extension Now Instructions.

Web how to complete form 7004 the tax form has three different parts. Web to successfully use form 7004, you’ll have to: Complete, edit or print tax forms instantly. Web use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns.

Web Key Takeaways What Is Form 7004?

Web fill out form 7004 as follows: An estimate of how much you have paid in. Ad irs 7004 inst & more fillable forms, register and subscribe now! Select the appropriate form from the table below to determine where to.

• Select The Appropriate Form Code In Part I To.

Web filling out the blank pdf correctly can be a straightforward process if you follow these irs 7004 form instructions. Taxpayers will require information such as name, address, contact information of taxpayer, business entity type, total tax amount one. Find the federal tax form either. A record of your earning history;